What Is A Cliff Period On Stock Options

Startups use cliff vesting commonly because it helps them evaluate employees before actually committing to. Cliff vesting refers to the vesting of employee benefits over a short period of time.

Equity Valuations May Also Be Facing A Cliff Gavekal Implications For Pensions Equity Financial Markets Pensions

Equity Valuations May Also Be Facing A Cliff Gavekal Implications For Pensions Equity Financial Markets Pensions

Many companies offer option grants with a one-year cliff.

What is a cliff period on stock options. For business then the four business day period shall begin to run on and include the first business day thereafter. What happens when you leave the company. Your stock option agreement.

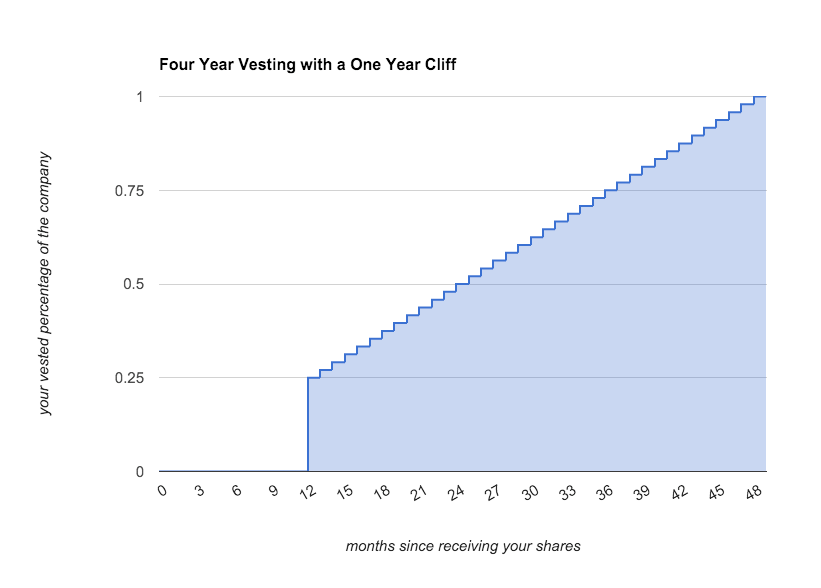

Also while grants of restricted stock and grants of RSUs are somewhat similar they too differ in key ways so it is important to understand RSUs in their own right. Each option is exercisable into one common share in the capital of the company at a price of 375 cents per share for a period of five years from the date of issuance. The options are subject to a four-year vesting with one-year cliff vesting which means that John has to stay employed with ABC for one year before he gets the right to exercise 10000 of the options and then he vests the remaining 30000 options at the rate of 136 a month over the next 36 months of employment.

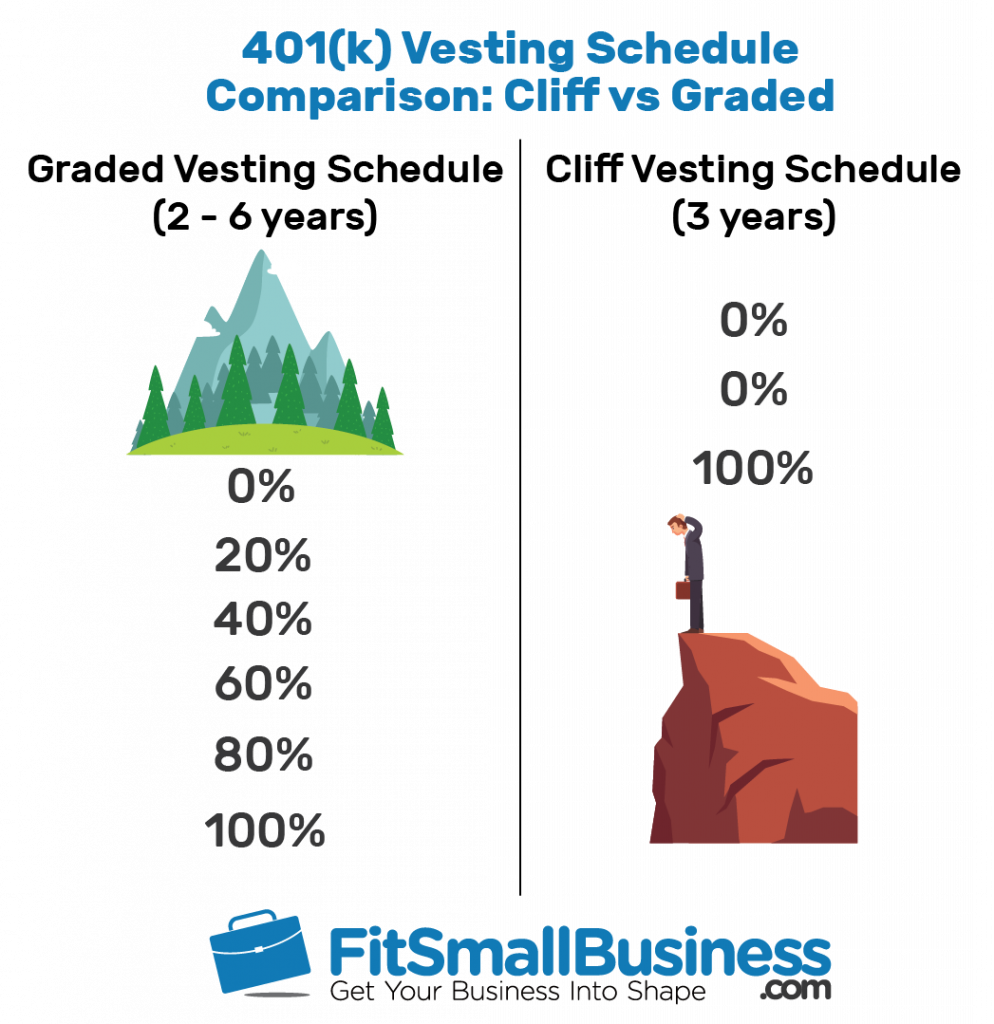

Types of startup stock options. I can understand how King Solomon saw a world of madness and folly and chaos. In a cliff plan the employee gets access to all of the stock options on the same date.

A registrant either furnishing a report on this form under Item 701 Regulation FD Disclosure or electing to file a report on this form under Item 801. Stock options were just a footnote. The options are subject to a four-year vesting with one year cliff vesting which means that John has to stay employed with ABC for one year before he gets the right to exercise 10000 of the.

Stock-option plans generally come in graded or cliff vesting schedules. A four-year vesting period means that it will take four years before you have the right to exercise all 20000 options. Generally a plan will provide for a certain vesting period typically four years with a one-year cliff says Rizzo.

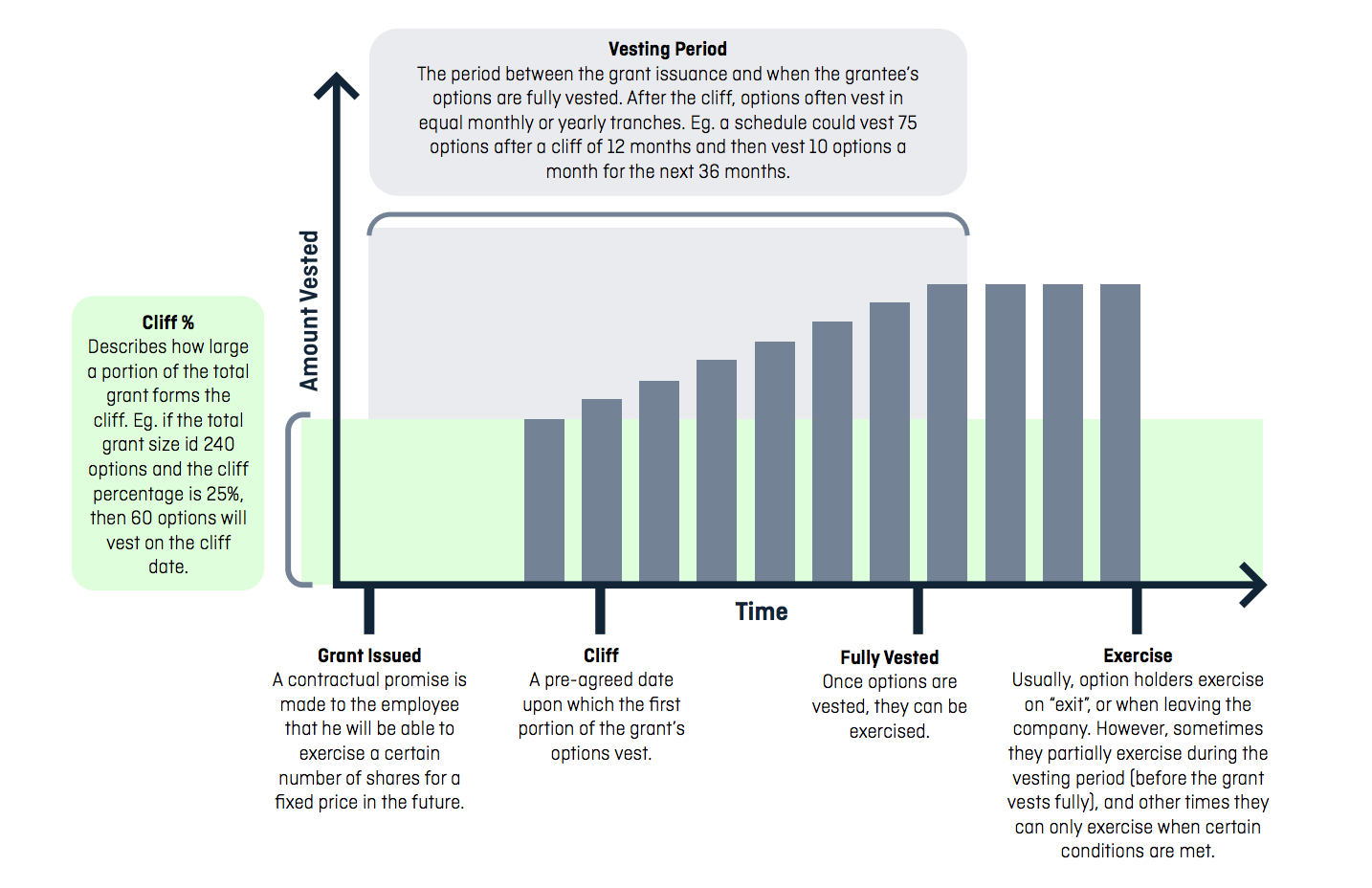

Kill Cliff Fight Club Launches as Adesanya Prepares to Challenge the UFC Light Heavyweight Title Israel Adesanya Signs On to Headline New Kill Cliff Fight Club The UFC champion known as The Last. Most time-based vesting schedules have a vesting cliff. Often there is a cliff by which the first few steps in the graph are missing so that there is no vesting at all for a period usually six or twelve months in the case of employee equity after which there is a cliff date upon which a large amount of vesting occurs all at once.

Under the new rules such performance-based options are not subject to variable accounting. Incentive stock options are much like non-qualified stock options in structure and design except for their tax treatment. A cliff is when the first portion of your option grant vests.

Stock prices are at astronomically high valuations and global debt is unsustainable in the hundreds of trillions. Executives can only exercise their options in stages over an extended period. In a graded plan employees are allowed to exercise only a portion of their options at a time.

Nearly 3 million Americans appear to have fallen off the unemployment benefits cliff after Christmas a scenario many had feared amid delays in pushing through another Covid relief bill. Types of startup stock options. Each stock option may carry a different vesting schedule.

I find the madness of todays world personally overwhelming. Restricted stock units RSUs are the most popular alternative to stock options but they work very differently. The good news is that because your options vest gradually over the course of this vesting period youll be able to access some.

Stock options arent actual shares of stocktheyre the right to buy a set number of company shares at a fixed price usually called a grant price strike price or exercise. In this case lets say the options have a four-year vesting period with a one-year cliff. Under the old rules stock options that vest based solely on performance conditions are subject to variable accounting.

While vesting periods for stock options are usually time-based they can also be based on the achievement of specified goals whether in corporate performance or employee performance see the FAQ on performance-based stock options. The employer still grants an employee the option the right but not the obligation to purchase a specific number of shares of company stock within a prescribed period of time at a predetermined price in most cases the. The options are being issued in accordance with the companys shareholder approved stock option plan.

In other words if you bail on the company within the first year thats the first year of employment not a calendar year you wont receive any stock options. This article series explains the basic facts of RSUs including vesting and tax treatment that you must know to. With time-based stock vesting you earn options or shares over time.

Stock options always have a limited term during which they can be exercised. Companies would also be well advised to abandon the practice of cliff. After the cliff you usually gradually vest the remaining options each month or quarter.

To say that its a world that is senseless to me is an understatement. Cliff vesting is when an employee earns the right to receive benefits from an employers plan after a specifed period rather than becoming vested in increasing amounts over time. Instead the accounting expense of these.

Stock Options Will Expire If Not Exercised. Cliff-vested options must use the straight-line method.

The Topic Of Flash Crashes Is Back In The News On Friday India S National Stock Exchange Nse Experienced A Flash Crash That Took Stock Exchange Crash Flash

The Topic Of Flash Crashes Is Back In The News On Friday India S National Stock Exchange Nse Experienced A Flash Crash That Took Stock Exchange Crash Flash

What Is Stock Vesting Got Offered A Grant By Your Employer By Capdesk Medium

What Is Stock Vesting Got Offered A Grant By Your Employer By Capdesk Medium

What Does Stock Option Vesting Schedule Stand For Stock Options Schedule Stressed Out

What Does Stock Option Vesting Schedule Stand For Stock Options Schedule Stressed Out

What Are The Odds The Market Will Crash During Your Retirement Years Marketwatch Stock Market Crash Track Investments Investing

What Are The Odds The Market Will Crash During Your Retirement Years Marketwatch Stock Market Crash Track Investments Investing

How Long Is The Common Vesting And Cliff Period For Startups Quora

Top 3 Reasons Why The Nasdaq Will Soon Breakout To A New High Nasdaq Financial Education Breakouts

Top 3 Reasons Why The Nasdaq Will Soon Breakout To A New High Nasdaq Financial Education Breakouts

What Is A Vesting Schedule Mystockoptions Com

What Is A Vesting Schedule Mystockoptions Com

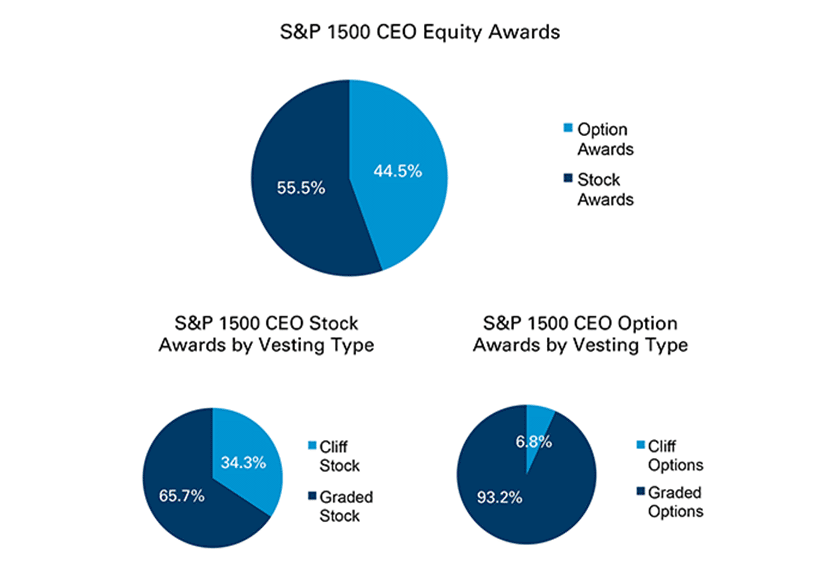

Equilar Equity Vesting Schedules For S P 1500 Ceos

Equilar Equity Vesting Schedules For S P 1500 Ceos

401 K Vesting Schedule Cliff Vs Graded Examples

401 K Vesting Schedule Cliff Vs Graded Examples

Four Year Vest Cliff And Strike Prices The Wonderful World Of Share Option Grants By Zoe Chambers Octopus Ventures Medium

Four Year Vest Cliff And Strike Prices The Wonderful World Of Share Option Grants By Zoe Chambers Octopus Ventures Medium

Employee Stock Option And Phantom Share Plans Pool Size Vesting Schedule Examples Ledgy

Employee Stock Option And Phantom Share Plans Pool Size Vesting Schedule Examples Ledgy

Is The Stock Market Cheap Dshort Advisor Perspectives Optiontradingforaliving Stock Market Stock Options Trading Wave Theory

Is The Stock Market Cheap Dshort Advisor Perspectives Optiontradingforaliving Stock Market Stock Options Trading Wave Theory

What Is Stock Vesting What It Means For Employee Stock Options Carta

Characterization Deferred Compensation Orange County Divorce Lawyers Minyard Morris

Characterization Deferred Compensation Orange County Divorce Lawyers Minyard Morris

Vesting And Cliffs From The Holloway Guide To Equity Compensation By Andy Sparks Holloway Medium

Vesting And Cliffs From The Holloway Guide To Equity Compensation By Andy Sparks Holloway Medium

What Is A Vesting Schedule Your Quick Guide

What Is A Vesting Schedule Your Quick Guide

Should You Ask For Equity Quick Guidebook To Figure Out How Much By Augustin Sayer Entrepreneurial Resolutions Medium

Should You Ask For Equity Quick Guidebook To Figure Out How Much By Augustin Sayer Entrepreneurial Resolutions Medium

Vesting Gust Equity Management Knowledge Base

Vesting Gust Equity Management Knowledge Base

Post a Comment for "What Is A Cliff Period On Stock Options"