Are Stock Warrants Good

The lower the warrant price then the greater the savings. Warrants are issued by companies giving the holder the right but not the obligation to buy a security at a particular price.

Epic Research Serves Useful Mcx Tips And Other Trading Tips We Also Helps Traders To Gain A Quick Overview Of Market S Perform Stock Options What Is Meant Tips

Epic Research Serves Useful Mcx Tips And Other Trading Tips We Also Helps Traders To Gain A Quick Overview Of Market S Perform Stock Options What Is Meant Tips

Companies often include warrants as part of share offerings to entice.

Are stock warrants good. On the surface warrants are similar to call options but different in other respects. DYNWS Great stock chart in the common. Therefore the intrinsic.

A stock warrant is a derivative contract that gives the holder the right to buy the companys stock at a specified price in the stipulated period. The holder has the right but not the obligation to. As with all SPAC warrants the exercise price is 1150.

Otherwise outsize losses are imminent if you walk in blindly. A stock warrant is issued by an employer that gives the holder the right to buy company shares at a certain price before the expiration. What Are Stock Warrants.

Stock warrants are a useful way for companies to boost revenues and for investors to get a shot at a quick profit. If the issuing companys stock increases in price above the warrants stated price the investor can redeem the warrant and buy the shares at the lower price. Warrants can be a good investment in any kind of market.

Warrants are good for a fixed period of time and are worthless once they expire. What a warrant does is it gives you the right to buy a share of stock at a certain price before a certain. Ambarella stock rallies as earnings outlook top Street expectations 438p API reports a weekly climb of more than 7 million barrels in US.

Warrants each whole warrant exercisable for one half 12 of a share of Common Stock at an exercise price of 1150 Shell Companies 1150. The return on the warrant would be 400 -- a good return no doubt. As such investors would lose their.

Stock warrants like stock options give investors the right to buy via a call warrant or sell via a put warrant a specific stock at a certain price level strike. Using two forms of analysis that have worked well for me over the years candlestick charting and warrant valuation versus the common stock Ive found 5 warrants you can buy right now and a few bonus warrants for the more adventurous that have good prospects going forward. How Stock Warrants Work.

Warrants are not popular in the United States but they are common in other countries such as China. The warrants for this SPAC stock trade for 872 since the underlying stock DiamondPeak Holdings are at 2110. In a bear market it can provide them with some additional protection.

However a warrant does not mean the actual ownership of the stocks but rather the right to purchase the company shares at a particular price in the future. This occurs because even as share prices drop the lower price of the warrant will make the loss less. Warrants are the most misunderstood part of SPAC investing in my opinion.

However if the stock is worth less than 20 in 10 years the warrants will expire worthless. The most frequent way warrants are used is in conjunction with a bond. A company issues a bond and attaches a warrant to the bond to make it more attractive to investors.

The warrant is a kicker to sweeten the deal by granting participants the right but not the obligation to acquire stock in the company at a set price by a given date. If for example the underlying share costs 6 and the warrant costs 4 he saves 2. In a bull market it can provide the investor with significant gains.

The easiest way to exercise a warrant is through your. When an investor exercises a warrant they purchase the stock and the proceeds are a source of capital for the company. Stock warrants can be a good investment alternative if youre keen on market movements and rely on a speculative investment strategy.

Disadvantages of Stock Warrants. Stock warrants like stock options give investors the right to buy via a call warrant or sell via a put warrant a specific stock at a certain price level strike price before a certain date. Crude supplies sources say.

When an investor buys a warrant instead of the underlying stock at that point he saves the difference between the stock price and the warrant price also called the premium of a warrant.

Common Stock Warrants Exclusive Database

Common Stock Warrants Exclusive Database

What Are Stock Warrants Explained Youtube

What Are Stock Warrants Explained Youtube

Watch Stock Warrants Explained Stock Warrants Allow You To Potentially By Lincoln W Daniel Bullacademy Org Medium

Watch Stock Warrants Explained Stock Warrants Allow You To Potentially By Lincoln W Daniel Bullacademy Org Medium

How To Buy Stock Warrants Stock Warrants Hq

How To Buy Stock Warrants Stock Warrants Hq

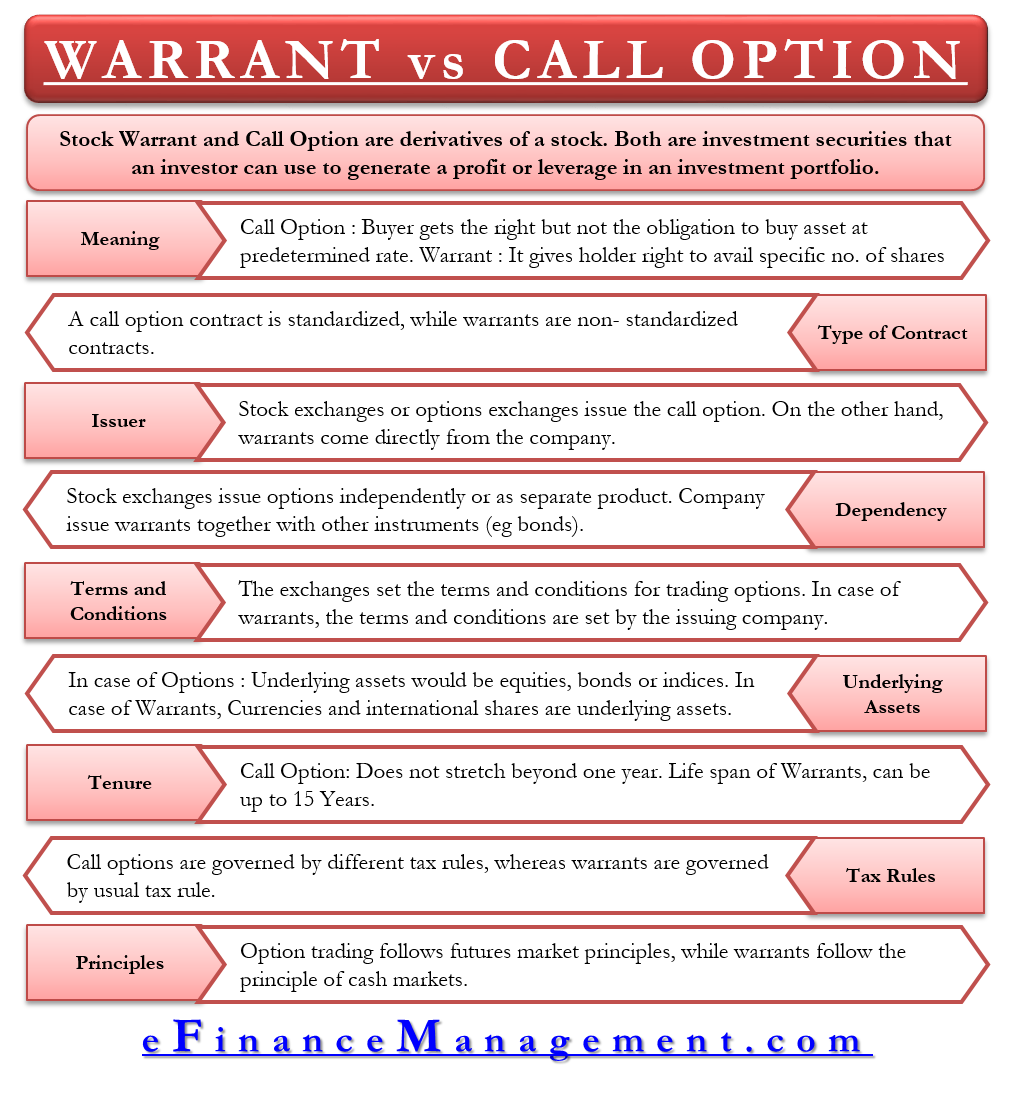

Warrant Vs Call Option All You Need To Know

Warrant Vs Call Option All You Need To Know

Stock Options And Warrants Why You Should Pay Attention To The Exercise Price Undervaluedequity Com

Stock Options And Warrants Why You Should Pay Attention To The Exercise Price Undervaluedequity Com

Why Stock Market Traders Use Stock Warrants Stock Market Market Trader Stock Options

Why Stock Market Traders Use Stock Warrants Stock Market Market Trader Stock Options

Your Investment Buddy Sorosign 3 Investing Forex Trading Training Forex System

Your Investment Buddy Sorosign 3 Investing Forex Trading Training Forex System

Frontier Stock Markets Seen Moving Up After Lost Decade Lost Decade Stock Market Frontier

Frontier Stock Markets Seen Moving Up After Lost Decade Lost Decade Stock Market Frontier

Share Purchase Agreement Template Best Of 11 Stock Purchase Agreement Templates To Download Purchase Agreement Templates Agreement

Share Purchase Agreement Template Best Of 11 Stock Purchase Agreement Templates To Download Purchase Agreement Templates Agreement

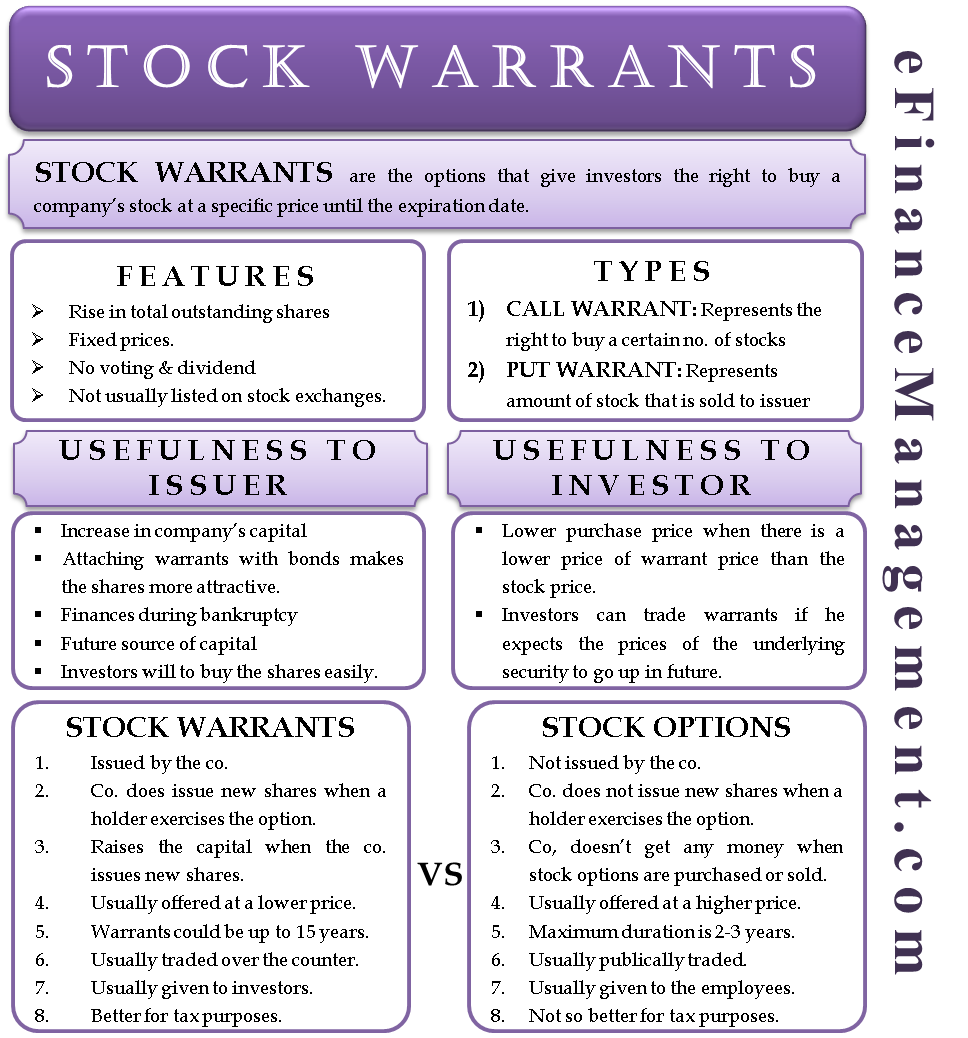

What Is Meant By Stock Warrants And How It Is Different From Stock Options What Is Meant Financial Advisory Stock Options

What Is Meant By Stock Warrants And How It Is Different From Stock Options What Is Meant Financial Advisory Stock Options

Stock Warrants Versus Stock Options Here S What S What

Stock Warrants Versus Stock Options Here S What S What

Warrants Are The Country S Market Equivalent To Standardized Stock Or Equity Options Option Trading Economic Events Options

Warrants Are The Country S Market Equivalent To Standardized Stock Or Equity Options Option Trading Economic Events Options

All About Stock Warrants Warrants Vs Options

All About Stock Warrants Warrants Vs Options

/Wiener_Riesen_Rad_Ltd_1898-41accd5aa0f9438198764c26178b58cb.jpg) I Own Some Stock Warrants How Do I Exercise Them

I Own Some Stock Warrants How Do I Exercise Them

Stock Warrant Definition Types Why Companies Issue Share Warrants

Stock Warrant Definition Types Why Companies Issue Share Warrants

Stock Warrants Why Do Companies Issue Stock Warrants

Stock Warrants Why Do Companies Issue Stock Warrants

Post a Comment for "Are Stock Warrants Good"