Ko Intrinsic Value

Please note that when modeling out Coca-Colas intrinsic value under an optimistic scenario ultimately we assume faster growth rates in Coca-Colas free cash flows. In depth view into Coca-Cola Co Intrinsic Value.

The Coca Cola Company Stock Value Analysis Nyse Ko

The Coca Cola Company Stock Value Analysis Nyse Ko

So I will go into detail about each of these issues.

Ko intrinsic value. The present value of an investment is the price you must pay right now to earn that intrinsic value in however many years you want to wait. Projected FCF explanation calculation historical data and more. In contrast other private professional wealth advisors use a multiplier approach by look to relative valuation against Coca Colas closest peers.

Intrinsic value of Coca-Cola Cos common stock per share Current share price. See details. If a business lasts for ten years and produces a million dollars of free cash profit every year its intrinsic value is ten million dollars.

Inside the KO Numbers. Fair Value EPS 85 2g 44 Bond Yield EPS Earnings per share over the last 12 months 85x Grahams PE ratio for a no-growth company g Long-term growth rate 44 Yield of high-grade corporate bonds in 1962 Bond. Here are seven of CFRAs.

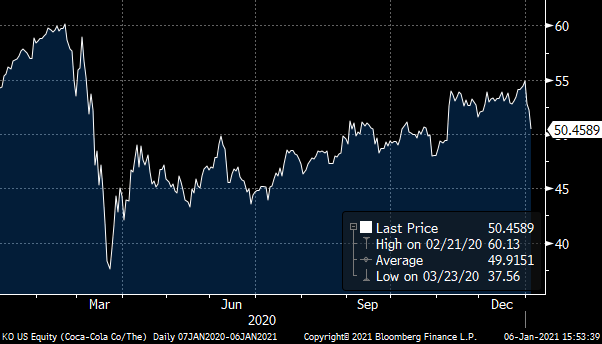

Some money managers use Coca Colas intrinsic value based on its ongoing forecasts of Coca Colas financial statements. If the option premium paid at the onset of the trade were 2 the total profit would be 8 if the. NYSEKO Intrinsic value January 27th 2020 Important assumptions Now the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows.

However to justify Coca-Cola. The total value is the sum of cash flows for the next ten years plus the discounted terminal value which results in the Total Equity Value which in this case is 18619b. Finbox uses the Revised formula which is as follows.

Intrinsic value is the discounted value of the cash that can be taken out of a business during its remaining life. 1 See details Disclaimer. Calculating The Intrinsic Value Of The Coca-Cola Company NYSEKO In this article we are going to estimate the intrinsic value of The Coca-Cola Company NYSEKO by taking the foreast future cash flows of the company and discounting them back to todays value.

In this post I will attempt to calculate Coca-Colas intrinsic value. KOs growth rate depends on volume growth price increases profit margins and share buybacks. Anyone calculating intrinsic value.

Projected FCF as of today March 03 2021 is 1931. In depth view into Coca-Cola Co Intrinsic Value. Compared to the current share price of 4596 the stock is fair value maybe slightly overvalued and not available at a discount at this time.

Now the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. Ben Graham Formula Value is an intrinsic value formula proposed by investor and professor Benjamin Graham. This results in an intrinsic value estimate of 4364.

This results in an intrinsic value of 36. I will use the Discounted Cash Flow DCF model. The last step is to then divide the equity value by the number of shares outstanding.

1 DPS 0 Sum of the last year dividends per share of Coca-Cola Cos common stock. DCF FCF Based explanation calculation historical data and more. First keep in mind Warren Buffett said.

The intrinsic value of a company is how much cash it can generate over its lifespan. Part of investing is coming up with your own evaluation of a companys future performance so try the calculation yourself and check your own assumptions. DCF FCF Based as of today February 26 2021 is 2146.

NYSEKO Intrinsic value January 27th 2020. Intrinsic value of Coca-Cola Cos common stock per share Current share price. Warren Buffett Explains How To Calculate The Intrinsic Value Of A Stock - YouTube.

In theory the stocks in the portfolio have intrinsic value that remains relatively stable for long-term investors even when their stock prices fluctuate in the near term. The intrinsic value of the call option is 10 or the 25 stock price minus the 15 strike price. Compared to the current share price of 4913 the company appears around fair value at the time of writing.

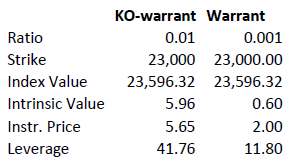

Knock Out Turbo Tutorial Staging

Knock Out Turbo Tutorial Staging

Coca Cola S Valuation Warren Buffett S 1988 Purchase Nasdaq

Coca Cola S Valuation Warren Buffett S 1988 Purchase Nasdaq

How To Calculate Intrinsic Value The Most Comprehensive Guide Updated 2017 Click To Read The Full Article On Intrinsic Value Investing Strategy Investing

How To Calculate Intrinsic Value The Most Comprehensive Guide Updated 2017 Click To Read The Full Article On Intrinsic Value Investing Strategy Investing

Coca Cola Is Very Overvalued Nyse Ko Seeking Alpha

Coca Cola Is Very Overvalued Nyse Ko Seeking Alpha

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Value Stocks Investment Analysis

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Value Stocks Investment Analysis

3ko Gold Xp 2800 Mg Male Enhancement Each Pack Of 3 Pills

3ko Gold Xp 2800 Mg Male Enhancement Each Pack Of 3 Pills

Managing The Leaps Perpetual Income Strategy

Pepsico Pep Return On Invested Capital Roic Vs Clx Cot Dps Ko Sector Https T Co 591wq79kdo Fundamental Investing Stock Market Investing Stock Market

Pepsico Pep Return On Invested Capital Roic Vs Clx Cot Dps Ko Sector Https T Co 591wq79kdo Fundamental Investing Stock Market Investing Stock Market

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Investment Tips Stock Market Basics

How To Find Intrinsic Value Of Stocks Using Graham Formula Intrinsic Value Investment Tips Stock Market Basics

Warren Buffet Stocks The Top 10 Warren Buffett Stocks Investorplace

Warren Buffet Stocks The Top 10 Warren Buffett Stocks Investorplace

Berkshire Hathaway Intrinsic Value Calculation Sven Carlin

Berkshire Hathaway Intrinsic Value Calculation Sven Carlin

Easy Intrinsic Value Formula With Example

Easy Intrinsic Value Formula With Example

Coca Cola Ko Stock Analysis Dividend Value Builder

Coca Cola Ko Stock Analysis Dividend Value Builder

Pepsico Don T Overpay For Quality Nasdaq Pep Seeking Alpha

Pepsico Don T Overpay For Quality Nasdaq Pep Seeking Alpha

Coca Cola Co Stock Rating And Data Gurufocus Com

Coca Cola Co Stock Rating And Data Gurufocus Com

Homeostatic Intrinsic Plasticity Is Functionally Altered In Fmr1 Ko Cortical Neurons Sciencedirect

Homeostatic Intrinsic Plasticity Is Functionally Altered In Fmr1 Ko Cortical Neurons Sciencedirect

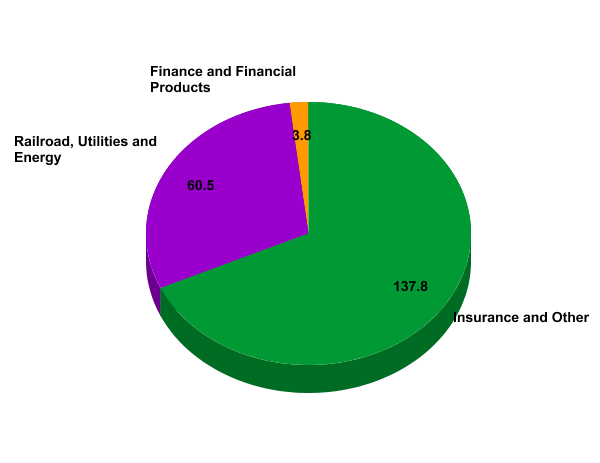

Berkshire Hathaway Intrinsic Value Pie Chart Nyse Brk A Seeking Alpha

Berkshire Hathaway Intrinsic Value Pie Chart Nyse Brk A Seeking Alpha

Post a Comment for "Ko Intrinsic Value"