Reverse Stock Market Etf

Companies such as ProShares. Inverse ETFs are designed to make money when the stocks or underlying indexes they target go down in price.

Inverse Bear Short ETFs A sortable list of Exchange Traded Funds ETFs that can be used to short the market or sectors of the market.

Reverse stock market etf. Bottom line the following ETFs go up in value as the underlying benchmark index they track goes down. 41 Best Inverse ETFs Short ETFs Bear ETFs When you invest in the stock market you can bet on both sides of the market using an online broker account. Rather it is an ETN that measures implied volatility.

The iPath SP 500 VIX Short-Term Futures ARCAVXX ETN is not an actual inverse ETF. Inverse ETFs are not short individual stocks. Then a reverse 2-for-1 split is announced.

Derivatives and other securities are used. Inverse ETFs exchange traded funds are an easy way to place bearish bets without physically shorting shares of stock. These products occupy a small slice of.

Inverse Equity ETFs invest in various stock assets. Consider using them to hedge an existing portfolio as well. These sophisticated instruments can.

W ith the ETF industry gaining in leaps and bounds in recent years the use of leveraged inverse ETFs often known as ultra-short funds has grown rapidly. Inverse Equities ETFs provide inverse exposure to well-known equity benchmarks. Your total portfolio is worth 40 4 shares x 10.

These funds make use of financial derivatives such as index swaps in order to make bets. They are long portfolios of securities structured to perform in an inverse direction to benchmarks. 22 2021 PRNewswire -- AdvisorShares a leading sponsor of actively managed exchange-traded funds ETFs has announced a reverse split of the issued and outstanding shares of.

An inverse ETF also known as a short ETF or bear ETF is an exchange-traded fund designed to return the exact opposite performance of a certain index or benchmark. Say you own four shares of an ETF that is trading at 10. When the stock market declines volatility increases and.

The most recent ETF launched in the. Funds in this category often track indices but can also build portfolios of specific equities without tracking an index. Direxion Announces Forward and Reverse Splits of Five ETFs January 29 2021 205 PM 7 min read NEW YORK Jan.

4 2020 PRNewswire -- Direxion has announced it will execute forward share splits for two of its exchange-traded funds ETFs as well as reverse share splits for an additional. Inverse ETFs to Bet on Market Sell-off. The largest Inverse ETF is the ProShares Short SP500 SH with 195B in assets.

In the last trailing year the best-performing Inverse ETF was SPXS at 18467. Ian Young February 24 2021 Stock indexes and index ETFs reversed course this morning to trade higher on Wednesday driven by renewed investor confidence in an economic resurgence. Essentially as stocks decline the value of inverse ETFs increases giving an investors a way to play the downside of the market by buying an ETF instead of directly shorting the market.

29 2021 PRNewswire -- Direxion has announced it will execute forward share splits. Reverse splits are the opposite of regular ETF splits but do get a little trickier. A way to profit from a decline Inverse or short ETFs are exchange-traded products that allow you to profit when a certain investment class declines in value.

Volatility in the stock market rose with iPath Series B SP 500 VIX Short-Term Futures ETN VXX gaining about 53 on Jan 3. These ETFs can be used to profit from declines in the stock market as they are designed to appreciate in value when the price of certain stock indexes fall in value.

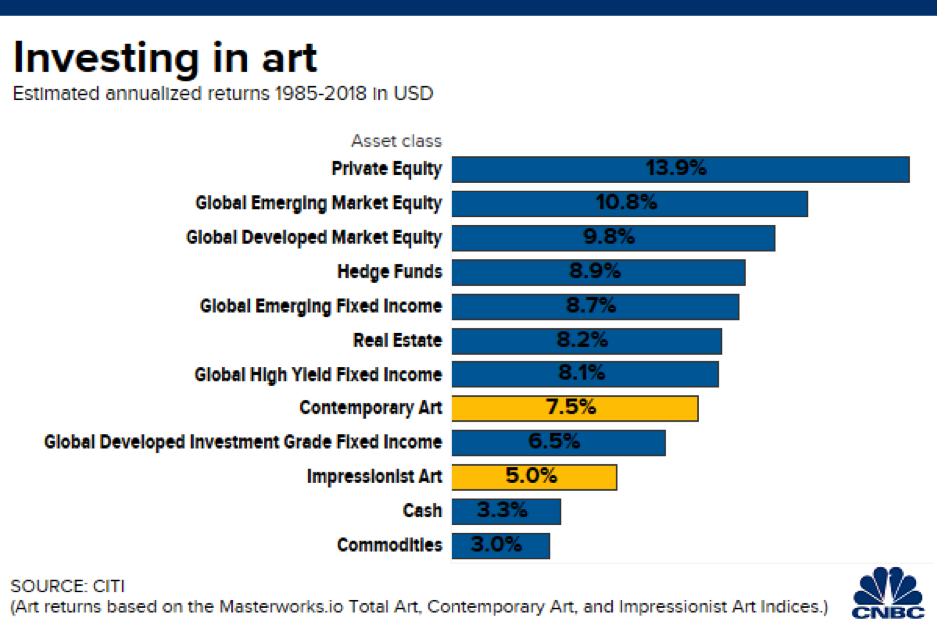

Is Investing In Fine Art A Better Option Than Bonds

Is Investing In Fine Art A Better Option Than Bonds

Recession Signs Market Crash Time For Inverse Etfs

Recession Signs Market Crash Time For Inverse Etfs

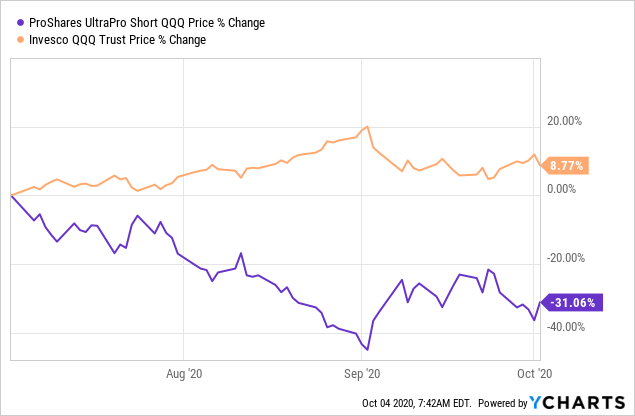

Proshares Ultrapro Short Qqq Etf More Frequent 10 Yield Opportunities Nasdaq Sqqq Seeking Alpha

Proshares Ultrapro Short Qqq Etf More Frequent 10 Yield Opportunities Nasdaq Sqqq Seeking Alpha

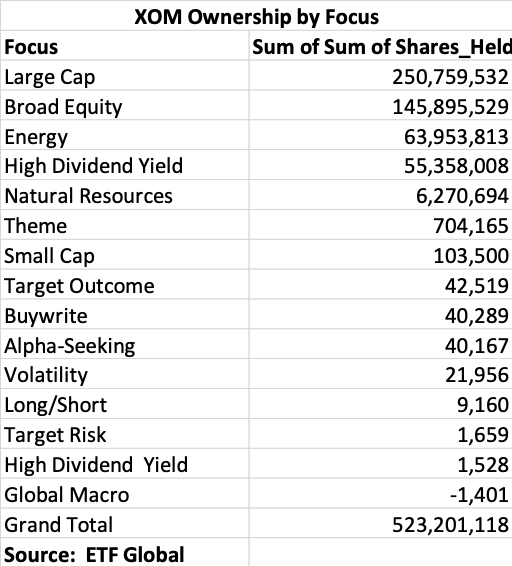

Rising Short Interest Has Primed The Pumps For A Reversal In Energy Etfs Seeking Alpha

Rising Short Interest Has Primed The Pumps For A Reversal In Energy Etfs Seeking Alpha

9 Etfs For The Short Investor To Buy Funds Us News

9 Etfs For The Short Investor To Buy Funds Us News

A Deceivingly Strong Trading Session As Small Cap Stocks Break Out Click The Chart Above To Read My Technical Analysi In 2020 Small Cap Stocks Small Caps Etf Trading

A Deceivingly Strong Trading Session As Small Cap Stocks Break Out Click The Chart Above To Read My Technical Analysi In 2020 Small Cap Stocks Small Caps Etf Trading

3 Ways To Short Nasdaq With Etfs Nasdaq

3 Ways To Short Nasdaq With Etfs Nasdaq

How Etf Investors Can Lose A Lot Of Money

How Etf Investors Can Lose A Lot Of Money

The Complex World Of Leveraged And Inverse Etfs Morningstar

The Complex World Of Leveraged And Inverse Etfs Morningstar

How To Profit From Oil And Silver Etfs In This Stock Market Downturn Stock Market Etf Trading Swing Trading

How To Profit From Oil And Silver Etfs In This Stock Market Downturn Stock Market Etf Trading Swing Trading

10 Inverse Etfs To Buy Funds Us News

10 Inverse Etfs To Buy Funds Us News

Top 5 Inverse Etf For Trading In A Bear Market Warrior Trading

Top 5 Inverse Etf For Trading In A Bear Market Warrior Trading

On October 12 My Objective Rule Based Market Timing System For Swing Trading Switched From Neutral To Sell Mode Trading Quotes Etf Trading Things To Sell

On October 12 My Objective Rule Based Market Timing System For Swing Trading Switched From Neutral To Sell Mode Trading Quotes Etf Trading Things To Sell

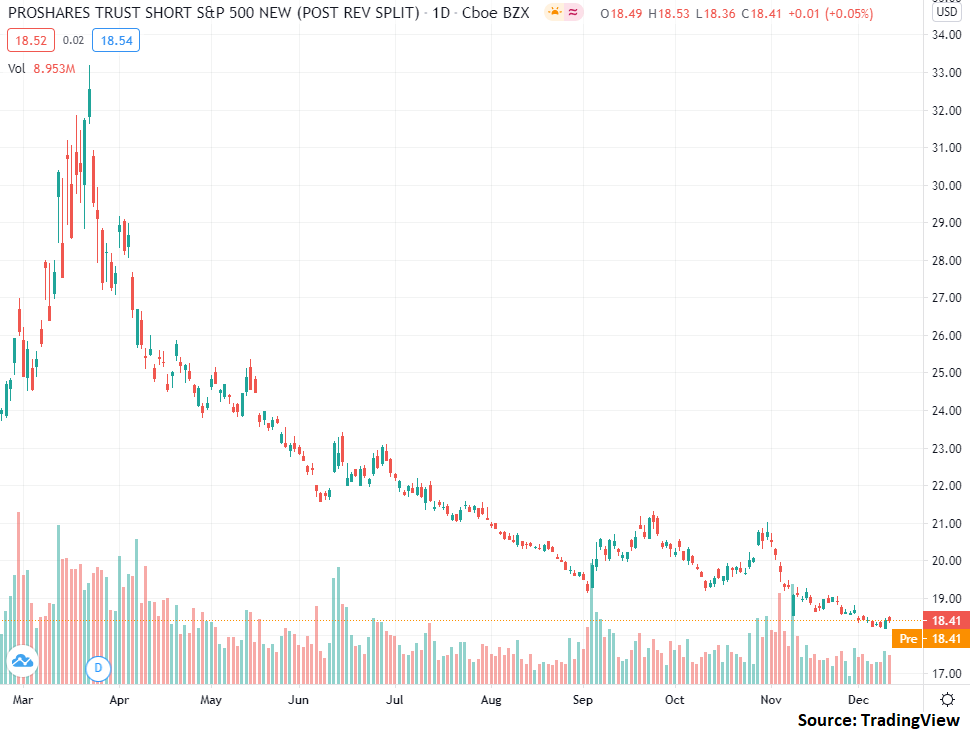

Why It S A Bad Idea To Buy The Proshares Short S P 500 Etf Nysearca Sh Seeking Alpha

Why It S A Bad Idea To Buy The Proshares Short S P 500 Etf Nysearca Sh Seeking Alpha

Stocks Vs Etf S Which Is Better For Long Term Investors

Stocks Vs Etf S Which Is Better For Long Term Investors

3 Inverse Sector Etfs For Market Bears

:max_bytes(150000):strip_icc()/stocks-lrg-4-5bfc3584c9e77c00519c86f8.jpg)

Post a Comment for "Reverse Stock Market Etf"