Nclh Stock Debt To Equity Ratio

Based on Norwegian Cruise Line Holdings Ltd. Total debt to assets is 4224 with long-term debt to equity ratio resting at 9612.

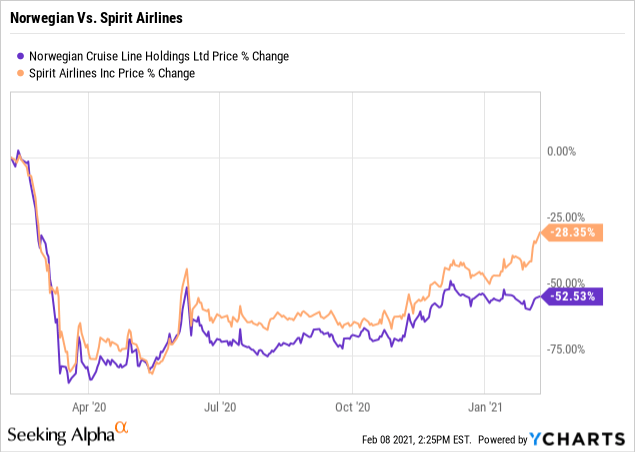

Norwegian Cruise Line 2021 Won T Be Easy Nyse Nclh Seeking Alpha

Norwegian Cruise Line 2021 Won T Be Easy Nyse Nclh Seeking Alpha

Norwegian Cruise Line Holdings long term debt for the quarter ending December 31 2020 was 10465B a 8448 increase year-over-year.

Nclh stock debt to equity ratio. Long term debt can be defined as the sum of all long term debt fields. Stock quotes reflect. Norwegian Cruise Line Holdings long term debt from 2011 to 2020.

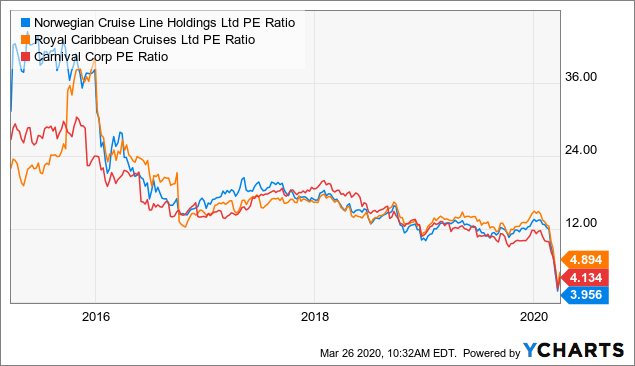

PE Ratio wo extraordinary items 1359. The debtequity ratio can be defined as a measure of a companys financial leverage calculated. Debt to Equity thus makes a valuable metrics that describes the debt company is using in order to support assets correlating with the value of shareholders equity The total Debt to Equity ratio for NCLH is recording 268 at the time of this writing.

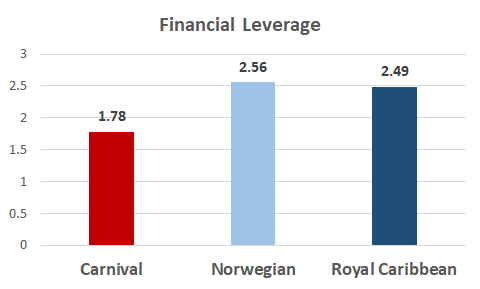

In addition long term Debt to Equity ratio is set at 256. Price to Sales Ratio. Debt to Equity Ratio.

Take note that some businesses are more capital intensive than others. In depth view into NCLH Norwegian Cruise Line Holdings stock including the latest price news dividend history earnings information and financials. Compare financial indicators patterns of diffirent equity instruments including Balance Sheet.

Based on Norwegian Cruise Line Holdings Ltd. Debt to Equity Total Debt Total Stockholders Equity Short-Term Debt Capital Lease Obligation Long-Term Debt Capital Lease Obligation Total Stockholders Equity 746358 6055335 6515579 104. NCLH the companys capital structure generated 10817 points at debt to equity in total while total debt to capital is 5196.

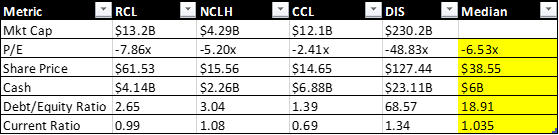

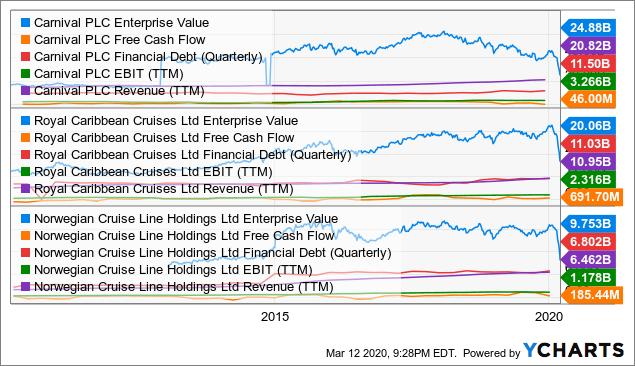

Finally the long-term debt to capital ratio is 4617. Thus I think NCLH was smart to raise both debt and equity before announcing the 2Q results. Even now its 11 times debt-to-equity DE ratio is far lower than RCLs 22 and Norwegians 24.

Total Debt to Total Equity. NYSENCLH Stock stands at 268. NCLHs long-term liabilities 1098B exceed its short-term assets 265B Financials.

Debt to Equity ratio of Norwegian Cruise Line Holdings Ltd. The stock has a 50-day moving average of 2465 and a 200-day moving average of 2277. Total debt to assets is 4224 with long-term debt to equity ratio resting at 9612.

Shares of NCLH stock opened at 3127 on Thursday. Norwegian Cruise Line Holdings long term debt for 2019 was 6055B a 421 increase from 2018. Its also true when you include second lien debt Carnival is also the most consistently.

NCLHs debt to equity ratio 326 is considered high. Norwegian Cruise Line Holdings Debt to Equity Ratio. Debt to Equity thus makes a valuable metrics that describes the debt company is using in order to support assets correlating with the value of shareholders equity The total Debt to Equity ratio for NCLH is recording 268 at the time of this writing.

The company has a debt-to-equity ratio of 256 a current ratio of 114 and a quick ratio of 110. In addition long term Debt to Equity ratio is set at 256. Thinking about buying stock in Norwegian Cruise Line UWM Holdings Assertio Holdings Hewlett Packard or Aslan.

The Companys quarterly Debt to Equity Ratio DE ratio is Total Long Term Debt divided by total shareholder equity. A higher number means the. Total Debt to Total Capital.

A DE ratio of 1 means its debt is equivalent to its common equity. Finally the long-term debt to capital ratio is 4617. The stock has a market cap of 862 billion a PE ratio of -228 and a beta of 287.

NCLHs debt has increased relative to shareholder equity 326 over the past 5 years ago 2 Financials. Good For Medium-Term Investing. NCLH the companys capital structure generated 10817 points at debt to equity in total while total debt to capital is 5196.

Its used to help gauge a companys financial health. Real-time last sale data for US. 2712 Free Cash Flow Quarterly -71102M.

If they are as bad as most analysts expect waiting to raise additional capital later in the year is a.

Comparing Cruise Line Stocks Nasdaq

Comparing Cruise Line Stocks Nasdaq

Nclh Stock Rating And Data Norwegian Cruise Line Holdings Ltd Gurufocus Com

Nclh Stock Rating And Data Norwegian Cruise Line Holdings Ltd Gurufocus Com

Regulation T Reg T The Borrowers Regulators Federal Reserve System

Regulation T Reg T The Borrowers Regulators Federal Reserve System

Https Www Benzinga Com Intraday Update 20 07 16630859 A Look Into Norwegian Cruise Lines Debt

Norwegian Cruise Line Ltd Nclh Today Up 6 25 To 33 13 Wallmine

Norwegian Cruise Line Ltd Nclh Today Up 6 25 To 33 13 Wallmine

Norwegian Cruise Line Nclh Set To Announce Quarterly Earnings On Thursday Marketbeat

Deutsche Bank Aktiengesellschaft Increases Norwegian Cruise Line Nyse Nclh Price Target To 25 00 Marketbeat

Https Www Leftbrainir Com S Nclh Q3 2020 Read And React Pdf

A Simple Day Trading Strategy For Beginners Gap And Go Trading Strategies Day Trading Strategies

A Simple Day Trading Strategy For Beginners Gap And Go Trading Strategies Day Trading Strategies

Cruise Stock Crumbles After Share Offering

Cruise Stock Crumbles After Share Offering

Liquidity And Leverage Comparisons For Cruise Lines Amid Covid 19 Chaos Seeking Alpha

Liquidity And Leverage Comparisons For Cruise Lines Amid Covid 19 Chaos Seeking Alpha

Norwegian Cruise Line Limited Visibility In 2020 Nyse Nclh Seeking Alpha

Norwegian Cruise Line Limited Visibility In 2020 Nyse Nclh Seeking Alpha

Royal Caribbean The Biggest Ship Of Them All Nyse Rcl Seeking Alpha

Royal Caribbean The Biggest Ship Of Them All Nyse Rcl Seeking Alpha

Which Are Better Cruise Line Stocks To Buy In The Stock Market Today

Which Are Better Cruise Line Stocks To Buy In The Stock Market Today

Carnival Cruise Lines Bull Case Assuming Zero 2020 Revenue Nyse Cuk Seeking Alpha

Carnival Cruise Lines Bull Case Assuming Zero 2020 Revenue Nyse Cuk Seeking Alpha

Post a Comment for "Nclh Stock Debt To Equity Ratio"