Stock Split Under Companies Act 2013

The types of the dividend are listed under 3 categories- Interim dividend declared at a board meeting of directors between the dates of two AGMs. Shriram Transport Finance Corporation - Postal Ballot Notice Under Section 110 Of The Companies Act 2013 To Members.

Sept 7 Move Over Berkshire And Exxon The World S Five Most Valuable Companies Are In Technology Apple Alphabet Technology World Chart

Sept 7 Move Over Berkshire And Exxon The World S Five Most Valuable Companies Are In Technology Apple Alphabet Technology World Chart

Incorporating a Company Holding a Board Meeting Issuing Shares.

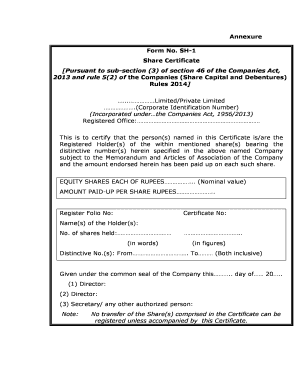

Stock split under companies act 2013. For EquityPreference shares in the. Take expert opinion on 50 procedures under Companies Act 2013 Read More. Section 56 of the Companies Act 2013 provides that the transfer of shares of the company and other securities will be registered by a company only when a proper instrument of transfer of shares share transfer form is filed as prescribed in the Form No.

All the companies registered under Companies Act 2013 can declare dividend except non-profit organizations registered under Section 8. The Ready Referencer introduces readers to the new concepts in the Companies Act 2013 and lists out the salient features of the law in a capsule form. Act 2013 thought it fit to bring out this Ready Referencer on Companies Act 2013 as a self learning aid to understand the basic tenets of the new Act.

This number is distinctive. It can be paid on both equity preference shares. As per Section 61 Companies Act 2013 the company can convert its shares which are fully paid up into stock.

In terms of SEBI Listing. As it has been laid down in section 123 of the act no company can pay dividend without taking out reserves for. The form sh 4 for transfer of share needs to be duly stamped with adequate value dated and executed by or on behalf of the transferor and the transferee.

It is paid to shareholder for their investment in shares of company. Also they are transferable in the manner prescribed in the Articles of the company. In furtherance to our letter dated January 28.

Board Resolution for Split of Shares Certificates. 162015-CLV dated 29th May 2015. I am grateful to CS K Sethuraman Group.

Substituted for issued under the common seal of the company by the Companies Amendment Act 2015 vide Notification F. The same has been defined under section 2 35 of the Companies Act 2013. The rate of dividend is not fixed it depends on the profitability of the company.

Check Articles of Association. Draft Board Resolution For Splitting Share Certificate split splitting subdivision sample format specimen procedure process how to what is special. Section 44 of the Companies Act 2013 states that shares or debentures or other interests of any member in a company are movable properties.

The term start-up or start-up company means a private company incorporated under the Companies Act 2013 18 of 2013 or the Companies Act 1956 1 of 1956 and recognised as start-up. Well subject to the provisions of Companies Act-2013 All Companies except those companies which are registered under sec-8 ie. It can be paid annually once or during the year.

37 employees stock option means the option given to the directors officers. Further Section 45 of the Act mandates the numbering of every share. The Dividend is paid as per provisions of companies act 2013 and companies declaration and payment of dividend rules 2014.

Unlike the 1956 Act under which merger of all companies irrespective of nature and size requires court approval the 2013 Act carves out a separate procedure for small companies 16 and the holding and wholly-owned subsidiaries. Make an application to the concerned Stock Exchanges and any other Stock Exchange where Company proposes to get its consolidated shares listed. If there is no such provision alter the provisions of Section 14 of Companies Act 2013.

10- Rupees Ten each has got sub-divided into 2 Two Equity Shares having face value. RESOLVED THAT pursuant to provisions of the Articles of Association of the Company and such other provisions of the Companies Act 2013 read with Rules thereunder including any statutory modifications or re-enactment thereof as may be applicable for the time being in force the consent of the Board of Directors of the Company be and is hereby accorded for splitting the Share Certificate No. Whether it is compulsory to make provision for depreciation before payment of dividend.

Further a shareholder must have certain contractual and other rights as per the provisions of the Companies Act 2013. Non-profit organizations can declare dividend. A Share is the smallest unit into which the companys capital is divided representing the ownership of the shareholders in the company.

Checklist for Alteration of Share Capital under Companies Act 2013. Under Companies Act - 2013 Chapter VIII containing sections which deals with the provisions related to declaration and payment of dividend. Exdon Trading Company - Outcome Of Board Meeting For Determining The Limits Under Sections 180 And 186 Of The Companies Act 2013 -.

Pursuant to the resolution passed by the Shareholders of the Company in the Annual General Meeting of the Company held on September 24 2010 and the resolution passed by the Board of Directors of the Company in its Meeting held thereafter each existing Equity Share of the Company having face value of Rs. Substituted for issued under the seal of the company by the Companies Share Capital and Debentures Second Amendment Rules 2015 vide Notification No. Issue of Employee Stock Options by Unlisted Public CompanyAs per provisions of Sec 621b of Companies Act 2013 where at any time a company having a share capital proposes to increase its subscribed capital by the issue of further shares such shares shall be offered to employees under a scheme of employees stock option subject to special resolution passed by the company and subject to such conditions as may be prescribed Sec 237 of Companies Act 2013 defines employees.

Merger of small companies and holding with wholly-owned subsidiaries.

Compliance Checklist For Issue Of Share Certificates Under Companies Act 2013 Scc Blog

Compliance Checklist For Issue Of Share Certificates Under Companies Act 2013 Scc Blog

Air Canada Stock Certificate 1988 Stock Certificates National Airlines Canadian Airlines

Air Canada Stock Certificate 1988 Stock Certificates National Airlines Canadian Airlines

Pay Rules Holiday Pay October Holidays Holiday

Pay Rules Holiday Pay October Holidays Holiday

How To Develop A Cloud Based Saas Application Software Product Saas Cloud Based App Development

How To Develop A Cloud Based Saas Application Software Product Saas Cloud Based App Development

Share Certificate Template Free Download Forms Fillable Printable Samples For Pdf Word Pdffiller

Share Certificate Template Free Download Forms Fillable Printable Samples For Pdf Word Pdffiller

Statutory Registers Under Companies Act 2013

Statutory Registers Under Companies Act 2013

Right Issue Of Shares Under Companies Act 2013 Rules

Right Issue Of Shares Under Companies Act 2013 Rules

Declaration And Payment Of Dividend Under Companies Law

Declaration And Payment Of Dividend Under Companies Law

April 28 Kkr Inspired Barbarians At The Gate Now An Activist Investor Is At Its Gate This May Explain Why Share Prices Private Equity Chart

April 28 Kkr Inspired Barbarians At The Gate Now An Activist Investor Is At Its Gate This May Explain Why Share Prices Private Equity Chart

12 Random Facts Ipad Repair Ipad Computer Store

12 Random Facts Ipad Repair Ipad Computer Store

/coca-cola-stock-certificate-56a091355f9b58eba4b1a1e1.png) After A Stock Split What Happens To Certificates

After A Stock Split What Happens To Certificates

Raising Capital Ipos Vs Private Equity Raising Capital Private Equity Equity

Raising Capital Ipos Vs Private Equity Raising Capital Private Equity Equity

Companies Act 1956 And 2013 And Its Effect On Raising Capital Ipleaders

Companies Act 1956 And 2013 And Its Effect On Raising Capital Ipleaders

The Separation Between Ownership And Control In Companies A Key To Success Law Right

The Separation Between Ownership And Control In Companies A Key To Success Law Right

National Metropolitan Bank 1877 Washington Dc Washington Dc National Metropolitan

National Metropolitan Bank 1877 Washington Dc Washington Dc National Metropolitan

Https Www Mayerbrown Com Media Files Perspectives Events Publications 2013 02 So What Does A Shareholder Member And Holder Of Sh Files 130205 Capital Markets Fileattachment 130205 Capital Markets Pdf

What Is A Stock Split Forbes Advisor

What Is A Stock Split Forbes Advisor

Pin On We Legalize Services We Offer

Pin On We Legalize Services We Offer

Post a Comment for "Stock Split Under Companies Act 2013"