Stock Market Valuation Definition

Fair market value is the amount a stock is worth on the open market. In other words a stocks actual value is whatever someone is willing to pay.

These are the GDPs in US.

:max_bytes(150000):strip_icc()/dotdash_Final_How_does_the_performance_of_the_stock_market_affect_individual_businesses_Nov_2020-01-acba7f0a342b4f29aa6cc0bb246d2dd3.jpg)

Stock market valuation definition. Every investor who wants to beat the market must master the skill of stock valuation. The total market valuation is measured by the ratio of total market cap TMC to GNP -- the equation representing Warren Buffetts best single measure. Investors in value stocks attempt to capitalize on inefficiencies in the market.

Understanding NAV and market value The net asset value of a fund is a simple concept to understand. Most commonly used in the. A ratio below 100 indicates that the stocks price is lower than our estimate of its fair value.

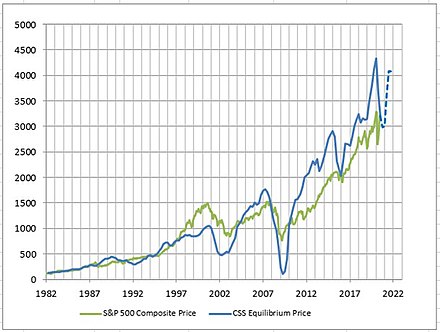

Buyers and sellers are reasonably knowledgeable about the. The market value of stock is the price at which a share of stock trades in the public market. This ratio since 1970 is shown in the second chart to the right.

The importance of valuing stocks evolves from the fact that the intrinsic value of a stock is not attached to its current price. While fundamental factors influence stock prices over the long term supply and demand rule stock prices in the short term. The net asset value NAV represents the net value of an entity and is calculated as the total value of the entitys assets minus the total value of its liabilities.

A value stock is a security trading at a lower price than what the companys performance may otherwise indicate. If you add up the total value of a funds assets and divide it by the number of shares. In financial markets stock valuation is the method of calculating theoretical values of companies and their stocks.

Stock valuation is the process of calculating how much a company stock is worth using methods that consider economic factors such as past prices and forecast data. This can help you predict future market prices. By definition value stocks should be less expensive than growth stocks but the current differential is startling.

Where INFLATION causes the price of several different batches of finished-goods stock bought during a trading period to differ the firm has the problem of deciding what money value to place upon the units sold in the PROFIT-AND-LOSS ACCOUNT since this affects the cost of goods sold and so GROSS PROFIT. The further the pricefair value ratio rises above 100 the more the median stock is overvalued. Original GDP data was in each countrys national currency.

Market value also known as OMV or open market valuation is the price an asset would fetch in the marketplace or the value that the investment community gives to a particular equity or. They are converted into the US. Stocks can be traded on a stock exchange such as the New York Stock Exchange or over the counter through a network of dealers.

Fair market value generally incorporates the following assumptions. In general a company can be valued on its own on an absolute basis or else on a relative basis compared to. The original market valuation is measured by the ratio of total market cap to GDP.

The price-to-earnings ratio PE of the iShares Russell 1000 Value ETF is 17. A stocks trading price represents the number that an arms-length willing seller and willing buyer find agreeable to each party. Valuation is a quantitative process of determining the fair value of an asset or a firm.

Dollars for these countries. The placing of an appropriate money value upon a firms STOCKS of raw materials work-in-progress and finished goods. As of 02262021 this ratio is 1901.

The price-to-earnings ratio or PE is one of the most widely-used stock analysis tools used by investors and analysts for determining stock valuation. It is the price that would be agreed on between a willing buyer and a willing seller with neither being required to act and both having reasonable knowledge of the relevant facts. Dollar using the latest exchange rate.

Essentially stock valuation is a method of determining the intrinsic value or theoretical value of a stock. Fair market value FMV is the price that property would sell for on the open market. The market value of stock measures the collective expectations of investors about a companys.

In addition to showing whether a companys. The main use of these methods is to predict future market prices or more generally potential market prices and thus to profit from price movement stocks that are judged undervalued are bought while stocks that are judged overvalued are sold in the expectation that undervalued stocks will overall rise in value while overvalued stocks will generally decrease in value.

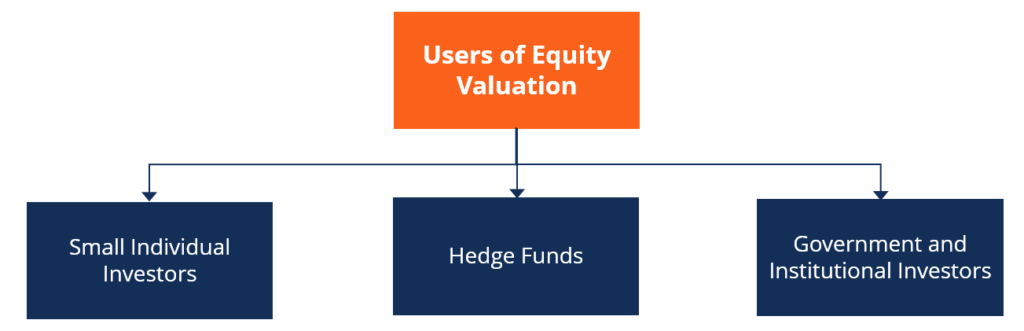

Equity Valuation Overview Types Of Users And Process

Equity Valuation Overview Types Of Users And Process

Valuation Ratio For Investors Stock Market Investing Ideas Of Stock Market Investing Stockmarket Investin Financial Ratio Stock Market Finance Investing

Valuation Ratio For Investors Stock Market Investing Ideas Of Stock Market Investing Stockmarket Investin Financial Ratio Stock Market Finance Investing

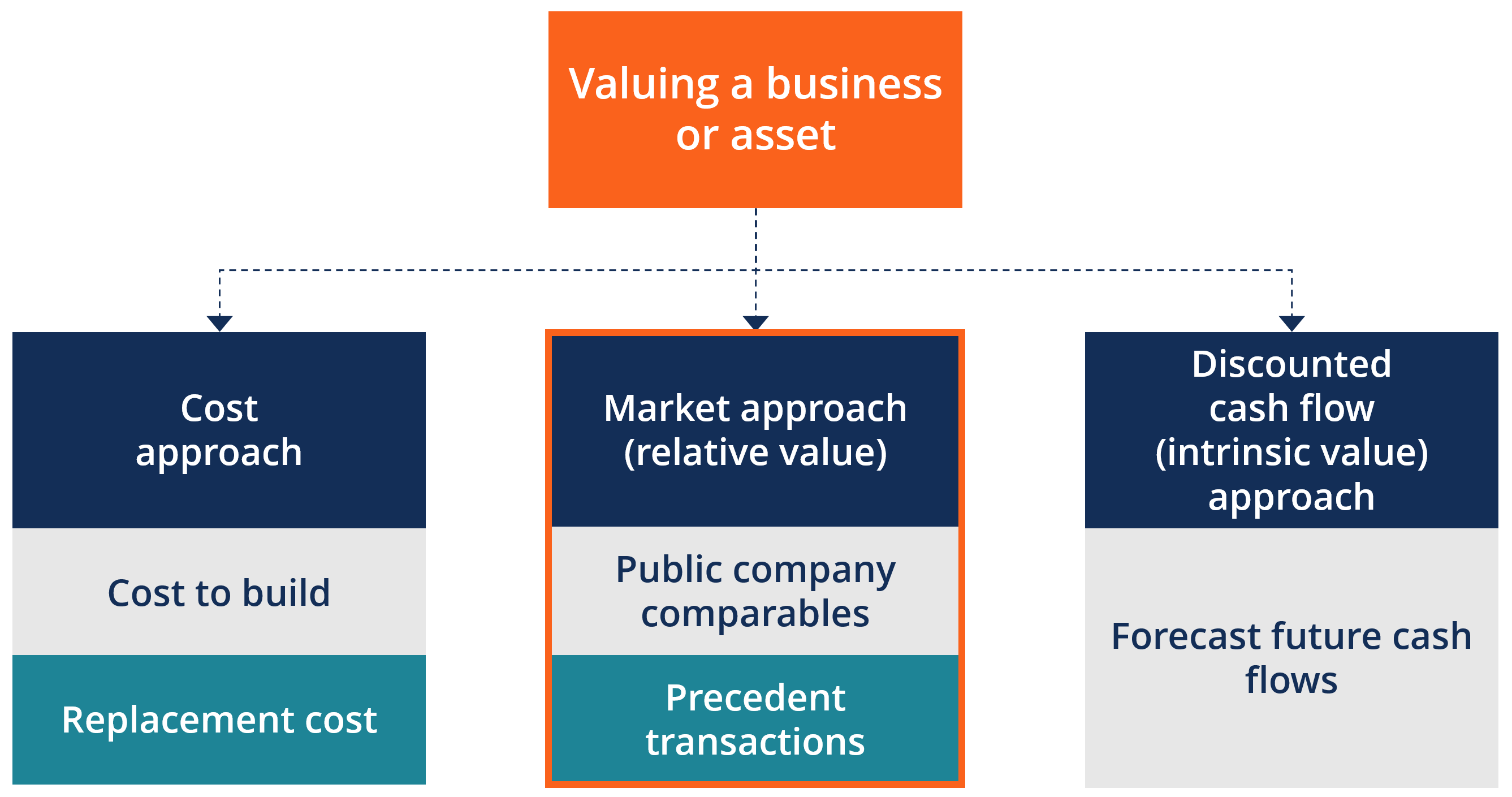

Stock Valuation Overview Types And Popular Methods

Stock Valuation Overview Types And Popular Methods

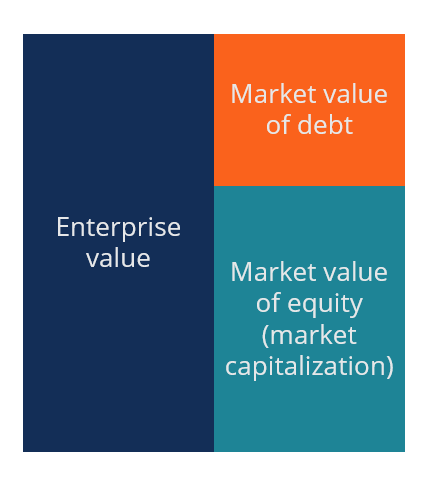

Enterprise Value Meaning Importance Calculation

Enterprise Value Meaning Importance Calculation

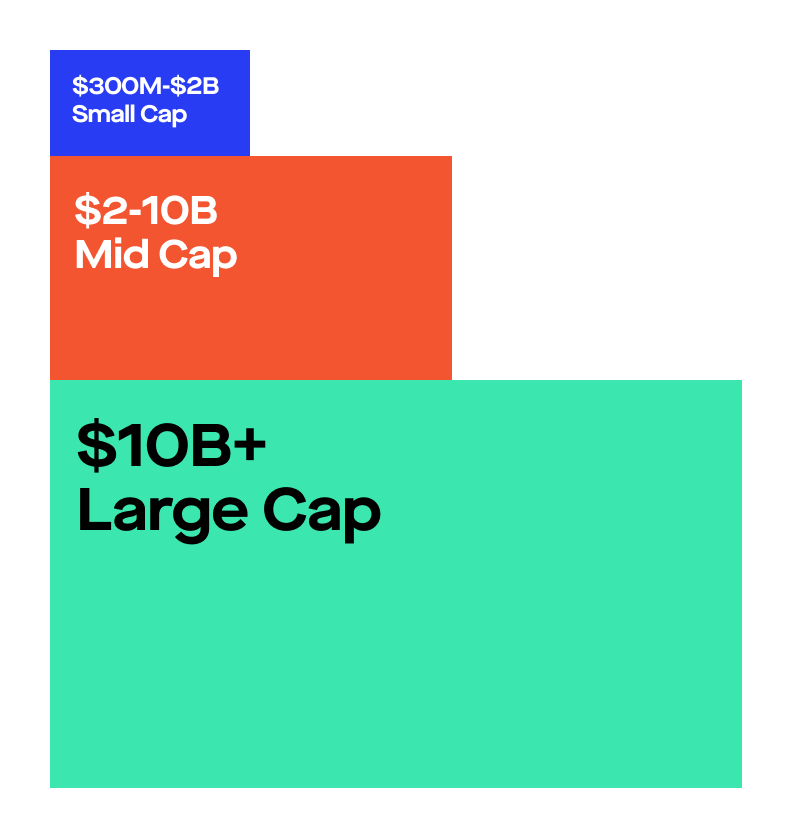

Market Capitalization Learn About Market Cap How To Calculate It

Market Capitalization Learn About Market Cap How To Calculate It

What Is Market Capitalization Robinhood

What Is Market Capitalization Robinhood

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Understand_a_Stock_Quote_Oct_2020-01-2343a2cf9541435cbe38ed5e9484af20.jpg) How To Understand A Stock Quote

How To Understand A Stock Quote

Market Approach Methods Uses Advantages And Disadvantages

Market Approach Methods Uses Advantages And Disadvantages

Market Value Vs Book Value Overview Similarities And Differences

Market Value Vs Book Value Overview Similarities And Differences

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Value_Added_MVA_Apr_2020-01-0552b692c94943a0bd80cd554965e002.jpg) Market Value Added Mva Definition

Market Value Added Mva Definition

:max_bytes(150000):strip_icc()/stock-market-down-56a6d24a5f9b58b7d0e4f823.png) Essentials Of Financial Markets

Essentials Of Financial Markets

:max_bytes(150000):strip_icc()/dotdash_Final_How_does_the_performance_of_the_stock_market_affect_individual_businesses_Nov_2020-01-acba7f0a342b4f29aa6cc0bb246d2dd3.jpg) How Does The Performance Of The Stock Market Affect Individual Businesses

How Does The Performance Of The Stock Market Affect Individual Businesses

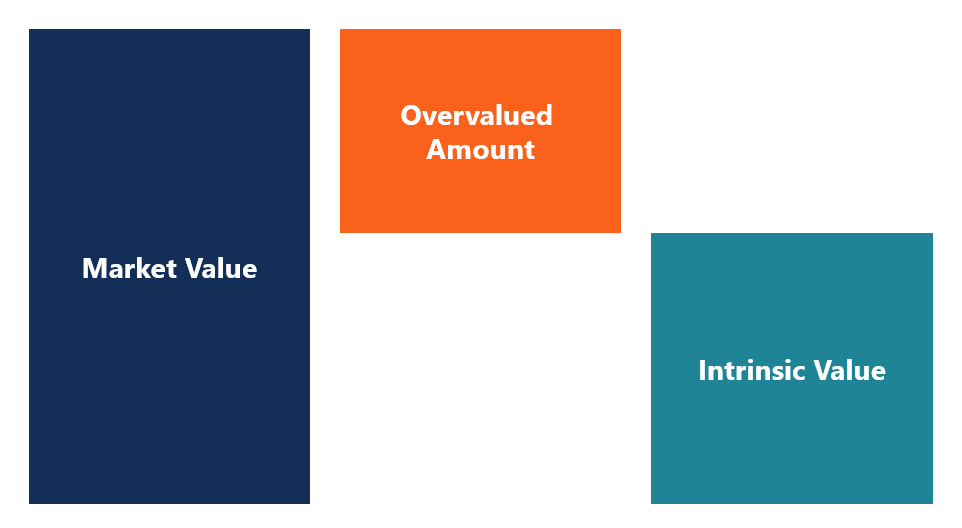

Overvalued Definition Intrinsic Value Ratios For Overvalued Investments

Overvalued Definition Intrinsic Value Ratios For Overvalued Investments

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Stock_2020-01-03fbeb0664c74b71aa025dcfd7661c82.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1144149669-9fca5c1050ed4ce38d6269816633e95c.jpg)

/dotdash_Final_Market_Indicators_Jun_2020-01-4781d74d7d664d1eadd64d5079e7515b.jpg)

:max_bytes(150000):strip_icc()/company_stock_performance_-5bfc2f4046e0fb0026021bf7.jpg)

Post a Comment for "Stock Market Valuation Definition"