Stock Market Average Return Over 30 Years

Two of those years -- 2013 and 2019 -- generated returns of more than 30 helping to make up. In all of modern history the average long term return of the stock market is usually around 7.

Long Term Investing Graph 30 Year Growth Example Mfs Investing Corporate Bonds Capital Appreciation

Long Term Investing Graph 30 Year Growth Example Mfs Investing Corporate Bonds Capital Appreciation

For example 1950 represents the 10-year annualized return from 1940 to 1950.

Stock market average return over 30 years. If you have 30 years you only need a rate of return of 1192 per year. Returns are average annual returns over the. A 80 weighting in stocks and a 20 weighing in bonds has provided an average annual return of 95 with the worst year -40.

What is the average investors return on mutual funds. In 2013 it was 3243. All returns shown are in AUD terms assuming currency exposure is unhedged and assumes dividends are reinvested.

And more like 30. Long term means at least 15 years. Warren Buffet compares the performance of Berkshire Hathaway to the SP 500 Index over the period of years from 1965 through 2018 in his shareholder letters.

Interactive chart showing the annual percentage change of the Dow Jones Industrial Average back to 1916. From 1965 through 2018 the SP 500 Index compounded annual gain is 97. Average annual returns for the index from 1957 through the end of 2018 were about 796.

Thats a pretty steep decline. Rolling 10-year returns for each year represent the annualized return for the previous 10 years. Based on the history of the market its a reasonable expectation for your long-term investments.

If you have 30 years you only need a rate of return of 834 per year. Negative stock market returns occur on average about one out of every four years. In 1957 the index adopted its current format of including 500 stocks.

Dow Jones By Year - Historical Annual Returns. The Great Depression a stock market crash of more than 80 World War II The Korean War and four recessions. The SP 500 Index originally began in 1926 as the composite index comprised of only 90 stocks.

Between 1990 and today you can see there have been up years and down years but over this 30-year period those fluctuations have averaged out as a positive return. Dow Jones - DJIA - 100 Year Historical Chart. The consistency of returns is fairly remarkable when you consider some of the events that have transpired in each of those 30 year periods.

1 According to historical records the average annual return since its inception in 1926 through. Three key stipulations to this number. The average stock market return.

For the 2018 year-end its 10 for the 10-year average return. The rate includes dividends. 20 years without a recession 30 years in Australian and global shares 31 December 2020 10000 growth over the past 30 years to 31 December 2020 logarithmic scale Source.

Over the last 30 years the average investor saw a return of 366 whereas the SP 500 had an average return of 673. Over the last 50 years the stock market saw an average return of 1009. A 70 weighting in stocks and a 30 weighing in bonds has provided an average annual return of 91 with the worst year -301.

From 1987 to 2016 its 1166 In 2015 the markets annual return was 131. From 1992 to 2016 the SPs average is 1072. If you can save 500 a month youll need an annual rate of return of 156 to reach 15 million in 25 years.

The average investor greatly underperforms the stock market. Interactive chart of the Dow Jones Industrial Average DJIA stock market index for the last 100 years. So you can see 12 is not a magic number.

The average stock market return for 10 years is 92 according to Goldman Sachs data for. Performance is calculated as the change from the last trading day of each year from the last trading day of the previous year. I used Bankrates investment calculator to arrive at these numbers.

Historical data is inflation-adjusted using the headline CPI and each data point represents the month-end closing value. The next chart shows rolling 10-year returns from 1938-2019 for the performance of stocks versus bonds. The current month is updated on an hourly basis with todays latest value.

The average annual return from its inception in 1926 through the end of 2018 was about 10. In 2014 it was 1381.

Although Not All These Indices Are Total Return Indices It Still Is A Pretty Good Overview Of What Has Happened Over The Pa Chart Stock Market Us Stock Market

Although Not All These Indices Are Total Return Indices It Still Is A Pretty Good Overview Of What Has Happened Over The Pa Chart Stock Market Us Stock Market

Returns Are Almost Never Average Investing Investment Advisor Finance

Returns Are Almost Never Average Investing Investment Advisor Finance

8 Key Facts Of S P 500 Returns From 1950 To Present Page 2 Of 2 Tradingninvestment Investing Stock Market Return

8 Key Facts Of S P 500 Returns From 1950 To Present Page 2 Of 2 Tradingninvestment Investing Stock Market Return

Best Time S Of Day Week And Month To Trade Stocks

Interactive Chart Of The Dow Jones Industrial Average Stock Market Index For The Last 100 Years Historical Dow Jones Stock Market Stock Market Chart Dow Jones

Interactive Chart Of The Dow Jones Industrial Average Stock Market Index For The Last 100 Years Historical Dow Jones Stock Market Stock Market Chart Dow Jones

Dow Jones Industrial Average Djia Stocks Yearly Performance Infograph Tradingninvestment Dow Jones Dow Jones Industrial Average Financial Quotes

Dow Jones Industrial Average Djia Stocks Yearly Performance Infograph Tradingninvestment Dow Jones Dow Jones Industrial Average Financial Quotes

Buy The Best Perform The Worst Asset Management Chart Best

Buy The Best Perform The Worst Asset Management Chart Best

It S Like The Financial Crisis Never Happened American Stock Asset Management Subprime Mortgage

It S Like The Financial Crisis Never Happened American Stock Asset Management Subprime Mortgage

Calculated Risk Qe Timeline Update Financial Instrument Options Trading Strategies Dow Jones Industrial Average

Calculated Risk Qe Timeline Update Financial Instrument Options Trading Strategies Dow Jones Industrial Average

What S The Worst 10 Year Return From A 50 50 Stock Bond Portfolio Finances Money 10 Years Years

What S The Worst 10 Year Return From A 50 50 Stock Bond Portfolio Finances Money 10 Years Years

Dow Adjusted For Inflation Since 1925 There Are Several Points Of Interest For One When Adjusted For Inflation The Bear Market That Stock Market Chart Dow

Dow Adjusted For Inflation Since 1925 There Are Several Points Of Interest For One When Adjusted For Inflation The Bear Market That Stock Market Chart Dow

A Bad Year In The Bond Market Is A Bad Day In The Stock Market Bond Market Stock Market Bond Funds

A Bad Year In The Bond Market Is A Bad Day In The Stock Market Bond Market Stock Market Bond Funds

Dispersion Of Returns Across Asset Classes Old Quotes Retirement Benefits Return

Dispersion Of Returns Across Asset Classes Old Quotes Retirement Benefits Return

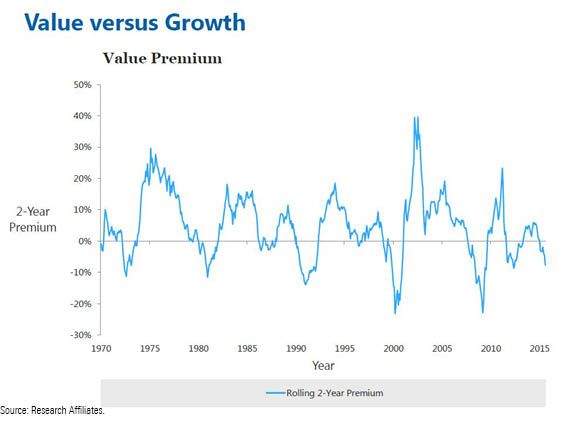

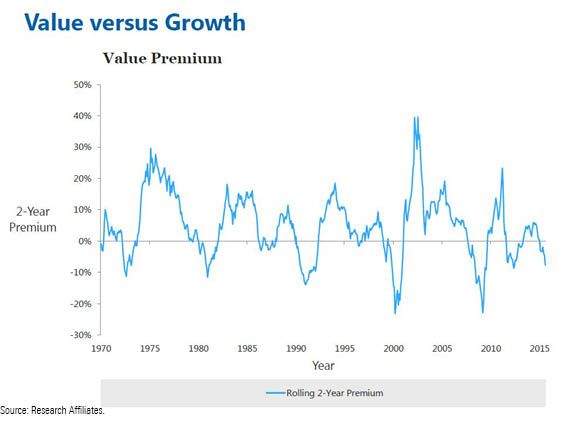

Msci Growth Vs Msci Value Rebounding Economic Activity Value Stocks

Msci Growth Vs Msci Value Rebounding Economic Activity Value Stocks

Realistic Investment Results Of Dollars And Data Investing Data Realistic

Realistic Investment Results Of Dollars And Data Investing Data Realistic

The Single Greatest Predictor Of Future Stock Market Returns Has A Message For Us From 2030 Marketwatch Stock Market Investing In Stocks Track Investments

The Single Greatest Predictor Of Future Stock Market Returns Has A Message For Us From 2030 Marketwatch Stock Market Investing In Stocks Track Investments

Post a Comment for "Stock Market Average Return Over 30 Years"