Stock Options Nq Vs Iso

ISO is for Employees Only. Depending on your attitude toward risk and your experience with swings in your companys stock price the certainty of your restricted stocks value can be appealing.

Nq Employee Stock Options Stock Options Options Trading Strategies Stock Options Trading

Nq Employee Stock Options Stock Options Options Trading Strategies Stock Options Trading

With an ISO there is no tax deduction for the company.

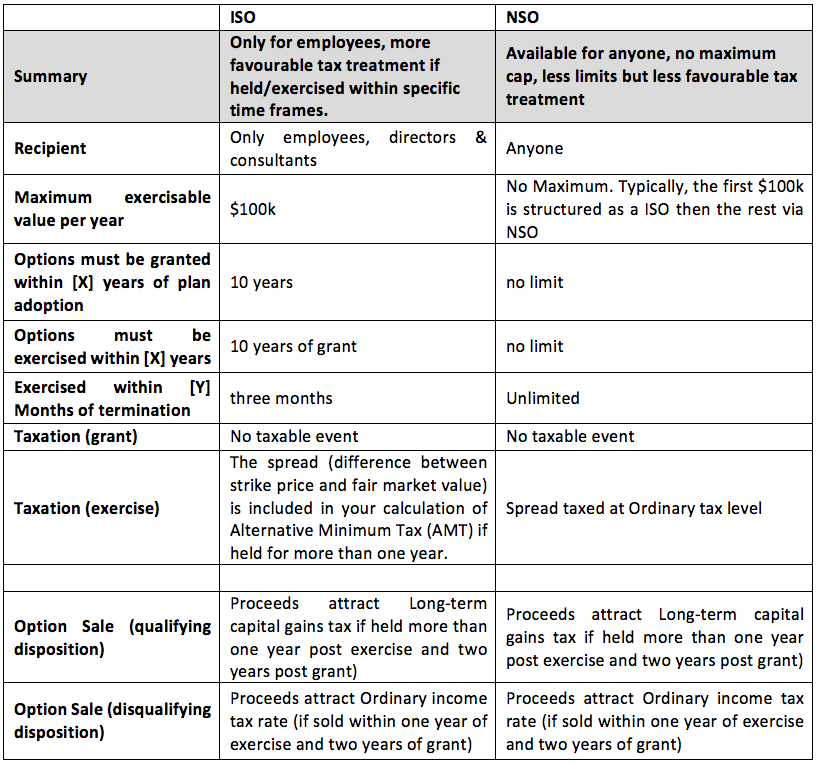

Stock options nq vs iso. NSOs are simpler and more common than incentive stock options ISOs. ISOs short for incentive stock options are a type of employee stock option only offered to key employees and top-tier management that can confer preferential tax treatment. ISOs also are called statutory or qualified.

They usually issue incentive stock options ISOs non-qualified stock options NSOs or restricted stock units RSUs. Non-qualified stock options NSOs are taxed as ordinary income. Gains from non-qualified stock options NQSO are considered ordinary income and are therefore not eligible for the tax break.

There are two types of employee stock options non-qualified stock options NQs and incentive stock options ISOs. Incentive stock options ISOs are not taxed per se rather any gain on the sale of the shares after the options are exercised is taxed as either a long-term or short-term capital gain depending. From the companys standpoint NSO is most advantageous because the company can take tax deductions when the employee or consultant exercises the stock option.

However while stock optionsboth nonstatutory NSO and incentive ISOand restricted stock awards RSAs remain the most popular and most recommended form of equity compensation other formssuch as restricted stock units RSUs and stock appreciation rights SARsare gaining popularity in certain markets and we are being asked. Stock options that are granted neither under an employee stock purchase plan nor an ISO plan are nonstatutory stock options. Unlike NQOs they are subject to many restrictions.

The 100K ISO limit is an effort to prevent abuse of this tax benefit. Incentive stock options also known as statutory stock options ISOs and non-qualified stock options also called non-statutory stock options NSOs. Each is taxed quite differently.

They are called non-qualified stock options because they do not meet all of the requirements of the Internal Revenue Code to be. Both are covered below. Incentive stock options ISOs can only be granted to employees.

There are two types of stock options. Thats because with an NSO the stock option is considered ordinary income to the employee or consultant. Nonqualified Stock Options NSO When a company grants stock options it might grant non-qualified stock options NSOs or incentive stock options ISOs.

Options granted under an employee stock purchase plan or an incentive stock option ISO plan are statutory stock options. Generally ISO stock is awarded only to top management and highly-valued employees. Profits made from exercising qualified stock options QSO are taxed at the capital gains tax rate typically 15 which is lower than the rate at which ordinary income is taxed.

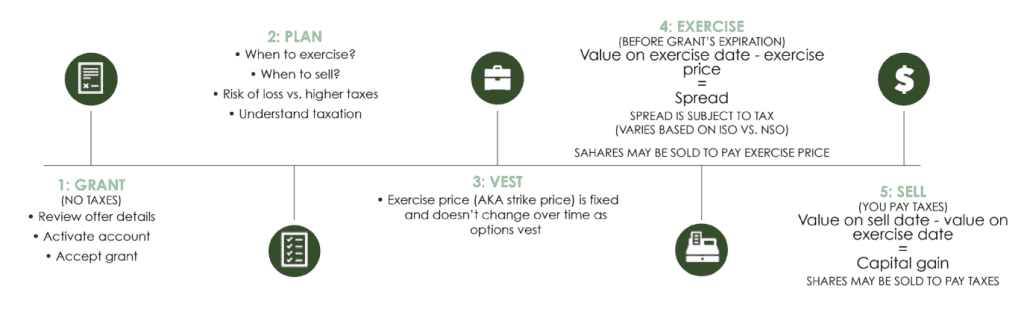

Having a market price lower than the exercise price. These mainly differ by howwhen you have to pay taxes and whether you have to purchase the shares. One of the questions executives of emerging companies face when issuing stock options is what type of option to issue.

Non-qualified stock options NSOs can be granted to anyone including employees consultants and directors. By contrast stock options ISO NQSO have great upside potential but can be underwater ie. While both are stock options that provide the right to purchase stock at a redetermined price at a future date in time they have different restrictions and might have different tax consequences for both the company and the grant recipient.

There are two types of stock options. NQOs can be better for the. ISOs are a type of stock option that qualifies for special tax treatment.

Knowing the difference is an essential part of your financial planning. Nonqualified stock options NQSOs the more common type and incentive stock options ISOs which offer some tax benefits but also raise the. Each is taxed quite differently.

Incentive stock options are reserved for employees offering them an opportunity to buy stock at a discounted price. Incentive Stock Options ISO vs. Incentive stock options can potentially generate better tax consequences for the employee if certain conditions are met.

Both are subject to different tax rules. Incentive stock options ISOs as opposed to non-qualified stock options NSOs qualify for favorable tax treatment by the IRS. Anything in excess of 100K worth of stock options exercisable in one year is treated by the IRS as NSOs.

Incentive stock options ISOs and non-qualified stock options NSOs. There are two main types of stock options. In case you are not aware of the primary differences between an ISO and a non-qualified stock option NQO here are the primary differences.

Companies can grant two kinds of stock options.

Should You Do An Iso To Nso Conversion With Your Stock Options

Should You Do An Iso To Nso Conversion With Your Stock Options

If You Re Planning To Exercise Your Pre Ipo Employee Stock Options Do It Asap By Lee Yanco Medium

Stock Option The Differences Between An Iso And An Nso Buchwald Associates

Stock Option The Differences Between An Iso And An Nso Buchwald Associates

Stock Options For Startups Founders Board Members Isos Vs Nsos

Stock Options For Startups Founders Board Members Isos Vs Nsos

Us Stock Options Primer Octopus Ventures

Us Stock Options Primer Octopus Ventures

Tax Alert Beware Of Double Taxation On Employee Stock Options Legacy Financial Group

Tax Alert Beware Of Double Taxation On Employee Stock Options Legacy Financial Group

When To Sell Stock Options Employee Stock Options Blog

When To Sell Stock Options Employee Stock Options Blog

When Should You Exercise Your Nonqualified Stock Options

The Ins Outs Of Stock Options In Total Moneytree Software

The Ins Outs Of Stock Options In Total Moneytree Software

Incentive Stock Options And Non Qualified Options Stock Options Incentive Investing

Incentive Stock Options And Non Qualified Options Stock Options Incentive Investing

Employee Stock Options Stock Options Fund Options

Employee Stock Options Stock Options Fund Options

Startup Equity Iso Vs Nso This Post Provides A General Overview By Nick Scannavino Medium

Startup Equity Iso Vs Nso This Post Provides A General Overview By Nick Scannavino Medium

Stock Options 101 The Essentials Mystockoptions Com

Stock Options 101 The Essentials Mystockoptions Com

What Are Non Qualified Stock Options Nsos Carta

What Are Non Qualified Stock Options Nsos Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg) Get The Most Out Of Employee Stock Options

Get The Most Out Of Employee Stock Options

Understanding Stock Options Iso S Vs Nso S Rca Emerging Wealth

Understanding Stock Options Iso S Vs Nso S Rca Emerging Wealth

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

Comparing Options Nonqualified Stock Options Vs Incentive Stock Options

Comparing Options Nonqualified Stock Options Vs Incentive Stock Options

Post a Comment for "Stock Options Nq Vs Iso"