How To Square Off Call Option

Is it possible to use an option call to offset a short stock position. If you have sold Call Options and want to square off your position you will have to buy back the same number of Call Options that you have written and these must be identical in terms of the underlying scrip and maturity date to the ones that you have sold.

Why Sellers Love Square.

How to square off call option. So if you have bought a Call option then you can sell a Call option of similar lot size underlying and expiry. The options contract will be physically settled if its in the money. There are two ways to settle squaring off and physical settlement.

For a buyer of a call option. This is presently not possible. When you take exactly opposite of your existing position it is called squaring off.

Most experienced option buyers keep a close eye on decaying time value and regularly square off positions as an option moves towards expiry to avoid further loss of time decay value while the. You can mention the price in that field and click square off if you want to exit from the admin position itself. Get answers to your questions.

Hi Al Moura yep you can just buy the same amount of options that you are short from the market to square off your position. The short call of my option spread was exercised and I became short stock. An option is a contract between two parties to buy or sell a given amount of underlying assets at pre-specified price on or before a given date.

Videos you watch may be added to the TVs watch. Live help when you need it. It is typically between 315 PM to 320 PM for Equity 325 PM for FO 445 PM for currency and 25 minutes before market close for commodities.

To come out of a trade in Index option before expiry you can square it off by taking an opposite trade. Lets say your existing position is BUY Call Option on Reliance. I have choosen the strike price 7750 call option NIFTY14OCT7750CE by clicking Buy in this contract Bought for the premium Rs118.

Reach out to our team via phone email live chat and social media. View the basic SQ option chain and compare options of Square Inc. What will happen if I dont square off my Option contract on expiry day.

Today my bob call option got auto square off and i suffer a loss. At expiry Company XYZ trades for 100 in the open market and the call option is priced at intrinsic value meaning the trader can now sell the option for 10 100 market price - 90 strike price. Positions need to be squared off by last trading day of the contract failing which exchange will square off those positions.

A Short Call means selling of a call option where you are obliged to buy the underlying asset at a fixed price in the future. The other way would be to just use a fresh selling orderF2 with option as limit and mentioning your price. This strategy has limited profit potential if the stock trades below the strike price sold and it is exposed to higher risk if the stock goes up above the strike price sold.

If you see the image in the post above you will see a price next to the square off button. Vice versa if you have a sell or short position. I buy this option at cash only then why u need 2x margin.

It is recommended that you close your open intraday positions before the above mentioned time. You can go to the Reports section and square off an Option. Click Done Review changes on next screen and Delete Variation.

You exercise an Option when you want to take delivery of the underlying stocks commodities or currency of the Option. Now if you SELL Put Option on Reliance with same strike price lot size and expiry then youre squaring off your position. If playback doesnt begin shortly try restarting your device.

Search our robust library of resources get started guides video tutorials and more. Based on market volatility intraday square off timings can change at the discretion of our risk management team. For contracts where delivery based physical settlement does not take place the implication is as follows -.

From the Edit Option view click the X next to the Option youd like to remove. As i already paid cash for my purchase value then i dint have further risk obligation from my as well as your side. Transfer Options with Square.

Find the latest on option chains for Square Inc. If you decide to square off your position before the expiry of the contract you will have to sell the same number of call options that you have purchased of the same underlying stock and maturity date and strike price. From the Edit Item page click Edit next to the Option set name that has the Option youd like to remove.

Selling Options require you to maintain a margin. Join our Seller Community. If you have a buy position use sell order for same quantity to square off.

Al MouraJanuary 12th 2012 at 1225pm.

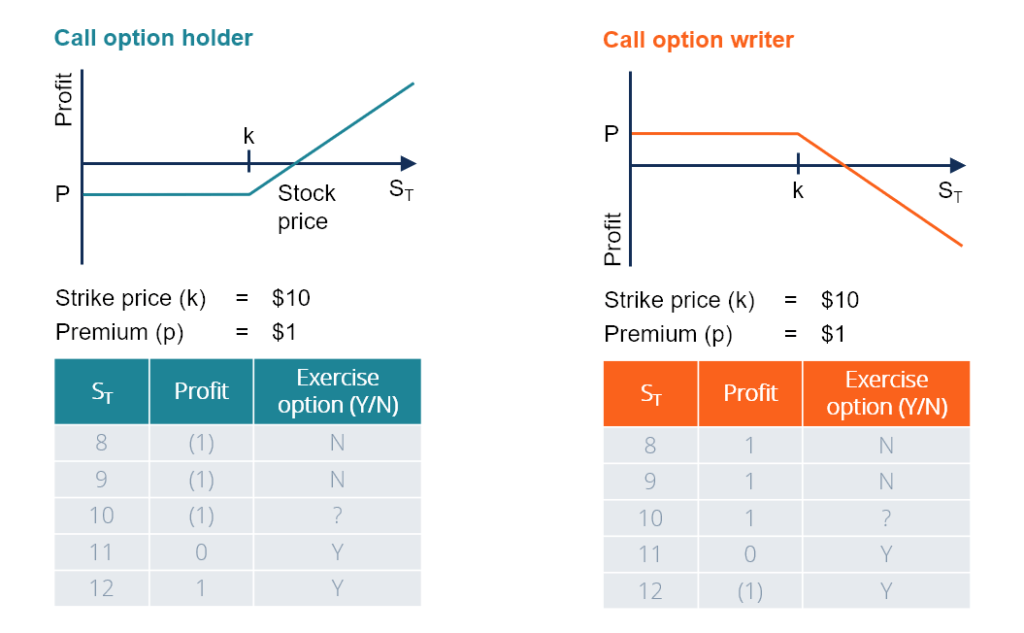

Summarizing Call Put Options Varsity By Zerodha

Call Ratio Backspread Option Strategy Explained Dalalstreetwinners Option Strategies Options Trading Strategies Strategies

Call Ratio Backspread Option Strategy Explained Dalalstreetwinners Option Strategies Options Trading Strategies Strategies

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Excel

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Excel

9 Jul Live Future Option Trading Profit 12900 Returns 10 Dala Future Options Option Trading Trading

9 Jul Live Future Option Trading Profit 12900 Returns 10 Dala Future Options Option Trading Trading

Professional Online Trading Tips Subscription Professional Trading Tips On Whatsapp Online Trading Trading Tips

Professional Online Trading Tips Subscription Professional Trading Tips On Whatsapp Online Trading Trading Tips

Strangle Option And Straddle Option A Simple Investment Strategy Stock Options Trading Option Trading Stock Options

Strangle Option And Straddle Option A Simple Investment Strategy Stock Options Trading Option Trading Stock Options

Selling Writing A Call Option Varsity By Zerodha

Education Option Best Option Strategies For Beginners 2019 In 2020 Option Strategies Covered Calls Strategies

Education Option Best Option Strategies For Beginners 2019 In 2020 Option Strategies Covered Calls Strategies

Option Straddles Options Trading Strategies Intraday Trading Option Trading

Option Straddles Options Trading Strategies Intraday Trading Option Trading

Stock Future Stock Market Automated Trading Intraday Trading

Stock Future Stock Market Automated Trading Intraday Trading

Intraday Trading As The Name Suggests Refers To The Trading System Where You Have To Square Off Your Tr Intraday Trading Trading Strategies What Is Day Trading

Intraday Trading As The Name Suggests Refers To The Trading System Where You Have To Square Off Your Tr Intraday Trading Trading Strategies What Is Day Trading

Call Option Understand How Buying Selling Call Options Works

Call Option Understand How Buying Selling Call Options Works

The Risk Usually Involved From Selling Call Options Is Covered By The Company Equities That Can Be Deli Covered Call Writing Covered Calls Investing Strategy

The Risk Usually Involved From Selling Call Options Is Covered By The Company Equities That Can Be Deli Covered Call Writing Covered Calls Investing Strategy

:max_bytes(150000):strip_icc()/PutWriting3-61675512850c4c0b9b6ccad12d329965.png)

/PutDefinition2-8a7d715894554ca990ef6946cc6a0306.png)

/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-01-def4a17c8b054eba9f90189fc30bf002.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

Post a Comment for "How To Square Off Call Option"