Intrinsic Value Of Ko Stock

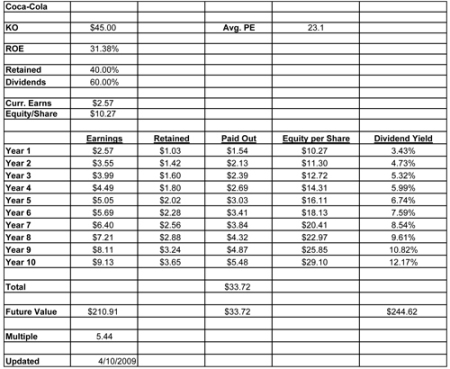

Projected FCF is 1872. Heres the formula for this approach using the PE ratio of a stock.

Coca Cola Is Very Overvalued Nyse Ko Seeking Alpha

Coca Cola Is Very Overvalued Nyse Ko Seeking Alpha

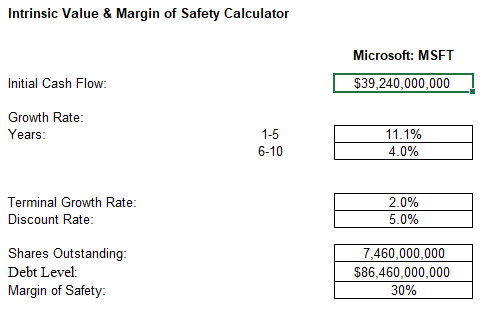

Please note that when modeling out Coca-Colas intrinsic value under an optimistic scenario ultimately we assume faster growth rates in Coca-Colas free cash flows.

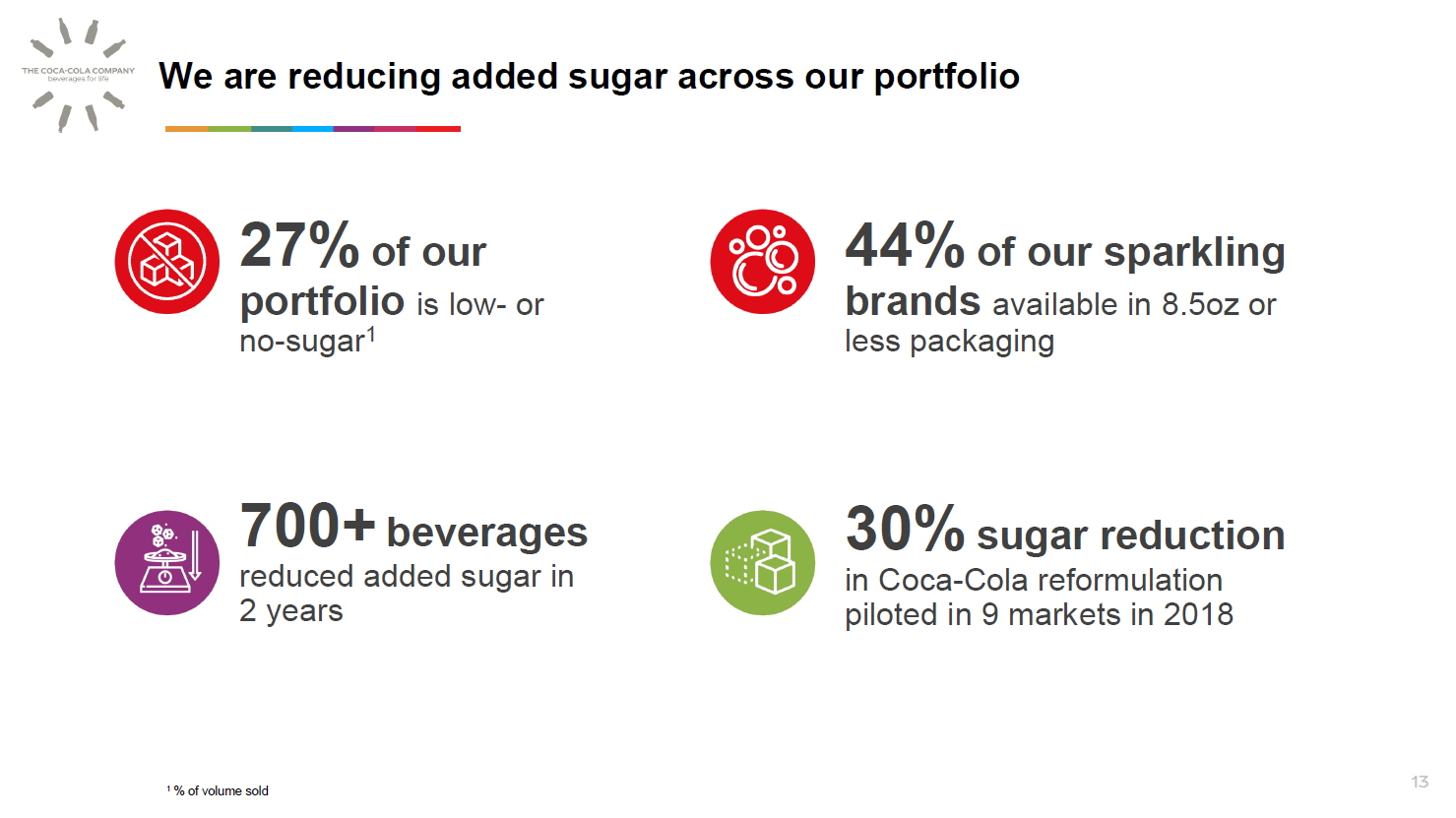

Intrinsic value of ko stock. CFRA maintains an intrinsic value portfolio that incorporates free cash flow profit margin retained earnings and liquidity. In this clip Warren Buffett teaches us how to calculate the intrinsic value of a stock How To Invest Course. Valuation of Coca-Colas common stock using dividend discount model DDM which belongs to discounted cash flow DCF approach of intrinsic stock value estimation.

Valuations are imprecise instruments though rather like a telescope move a few degrees and end up in a different galaxy. So the total value of Coca-Cola stock using my relatively conservative estimates is 4835. This results in an intrinsic value estimate of 4364.

NYSEKO Intrinsic value January 27th 2020 Important assumptions Now the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. Dividends and future cash. Do keep this in mind.

In depth view into Coca-Cola Co Intrinsic Value. Many models that calculate the fundamental value of a security factor in variables largely pertaining to cash. The net present value of the dividends KO is expected to pay over the next 30 years is 3612.

Intrinsic value Earnings per share EPS x 1 r x PE ratio. KO Analyst Garrett Nelson says Coca-Cola shares are attractive in uncertain times given their low volatility. Since Coca Cola is currently traded on the exchange buyers and sellers on that exchange determine the market value of Coca Cola Stock.

Projected FCF explanation calculation historical data and more. As of today 2021-02-07 Coca-Cola Cos Intrinsic Value. NYSEKO Intrinsic value May 22nd 2020 The assumptions.

Compared to the current share price of 4913 the company appears around fair value at the time of writing. Where r the expected earnings growth rate. However Coca Colas intrinsic value may or may not be the same as its current market price in which case there is an opportunity to profit from the mispricing assuming the market price will eventually merge.

Here are seven of CFRAs intrinsic value stocks to buy. We would point out that the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. CFRA has a strong buy rating and 60 price target for KO stock.

When figuring out a stocks intrinsic value cash is king. From our 16-page Stock. Intrinsic value of Coca-Cola Cos common stock per share Current share price.

Projected FCF as of today March 03 2021 is 1931. KO share price free cash flow. Valuation of Coca-Colas common stock using free cash flow to equity FCFE model which belongs to discounted cash flow DCF approach of intrinsic stock value estimation.

CFRA has a strong buy rating and 60 price target for KO. CFRA maintains an intrinsic value portfolio that incorporates free cash flow profit margin retained earnings and liquidity. The resulting estimated intrinsic value per share after discounting the sum back to the present is approximately 8599.

The details of how we calculate the intrinsic value of stocks are described in detail here. Discounting at 11 the value of KOs future share price is 1223. Should value investors buy The Coca-Cola Company stock.

Therefore Coca-Cola Cos Price-to-Intrinsic-Value-Projected-FCF of today is 27. The stock price of Coca-Cola Co is 49650000.

Easy Intrinsic Value Formula With Example

Easy Intrinsic Value Formula With Example

Calculating A Stock S Intrinsic Value

Calculating A Stock S Intrinsic Value

Red Green Candle Strategy Option Strategies Strategies Forex Strategy

Red Green Candle Strategy Option Strategies Strategies Forex Strategy

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Value Stocks Investment Analysis

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Value Stocks Investment Analysis

Dividend Growth Model How To Calculate Stock Intrinsic Value

Margin Of Safety Formula Calculator For Stocks Xl Download

Margin Of Safety Formula Calculator For Stocks Xl Download

S P 500 Intrinsic Value Up Again

S P 500 Intrinsic Value Up Again

Pin By Vishal On Beacon Stock Picture Quotes Value Stocks Investing

Pin By Vishal On Beacon Stock Picture Quotes Value Stocks Investing

Pepsico Pep Return On Invested Capital Roic Vs Clx Cot Dps Ko Sector Https T Co 591wq79kdo Fundamental Investing Stock Market Investing Stock Market

Pepsico Pep Return On Invested Capital Roic Vs Clx Cot Dps Ko Sector Https T Co 591wq79kdo Fundamental Investing Stock Market Investing Stock Market

How To Calculate Intrinsic Value The Most Comprehensive Guide Updated 2017 Click To Read The Full Article On Intrinsic Value Investing Strategy Investing

How To Calculate Intrinsic Value The Most Comprehensive Guide Updated 2017 Click To Read The Full Article On Intrinsic Value Investing Strategy Investing

A Complete Guide On Value Investing In India Value Investing Investing Stock Market Investing

A Complete Guide On Value Investing In India Value Investing Investing Stock Market Investing

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Investment Tips Stock Market Basics

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Investment Tips Stock Market Basics

![]() Intrinsic Value Of A Stock Buffett S Munger S Value Formula Tev Blog

Intrinsic Value Of A Stock Buffett S Munger S Value Formula Tev Blog

The Main Factors That Affect The Options Premium Option Trading Trading Strategies Investing

The Main Factors That Affect The Options Premium Option Trading Trading Strategies Investing

Illustrated Valuations Intrinsic Value Estimations Bargain Hunting In The Style Of Warren Buffett And Charlie Munger Labitan Bud 9780359637812 Amazon Com Books

Illustrated Valuations Intrinsic Value Estimations Bargain Hunting In The Style Of Warren Buffett And Charlie Munger Labitan Bud 9780359637812 Amazon Com Books

Post a Comment for "Intrinsic Value Of Ko Stock"