Stock Return Correlation Calculator

Calculating the the returns for multiple stocks is just as easy as the single stock. Save your entries under the Data tab in the right-hand column.

Pin By Isla Horn On My Beautiful Collections Portfolio Marketing Apt

Pin By Isla Horn On My Beautiful Collections Portfolio Marketing Apt

Next youll calculate a daily deviation for each stock.

Stock return correlation calculator. To find the correlation between two stocks youll start by finding the average price for each one. Multpl_stock_daily_returns multpl_stocksAdj Closepct_change multpl_stock_monthly_returns multpl_stocksAdj CloseresampleMffillpct_change. Stock exchange and supported by Alpha Vantage.

In order to calculate the correlation coefficient you will need information on returns daily price changes for two stocks over the same period of time. Stock Calculator Calculate per share rate of return on a stock sale in terms of current yield and annualized holding period yield. Performance is historical and does not guarantee future results.

Other Solutions to Consider. Using This Calculator Use this calculator to determine the statistical strength of relationships between two sets of numbers. Profit P SP NS - SC - BP NS BC.

Some stocks traded on non-US. Exchanges are also supported. Stock exchange and supported by Alpha Vantage.

Stock Correlation Calculator Use the Stock Correlation Calculator to compute the correlation coefficient for any stock exchange-traded fund ETF and mutual fund listed on a major US. A large correlation of9477 hints that Apple and Microsofts stock prices move closely together. Two securities might have a high correlation if the return is daily percent changes over the past 52 weeks but a low correlation if the.

Cor apple micr simply returned the correlation between the two stocks. A mutual relationship and connection between one or more relationship is called as the correlation. Additionally you can simulate daily weekly monthly or annual periodic investments into any stock and see your total estimated portfolio value on every date.

This asset correlation testing tool allows you to view correlations for stocks ETFs and mutual funds for the given time period. You can also try our Beta Calculator free tool or explore TOP 1000 Most and Least correlated assets for any stock exchange. Learn more about asset correlations between each other.

Click on the Add More link to add more numbers to the sample dataset. Stock Return Calculator Compute total return with dividends reinvested annualized return plus a summary of profitable and unprofitable returns for any stock exchange-traded fund ETF and mutual fund listed on a major US. Correlating stock returns using Python In this tutorial Ill walk you through a simple methodology to correlate various stocks against each other.

Returns are calculated as the difference between the closing prices of the stock over two days of trading. The correlation coefficient is used in statistics to know the strength of one or two relations. Current performance may be lower or higher.

The co-efficient will range between -1 and 1 with positive correlations increasing the value negative correlations decreasing the value. Below is a stock return calculator which automatically factors and calculates dividend reinvestment DRIP. Returns are calculated as the difference between the closing prices of the stock over two days of trading.

The Stock Calculator uses the following basic formula. Cor apple_micr_matrix returned a matrix that shows all of the possible pairwise correlations. There are over 4500 American stocks in the database.

Next we need to calculate the average return for each stock. Indexes are not supported. Most recent month-end performance is available in the Performance topic.

For ABC it would be 11 17 21 14 02 5 130. Enter x and y value in the correlation coefficient calculator to find the correlation. Thats the average price.

Exchanges are also supported. Investment returnsprincipal value will fluctuate so that an investors shares when redeemed may be worth more or less than their original cost. In an empty cell type CORREL and then select one entire column and add a comma to the cell.

This is also why correlating stock prices is difficult. Choose a time period then add up each stocks daily price for that time period and divide by the number of days in the period. In order to calculate the correlation coefficient you will need information on returns daily price changes for two stocks over the same period of time.

Some stocks traded on non-US. Here is an online tool for calculating Asset Correlations between stocks ETFs and indexes. For XYZ it would be 3 42 49 41 25 5 374.

Select the other column add a to close the parenthesis and hit Enter This should produce the correlation coefficientbetween the two investments a figure ranging from -10 to 10. Well grab the prices of the selected stocks using python drop them into a clean dataframe run a correlation and visualize our results. You also view the rolling correlation for a given number of trading days to see how the correlation between the assets has changed over time.

Https Zapier Com Engine Hydrate 6449840 Ejx10fflwzaqb Dvkgeftjvju6qpdffbnagpmlr8kvmsplntzetsxxz77rbgq D09 Chx90zifajru In 2020 Stock Market Marketing Option Trading

Https Zapier Com Engine Hydrate 6449840 Ejx10fflwzaqb Dvkgeftjvju6qpdffbnagpmlr8kvmsplntzetsxxz77rbgq D09 Chx90zifajru In 2020 Stock Market Marketing Option Trading

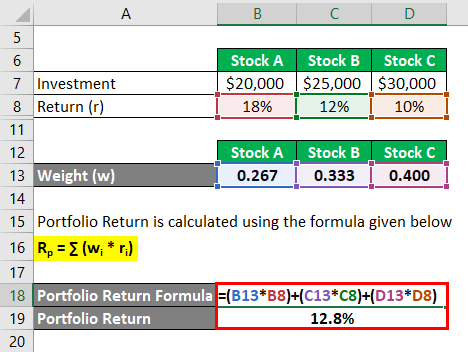

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Return Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM2_2-b5f6378f74164191a5e589e307d88c51.png) Capital Asset Pricing Model Capm

Capital Asset Pricing Model Capm

Pros And Cons Of Automated Trading Systems Automated Trading Stock Market Stock Trading

Pros And Cons Of Automated Trading Systems Automated Trading Stock Market Stock Trading

10 Yrs Returns Vs P E Ratio This Plot Shows The Correlation Of Expected Returns To The Valuation Of Stocks When You Purc Stock Market Research Paper Graphing

10 Yrs Returns Vs P E Ratio This Plot Shows The Correlation Of Expected Returns To The Valuation Of Stocks When You Purc Stock Market Research Paper Graphing

How Can You Calculate Correlation Using Excel

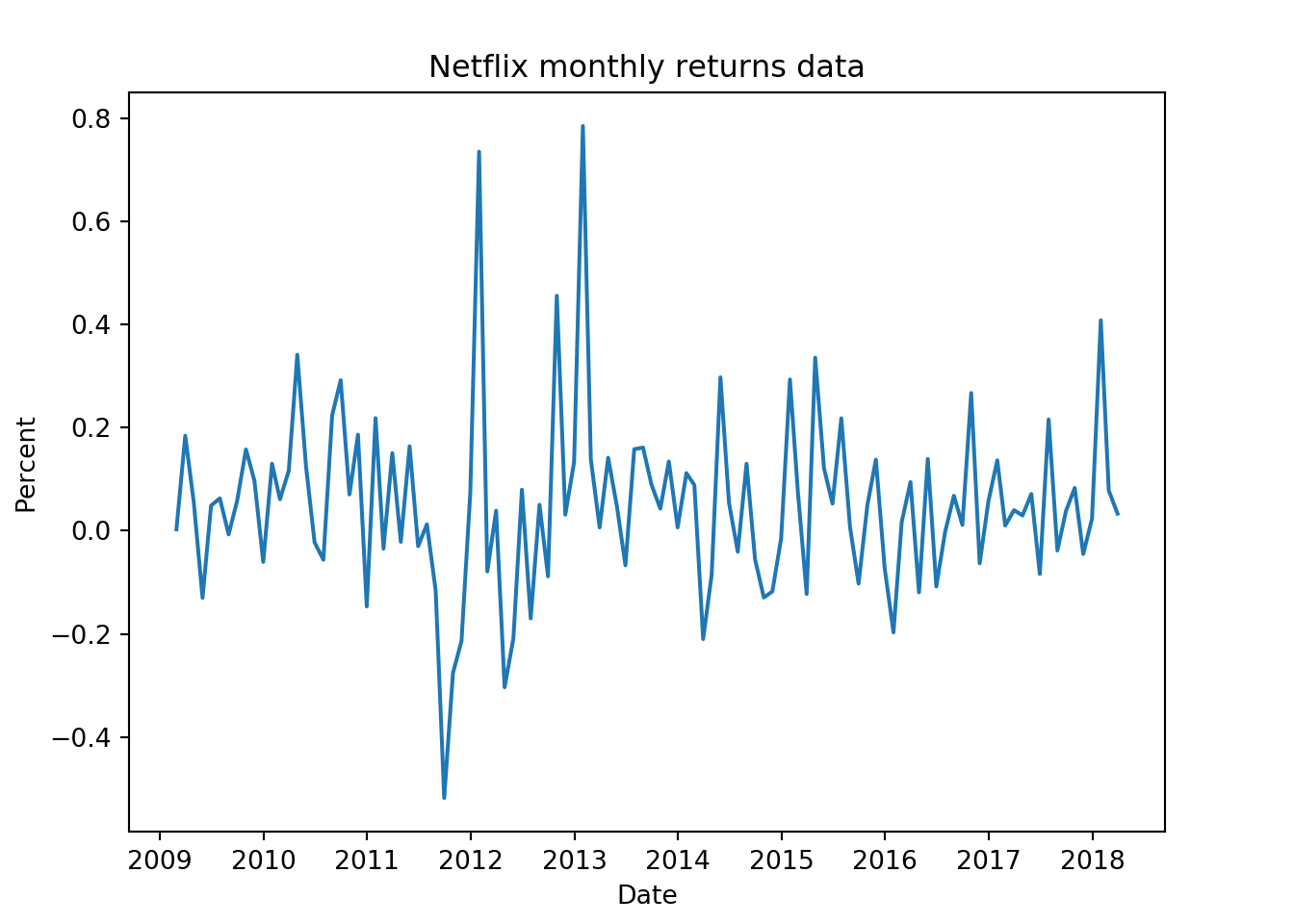

How Volatility Affects A Stock S Return Tested With Python By Dane Brear Analytics Vidhya Medium

How Volatility Affects A Stock S Return Tested With Python By Dane Brear Analytics Vidhya Medium

Secret Profit Matrix Best Forex Guide Trading Strategy Forex Nadex Itrade Stock Market Trading Strategies Stock Prices

Secret Profit Matrix Best Forex Guide Trading Strategy Forex Nadex Itrade Stock Market Trading Strategies Stock Prices

How To Calculate Stock Returns In Python Coding Finance

How To Calculate Stock Returns In Python Coding Finance

2021 Cfa Level I Exam Cfa Study Preparation

2021 Cfa Level I Exam Cfa Study Preparation

Finviz Com Stock Screener Stock Screener Financial Dow

Finviz Com Stock Screener Stock Screener Financial Dow

Finance Formula 1 728 Jpg 728 1030 Standard Deviation Finance Probability

Finance Formula 1 728 Jpg 728 1030 Standard Deviation Finance Probability

How To Calculate The Historical Variance Of Stock Returns The Motley Fool

How To Calculate The Historical Variance Of Stock Returns The Motley Fool

Swiss Royal Banc Is A Global Financial Institution And Online Trading Brokerage Trading Stocks Ideas Of Tradin Option Trading Online Trading Forex Trading

Swiss Royal Banc Is A Global Financial Institution And Online Trading Brokerage Trading Stocks Ideas Of Tradin Option Trading Online Trading Forex Trading

Dupont Analysis Definition Calculate Roe Formula Uses Example Financial Life Hacks Financial Analysis Dupont Analysis

Dupont Analysis Definition Calculate Roe Formula Uses Example Financial Life Hacks Financial Analysis Dupont Analysis

Invest Wisely Investment Tips Invest Wisely Finance Investing

Invest Wisely Investment Tips Invest Wisely Finance Investing

Are Stock Returns Normally Distributed By Tony Yiu Towards Data Science

Are Stock Returns Normally Distributed By Tony Yiu Towards Data Science

Arbitrage Pricing Theory Accounting And Finance Financial Life Hacks Economics Lessons

Arbitrage Pricing Theory Accounting And Finance Financial Life Hacks Economics Lessons

/dotdash_Final_Excess_Returns_Dec_2020-01-2a81d7a448684458b0ed30db04fd145c.jpg)

Post a Comment for "Stock Return Correlation Calculator"