Financial Market Volatility Macroeconomic Fundamentals And Investor Sentiment

Patterns in market wide investor sentiment stock prices and volume. Market volatility is the variation of a trading price over time.

Https Www Mdpi Com 2227 7072 7 2 26 Pdf

In this paper we investigate the dynamic relationship between financial market volatility macroeconomic fundamentals and investor sentiment employing a two-factor model to decompose volatility into a persistent long run component and a transitory short run component.

Financial market volatility macroeconomic fundamentals and investor sentiment. Most of the peaks and troughs during that span were as much a function of investor sentiment extremes as any traditional market-related fundamentals. Macroeconomic fundamentals and investor sentiment. Theres a common belief among financial advisors and sophisticated investors.

MPLNWS MultiPlan fka. Predictability of macroeconomic fundamentals and investor sentiment with respect to volatility of the stock market was modelled with auto-regressive distributive lags ARDL p q. Such persistent connection between the sentiment index and stock volatility suggests that investor sentiment is one of the most crucial determinants of.

The law firm of Kessler Topaz Meltzer Check LLP announces that a securities fraud class action lawsuit has been filed against MultiPlan Corporation NYSE. The findings indicate the persistence of volatility in market indices. Investor sentiment and expectations for a rapid economic recovery appear to be behind the recent yield spikes rather than an overheating economy.

In this paper we investigate the dynamic relationship between financial market volatility macroeconomic fundamentals and investor sentiment employing a two-factor model to decompose volatility into a persistent long-run component and a transitory short-run component. The stock market is a leading indicator of where the economy will be in the not too distant future. Association between stock market volatility and investor sentiment makes this study different from existing studies.

Such persistent connection between the sentiment index and stock volatility suggests that investor sentiment is one of the most crucial determinants of Indian stock market volatility. Increasing volatility whether total volatility or persistent volatility leads to a significant drop in output growth inflation and sentiment. Using a structural VAR model with Bayesian sign restrictions we show that adverse shocks to aggregate demand and supply cause an increase in the persistent component of both stock and bond market volatility and that adverse.

However the belief that the stock market is no longer bearing any fruit just isnt justified. The key difference is that shocks to persistent volatility lead to deeper economic contractions which can be explained by its protracted rise in magnitude after the shock. The investor sentiment approach that we develop in this paper is by contrast distinctly top down and macroeconomic.

Yields remain near historic lows giving the Fed. The starting point for this approach is that many of the bottom up models lead to a similar reduced form of variation over time in mass psychology and. Volatility rules for now as investors are pulling out of Big Tech a move that is pushing the general markets down.

The bearish sentiment comes as new COVID case numbers are falling along. In this paper we investigate the dynamic relationship between financial market volatility macroeconomic fundamentals and investor sentiment employing a two-factor model to decompose volatility into a persistent long run component and a transitory short run component. ACCEPTED MANUSCRIPT ACCEPTED MANUSCRIPT 2 Financial Market Volatility Macroeconomic Fundamentals.

This study explores the relationship between investor sentiment and stock return volatility using monthly data from National Stock Exchange NSE of India over July 2001 to December 2013 period. Both investor sentiment and volatility increase but in neither case is the impact statistically significant. The sign restrictions associated with the three macroeconomic shocks the investor sentiment.

The most common way to measure the variation of the price of the broader market is the VIX which is the CBOE Volatility Index. Financial Times reports that investor expectations are softening not just in the US but also internationally. It measures option prices on the SP 500.

Only inflation rate and money supply displayed short-run dynamics with the volatility of the Kuala Lumpur Composite Index KLCI during the period of study. Stock market broke out to new highs at the end of October 2019 it had been in a trading range since January of 2018. Volatility is also a tool that you can use to hedge your portfolio or trade for profits.

Firstly since the commonly used measure of total volatility conflates the two components policy makers and practitioners are better served by utilizing a volatility measure that is more closely. Using a structural VAR model with Bayesian sign restrictions we show that adverse shocks to aggregate demand and supply cause an increase in the persistent component of both stock and bond market volatility and that adverse. The findings indicate the persistence of volatility in market indices.

With all the recent volatility the belief that the market is in a tailspin and its time to pull out is widespread. Financial market Volatility macroeconomic fundamentals. We study the macroeconomic properties of the two volatility components separately for three reasons.

Https Www Ucd Ie T4cms Investor 20sentiment Bathia 20 20bredin Pdf

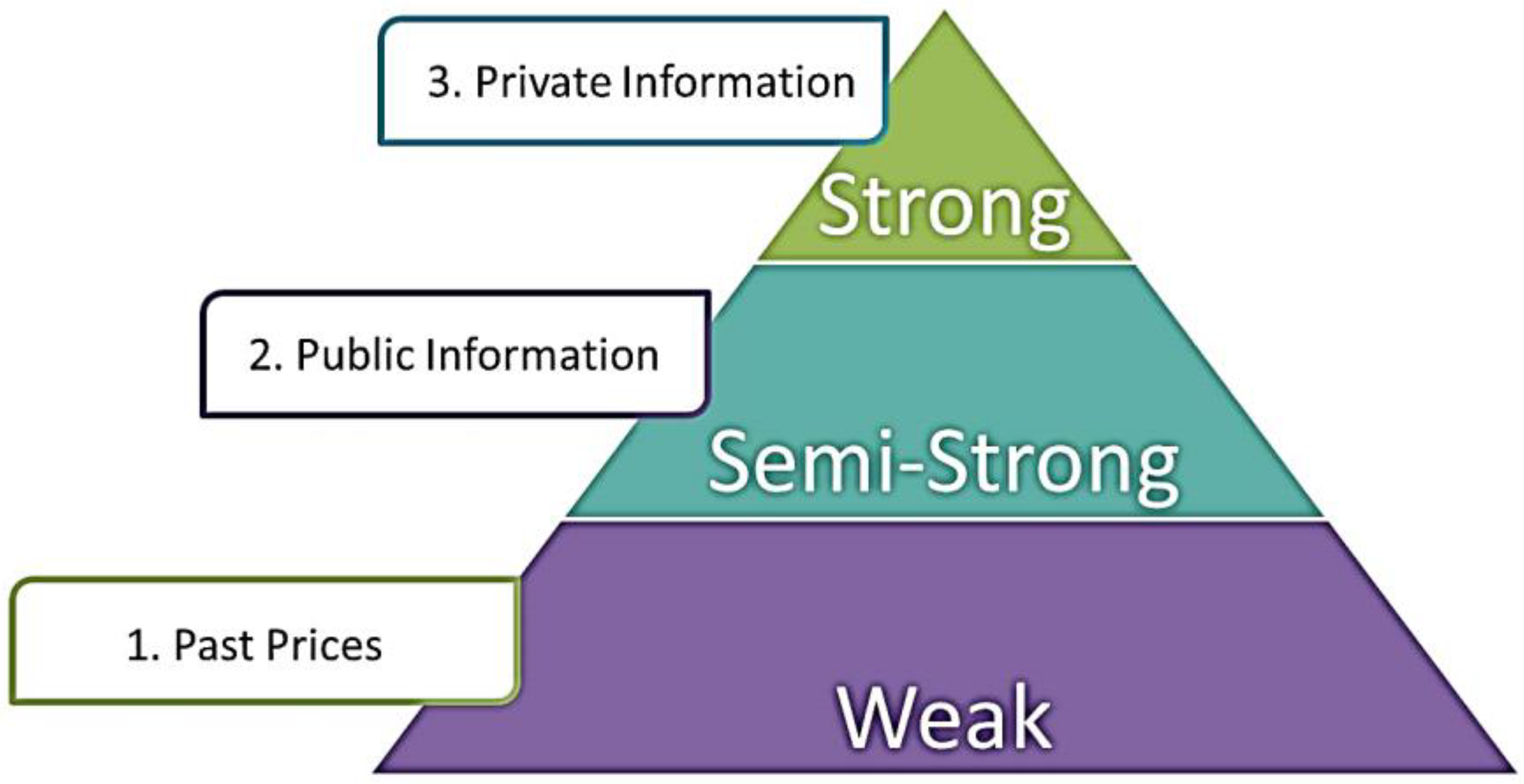

Jrfm Free Full Text Stock Investment And Excess Returns A Critical Review In The Light Of The Efficient Market Hypothesis Html

Jrfm Free Full Text Stock Investment And Excess Returns A Critical Review In The Light Of The Efficient Market Hypothesis Html

Investor Attention Can Google Search Volumes Predict Stock Returns

Investor Attention Can Google Search Volumes Predict Stock Returns

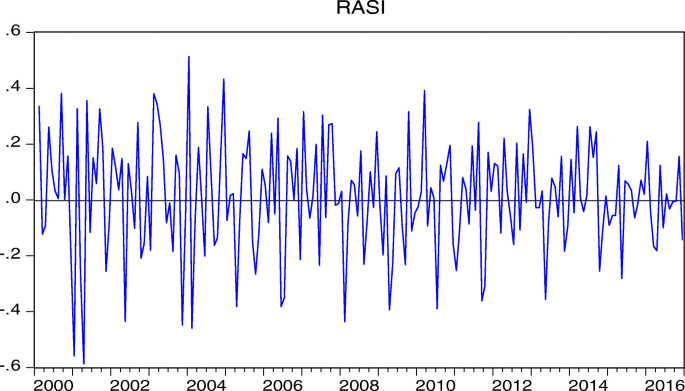

The Contagion Effect Of International Crude Oil Price Fluctuations On Chinese Stock Market Investor Sentiment Sciencedirect

The Contagion Effect Of International Crude Oil Price Fluctuations On Chinese Stock Market Investor Sentiment Sciencedirect

An Empirical Examination Of Investor Sentiment And Stock Market Volatility Evidence From India Springerlink

An Empirical Examination Of Investor Sentiment And Stock Market Volatility Evidence From India Springerlink

Melt Up Overview When It Occurs Practical Example

Melt Up Overview When It Occurs Practical Example

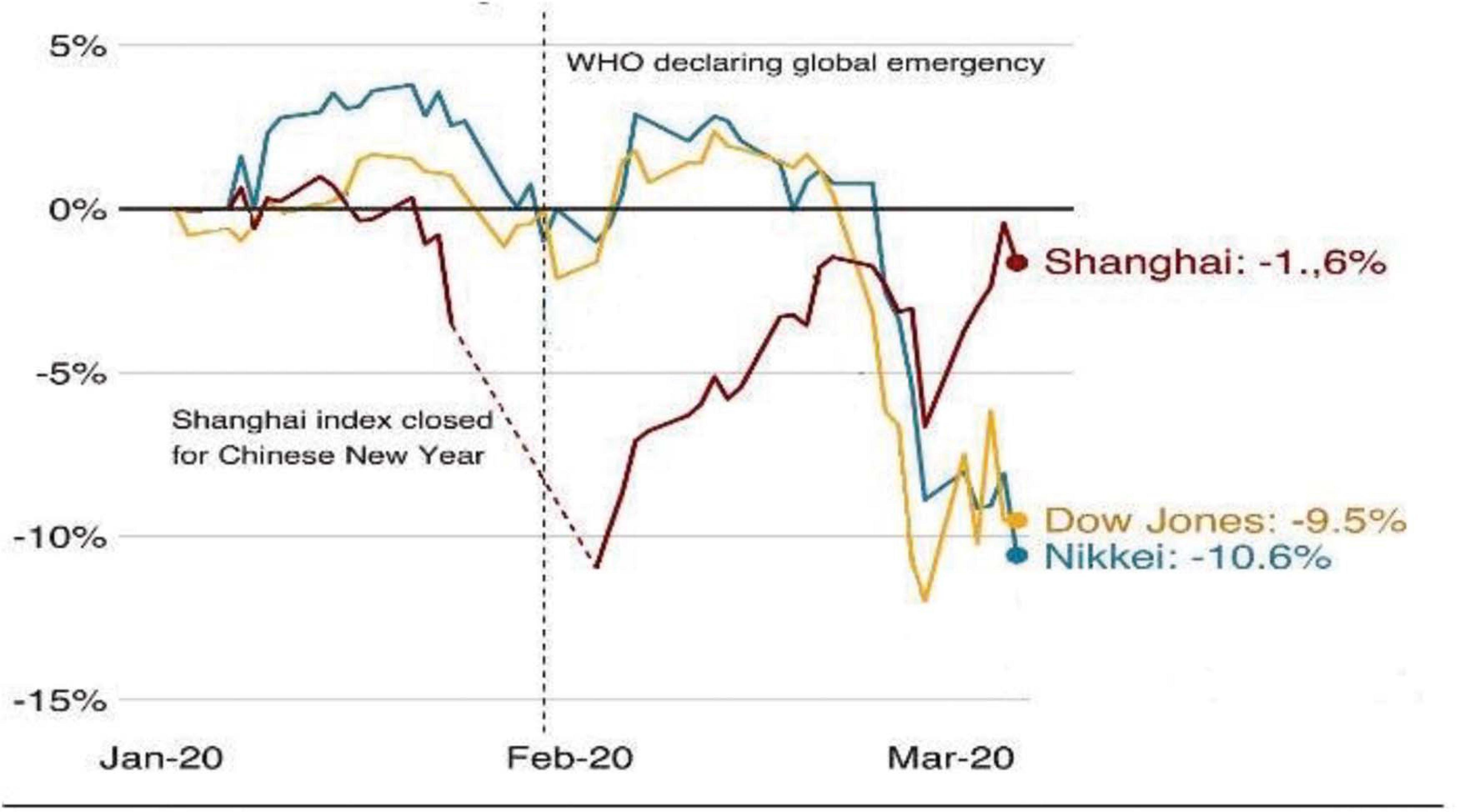

Frontiers The Investor Psychology And Stock Market Behavior During The Initial Era Of Covid 19 A Study Of China Japan And The United States Psychology

Frontiers The Investor Psychology And Stock Market Behavior During The Initial Era Of Covid 19 A Study Of China Japan And The United States Psychology

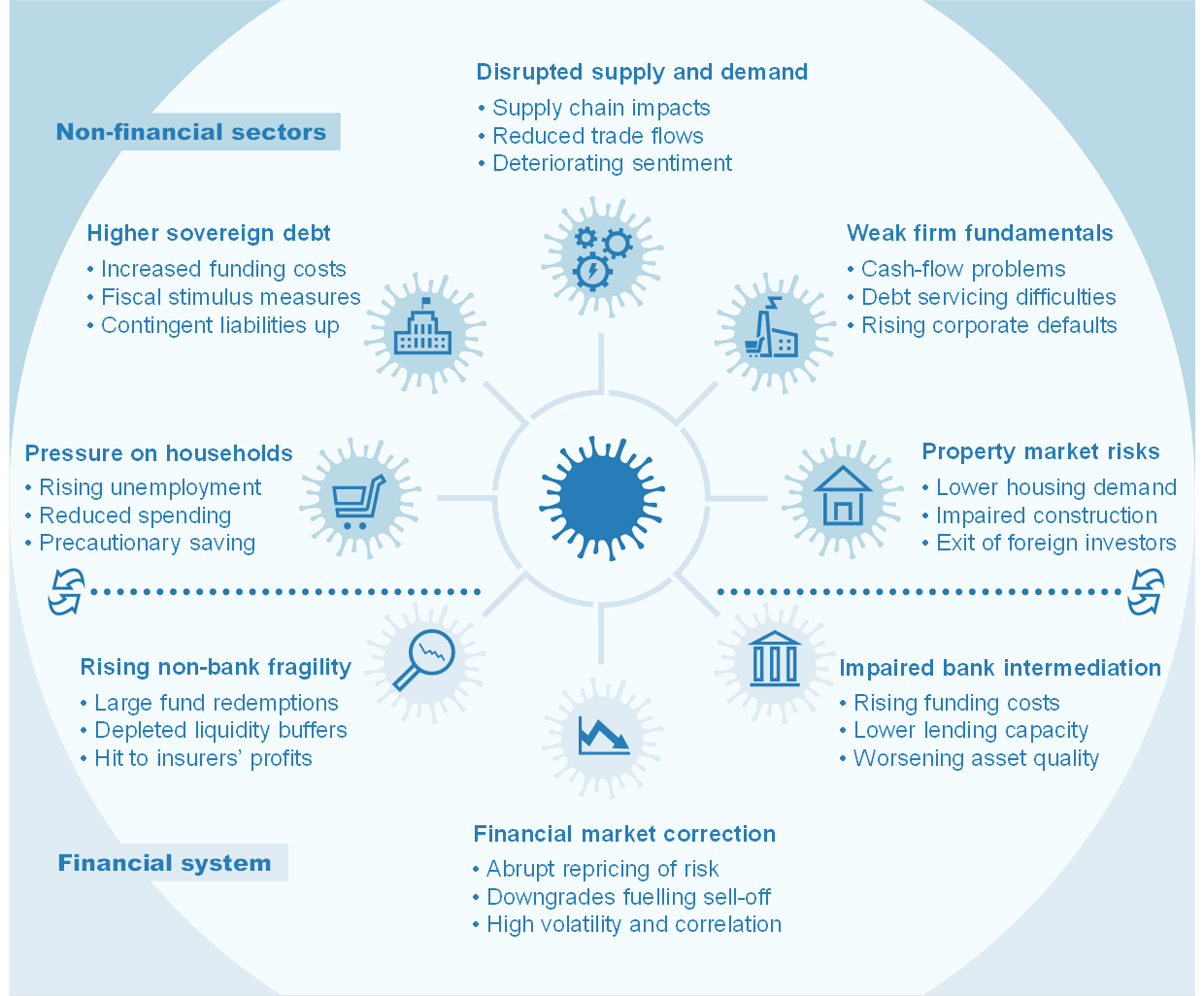

Financial Stability Review May 2020

Financial Stability Review May 2020

Financial Market Volatility Macroeconomic Fundamentals And Investor Sentiment Sciencedirect

Financial Market Volatility Macroeconomic Fundamentals And Investor Sentiment Sciencedirect

Http Www Q Group Org Wp Content Uploads 2014 01 Zhou Investor Sentiment Aligned Pdf

Pdf Why Does Stock Market Investor Sentiment Influence Corporate Investment

Pdf Why Does Stock Market Investor Sentiment Influence Corporate Investment

Https Www Mdpi Com 2071 1050 12 4 1571 Pdf

Https Www Mdpi Com 2071 1050 12 4 1310 Pdf

Https Www Oecd Org Finance Esg Investing Practices Progress Challenges Pdf

Pdf Impact Of Macroeconomic Variables On Stock Market Volatility In Emerging Economies A Case Of India China

Pdf Impact Of Macroeconomic Variables On Stock Market Volatility In Emerging Economies A Case Of India China

Https Www Ecb Europa Eu Events Pdf Conferences 140407 Wang Investorattentionandfxmarketvolatility Pdf A01e9d619ab70233d30ba87ac18243ba

Pandemic Related Financial Market Volatility Spillovers Evidence From The Chinese Covid 19 Epicentre Sciencedirect

Pandemic Related Financial Market Volatility Spillovers Evidence From The Chinese Covid 19 Epicentre Sciencedirect

Https Papers Ssrn Com Sol3 Delivery Cfm Ssrn Id3222312 Code2074384 Pdf Abstractid 3222312 Mirid 1

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Post a Comment for "Financial Market Volatility Macroeconomic Fundamentals And Investor Sentiment"