Stock Market Drop Due To Covid

The coronavirus pandemic has caused market turmoil not seen since The Great Depression which has decimated retirement plans for some and created tremendous opportunity for others. At its lowest closing session shares were down just under 86.

The Worlds 10 Largest Stock Markets The Briefing The 10 Largest Stock Markets Represent 78 8 Of The Stock Market Global Stock Market Shenzhen Stock Exchange

The Worlds 10 Largest Stock Markets The Briefing The 10 Largest Stock Markets Represent 78 8 Of The Stock Market Global Stock Market Shenzhen Stock Exchange

The cruise ship did unload several hundred people on Monday after nearly a dozen on board tested positive for COVID-19.

Stock market drop due to covid. Thats startling considering that. So back in the early days of the pandemic the stock market took us all on a ride. The Dow Jones industrial average plummeted as much as 1080 points - or 37 - on.

On 27 February due to mounting worries about the coronavirus outbreak various US. The Dow Jones has declined by about 28 between February 11 and March 12 2020 driven by the Coronavirus pandemic and turmoil in the crude oil markets. A plunging price for a stock is a potential opportunity at times.

The Dow Jones Industrial Average declined by more than 622 points. Also some of the smaller businesses that cant stay open due to Covid-19 are nowhere in the SP 500. It is too simple to assume.

How Did the Coronavirus Crash Affect the Stock Market. Unprecedented levels of uncertainty caused by the coronavirus disease 2019 COVID-19 whipsawed the broader market like never before this year. US stocks were swept up in a global sell-off on Monday as investors grappled with spreading coronavirus fears.

The coronavirus epidemic will get much worse in the United States in coming weeks. The current market has crashed around 30 per cent in less than three months. The March 2020 market crash - driven by the rapid spread of coronavirus around the world - is just the latest in a long line of panics throughout the hundreds of centuries that have roiled markets.

Stock market indices including the NASDAQ-100 the SP 500 Index and the Dow Jones Industrial Average posted their sharpest falls since 2008 with the Dow falling 1191 points its largest one-day drop since the 2008 financial crisis. That selling was a factor in the stock markets 26 percent drop on Wednesday the SP 500s worst daily decline in three months Mark Haefele the chief investment officer at UBS Global. One prediction seems solid.

But where the stock market is heading is much less certain. The 124-year-old Dow Jones Industrial Average. On 27 February due to mounting worries about the coronavirus outbreak stock markets in Asia-Pacific and Europe saw 35 declines with the NASDAQ-100 the SP 500 Index and the Dow Jones Industrial Average posting their sharpest falls since 2008 and the Dow falling 1191 points its largest one-day drop since the 2008 financial crisis.

The major stock indexes declined on Friday after major tech companies reported how theyve been affected by the COVID-19 pandemic. The longest bull market in US. Down 55 year-to-date through March 10 CCL stock has been punished by the.

History came to a sudden end this week punctuated by a Thursday selloff that was the steepest one-day fall since the October 1987 stock market crash driven by. Here as well there may be something to this explanation but it is also highly incomplete. Most SP 500 firms seeing trouble have been able to borrow funds to see out Covid-19 so far.

Markets frequently see certain companies where stock prices drop greatly even though the core business remains largely intact. According to this explanation the stock-market impact of the COVID-19 pandemic is more temporally concentrated and more likely to trigger daily stock -market jumps and high stock-market volatility than Spanish Flu developments did a century earlier. Global markets not just here in the US took a huge plunge triggering a short-lived bear market where the stock market falls by at least 20 and an economic recession in the following months.

Due to COVID-19 no one knows when the economy will be back on track. When Covid-19 took down high-contact businesses this initially sent a chill down Disneys back.

Stock Markets Reaction To Covid 19 Cases Or Fatalities Sciencedirect

Stock Markets Reaction To Covid 19 Cases Or Fatalities Sciencedirect

Stock Market Ends Year At Record Levels The Washington Post

Stock Market Ends Year At Record Levels The Washington Post

Covid 19 Impact On Latin American Stock Market 2020 Statista

Covid 19 Impact On Latin American Stock Market 2020 Statista

The 2020 Us Stock Market Drop Was Bad In 2020 Us Stock Market Stock Market Data Visualization

The 2020 Us Stock Market Drop Was Bad In 2020 Us Stock Market Stock Market Data Visualization

Stock Market Today Stocks Begin 2021 With A Sell Off Dow Drops More Than 300 Points

Stock Market Today Stocks Begin 2021 With A Sell Off Dow Drops More Than 300 Points

Stock Market Today Stocks Suffer Their Worst Day Since March With The Dow Plunging More Than 1 800 Points

Stock Market Today Stocks Suffer Their Worst Day Since March With The Dow Plunging More Than 1 800 Points

Infographic U S Stock Market Wraps Up Best Quarter In Decades Stock Market Us Stock Market Marketing

Infographic U S Stock Market Wraps Up Best Quarter In Decades Stock Market Us Stock Market Marketing

Is The Everything Bubble Finally Popping This Chart Might Have The Answer Marketwatch Stock Market Stock Market Crash Marketing

Is The Everything Bubble Finally Popping This Chart Might Have The Answer Marketwatch Stock Market Stock Market Crash Marketing

Stock Market Crash Here Is Why We Are In A Goldilocks Scenario For Stocks

Stock Market Crash Here Is Why We Are In A Goldilocks Scenario For Stocks

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments A Interest Rates Financial Wealth Developed Economy

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments A Interest Rates Financial Wealth Developed Economy

Stock Market Crash Overview How It Happens Examples

Stock Market Crash Overview How It Happens Examples

Yes Stocks Could Drop 50 Percent Stock Market Stock Market Crash Us Stock Market

Yes Stocks Could Drop 50 Percent Stock Market Stock Market Crash Us Stock Market

Charting The World S Major Stock Markets On The Same Scale 1990 2019 Stock Market Developed Economy Purchasing Power Parity

Charting The World S Major Stock Markets On The Same Scale 1990 2019 Stock Market Developed Economy Purchasing Power Parity

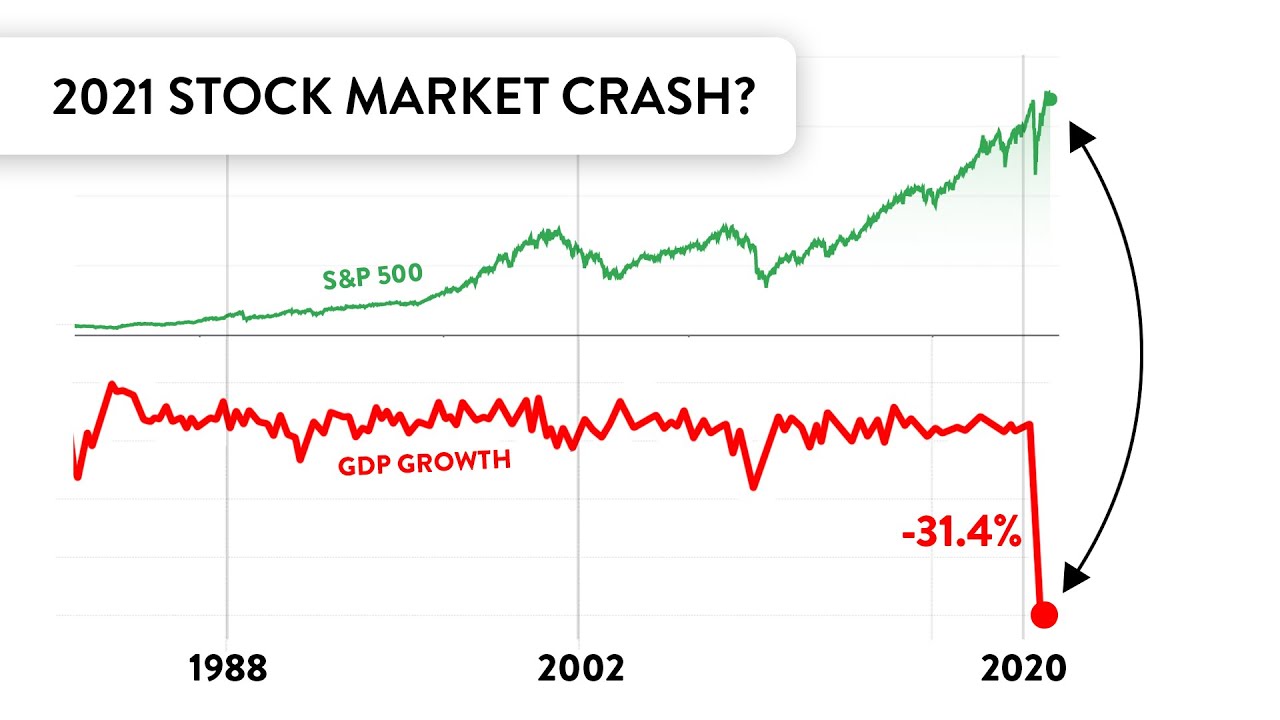

The Stock Market Is Currently Broken Stock Market Crash In 2021 Youtube

The Stock Market Is Currently Broken Stock Market Crash In 2021 Youtube

The Dotcom Bubble Internet Bubble Bubble Series Stock Market Art Wall Street Art Stock Market Poster Wall Street Poster Stock Market Gift Wall Street Bubbles Wall Street Art Stock Market

The Dotcom Bubble Internet Bubble Bubble Series Stock Market Art Wall Street Art Stock Market Poster Wall Street Poster Stock Market Gift Wall Street Bubbles Wall Street Art Stock Market

Post a Comment for "Stock Market Drop Due To Covid"