Stock Market History Recession

On average the US. The recession in the early 1990s that followed a long economic expansion in the 1980s the 2001.

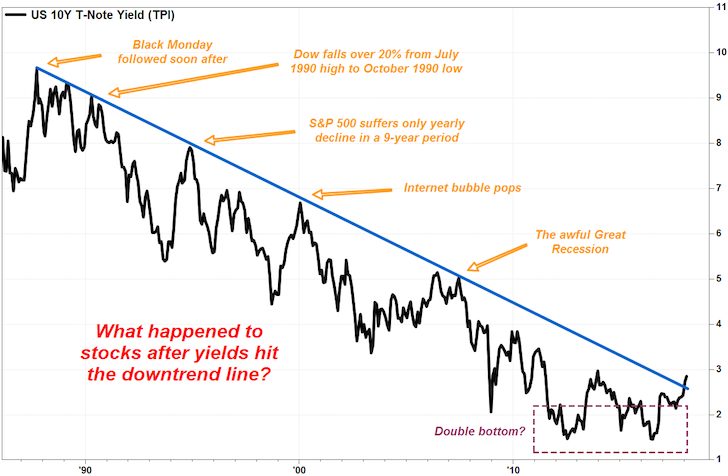

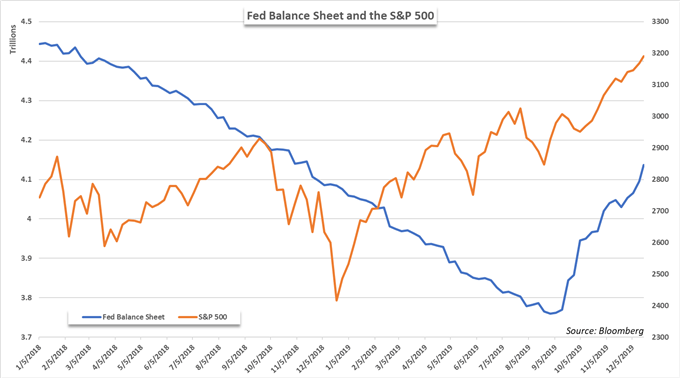

The Biggest Force Powering The Stock Market Is Starting To Disappear And It Could Be A Huge Problem Business Insider Business Insider Stock Market Marketing

The Biggest Force Powering The Stock Market Is Starting To Disappear And It Could Be A Huge Problem Business Insider Business Insider Stock Market Marketing

A bull market had been running since March 11 2009 when the Dow closed at 693040.

Stock market history recession. Until March 2020 it hadnt fallen 20 since then making it the longest-running bull market in US. Before the coronavirus recession began in March 2020 no post-World War II era had come anywhere near the depth of the Great Depression which lasted from 1929 until 1941 which included a bull market between 1933 and 1937 and was caused by the 1929 crash of the stock market and other factors. But not every recession leads to a complete disaster in the stock market.

A correction is defined as a 10 decline in one of the major US. During this decade stock markets soared until the tech bubble burst in March 2000. The fear index the.

Stock market crash was in October 1929 when the decade-long Roaring 20s economy ran out of steam. That second type of stock may actually benefit during recessions by scooping up market share. 20 Reasons and causes.

The first major US. With commodities like homes and autos selling like hotcakes speculators. InvestorPlace - Stock Market News Stock Advice Trading Tips.

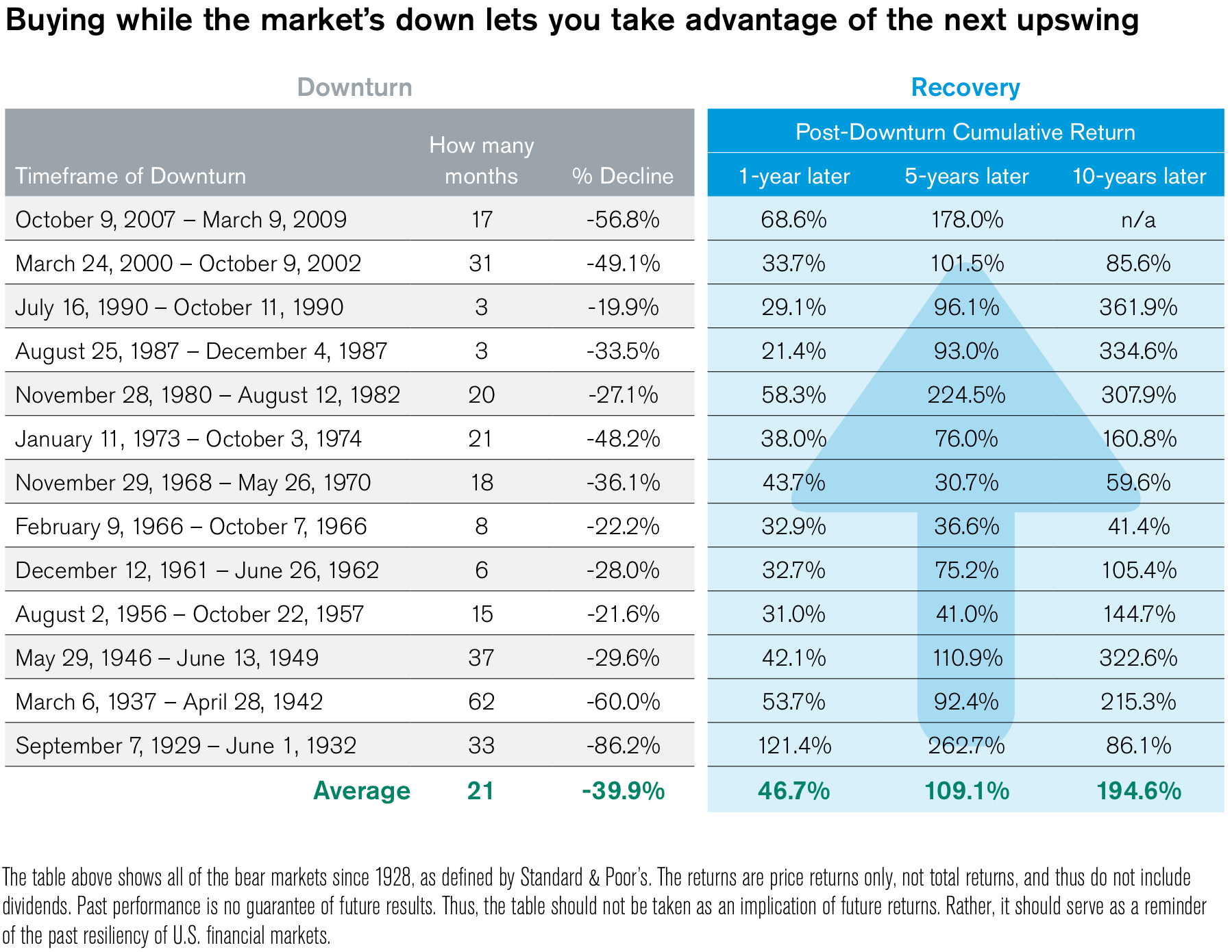

The current month is updated on an hourly basis with todays latest value. Putting these 14 periods end-to-end would result in a loss of -964. The Great Depression the 1937 recession 1973-75 recession and the Great Recession all caused the markets to be cut in half or worse.

A bear market prices decrease 20 or more occurs during a recession and a bull market prices increase during an expansion. In the recession years of 2007 to 2009 PepsiCo stock had a high of 7957 and a low of 4581. The New Deal ended the first recession boosting growth by 108The second recession ended when the drought did and the government increased spending for World War II.

At the low its share price declined 424 from its high. At the low its share price declined 424. Stock market peaks six months before the start of a recession.

The stock market crashed in late 1937. 16 a bomber killed 30 people on Wall Street in the heart of New Yorks. Library of Congress 1920 - Return on SP Composite index.

A 10-year drought in the Midwest created the Dust Bowl that devastated farmers. Now much can be hidden in an average. Stock indexes typically the SP 500 or Dow Jones Industrial Average from a recent 52-week high close.

It historically bottoms out approximately six months after the start of a recession and usually starts. Historical data is inflation-adjusted using the headline CPI and each data point represents the month-end closing value. Clearly we didnt hit recession territory until well into the pandemic.

By definition a recession must last at least six months where a bull or bear market could last a matter of days in theory. May 1937June 1938 Duration. -1234 - Return on 3-month Treasury bills.

The 14 recessions with negative returns lasted 18 months on average with an average return of -142. And if Id just gone with Dollar General NYSEDG. 19 nine days before the official start of the recession.

Lets take a quick look at how the stock market performed during three recessions in recent history. In 2020 the market peaked on Feb. The stock market typically continues to decline sharply for several months during a recession.

Interactive chart of the Dow Jones Industrial Average DJIA stock market index for the last 100 years. In fact after 11 trading days the Dow Jones managed to climb out of. There have been a number of times throughout history where the United States went into a recession but not a debilitating market crash.

The 1929 stock market crash destroyed businesses and life savings. Thats why the following four recession-resistant tech stocks look like fine buys today even if the. Interestingly the average price return of the SP 500 during these recessions was around 0.

Early in the recession stock declined losing 26 until bottoming October 11 1990 C-1. The last recession aka global financial crisis had markets down.

Historical Stock Market Performance When Interest Rates Rise Financial Samurai

Historical Stock Market Performance When Interest Rates Rise Financial Samurai

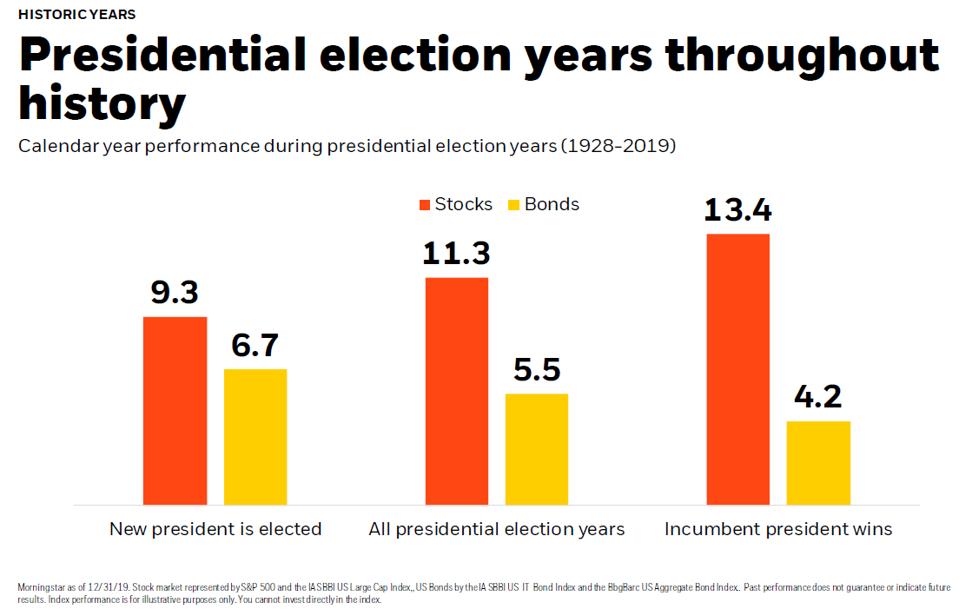

Here S How The Stock Market Has Performed Before During And After Presidential Elections

Here S How The Stock Market Has Performed Before During And After Presidential Elections

The Stock Market Crash Of 1929 Stock Market Crash Stock Market Stock Market History

The Stock Market Crash Of 1929 Stock Market Crash Stock Market Stock Market History

Stock Market News Now Is Not The Time To Panic Say Market Watchers Fortune

Stock Market News Now Is Not The Time To Panic Say Market Watchers Fortune

Msci Growth Vs Msci Value Rebounding Economic Activity Value Stocks

Msci Growth Vs Msci Value Rebounding Economic Activity Value Stocks

Historical Stock Market Returns By Us Presidents August 2020 Update Razor Wealth Management

Historical Stock Market Returns By Us Presidents August 2020 Update Razor Wealth Management

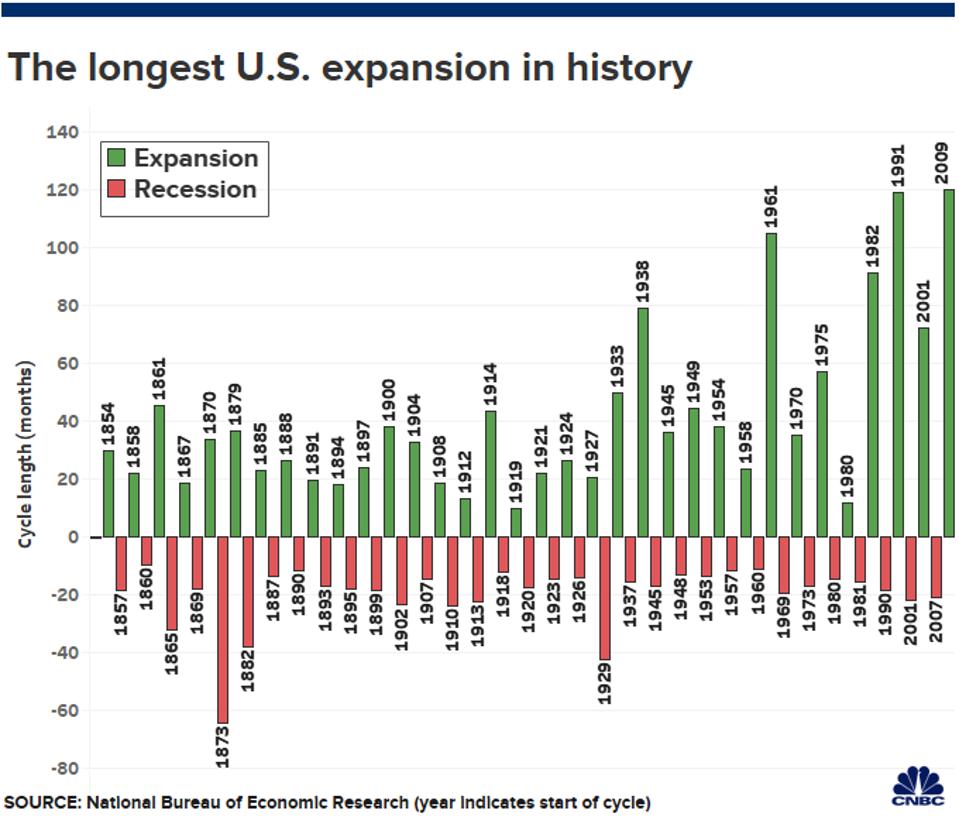

Longest Economic Expansion In United States History

Longest Economic Expansion In United States History

How To Profit From Stocks During A Recession Investor S Handbook

How To Profit From Stocks During A Recession Investor S Handbook

Chart Gtr Expansions Vs Recessions 916x557 Dow Jones Index Economic Indicator Economic Research

Chart Gtr Expansions Vs Recessions 916x557 Dow Jones Index Economic Indicator Economic Research

8 Stock Market Crash Great Depression History Hub

:max_bytes(150000):strip_icc()/Clipboard01-bbbd8482e51843389bd9d29b825cb1a1.jpg) A History Of The S P 500 Dividend Yield

A History Of The S P 500 Dividend Yield

What Are The Signs That A Stock Market Crash Is Coming My Trading Skills

What Are The Signs That A Stock Market Crash Is Coming My Trading Skills

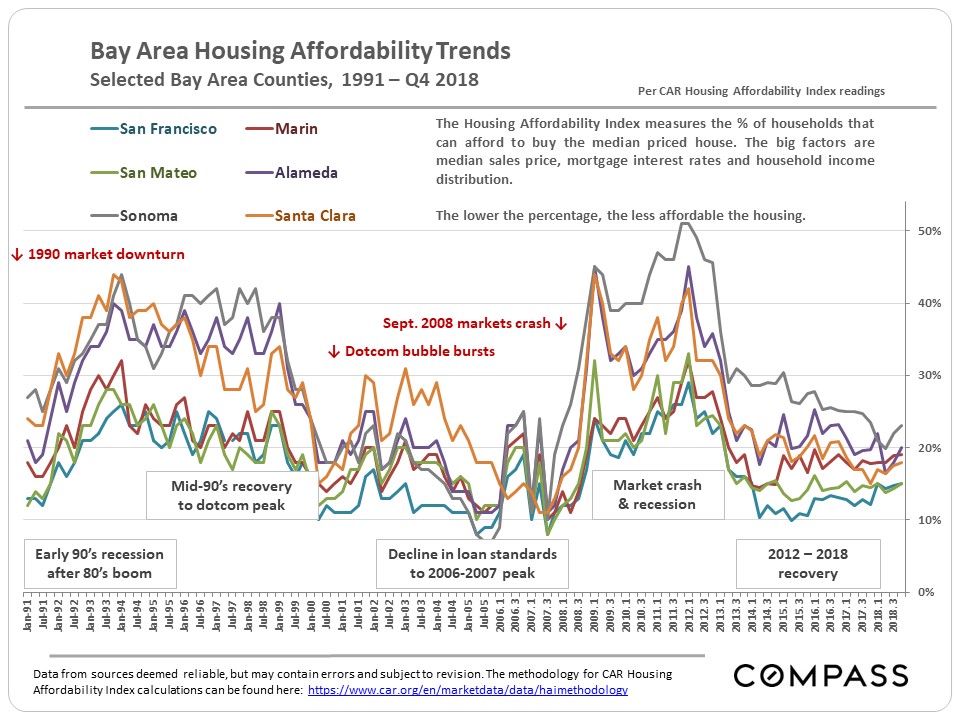

30 Years Of Bay Area Real Estate Cycles Compass Compass

30 Years Of Bay Area Real Estate Cycles Compass Compass

What To Expect From The Stock Market In 2020 Based On History And Statistics Seeking Alpha

What To Expect From The Stock Market In 2020 Based On History And Statistics Seeking Alpha

The Complete History Of The Financial Crisis In One Chart September 11th 2013 Financial Graphing Create Graph

The Complete History Of The Financial Crisis In One Chart September 11th 2013 Financial Graphing Create Graph

Here S How Warren Buffett Sees The Stock Market Stock Market Marketing Investing

Here S How Warren Buffett Sees The Stock Market Stock Market Marketing Investing

:max_bytes(150000):strip_icc()/2019-03-08-MarketMilestones-5c82eebe46e0fb00010f10bd.png) Market Milestones As The Bull Market Turns 10

Market Milestones As The Bull Market Turns 10

Vix Volatility Index Historical Chart Macrotrends

Vix Volatility Index Historical Chart Macrotrends

:max_bytes(150000):strip_icc()/aBtUl-s-amp-p-500-bear-markets-and-recoveries2-1224ae91815a4cbca5be50178f6f34aa.png)

Post a Comment for "Stock Market History Recession"