Historical Stock Market In Presidential Election Years

Note that following the lead of. It was furthered by Pepperdine professor Marshall Nickles in a paper called Presidential.

Bull Markets Come In All Shapes And Sizes We Analyze Historical Market Cycles On Criteria Such As Duration Magnitude Ve Investimento Carteira Estados Unidos

Bull Markets Come In All Shapes And Sizes We Analyze Historical Market Cycles On Criteria Such As Duration Magnitude Ve Investimento Carteira Estados Unidos

Since 1952 the Dow Jones Industrial Average has climbed 101 on average during election years when a sitting president has run for reelection according to the Stock Traders Almanac which is.

Historical stock market in presidential election years. A stock market crash cleaved the value of the SP 500 nearly in half between January 1973 and October 1974 accompanied by double-digit inflation and a 16-month recession that began in the fall of. Stock market performance thus far in 2019 has coincided with the presidential election cycle pattern. According to Dan Clifton of Strategas Research Partners history.

Equity Clock provides free stock research and analysis on individual equities in the market to aid your stock investing picks. Stock markets average price-only return in the first two years of the four-year presidential term is 56 per year versus 93 in the third- and fourth years. This is largely consistent with the historical record.

According to Dan Clifton of Strategas Research Partners in the year after the election historically the market SP 500 responds better to a Republican victory initially November through February of the following year but a Democratic victory ends up outperforming a Republican victory by about 7. Industrial Energy and Financial stocks generally lagged the market in the first half of 2020 and for several years prior to that. 2004-2008 - Bushs 2nd Term.

Certainly those averages came with plenty of ups and downs over the last 200 years. But over the past century the stock market has mostly run briskly across most of the presidential cycle before losing momentum during election years. Jon Vialoux is a registered Associate Portfolio Manager at CastleMoore Inc.

In 2016 the three months preceding the presidential election saw implied options volatility for the SP 500 measured by the VIX range between 10 and 15. I am referring to the notion that the US. We find using election dates as a markettiming indicator is inconclusive and volatility around presidential elections is slightly less than in other years contrary to common belief.

Stock market SPX 039 does particularly well in the year leading up to a presidential election especially one in which a first-term president is up. But in the closing months of the year these sectors began to draw increased interest from investors and saw stock performance improve. Only presidents who were elected as opposed to VPs who stepped in are shown.

Beginning in 1833 the Dow Jones Industrial average has seen an average gain of 104 the year before a presidential election and an average gain of nearly 6 during the election year. Click Here to see all of our Historical Chart Galleries. Although the stock market is not the economy historically both have played major roles in the outcome of presidential elections.

Stock Market Performance by President From Election Date This interactive chart shows the running percentage gain in the Dow Jones Industrial Average by Presidential term. Mid-Term Election Year Seasonal Chart. 1992-1996 - Clintons 1st Term.

In the 12 months following the election the SP 500 averaged 48 when the incumbent won versus 25 if they lost. 2008-2012 - Obamas 1st Term. Despite the catastrophic pandemic mass protests against police violence the contentious 2020 presidential election and the struggling economy the stock market ultimately reached all-time highs.

1996-2000 - Clintons 2nd Term. Stock market has posted a gain 84 of the time in election-year Decembers since 1944 versus 74 for all Decembers. Is your time up.

CFRA suggests that an end to election uncertainty has been a factor as. In the 23 four-year presidential election cycles beginning in 1928 through this year the market failed to produce a gain only five times in the third year of the cycle 19311939 1947 2011 and 2015 which on average outperformed the other three years by a wide margin. However stock market returns have historically been good predictors of presidential election outcomes particularly threemonth returns prior to the election.

2012-2016 - Obamas 2nd Term. 2000-2004 - Bushs 1st Term. Since 1930 the Dow Jones Industrial Average.

This likely reflects expectations for an upturn in the economy in 2021. Lets take an extended look at the election years stock market history. That same index has been between 25.

Each series begins in the month of election and runs to the election of the next president. The line at 45 weeks is approximately when the presidential election occurs. Presidential Stock Market Cycles.

2016-Present - Trumps 1st Term. Comments and opinions offered in this website are for information only. Since the Dow Jones Industrial Average DJIA -119 was created in the late 1800s the US.

The Market Likes CertaintyLarge Cap Returns in Election Years Weekly Data 1988 to Present SP 500 Index In the chart below we trace the path of the SP 500 on a weekly basis for each presidential election year back to 1988.

Image Result For Equity Risk Premium Historical Asset Management Equity Risk

Image Result For Equity Risk Premium Historical Asset Management Equity Risk

Weakest Part Of Presidential Cycle The Big Picture Stock Market Cycle Chart

Weakest Part Of Presidential Cycle The Big Picture Stock Market Cycle Chart

Msci Growth Vs Msci Value Rebounding Economic Activity Value Stocks

Msci Growth Vs Msci Value Rebounding Economic Activity Value Stocks

A Rising Mountain Of Student Debt The Big Picture Student Debt Student Big Picture

A Rising Mountain Of Student Debt The Big Picture Student Debt Student Big Picture

Rising Rates Dispelling The Myth

Rising Rates Dispelling The Myth

U S Midyear Outlook From Recession To Recovery Capital Group Dow Jones Index Practice Management Fund Accounting

U S Midyear Outlook From Recession To Recovery Capital Group Dow Jones Index Practice Management Fund Accounting

Diversification Has Helped Lower Volatility And Raise Returns Over Time Asset Management Global Insight

Diversification Has Helped Lower Volatility And Raise Returns Over Time Asset Management Global Insight

Has Indexing Gotten Too Big Smart Money Asset Management Advisor

Has Indexing Gotten Too Big Smart Money Asset Management Advisor

Technical Analysts Need Fundamental Action From Central Banks To Make The Chart Look Bullish For Gold Gold Chart Central Bank

Technical Analysts Need Fundamental Action From Central Banks To Make The Chart Look Bullish For Gold Gold Chart Central Bank

Image Result For Stock Market Sector Historical Performance Stock Market Charts And Graphs Wealth Management

Image Result For Stock Market Sector Historical Performance Stock Market Charts And Graphs Wealth Management

Buy The Best Perform The Worst Asset Management Chart Best

Buy The Best Perform The Worst Asset Management Chart Best

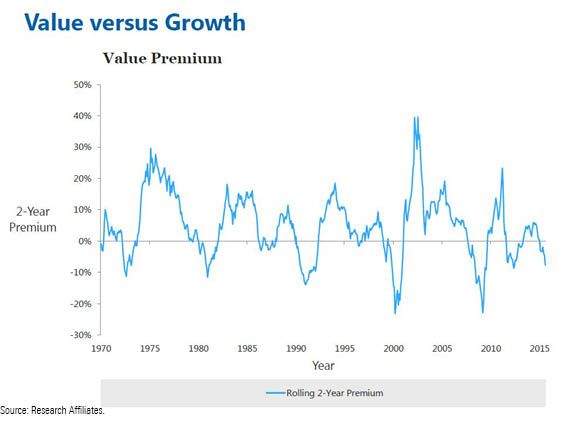

Value Investors Are Vexed Investors Value Stocks Value Investing

Value Investors Are Vexed Investors Value Stocks Value Investing

Bull Markets Come In All Shapes And Sizes We Analyze Historical Market Cycles On Criteria Such As Duration Magnitude Velo Asset Management Marketing Analyze

Bull Markets Come In All Shapes And Sizes We Analyze Historical Market Cycles On Criteria Such As Duration Magnitude Velo Asset Management Marketing Analyze

Us Vs Row P E Rule Of Thumb Marketing Rules

Us Vs Row P E Rule Of Thumb Marketing Rules

If Bubbles Eventually Revert To Their Starting Level Phase 3 Capitulation And A Return To Pre Bubble Prices Still Lies Ahead Housing Market Bubbles Symmetry

If Bubbles Eventually Revert To Their Starting Level Phase 3 Capitulation And A Return To Pre Bubble Prices Still Lies Ahead Housing Market Bubbles Symmetry

Expensive Markets Lead To Bigger Drawbacks Stock Market Investing Marketing

Expensive Markets Lead To Bigger Drawbacks Stock Market Investing Marketing

The Dallas Shooting Was Among The Deadliest For Police In U S History Police Chart History

The Dallas Shooting Was Among The Deadliest For Police In U S History Police Chart History

If History Is Any Guide We Re Standing At The Edge Of 40 96 Returns Over The Next Two Years This Isn T Wishful Thinkin Stock Market Investing Marketing Set

If History Is Any Guide We Re Standing At The Edge Of 40 96 Returns Over The Next Two Years This Isn T Wishful Thinkin Stock Market Investing Marketing Set

Post a Comment for "Historical Stock Market In Presidential Election Years"