Stock Option Tax Calculator Ireland

They arise when the employee exercises the optionie when the employee acquires the shares under the employee stock option. Taxes for Non-Qualified Stock Options.

Learn Something New 101 New Skills To Learn Starting Today Accounting Services Accounting Skills To Learn

Learn Something New 101 New Skills To Learn Starting Today Accounting Services Accounting Skills To Learn

Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share.

Stock option tax calculator ireland. 20 100 shares 2000. Choices When Exercising Stock Options. Employee Benefit under Subsection 71 of the Income Tax Act No tax consequences arise when the employee receives the option.

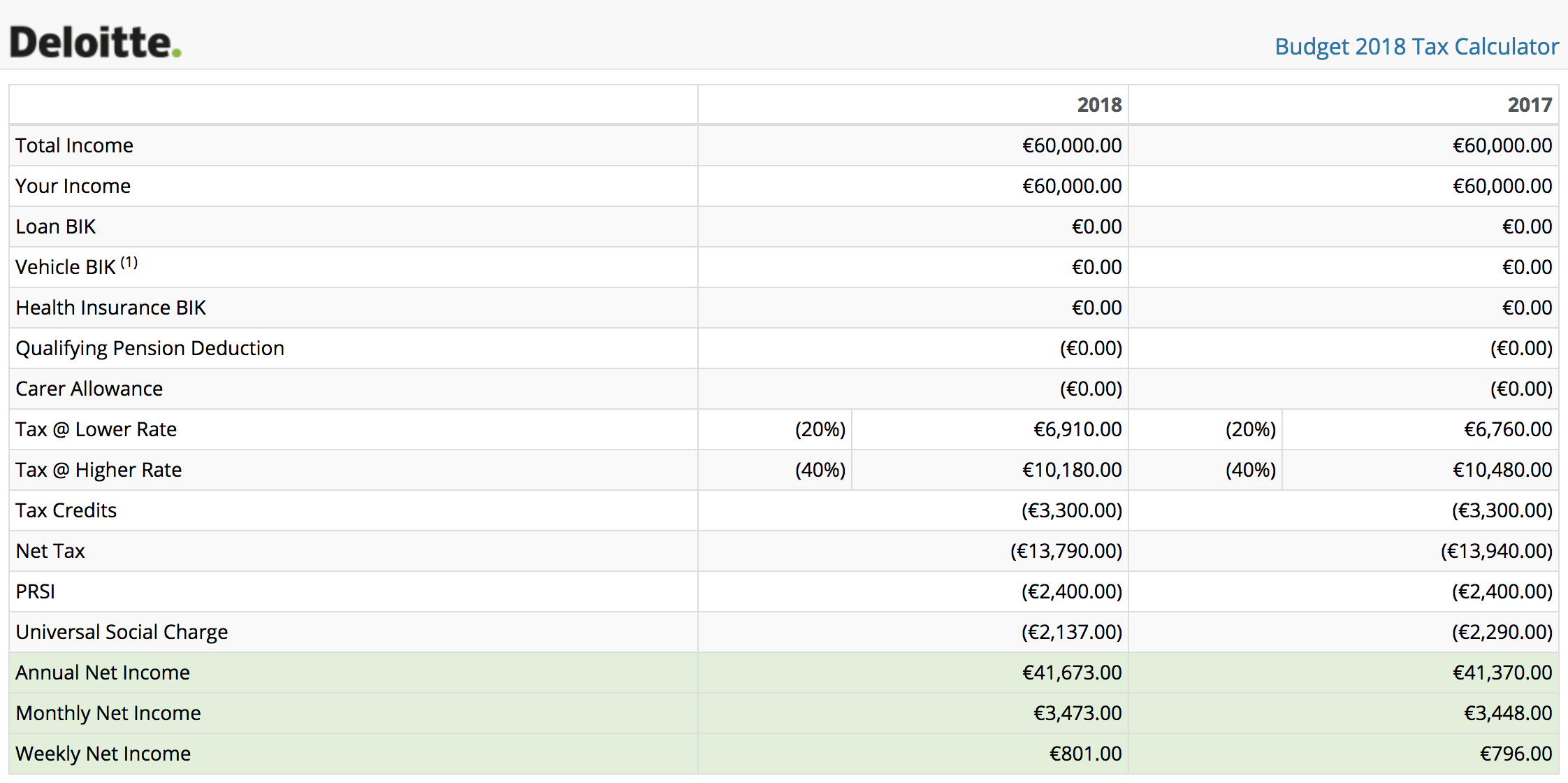

Calculate Tax Clear Form Click here for more insights from Deloitte. The value of the benefit is the market value of the shares at the date they were awarded. The Stock Option Plan specifies the total number of shares in the option pool.

Any tax you pay on the grant of the option will be offset against any tax due when you exercise the option. These shares are a benefit in kind BIK. The deductions used in the above tax calculator assume you are not married and you have no dependants.

Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you exercised the option and purchased the stock times the number of shares you purchased. No responsibility is taken by Deloitte for any errors or for any loss however occasioned to. Value of Shares10000 shares 3 30000.

Assuming the 40 tax rate applies. An index may also be made up of a basket of shares tracking a certain industry or sector for example gold oil and gas water alternative energy coal or utilities. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Those plans generally have tax. Cost of Shares10000 shares 1 10000. Any income tax due on the exercise of the option is chargeable under self.

The country profiles are regularly reviewed and updated as needed. Exercising your non-qualified stock options triggers a tax. 45 25 20 x 100 shares 2000.

The stock options were granted pursuant to an official employer Stock Option Plan. A stock option grants you the right to purchase a certain number of shares of stock at an established price. The tax implications can vary widely be sure to consult a tax advisor before you exercise your stock options.

Calculate the value of a call or put option or multi-option strategies. Taxation in Ireland Irish Income Tax is a progressive tax with two tax bands. This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option.

Stock options restricted stock restricted stock units performance shares stock appreciation rights and employee stock purchase plans. Income-Tax Implications of Exercising an Employee Stock Option. NA not sold yet Number of shares.

The Global Tax Guide explains the taxation of equity awards in 43 countries. In most cases Incentive Stock Options provide more favorable tax. That means youve made 10 per share.

They track the performance of a particular index made up of a basket of shares such as the ISEQ 20 Index an index of the leading shares quoted on the Irish Stock Exchange. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. The tax due on the exercise of a share option is known as Relevant Tax on Share Options RTSO.

The tax rules for stock options are complex. Share options A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company. Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less.

Usually you have several choices when you exercise your vested stock options. Use Deloittes Irish Tax Calculator to estimate your net income based on the provisions in the latest Budget. This gives the total tax bill of 10400.

From 2011 onwards PRSI 4 and the USC 8 charges also apply. So if you have 100 shares youll spend 2000 but receive a value of 3000. See visualisations of a strategys return on investment by possible future stock prices.

If you receive stock options talk with your tax advisor to determine how these tax rules affect you. Assuming the 40 tax rate applies the tax on the share options is 8000. We do our best to keep the writing lively.

Free stock-option profit calculation tool. Any income tax which arises in respect of an unapproved share option scheme must be calculated and paid over to Revenue by the employee. The Stock Option Plan was approved by the stockholders of the grantor within 12 months.

A standard rate of 20 which applies to lower income levels and a standard tax band of 40 which applies to higher wages. There are two types of stock optionsIncentive Stock Options ISOs and Non-qualified Stock Options NSOsand they are treated very differently for tax purposes. Unapproved Share Option Schemes These are essentially all other share option schemes which do not qualify as approved share option schemes.

Hold Your Stock Options. Exercising your stock options is a sophisticated and sometimes complicated transaction. You must calculate the Universal Social Charge USC and Pay Related Social Insurance PRSI and include it with the amount of RTSO.

This is calculated as follows.

Https Www Revenue Ie En Tax Professionals Tdm Income Tax Capital Gains Tax Corporation Tax Part 19 19 04 06a Pdf

All About Deferred Tax And Its Entry In Books

All About Deferred Tax And Its Entry In Books

Wix Stores Including Tax In The Product Price Help Center Wix Com

Wix Stores Including Tax In The Product Price Help Center Wix Com

Xyz Company S December 31 2015 Trial Balance Is As Follows Income Statement This Or That Questions Investing

Xyz Company S December 31 2015 Trial Balance Is As Follows Income Statement This Or That Questions Investing

Life In Dublin What Should You Know Max Pronko

Life In Dublin What Should You Know Max Pronko

Self Employed Tax Calculator Take Home Pay Free Tool Nutmeg

Self Employed Tax Calculator Take Home Pay Free Tool Nutmeg

6 Things To Bring Your Accountant To Prepare Your Tax Return

6 Things To Bring Your Accountant To Prepare Your Tax Return

Charitable Giving Tax Savings Calculator Fidelity Charitable

Charitable Giving Tax Savings Calculator Fidelity Charitable

Kids User Profile User Interface Design Graphic Design Services Kids

Kids User Profile User Interface Design Graphic Design Services Kids

/tax_calculation_shutterstock_556457371-5bfc2fe2c9e77c00519b7136.jpg) Do Preferred Shares Offer Companies A Tax Advantage

Do Preferred Shares Offer Companies A Tax Advantage

Don T Let These Home Buying Myths Fool You Home Buying Real Estate Fun The Fool

Don T Let These Home Buying Myths Fool You Home Buying Real Estate Fun The Fool

How To Calculate Your Income Tax In 5 Simple Steps 2021

How To Calculate Your Income Tax In 5 Simple Steps 2021

Income Tax 2020 Changes Every Canadian Needs To Know In 2020 Income Tax Income Tax Return Tax Return

Income Tax 2020 Changes Every Canadian Needs To Know In 2020 Income Tax Income Tax Return Tax Return

Tax Implications For Indian Residents Investing In The Us Stock Market

Tax Implications For Indian Residents Investing In The Us Stock Market

Stock Price Calculator For Common Stock Valuation Mortgage Payment Calculator Budget Calculator Amortization Schedule

Stock Price Calculator For Common Stock Valuation Mortgage Payment Calculator Budget Calculator Amortization Schedule

Post a Comment for "Stock Option Tax Calculator Ireland"