Predicted Stock Return Calculator Stats

Predict stock returns Let us look at the monthly data of price returns for Tata Steel and BSE Sensex for the past 12 months and input the same in the forecast function. Once you have the slope and y-intercept you compute the regression predicted values using the following formula.

How Much Does The Stock Market Return Get Rich Slowly

How Much Does The Stock Market Return Get Rich Slowly

Stock exchange and supported by Alpha VantageSome stocks traded on non-US.

Predicted stock return calculator stats. I would like to calculate the 1 year difference in stock prices to calculate the stock return. O What would be the predicted stock return for a company whose CEO made 25 million. By using STATA I want to calculate stock returns through prices of firms.

If analysts predict that Sensex will deliver around 2 average returns in July the forecast for Tata Steels return works out to be 304. When we figure rates of return for our calculators were assuming youll have an asset allocation that includes some stocks some bonds and some cash. Compute total return with dividends reinvested annualized return plus a summary of profitable and unprofitable returns for any stock exchange-traded fund ETF and mutual fund listed on a major US.

Well the SmartAsset investment calculator default is 4. Plus a 50 or 5 probability times a 10 or 1 return. For example if you predict that a stock trading for 30 will rise.

Still the statistical measurement may have value in. Calculate your earnings and more. Simulating the value of an asset on an.

The expected return on investment A would then be calculated as follows. Profit P SP NS - SC - BP NS BC. Stock Constant Growth Calculator.

It also displays returns and performance rank of the fund within its peer group for different. Expected total return is the same calculation as total return but using future assumptions instead of actual investment results. Updated Mar 31 2020.

Additionally you can simulate daily weekly monthly or annual periodic investments into any stock and see your total estimated portfolio value on every date. Exchanges are also supported. This not only includes your investment capital and rate of return but inflation.

First it finds current earnings using price and PE ratio both inputs. Y β 0 β 1 x. Below is a stock return calculator which automatically factors and calculates dividend reinvestment DRIP.

The logic used by the calculator is straightforward but it takes a few steps to explain it. Its often used all by itself to predict the future return rate. If the price-earnings ratio rose to 19 an increase of roughly 27 it would result in an expected annual return of about 94 2 47 27.

Some active investors model variations of a stock or other asset to simulate its price and that of the instruments that are based on it such as derivatives. Expected Rate of Return Σ i1 to n R i P i Where R i Return in Scenario i P i Probability for the Return in Scenario i i Number of Scenarios n Total number of Probability and Return. Stock Non-constant Growth Calculator.

Plus a 30 or 3 probability of a return of negative 5 or -5 3 5 15 65. Expected Return of A 0215 0510 03-5 That is a 20 or 2 probability times a 15 or 15 return. The Returns Calculator gives you an answer by calculating fund returns for the period chosen by you.

How the Calculator Works. This may seem low to you if youve read that the stock market averages much higher returns over the course of decades. Meeting your long-term investment goal is dependent on a number of factors.

It is the same answer 437 Analyze the residual plot below and identify which if any of the conditions for an adequate linear model is not meto Which of the conditions below might indicate that a linear model would not be appropriate. 4315 The following. The Stock Calculator uses the following basic formula.

Hat y hat beta_0 hat beta_1 x y. For example we have price 3213 on 2008 as first paneldata for firmID 1075 and a stock price of 3651 on 2009 for FirmID 1075. The calculation is simple but need to compute the regression coefficients first.

E EP x P EP the reciprocal of the PE ratio is known as the Earnings Yield. The correlation coefficient has limited ability in predicting returns in the stock market for individual stocks. So the calculation for yearly stock return is.

On the other hand if the earnings multiple fell to 18 a decline of 27 wed be left with about a 4 return 2 47 27.

Pdf Predicting Stock Returns Volatility An Evaluation Of Linear Vs Nonlinear Methods

Pdf Predicting Stock Returns Volatility An Evaluation Of Linear Vs Nonlinear Methods

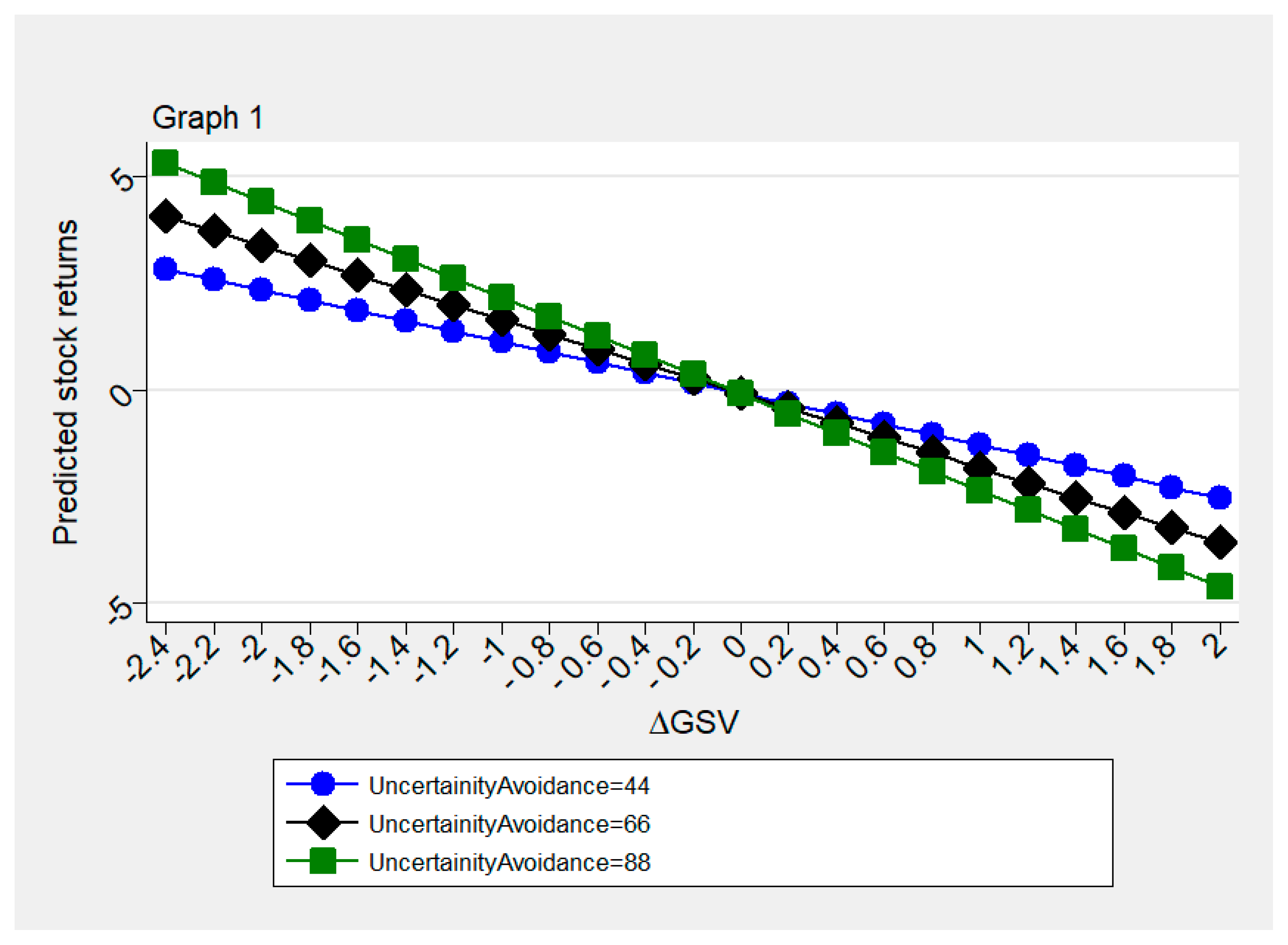

Risks Free Full Text Are Investors Attention And Uncertainty Aversion The Risk Factors For Stock Markets International Evidence From The Covid 19 Crisis Html

Risks Free Full Text Are Investors Attention And Uncertainty Aversion The Risk Factors For Stock Markets International Evidence From The Covid 19 Crisis Html

Pdf Regression Techniques For The Prediction Of Stock Price Trend

Pdf Regression Techniques For The Prediction Of Stock Price Trend

Statistical Analysis Of A Stock Price By Gianluca Malato Towards Data Science

Statistical Analysis Of A Stock Price By Gianluca Malato Towards Data Science

Stock Price Prediction Using Machine Learning Deep Learning

Stock Price Prediction Using Machine Learning Deep Learning

Stock Returns Regression In Excel Youtube

Stock Returns Regression In Excel Youtube

Pdf Does Trading Volume Contain Information To Predict Stock Returns Evidence From China S Stock Markets

Pdf Does Trading Volume Contain Information To Predict Stock Returns Evidence From China S Stock Markets

Predicting Stock Price Mathematically Youtube

Predicting Stock Price Mathematically Youtube

Pdf Predicting Abnormal Stock Return Volatility Using Textual Analysis Of News A Meta Learning Approach

Pdf Predicting Abnormal Stock Return Volatility Using Textual Analysis Of News A Meta Learning Approach

Pdf Using News Articles To Predict Stock Price Movements

Pdf Using News Articles To Predict Stock Price Movements

Pdf Does Price To Book Value Predict Stock Price Evidence From Nigerian Firms

Pdf Does Price To Book Value Predict Stock Price Evidence From Nigerian Firms

Crude Oil Predicts Equity Returns Quantpedia

Crude Oil Predicts Equity Returns Quantpedia

Pdf Predicting Stock Returns Using Neural Networks

Pdf Predicting Stock Returns Using Neural Networks

Gdax Bitcoin Bitcoin Mining Puzzle Example Decentralized Exchange Bitcoin Bitcoin Predictions Live Bitcoin Poker Cry Buy Cryptocurrency Bitcoin Bitcoin Price

Gdax Bitcoin Bitcoin Mining Puzzle Example Decentralized Exchange Bitcoin Bitcoin Predictions Live Bitcoin Poker Cry Buy Cryptocurrency Bitcoin Bitcoin Price

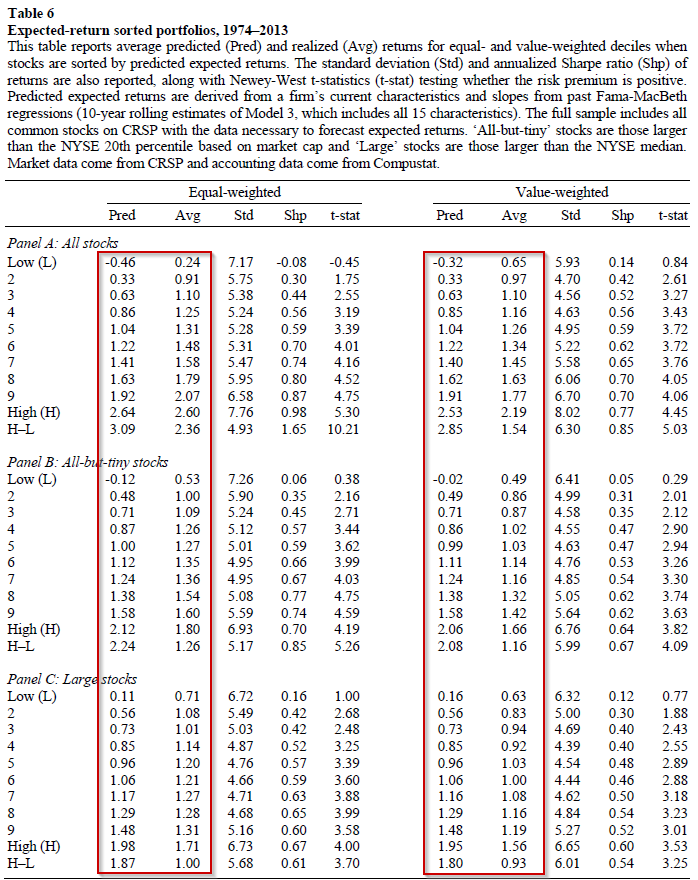

Predicting Stock Returns Using Firm Characteristics

Predicting Stock Returns Using Firm Characteristics

Predicting A Stock Price Using Regression Youtube

Predicting A Stock Price Using Regression Youtube

What Is The Average Stock Market Return

What Is The Average Stock Market Return

What Will The Stock Market Return In 2021

What Will The Stock Market Return In 2021

Pdf Stock Market Prediction Accuracy Analysis Using Kappa Measure

Pdf Stock Market Prediction Accuracy Analysis Using Kappa Measure

Post a Comment for "Predicted Stock Return Calculator Stats"