How To Calculate Volume In Stock Market

The quickest way to find the session or 100-day average volume for a stock is in the Details tool. Relative volume Current volume Average volume 3 million 4 million 075 The equation would give a ratio of 075x.

:max_bytes(150000):strip_icc()/dotdash_Final_Tales_From_the_Trenches_The_Rising_Wedge_Breakdown_Dec_2020-06-8f1b78c3bb8841af9e6c0a614ce06329.jpg) Tales From The Trenches The Rising Wedge Breakdown

Tales From The Trenches The Rising Wedge Breakdown

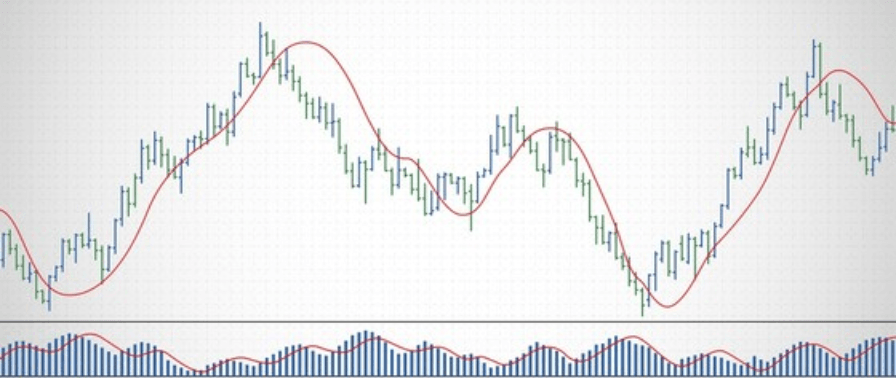

How this indicator works Compare the Average Volume for the specified period to determine if volume is above or below average.

/ArmsIndex-TRIN-5c549e4446e0fb000152e735.png)

How to calculate volume in stock market. Calculate the typical price for the chosen intraday period by finding the average of the high low and close. The trading volume means the measure of the total shares that have changed hands for a specific time period. The dollar volume is the total value of the shares traded.

The Calculation Involves Five Steps. After one hour of trading volume at 1030 am was 3 million shares done. Dollar volume is calculated by trading volume multiplied by price.

A volume spike signifies that todays trading activity is out of the ordinary which implies that something significant is happening today. If the market makes moves a large amount during a given period. If the volume has a green bar then the price rose during that period and it is considered by the market as buying volume estimated.

Volume 13 π 15 2 5 11781 in 3. If theres high volume at. Stock volume also indicates the amount of stock liquidity at work.

Liquidity shows how easy it is to buy and. ATHM surges up on a volume spike. When looked at on a chart volume basically shows the interest level in a stock.

A high daily volume is common when stock-specific news items are released. Using the companys growth rate over the past years you can estimate the. The ADV is a very important measure that is used by investors to gauge the liquidity of a stock.

Large moves in the stock market are often accompanied by a volume spike. Volume measures the number of shares traded in a stock or contracts traded in futures or options. Volume bars may be colored.

It is the average of the high price the low price and the close price of the stock for that day. We explain how to calculate the ADV and how it is used by traders and investors to make trading decisions. For example if XYZ has a total trading volume of 100000 shares at 5 then the dollar volume is 500000.

To calculate a stocks PEG value youll need to know the PE ratio and the 12-month growth rate of the company. Get a cumulative total of the values in step 2 Step 4. The first step is to calculate the typical price for the stock.

Volume is an important indicator in technical analysis because it is used to measure the relative significance of any market move. Therefore the total trading volume is 3 million shares. Volume can be an indicator of market strength as rising markets on increasing volume are.

A stocks volume refers to the number of shares that are sold or traded over a certain period of time usually daily. For example First 1 million shares were bought at 12 per share later 2 million shares were purchased at 13 per share. The Average Volume is the total volume for a specified period divided by the number of bars in that same period.

A red volume bar means the price declined during that period and the market considers the volume during that period as selling volume estimated. Using AAPL again as an example with an average 5 day volume of 4 million. Trading volume is reported in terms of the number of shares that were traded and as the dollar amount of.

Get a cumulative. Now all she has to do is use her angelic childlike appeal to manipulate the staff into emptying the containers of ice cream into her cone. In a public stock exchange such as the New York London or Frankfurt transactions are recorded and.

How Is Stock Market Volume Calculated. The average daily volume ADV or average daily trading volume equals the average number of shares traded over a certain period of time. Open the tool up and scroll down past the news.

Increased volume flows are correlated to increased volatility. Money managers use dollar volume metrics to determine whether a stock has enough liquidity to support a position. Using the formula HLC3 if H 20 L 15 and C 18 the stocks average price would be.

The dollar volume is the total value of the shares traded. Under Quotes youll find the Session Volume and. Multiply each periods typical price by the volume Step 3.

Bea also calculates the volume of the sugar cone and finds that the difference is 15 and decides to purchase a sugar cone. Typical Price 201518 3 1767. How Is Stock Market Volume Calculated.

What Is Volume In Share Market Angel Broking

What Is Volume In Share Market Angel Broking

Stock Volume Analysis 5paisa 5pschool

Stock Volume Analysis 5paisa 5pschool

What Is Volume In Stock Trading The Motley Fool

What Is Volume In Stock Trading The Motley Fool

/ArmsIndex-TRIN-5c549e4446e0fb000152e735.png) Arms Index Trin Definition And Application

Arms Index Trin Definition And Application

Investing 101 How To Read A Stock Chart For Beginners

Investing 101 How To Read A Stock Chart For Beginners

Volume Of Trade Overview Calculation And Example

Volume Of Trade Overview Calculation And Example

:max_bytes(150000):strip_icc()/dotdash_Final_Rules_for_Picking_Stocks_When_Intraday_Trading_Aug_2020-02-4d94d47059144265b9986875e0bcf113.jpg) Rules For Picking Stocks When Intraday Trading

Rules For Picking Stocks When Intraday Trading

What You Can Learn From A Stock S Trading Volume Technical Analysis Course Youtube

What You Can Learn From A Stock S Trading Volume Technical Analysis Course Youtube

What Is Open High Low Close In Stocks Analyzing Alpha

What Is Open High Low Close In Stocks Analyzing Alpha

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-03-823a5a555de94fe7b0ae40a0fd687810.jpg) Trading Volatile Stocks With Technical Indicators

Trading Volatile Stocks With Technical Indicators

Best Indicators For Day Trading Warrior Trading

Best Indicators For Day Trading Warrior Trading

Vpa Related Vol Afl For Amibroker Afl Trading Analysis

Vpa Related Vol Afl For Amibroker Afl Trading Analysis

Average Daily Trading Volume Adtv Overview

Average Daily Trading Volume Adtv Overview

Volume Price Trend Indicator Vpt Overview Formula How To Interpret

Volume Price Trend Indicator Vpt Overview Formula How To Interpret

Interpreting Volume In Technical Analysis

Interpreting Volume In Technical Analysis

Stock Volume What Is Volume In Stocks And Why Does It Matter

Stock Volume What Is Volume In Stocks And Why Does It Matter

Volume And Price Movement Gif 520 350 Stock Options Trading Stock Options Investing Investing In Stocks

Volume And Price Movement Gif 520 350 Stock Options Trading Stock Options Investing Investing In Stocks

:max_bytes(150000):strip_icc()/RobinhoodLevel2-9fc2600afd384175b8b6a9af7e37df62.png)

/stock-market-836258860-b02336942c2b4590a42bfbeb1f2ab806.jpg)

Post a Comment for "How To Calculate Volume In Stock Market"