Stock Warrants Strike Price

If a stock is trading at 50 and the strike of the warrant is 40 the warrant should trade for at least 10 assuming one warrant equals one. You can sell it at market rate or you can exercise for shares if you want to hold commons.

Therefore the warrants will not be exercised.

Stock warrants strike price. Stock quotes reflect trades reported through Nasdaq only. Stock warrants like stock options give investors the right to buy via a call warrant or sell via a put warrant a specific stock at a certain price level strike price before a certain date. For example say you exercise warrants with a strike price of 20 per share to buy 100 shares of XYZ and you originally paid 400 for the warrants.

Exercising stock warrants results in taxable income that amounts to the difference between the strike price and the price of a share minus the cost basis. You can sell it at market rate or you can exercise for shares if you want to hold commons. Your total investment is thus 2400.

The basics of stock warrants A stock warrant gives the holder the right to purchase additional shares of stock at a specified price within a certain time frame. At 20 common 1150 strike price your warrant is intrinsically worth 850 each. The warrants have a strike price of 1150 which translated into an intrinsic value of 1750 at the time.

If a companys stock price stays above the strike price or above a certain price the company can change the warrants exercise date to be sooner than it previously was. Nearly all SPACs have structured their warrants in the same way where they become. But their intrinsic value will be much higher if the underlying stock.

Warrants each whole warrant exercisable for one half 12 of a share of Common Stock at an exercise price of 1150. The company thought there was no risk in issuing warrants with a strike price of 13 when its stock price was only 5. Reinvent Technology Partners Redeemable Warrants each whole warrant exercisable for one Class A ordinary share at an exercise price of 1150.

The warrant doesnt obligate the. The warrants are now trading for 641 since they are in-the-money ie the LCA stock is above the exercise price of 1150. 10 coverage on a 3000000 loan is 300000 worth of warrants.

However as the company recovered the stock price soared to 30 and Chrysler lost 311 million on the deal. The merger takes off and by redemption date after merger the common stock has risen to 20. Thats 325 return on your initial investment.

If the stock never rises above the strike price the warrant expires so it becomes worthless. The strike price sometimes called exercise price. If a warrant has an agreed-upon strike price of 20 per share and the market price of the stock rises to 25 per share the investor can redeem the warrant certificate and buy the shares for 20 per share netting an immediate 5 per share gain.

As we will describe below its useful to think of warrant coverage in terms of dollars first. The merger takes off and by redemption date after merger the common stock has risen to 20. How many shares that is and at what price they can be acquired is determined by the Strike Price.

Since the stock price today is 5 and the warrants have a strike price of 25 exercising the warrants today does not make sense. Warrants can be bought and sold up until expiry. In venture lending 5 to 20 coverage is typical and negotiated for each transaction.

Thats 325 return on your initial investment. If this happens and you dont exercise the warrant in time the warrant will expire worthless. Real-time last sale data for US.

Intrinsic value for a warrant or call is the difference between the price of the underlying stock and the exercise or strike price. The intrinsic value can be zero but it can never be negative. Structurally stock warrants are used to attract buyers to a companys stock potentially enabling the recipient to buy the stock down the road at the warrants strike price the agreed-upon.

Chrysler stock was at a low point as the company was near bankruptcy. It will force the warrant holder to purchase new stock at 25share while the stock can just be bought in the secondary market at 5share. At 20 common - 1150 strike price your warrant is intrinsically worth 850 each.

Intraday data delayed at least 15 minutes or per exchange requirements.

A Guide To Warrants In Venture Debt Flow Capital

A Guide To Warrants In Venture Debt Flow Capital

/Wiener_Riesen_Rad_Ltd_1898-41accd5aa0f9438198764c26178b58cb.jpg) I Own Some Stock Warrants How Do I Exercise Them

I Own Some Stock Warrants How Do I Exercise Them

What Is An Equity Warrant Element Saas Finance Saas Finance

What Is An Equity Warrant Element Saas Finance Saas Finance

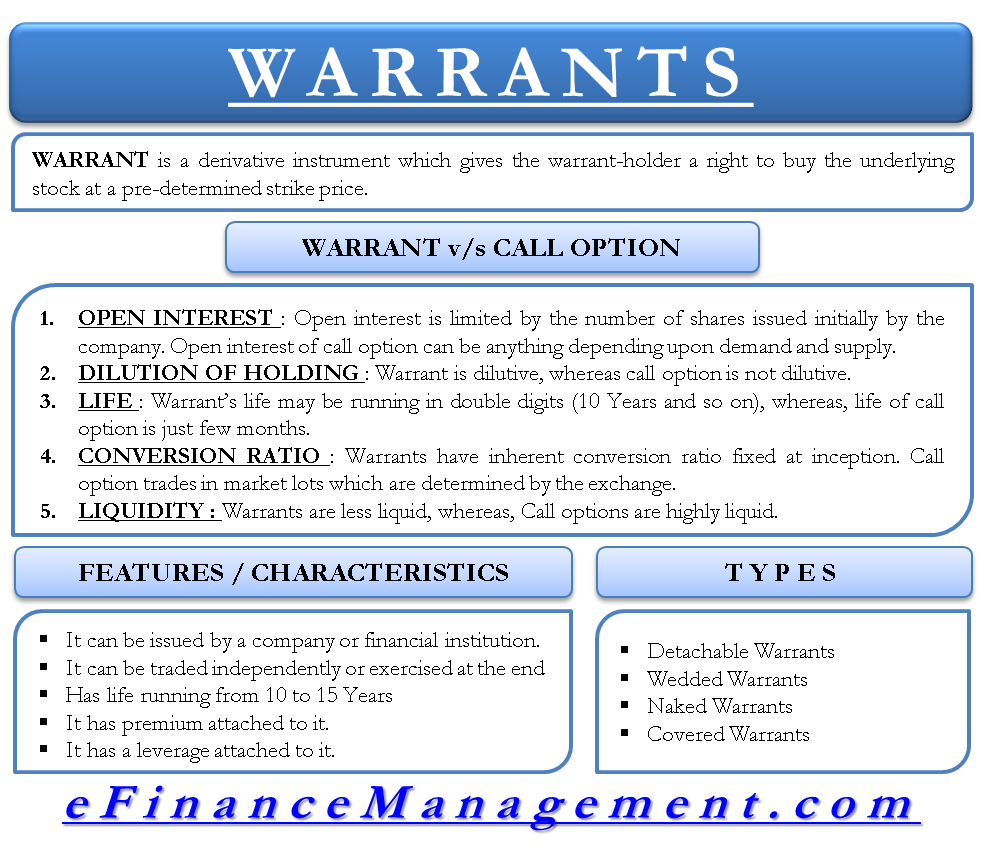

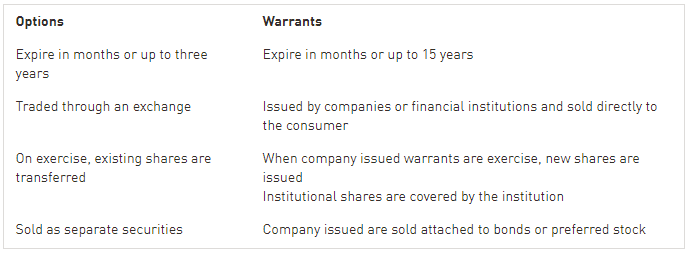

Warrant Define Vs Options Features Types Efinancemanagement

Warrant Define Vs Options Features Types Efinancemanagement

Http Www Binaryoptionsblog Co Il Stock Market Get Money Online How To Get Money

Http Www Binaryoptionsblog Co Il Stock Market Get Money Online How To Get Money

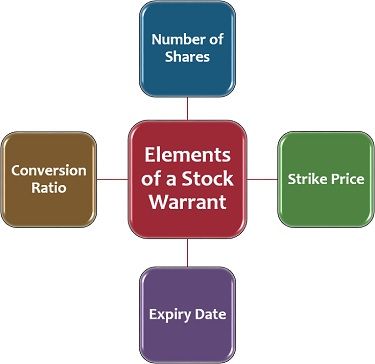

What Are Stock Warrants Definition Elements Factors Types Advantages Disadvantages The Investors Book

What Are Stock Warrants Definition Elements Factors Types Advantages Disadvantages The Investors Book

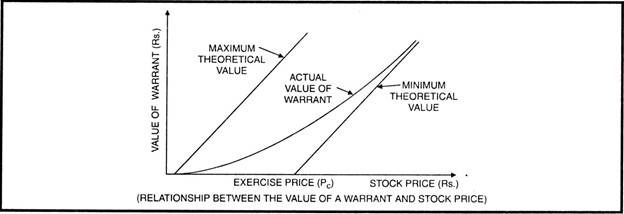

Valuation Of Warrants With Formula

Valuation Of Warrants With Formula

Stockmarketfunding Reviews Profitable Stock And Options Trades Call Us 702 685 0772 And Learn About The Stockmarketfundi Stock Market Option Trading Marketing

Stockmarketfunding Reviews Profitable Stock And Options Trades Call Us 702 685 0772 And Learn About The Stockmarketfundi Stock Market Option Trading Marketing

Stock Warrants Why Do Companies Issue Stock Warrants

Stock Warrants Why Do Companies Issue Stock Warrants

Guide To Stock Warrants What Is A Stock Warrant

Guide To Stock Warrants What Is A Stock Warrant

What Are Stock Warrants Explained Youtube

What Are Stock Warrants Explained Youtube

How To Buy Stock Warrants Stock Warrants Hq

How To Buy Stock Warrants Stock Warrants Hq

Trading Options Option Trading Investment Advice Twitter Sign Up

Trading Options Option Trading Investment Advice Twitter Sign Up

Watch Stock Warrants Explained Stock Warrants Allow You To Potentially By Lincoln W Daniel Bullacademy Org Medium

Watch Stock Warrants Explained Stock Warrants Allow You To Potentially By Lincoln W Daniel Bullacademy Org Medium

Stock Warrants Versus Stock Options Here S What S What

Stock Warrants Versus Stock Options Here S What S What

How Does The Stock Warrants Work Stock Warrants Are Derivatives That Provide The Right But Not The Obligation To Buy A Pa Stock Market Free Tips Market Trader

How Does The Stock Warrants Work Stock Warrants Are Derivatives That Provide The Right But Not The Obligation To Buy A Pa Stock Market Free Tips Market Trader

Common Stock Warrants Exclusive Database

Common Stock Warrants Exclusive Database

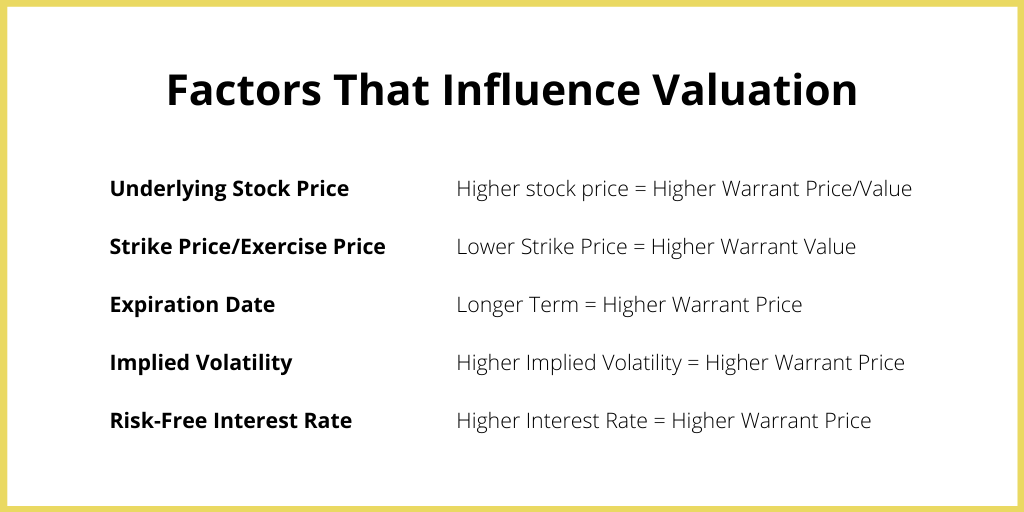

Factors That Influence Black Scholes Warrant Dilution

Post a Comment for "Stock Warrants Strike Price"