Stock Market Losses Taxes Reddit

Dont Worry -- Losses Can Reduce Your Taxes. Stock Market Loss in 2020.

Reddit S Profane Greedy Traders Are Shaking Up The Stock Market Bloomberg Businessweek In 2020 Stock Market Stock Charts Understanding The Stock Market

Reddit S Profane Greedy Traders Are Shaking Up The Stock Market Bloomberg Businessweek In 2020 Stock Market Stock Charts Understanding The Stock Market

The loss on stocks and any other capital asset is a capital loss.

Stock market losses taxes reddit. Market Snapshot Dow closes 470 points lower as rising yields saddle stocks with weekly losses Last Updated. Dont fret over losses. You can use capital losses to offset capital gains during a taxable year allowing you to remove some income from your tax.

Market participants digested mounting concerns over a new infectious strain of the coronavirus identified in the United Kingdom and the news that Congress in the United States finally agreed an additional 900 billion virus-relief package. Uncle Sam is watching your wins and losses from the Reddit-fueled surge in GameStop AMC and other stocksIf you made a big profit get ready to pay up to a third of your gains to. Capital Gains Taxes The profit from the sale of stock shares is taxed at capital.

The surge cost Wall Street investors almost 20 billion in mark-to-market losses according to data from S3 Partners. For example a trader with a 13000 loss in the 25 tax bracket only able to deduct the 3000 is leaving 10000 on the table. Taxes on stock market losses.

Welcome to the stock market on steroids. Shares of Intel INTC -190 and Caterpillar CAT -187 are contributing to the indexs intraday decline as the Dow DJIA -018 was most recently trading 69 points 02 lower. Yes I as that arrogant simple minded and stupid.

So long story short I invest my wife and I nest egg in 1 stock. In the current financial year I suffered a loss of Rs 2 lakh in my equity portfolio share tradingIs there any provision to set-off this loss against my income tax liability. Shubham Agrawal Senior Taxation Advisor TaxFilein responds.

I was wondering specifically about stock market losses. So I lost well over 100000 in the stock market in January 2020. All other months of 2020 I was trading intermittently maybe 2-5 trades per week.

I earn Rs 20 lakh a year. We sold at 300 and bought back in 500. Federal tax brackets run from 10 percent to 37 percent.

Those married but filing. So a 3000 loss on stocks could save you as much as 1110 at the high end 37 percent 3000 or as little as 300 if youre in the. These guys on Reddit figured.

Theres a simple tax strategy you can use to turn your losses into victories on your tax return. We bought into amzn back in 09 and kept in for a while. Stocks pared losses on Monday after opening lower in the morning.

You have suffered a loss under the head Capital gains. When you receive Form 1099-B from your broker the stock gains and losses will reflect your choice of tax lots. So far the losses have been on paper if I shift it they would be real.

How do you deal with large losses. Realized capital losses from stocks can be used to reduce your tax bill. My 401K has lost 80K since the market crashed twice what it suffered in the 2008 debacle and retirement is less than 7 years away.

Posted by1 year ago. Obviously you dont pay taxes on stock losses but you do have to report all stock. If I made 100k the previous year I understood that you are required to pay capital gains tax 40 roughly.

26 2021 at 424 pm. This equates to an additional tax liability of 2500 a big hit to. Rules do not allow loss from capital gains to be set off against.

Couldnt find anything specific to my question. Up to 3000 of realized capital loss can be used to reduce your taxable income in one year if an investors tax-filing status is single or married filing jointly. Long story short when it hit 1k we humbly backed out.

When you sell stocks your broker issues IRS Form 1099-B which summarizes your annual transactions. 26 2021 at 738 am. Ive so far lost the gains from the metieorical rise in the market in the past year or so.

Capital losses may be used to reduce capital gains in the year of sale any of the immediate three years or any future year. Losses in the stock market come in different forms and each of these types of losses can be painful but you can mitigate the sting with the right mindset and a willingness to learn from the situation. I was an active day trader in the month of January meaning I was trading everyday 5-10 trades per day.

So if you sell stock you lost 10000 on and realize that 10000 in losses during a year when you have no capital gains you can reduce your other income by 3000 and carry over the remaining. In other cases your losses arent as apparent because theyre more subtle and take place over a longer period of time.

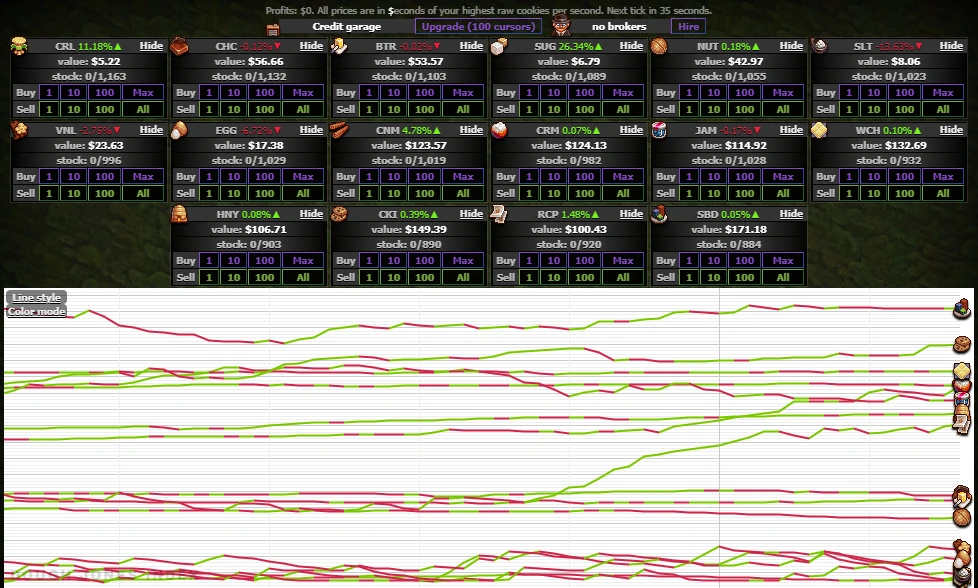

Stock Market Cookie Clicker Wiki Fandom

Stock Market Cookie Clicker Wiki Fandom

Making Sense Of The Markets This Week February 1 2021 Moneysense

Making Sense Of The Markets This Week February 1 2021 Moneysense

Bitcoin Etf Approval Reddit Bitcoin Bitcoin Chart Bitcoin Transaction

Bitcoin Etf Approval Reddit Bitcoin Bitcoin Chart Bitcoin Transaction

Here S What You Should Know About The Stock Market Tanking

Here S What You Should Know About The Stock Market Tanking

6 Reasons Why Most People Lose Money In The Stock Market

6 Reasons Why Most People Lose Money In The Stock Market

How Will Tomorrow S Us Presidential Election Affect The Stock Market Value The Markets

How Will Tomorrow S Us Presidential Election Affect The Stock Market Value The Markets

Tax Implications For Indian Residents Investing In The Us Stock Market

Tax Implications For Indian Residents Investing In The Us Stock Market

For Folks That Keep Wondering About Wash Sales Robinhood Stock Options Investing Stock Options Trading Wonder

For Folks That Keep Wondering About Wash Sales Robinhood Stock Options Investing Stock Options Trading Wonder

Gamestop Stock Crashed But Reddit Still Wants To Send It To The Moon How And What S Next Cnet

Gamestop Stock Crashed But Reddit Still Wants To Send It To The Moon How And What S Next Cnet

When Will The Stock Market Crash My 2021 Prediction Fatfire Woman

When Will The Stock Market Crash My 2021 Prediction Fatfire Woman

Time In Market Is More Important Than Timing The Market Investing Diy Investing Equity

Time In Market Is More Important Than Timing The Market Investing Diy Investing Equity

Your 401 K And Stock Market Volatility

Your 401 K And Stock Market Volatility

Stocks Print Td9 Sell Signal Correlated Bitcoin Could Plunge In Tandem Bitcoin Stock Market Tandem

Stocks Print Td9 Sell Signal Correlated Bitcoin Could Plunge In Tandem Bitcoin Stock Market Tandem

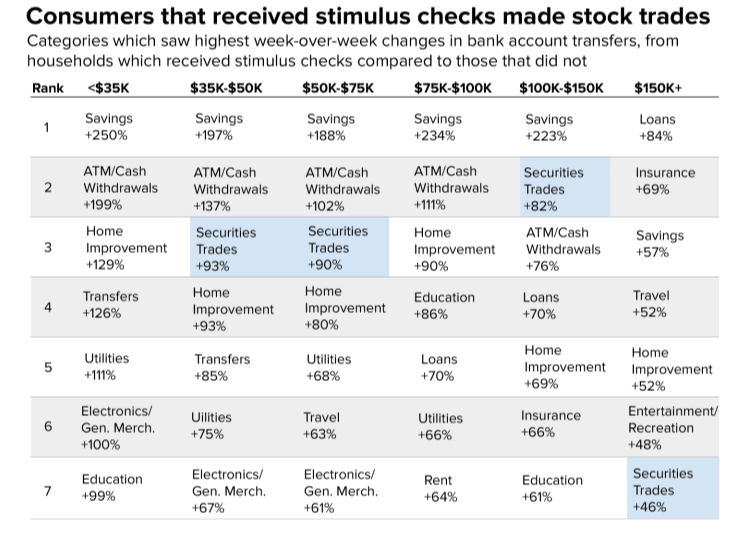

The Rise Of Robinhood Traders And Its Implications Seeking Alpha

The Rise Of Robinhood Traders And Its Implications Seeking Alpha

Bitcoin Wiki Patriot Coin Cryptocurrency Taxes On Cryptocurrency Reddit Bitcoin Buy Lamborghini Bitcoin Diamond L Cryptocurrency Bitcoin Cryptocurrency Trading

Bitcoin Wiki Patriot Coin Cryptocurrency Taxes On Cryptocurrency Reddit Bitcoin Buy Lamborghini Bitcoin Diamond L Cryptocurrency Bitcoin Cryptocurrency Trading

Post a Comment for "Stock Market Losses Taxes Reddit"