How To Trade Bond Futures

Bond futures are used by speculators to bet on the price of a bond. Treasury bond markets arguably have the greatest.

How To Start Trading In 2020 Tradingtools Trading Investing Options Trading Books

How To Start Trading In 2020 Tradingtools Trading Investing Options Trading Books

Post large amounts of buy sell orders in big volume at a particular price Second.

How to trade bond futures. Which can be stocks bonds currencies commodities or. For other bonds E-Trade charges a 1 commission per bond. How to Trade Bond Futures.

All you need to start trading Treasury bond futures is to create an account with the exchange through your futures broker and deposit the required margin. Options on futures quotes. Let me show the Correct Way to Trade Bond Futures Enjoy a Free Week of Masters in Trading.

Treasury bond futures represent a liquid market and many participate in its trade including bankers bond dealers hedgers and other financial service professionals. Bonds can also be traded between investors prior to its maturity date. Get specs compare futures to cash and more.

The equity in each futures account is marked to market daily. The online secondary market requires a 10 minimum and 250 maximum commission charge. Before we get into how to day trade futures we first need to discuss what day trading is.

Once the market got close enough. The big order will attract other traders herd mentality who will try to buy at the same price. While at the same time you also know that not every futures market will match your trading strategy.

CBOT Treasury futures are standardized contracts for the purchase and sale of US. The following article on The Best Futures Markets To Day Trade In 2020 is the opinion of Optimus Futures. Participating in Treasury bond futures can allow one to hedge long term risk address yield curves and use a variety of trading strategies like spread trading and trading against.

Futures trading involves buying and selling futures contracts. Bonds can be a great way to diversify your investment portfolio however they can also be quite complex. By its definition day trading is the purchase and sale of a securitystockbond within a single trading day.

This simply means that at the end of each trading day all futures accounts are settled and money is actually transferred between the accounts of all market participants based on their gains and losses during the trading session. The 10 yr notes or the ZN are very similar to the 30 yr except it does trade in half points so minimum fluctuation is 15625 and the 10 years will have smaller moves than the 30 yr although 99 in the same direction opens the door for. E-Trade offers easy-to-use bond tools and the.

So here is how to trade bonds like Paul Rotter its a 3 step process. A type of financial derivative futures allow you to buy or sell an underlying asset at a future date based on a price agreed upon today. A lot of day trades are based on short-term market moves like something that happens in the news or a breaking development.

Get the latest 30 Year US. As a trader you know that not every strategy will suit your style or match your goals. I included some contract specs on the T Bonds futures below as well as an intra-day chart for your review.

Government bond market offers the greatest liquidity security in terms of credit worthiness and diversity among the government bond markets across the globe. Understand mark to market. For new investors the stock market is the first place to flock to but the US.

A bond futures contract trades on a futures exchange and is bought and sold through a brokerage firm that offers futures trading. To trade options you need a margin approved brokerage account with access to options and futures trading. Futures are leveraged instruments so you need not have the full dollar worth of the contract to start.

MASTERSINTRADINGCOMYOUFREE Learn how to Trade Bond Futures. Ben Hernandez September 10 2018. Treasury Bond Futures price US as well as the latest futures prices and other commodity market news at Nasdaq.

A bond thats traded below the market value is said to be trading at a discount while a bond trading for more than its face value is trading at a premium. Treasury futures featuring 2- 5- and 10-year notes Ultra 10 T-bond and Ultra T-Bond futures. Government notes or bonds for future delivery.

Monthly Sp Cash Chart For Perspective Along With Some Simple Advice For Futures Traders It Is A Whole Commitment Of Traders Streaming Quote Pricing Calculator

Monthly Sp Cash Chart For Perspective Along With Some Simple Advice For Futures Traders It Is A Whole Commitment Of Traders Streaming Quote Pricing Calculator

T Bond Futures Have Been Extremely Volatile And Affect Many Markets Both On The Futures Side As Well O Commitment Of Traders Streaming Quote Automated Trading

T Bond Futures Have Been Extremely Volatile And Affect Many Markets Both On The Futures Side As Well O Commitment Of Traders Streaming Quote Automated Trading

Day Trading The 30 Year Us Treasury Bonds Youtube Day Trading Treasury Bonds Trading Quotes

Day Trading The 30 Year Us Treasury Bonds Youtube Day Trading Treasury Bonds Trading Quotes

Can I Make A Living Trading Options Updated For 2021 In 2020 Option Trading Weekly Options Trading Online Broker

Can I Make A Living Trading Options Updated For 2021 In 2020 Option Trading Weekly Options Trading Online Broker

Pin On Finance Investing And Trading

Pin On Finance Investing And Trading

Week Of 3 1 10 Learn How To Day Trade The E Mini S P 500 Euro Fx Mini Dow And 30 Year Bond Markets These Trades And M Study Course Day Trading Home Study

Week Of 3 1 10 Learn How To Day Trade The E Mini S P 500 Euro Fx Mini Dow And 30 Year Bond Markets These Trades And M Study Course Day Trading Home Study

There Is More To Trading Than Just The Stock Index Futures And Micros Take A Look At The 30 Year Bonds Chart An In 2020 Crude Oil Futures Stock Index Marketing Data

There Is More To Trading Than Just The Stock Index Futures And Micros Take A Look At The 30 Year Bonds Chart An In 2020 Crude Oil Futures Stock Index Marketing Data

In My Humble Personal Opinion Before We Get Too Excited From Recent Stock Market Rally We Will Need Commitment Of Traders Streaming Quote Automated Trading

In My Humble Personal Opinion Before We Get Too Excited From Recent Stock Market Rally We Will Need Commitment Of Traders Streaming Quote Automated Trading

30 Year Bonds Line Break Algorithmic Trading Youtube Cryptocurrency Trading Trading Automated Trading

30 Year Bonds Line Break Algorithmic Trading Youtube Cryptocurrency Trading Trading Automated Trading

Orderflows Market Analysis April 26 2017 Emini Sp Soybeans Bonds Five Ye Analysis Marketing April 26

Orderflows Market Analysis April 26 2017 Emini Sp Soybeans Bonds Five Ye Analysis Marketing April 26

Markets Forex Stocks Futures Commodities Tresury Bond This Binary Options Strategy High Lo Options Trading Strategies Option Strategies Implied Volatility

Markets Forex Stocks Futures Commodities Tresury Bond This Binary Options Strategy High Lo Options Trading Strategies Option Strategies Implied Volatility

Futures Trading Definition Futures Contract A Contractual Agreement To Buy Or Sel Financial Instrument Futures Contract Securities And Exchange Commission

Futures Trading Definition Futures Contract A Contractual Agreement To Buy Or Sel Financial Instrument Futures Contract Securities And Exchange Commission

Day Trading Emini Futures Trade Setup That Works Daily Youtube Day Trading Trading Quotes Trading

Day Trading Emini Futures Trade Setup That Works Daily Youtube Day Trading Trading Quotes Trading

Investing Guide For Beginners Understanding Futures Options Trading Stocks Bonds Bitcoins Finance F Finance Investing Future Options Stock Options Trading

Investing Guide For Beginners Understanding Futures Options Trading Stocks Bonds Bitcoins Finance F Finance Investing Future Options Stock Options Trading

Trading E Mini Futures 1750 In Profit Lessons On How To Avoid Mistakes Youtube Trading Quotes Trading Cryptocurrency Trading

Trading E Mini Futures 1750 In Profit Lessons On How To Avoid Mistakes Youtube Trading Quotes Trading Cryptocurrency Trading

Bond Futures How To Trade Bond Futures Bond Futures Trading Strategies Tutorial Jonathan Rose Youtube Stock Market Futures Stock Market Online Trading

Bond Futures How To Trade Bond Futures Bond Futures Trading Strategies Tutorial Jonathan Rose Youtube Stock Market Futures Stock Market Online Trading

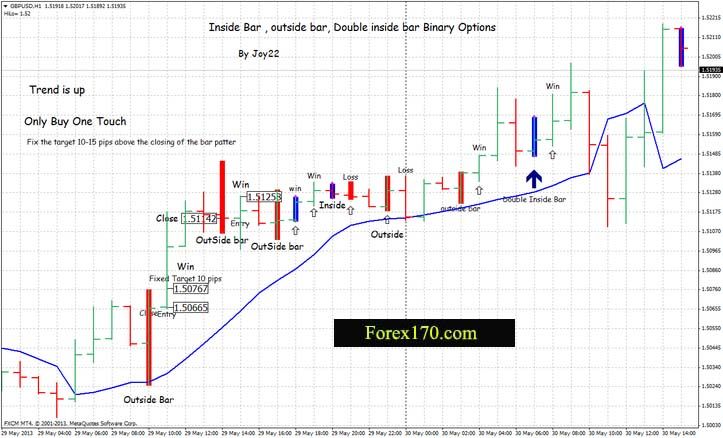

Inside Bar Outside Bar Double Inside Bar Binary Options Strategy One Touch Strategy Forex Trading Strategies Dow Option Strategies Outside Bars Inside Bar

Inside Bar Outside Bar Double Inside Bar Binary Options Strategy One Touch Strategy Forex Trading Strategies Dow Option Strategies Outside Bars Inside Bar

Payoff Profile Of Futures Learn What Futures Are And How They Work Explained Trading Payoff

Payoff Profile Of Futures Learn What Futures Are And How They Work Explained Trading Payoff

Futures Trading 5 Hacks For Successful Futures Trading Learn Futures Strategies In Simple Step Youtube Trading Online Trading Day Trader

Futures Trading 5 Hacks For Successful Futures Trading Learn Futures Strategies In Simple Step Youtube Trading Online Trading Day Trader

Post a Comment for "How To Trade Bond Futures"