Stock Market Bubble Wiki

During a bubble stock prices often sore to astounding heights. Updated Jun 25 2019.

Kx4 Pro Russian Trading System Cost 3125 Stock Market Forex Wiki Trading Stock Market Student Images Trading

Kx4 Pro Russian Trading System Cost 3125 Stock Market Forex Wiki Trading Stock Market Student Images Trading

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

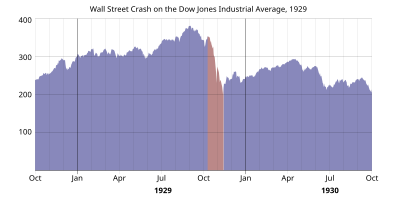

Stock market bubble wiki. A new ETrade Financial survey of 904 active investors revealed that 66 of them believe the stock market is either fully or somewhat in a bubble. There have been a number of famous stock market crashes like the Wall Street Crash of 1929 the stock market crash of 19734 the Black Monday of 1987 the Dot-com bubble of 2000 and the Stock Market Crash of 2008. One of the most famous stock market crashes started October 24 1929 on Black Thursday.

Suddenly the bubble bursts and everything comes tumbling down. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. Below well look more closely.

Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time. This is how Im gearing up. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

Two instances of an equity bubble are the Tulip Mania and the dot-com bubble. The Japanese asset price bubble バブル景気 baburu keiki bubble economy was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. 3 Ways Im Preparing for the Stock Market Bubble to Burst Theres a good chance a stock market crash is coming soon.

When it comes to the stock market traditional valuation metrics can be used to identify extreme overvaluation. As a result you may expect terrific growth from your portfolio. This may just be the most crazy market hes seen in his career.

An economic bubble or asset bubble is a situation in which asset prices appear to be based on implausible or inconsistent views about the future. An additional 26 said the stock market is. Provided the former are strong and the.

The Great Crash is associated with October 25 1929 called Black Friday the day after the largest sell-off of shares in US. Theyre up another 41 in premarket trading Monday as. These kind of bubbles are characterised by easy liquidity tangible and real assets and an actual innovation that boosts confidence.

Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. A stock market bubble is a period of growth in stock prices followed by a fall. Stock market is forming a Real McCoy bubble that may end up hurting investors.

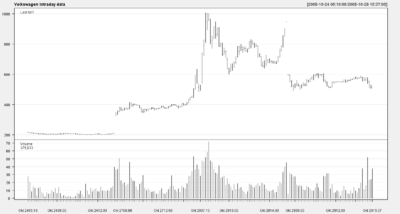

Stock in GameStop a legacy company whose stores are often located in struggling malls skyrocketed 51 on Friday to 6501. Signs of a market bubble are building according to the Wall Street Journal. It was the most devastating stock market crash in the history of the United States when taking into consideration the full extent and duration of its aftereffects.

Now your amazing portfolio has lost a tremendous amount of value jeopardizing your savings and retirement. 4 Ways to Survive a Stock Market Bubble. Stock Market Bubble is the phenomena where the prices of the stock of the companies do not reflect the fundamental position of the company and because of this there is a divide between the real economy and the financial economy caused either due to irrational exuberance of the market participants or due to herd mentality or any other similar reasonIn this situation the stock prices are inflated and cant be supported by the actual performance of the company and its profits.

In early 1992 this price bubble burst and Japans economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity as well as an. For example an equity index that is trading at a price-to-earnings ratio that is.

When they fall they do so quickly and often below the starting value. He said in a CNBC Closing Bell interview aired on Wednesday. A Bubble Is Forming Legendary investor Jeremy Grantham believes the US.

An equity bubble is characterised by tangible investments and the unsustainable desire to satisfy a legitimate market in high demand. FACEBOOK TWITTER LINKEDIN By Mark Kolakowski. Are stock markets especially the US market in a bubble that is sure to pop.

Calls of a stock market bubble have gotten a lot more common and even some of Wall Streets finest are starting to look for reversals of fortune for favored stocks. The answer depends on prospects for corporate earnings and interest rates. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior.

Trading With Range Bars Ichimoku Cloud Awesome Oscillator Forex Wiki Trading Forex Trading Forex Trading Software

Trading With Range Bars Ichimoku Cloud Awesome Oscillator Forex Wiki Trading Forex Trading Forex Trading Software

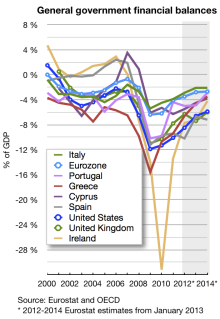

Corporate Debt Bubble Wikipedia

Corporate Debt Bubble Wikipedia

United States Housing Bubble Wikipedia

United States Housing Bubble Wikipedia

Irish Property Bubble Wikipedia

Irish Property Bubble Wikipedia

Wall Street Crash Of 1929 Simple English Wikipedia The Free Encyclopedia

Wall Street Crash Of 1929 Simple English Wikipedia The Free Encyclopedia

Tehran Stock Exchange Wikipedia

Tehran Stock Exchange Wikipedia

Post 2008 Irish Economic Downturn Wikipedia

Post 2008 Irish Economic Downturn Wikipedia

File Subprime Crisis Diagram X1 Png Wikipedia

File Subprime Crisis Diagram X1 Png Wikipedia

Financial Market Impact Of The Covid 19 Pandemic Wikipedia

Financial Market Impact Of The Covid 19 Pandemic Wikipedia

Hyperinflation In Brazil Wikipedia

Hyperinflation In Brazil Wikipedia

Post a Comment for "Stock Market Bubble Wiki"