Dave Ramsey Sell Stock To Pay Off Mortgage

Instead I tax-free exchanged that deal into two more duplexes. See how early youll pay off your mortgage and how much interest youll save.

Dave Ramsey There Are Other Ways Dave Ramsey Decaturdaily Com

Dave Ramsey There Are Other Ways Dave Ramsey Decaturdaily Com

I almost sold enough today to pay off the mortgage but stopped before clicking the button.

Dave ramsey sell stock to pay off mortgage. Here are some other options for paying extra on your mortgage and how those extra payments affect as an example a 220000 30-year mortgage with a 4 interest rate. Your current principal and interest payment is 993 every month on a 30-year fixed-rate loan. This is perhaps the biggest fallacy from Dave Ramsey.

You decide to make an additional 300 payment toward principal every month to pay off your home faster. We had worked the balance of the mortgage back down to 93000 by making extra payments over the years. One way Ramsey teaches homeowners to pay off their mortgages is by converting your 30-year mortgage into a fixed-rate 15-year home loan.

However I am having a hard time actually going through with it because the dividends alone are more than I pay in interest on the loan. Adding just one extra payment each year knocks years off your mortgage. Dave tells Lisa hed pay it off tomorrow.

In 2016 we made the decision to go all in to pay off our mortgage. This is a balanced approach. Dave Ramsey is awesome at getting you out of financial.

Thats if your mortgage payment eats up so much of your paycheck theres nothing left to throw at debt. What they have in investments is just about equal to their 380000 mortgageTheir household income is about 175000 a year. So in effect you are using the leverage of a low fixed-rate loan to invest the difference in the stock market.

Dave Ramsey argues we should pay off our mortgage. If you lose your job that loan needs to be paid back within 60 days. Youll pay your mortgage off 11 years early and youll.

One recommendation Ramsey makes is to convert your 30-year mortgage into a fixed-rate 15-year home loan. Your Mortgage Payment Is Way Too Big. Dave Ramsey is a seven-time 1 national best-selling author personal finance expert and host of The Dave Ramsey Show heard by more than 16 million listeners each week.

Its Baby Step 6 on his path to financial freedom. You also need to ask yourself if you would go into debt to. If you have a low mortgage rate and you are a proficient investor investing instead of prepaying is probably the more financially rewarding option.

Should you like my friend sell stocks held in a taxable account in order to pay off your mortgage. If youre still not convinced that retirement investing should come before you pay off the mortgage you can talk to an investing professional. And 401k loans can backfire quickly.

Here are two circumstances in which Dave says it makes sense to sell your home to pay off debt. I know what Dave would say and I would not take out a loan to invest in stocks. If I followed The Gospel According to Dave Id be debt-free after selling my first triplex in order to pay off more than 40000 in credit card and auto loan debt acquired as a result of a carefree youth.

Thats a tax deduction meaning if that couple makes 75000 a year and they take a 10000 tax deduction they dont pay taxes on 75000. If you do this weird Dave Ramsey thing though and you pay off the house you no longer pay taxes on 65000 because you would not have a tax deduction. Invest 15 then use any extra money to pay off your mortgage early.

With current mortgage rates in the sub-4 range you are at or below the average rate of inflation. Not only will you pay off a 15-year mortgage in half the time but youll also pay much less in interest. This is why Dave says you should first invest 15 of your income for retirement before you work toward paying off your mortgage.

If you cash out your stocks and dont change your habits youre going to fall back into these old habits againMake sure youre committed to never buying anything with debt again. Our Decision to Pay off the Mortgage. Making a firm decision to pay off our mortgage.

In contrast Ric Edelman argues that we should never pay off our mortgage. If its not youll be forced to payyou guessed ita 10 penalty plus taxes. Need to Talk About It.

Steven has 37000 in consumer debt and wants to know if he should cash out his single stocks to get rid of all his consumer debt. This is a trickier question. They instead pay taxes on 65000.

Theres really only one must-sell situation in Daves eyes. Make an Extra House Payment Each Quarter. If your stocks are highly appreciated perhaps not.

Lisa in Vancouver and her husband want to know if they should sell all of their stock investments to pay off their house. The Dave Ramsey mortgage plan encourages homeowners to aggressively pay off their mortgages early however. Not only will you pay off a 15-year mortgage in half the.

Lets say your remaining balance on your home is 200000. Your mortgage payment should be no more than 25 of your monthly take-home pay. Also over the long haul stocks average 8 annually.

In some cases it is a good idea to sell off investments to pay down debt but before you do think about why you landed in debt in the first place and aim to not have a repeat. While we continued to live below our means we didnt have any focus or a real plan. Remember you can.

Another mistake people make is taking out a 401k loan to pay off their debtbut you end up having to pay yourself back with interest.

Pay Off Mortgage Or Keep Cash Youtube

Pay Off Mortgage Or Keep Cash Youtube

The Total Money Makeover By Dave Ramsey He Is Hardly Obscure But I Can T Recommend The Book Or Dave Hi Money Makeover Total Money Makeover Financial Fitness

The Total Money Makeover By Dave Ramsey He Is Hardly Obscure But I Can T Recommend The Book Or Dave Hi Money Makeover Total Money Makeover Financial Fitness

Dave Ramsey Financial Peace University And 7 Baby Steps To Getting Out Of Debt

Dave Ramsey Financial Peace University And 7 Baby Steps To Getting Out Of Debt

Dave Ramsey Defends Millionaire Formula

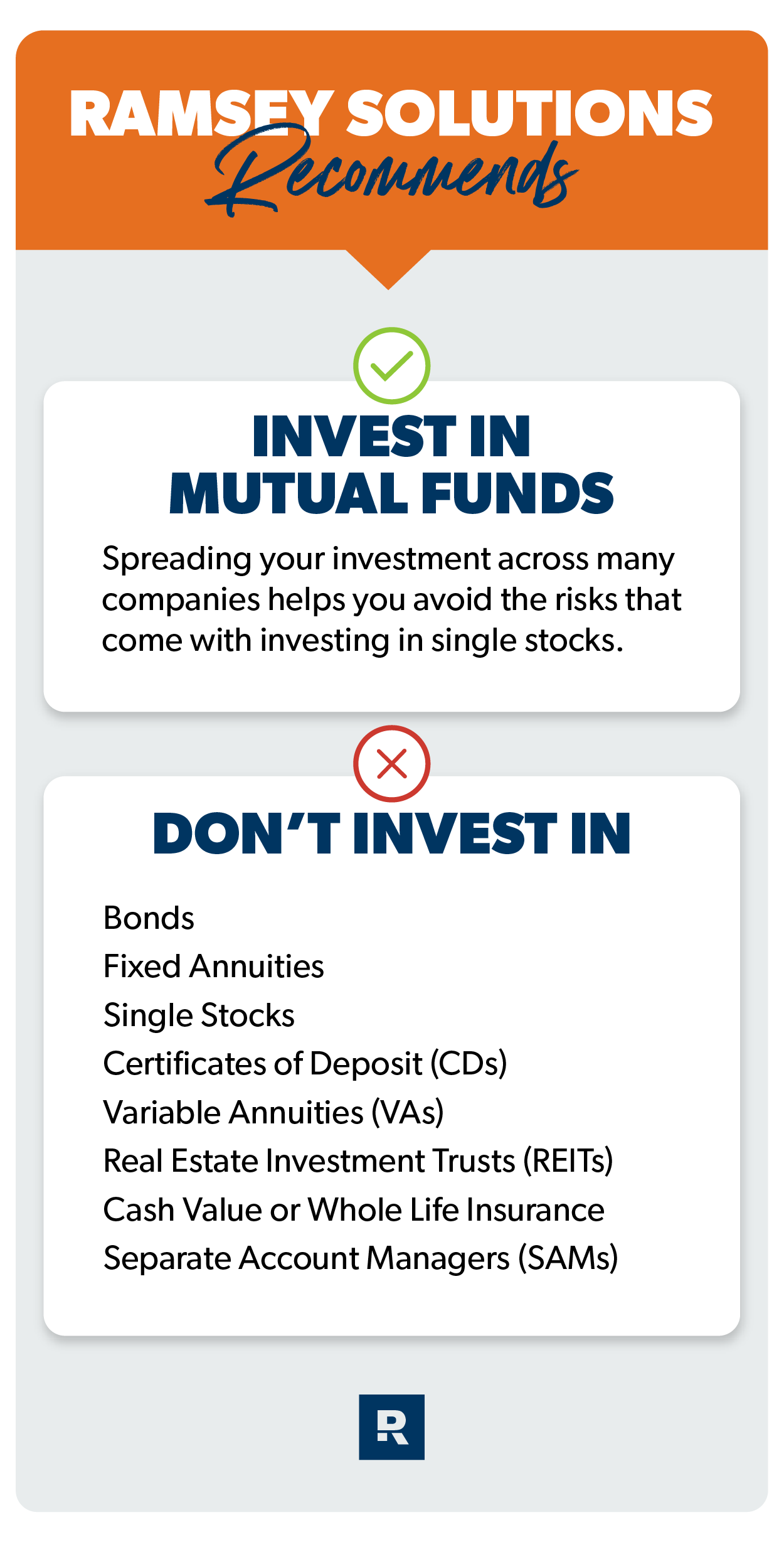

Dave S Investing Philosophy Daveramsey Com

Dave S Investing Philosophy Daveramsey Com

The Debt Free Scream Your Inspirational Rally Cry Daveramsey Com

The Debt Free Scream Your Inspirational Rally Cry Daveramsey Com

17 Dave Ramsey Quotes That Will Help You Stay Motivated Pay Off Debt

17 Dave Ramsey Quotes That Will Help You Stay Motivated Pay Off Debt

3 Easy Ways To Pay Off Your Mortgage Early Dave Ramsey Sell Your House Fast Pay Off Mortgage Early

3 Easy Ways To Pay Off Your Mortgage Early Dave Ramsey Sell Your House Fast Pay Off Mortgage Early

Why You Should Focus On Paying Down The Mortgage Over Investing Youtube

Why You Should Focus On Paying Down The Mortgage Over Investing Youtube

Dave Ramsey S New House Did He Follow His Own Advice And Pay Cash

Dave Ramsey S New House Did He Follow His Own Advice And Pay Cash

Dave Ramsey S 4 Mutual Funds Explained Shawn Roe Dave Ramsey Mutual Funds Mutuals Funds Dave Ramsey

Dave Ramsey S 4 Mutual Funds Explained Shawn Roe Dave Ramsey Mutual Funds Mutuals Funds Dave Ramsey

Dave Ramsey Daveramsey Twitter

Dave Ramsey Daveramsey Twitter

Why I Don T Completely Agree With Dave Ramsey Teen Financial Freedom

Why I Don T Completely Agree With Dave Ramsey Teen Financial Freedom

How To Win With Money In 7 Baby Steps Everydollar Com

How To Win With Money In 7 Baby Steps Everydollar Com

Post a Comment for "Dave Ramsey Sell Stock To Pay Off Mortgage"