How Option Delta Is Calculated

Investors can calculate the delta-adjusted notional value of a portfolio by adding the options weighted deltas together. So you can figure if the stock goes up 1 the position will increase roughly 750.

How To Use The Greeks To Predict Option Prices

How To Use The Greeks To Predict Option Prices

INPUTS Change the numbers below to calculate other option price delta and gamma values days 005479452 years.

How option delta is calculated. Owning the 115 call option is like owning 24 shares of Microsoft stock 024 x 100. The delta for the 115 call option is 024. I calculate call delta in cell V44 continuing in the example from the first part where I have already calculated the two individual terms in cells M44 and S44.

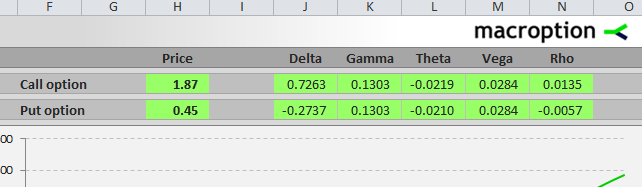

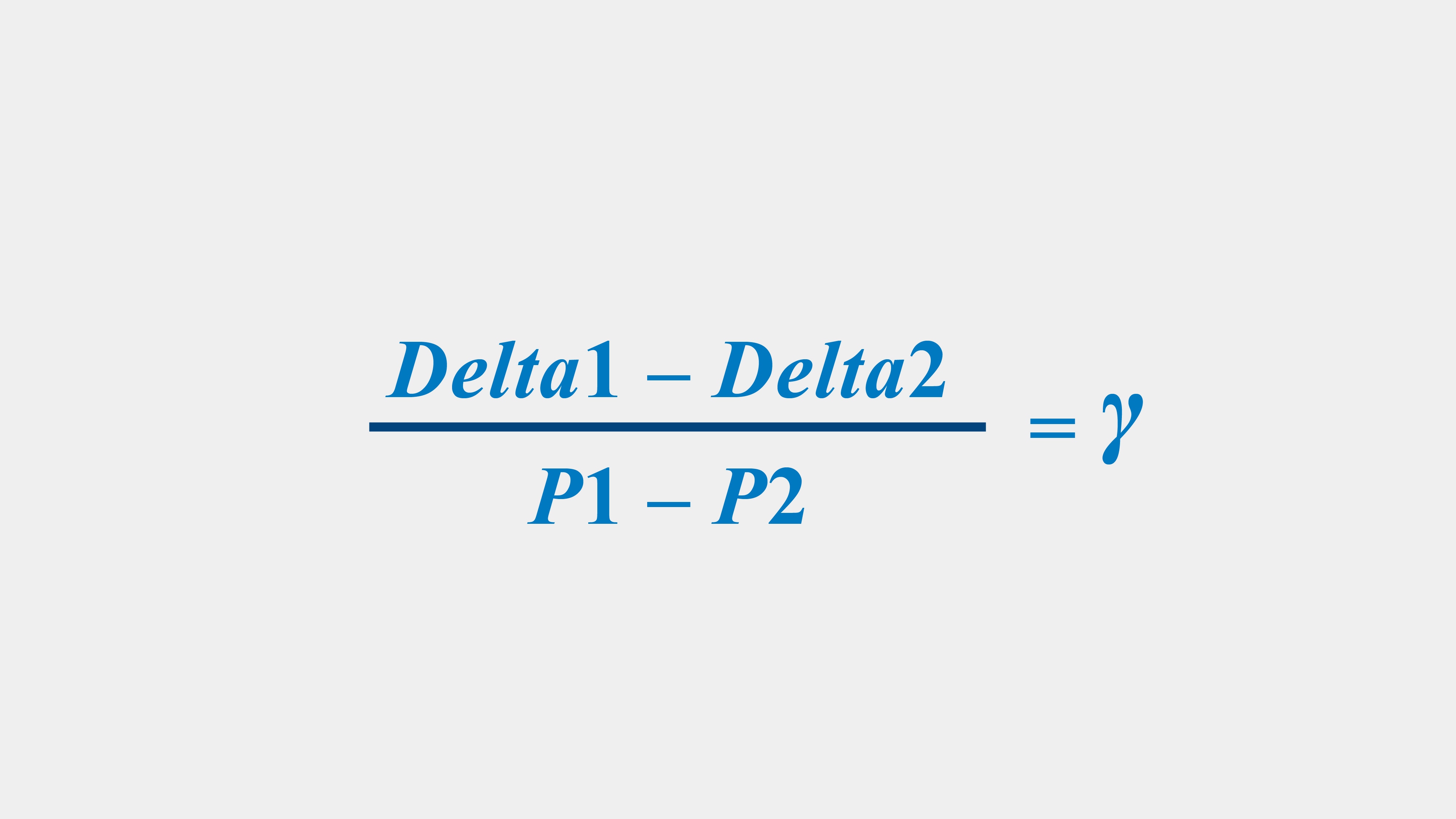

The formula for Delta is. This calculator utilizes the inputs below to generate call put prices delta gamma and theta from the Black-Scholes model. M44S44 The calculation of put delta is almost the same using the same cells.

If an option contract has a delta of 035 and the price of the stock rises by 1 then the options contract would increase by 035. The delta adjusted notional value quantifies changes to a portfolios value. Values range from 10 to 10 or 100.

Our underlying futures product moved from 96 to 975. That means your call options are acting as a substitute for 750 shares of the underlying stock. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

Heres what well cover in todays update. Option delta provides investors with a method of calculating future market prices for options based on projected changes in the underlying market. Check out todays TradeHacker Update.

However you sold the 115 call option so that part of your delta calculation will be negative. If the price of the stock decreases by 1 then it would lose 035. Δ S V.

Therefore your delta position is 39 24 15. ROKU thinks they are the best Adding a Weekly Double Calendar in SPX For full details read more. Option Price Delta Gamma Calculator.

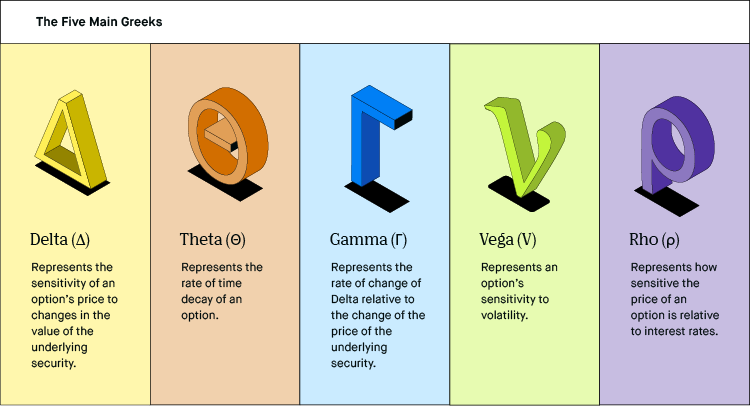

An options delta refers to how sensitive the options price is relative to a 1 change in the underlying security. However even the Black and Scholes model is used to determining the value of Delta where there is a variable in it which is N d1 which can be calculated using computer software. Anticipate a future market move.

Delta is expressed as a number between -1 and 1. Option Calculator Delta is a measure of the rate of change in an options theoretical value for a one-unit change in the price of the underlying. Call Option Put Option.

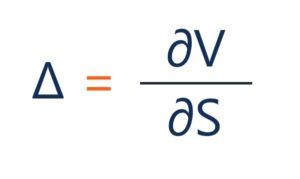

Delta frac partial V partial S. The delta of the option is negative however because you have sold the option you reverse the sign of the delta therefore making your position delta positive a negative multiplied by a negative equals a positive. The formulas for delta are relatively simple and so is the calculation in Excel.

Watch our video on how options delta affects options pricing. Call deltas are positive. To calculate position delta multiply75 x 100 assuming each contract represents 100 shares x 10 contracts.

More specifically a call option Delta will range from 0 to 1 and a put option Delta will range from -1 to 0. Delta is a percentage measure. Delta measures the rate of change in an options price per 1 move.

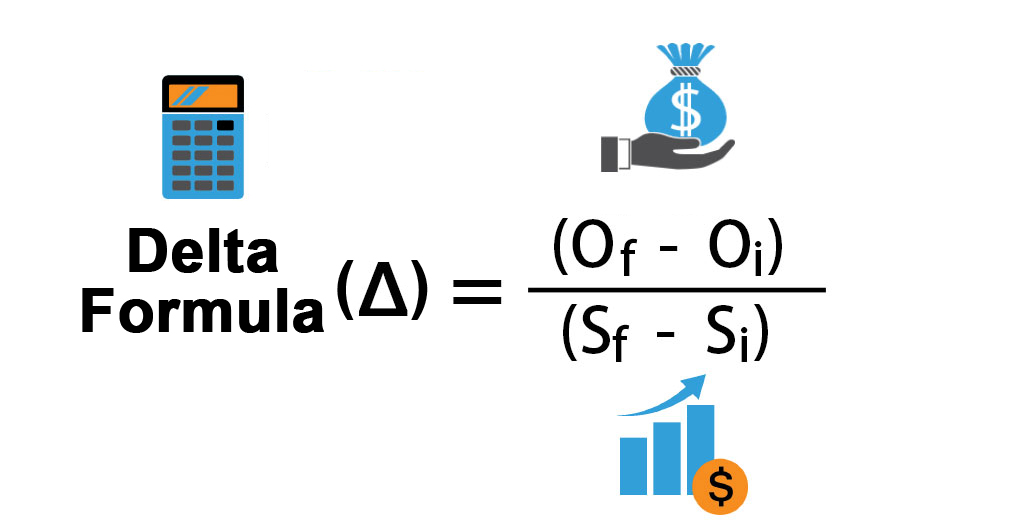

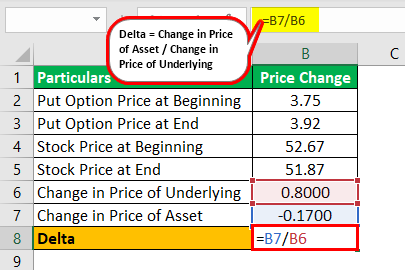

The delta for the 110 call option is 039. Delta Change in Price of Asset Change in Price of Underlying. Put deltas are negative reflecting the fact that the put option price and the underlying price are inversely related.

If you are trading an option on a stock this is the current share price of the stock. This means whatever the change of the underlying future is the option will move by 50 of that change. Examples of Delta Formula with Excel Template.

Using our example from above if you are long a call on TOP with a Delta of 050 and the underlying makes the move up from 5000 to 5100 your option would now be worth 250. Delta can be positive or negative depending on if the option is a put or call. The delta of an option is the rate of change of the price with respect to changes in the price of the underlying.

Assume we have a call option priced at 100 and it has a50 delta. How is an options Delta calculated. Copies of this document may be obtained from your broker from any exchange on which options are traded or by contacting The Options Clearing Corporation 125 S.

Options involve risk and are not suitable for all investors. If the stock price increases by 1 point a negative delta means the price of the option will decrease by 050. Identify the price of the underlying asset.

So owning the 110 call option is like owning 39 shares of Microsoft stock 039 x 100. This gives you a result of 750. Delta measures the degree to which an option is exposed to shifts in the price of the underlying asset ie a stock or commodity ie a futures contract.

What Is Delta D In Finance Overview Uses How To Calculate

What Is Delta D In Finance Overview Uses How To Calculate

How To Calculate The Delta Of An Option Quora

Gamma Part 2 Varsity By Zerodha

Delta Explained The Options Futures Guide

Delta Explained The Options Futures Guide

The Options Industry Council Oic Delta

The Options Industry Council Oic Delta

What Every Option Trader Should Know About Delta Martinkronicle

What Every Option Trader Should Know About Delta Martinkronicle

Delta Formula Calculator Examples With Excel Template

Delta Formula Calculator Examples With Excel Template

Greek Calculator Varsity By Zerodha

Option Greeks Excel Formulas Macroption

Option Greeks Excel Formulas Macroption

Option Volatility Greeks Vega Volga Vanna Financetrainingcourse Com

Option Volatility Greeks Vega Volga Vanna Financetrainingcourse Com

Option Delta Equation And Vba Code

Option Delta Equation And Vba Code

Position Delta Calculating Position Delta The Options Playbook

Position Delta Calculating Position Delta The Options Playbook

27e Options Delta Hedging My Cfa Notes Level Iii

27e Options Delta Hedging My Cfa Notes Level Iii

Delta Formula Definition Example Step By Step Guide To Calculate Delta

Delta Formula Definition Example Step By Step Guide To Calculate Delta

What Are Options Greeks 2020 Robinhood

What Are Options Greeks 2020 Robinhood

Probability Of A Successful Option Trade

Probability Of A Successful Option Trade

The Option Greeks Delta Part 1 Varsity By Zerodha

Post a Comment for "How Option Delta Is Calculated"