Stock Option Calculator Canada

If you plan on this stock being a forever stock you may choose a longer time horizon. Options involve risk and are not suitable for all investors.

Financial Savvy Stock Investing And Tracking Tools Investing In Stocks Investing Financial Savvy

Financial Savvy Stock Investing And Tracking Tools Investing In Stocks Investing Financial Savvy

See visualisations of a strategys return on investment by possible future stock prices.

Stock option calculator canada. If this type of benefit is the only amount reported on a T4 slip see the reporting instructions in order to avoid receiving a PIER report deficiency. Exchange for Physical EFPs Exchange for Risk EFRs. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in.

Even after a few years of moderate growth stock options can produce a handsome return. Using an options profit calculator can be a major benefit for any investor. Even after a few years of moderate growth stock options can produce a handsome return.

Withholding payroll deductions on options. Stock options are sold in contracts or lots of 100. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

Taxable benefit When a corporation agrees to sell or issue its shares to an employee or when a mutual fund trust grants options to an employee to acquire trust units the employee may receive. The Black-Scholes Option Pricing Formula. The last two fields however are essential to the accuracy of the calculator.

Free stock-option profit calculation tool. There are different types of stock options that can be issued to employees more information can be found on the Canada Revenue Agencys website. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

This is the price per a single stock option. You pay the stock option cost 1000 to your employer and receive the 100 shares in your brokerage account. Use this calculator to determine the value of your stock options for the next one to twenty-five years.

But if the employee-stock-option shares are those of a non-CCPCie a public corporationthe employee must account for the benefit in the year that he or she exercised the employee stock option and acquired the shares. The first is the average annual dividend yield for a. Profit P SP NS - SC - BP NS BC.

The Stock Calculator uses the following basic formula. Use this calculator to determine the value of your stock options for the next one to twenty-five years. This plan allows the employee to purchase shares of the employers company or of a non-arms length company at a predetermined price.

Important Note on Calculator. Canadas tax system defers tax for those acquiring shares of a CCPC due to the market forces and liquidity issues that. Long call bullish Calculator Purchasing a call is one of the most basic options trading strategies and is suitable when sentiment is strongly bullish.

The stock price is 50. Its a well-regarded formula that calculates theoretical values of an investment based on current financial metrics such as stock prices interest rates expiration time and moreThe Black-Scholes formula helps investors and lenders to determine the best possible option for. Copies of this document may be obtained from your broker from any exchange on which options are traded or by contacting The Options Clearing Corporation 125 S.

Provide Information About the Stocks Dividend. This is the market price for a share of the stock at expiration. Cross Transactions Prearranged Transactions and Block Trades.

In other words the contract gives the option buyer the right to purchase 100 shares at the strike price. This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies. The trader pays money when entering the trade.

Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. It can be used as a leveraging tool as an alternative to margin trading. When your stock options vest on January 1 you decide to exercise your shares.

In part 1 of our equity 101 series we covered the basics of stock options and how to read your option grant. You can compare the prices of your options by using the Black-Scholes formula. Heres where you may have to make some assumptions.

Stock value can vary based on many factors such as the management of the company and the current state of the economy. The position profits when the stock price rises. In part 2 we covered how companies determine your strike price the price you pay to purchase shares and how to figure out how much your options are worth.

Calculate the value of a call or put option or multi-option strategies. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit. An employee stock option is an arrangement where the employer gives an employee the right to buy shares in the company in which they work usually at a discounted price specified by the employer.

It can help you determine the value of your portfolio in todays ever evolving market and provides a simplified way to view. On June 1 the stock price is 70. Implied Pricing for Fixed Income Derivatives.

Stock Price At Expiration. A long call is a net debit position ie. The Pensionable and Insurable Earnings Review PIER program checks security options reported as a non-cash taxable benefit.

Locate current stock prices by entering the ticker symbol. Your stock options cost 1000 100 share options x 10 grant price.

Forex Pip Calculator Forex Reviews Forex Trading For Beginners Book Bloomberg Forex Calendar For Trading Quotes Financial Planning App Stock Trading

Forex Pip Calculator Forex Reviews Forex Trading For Beginners Book Bloomberg Forex Calendar For Trading Quotes Financial Planning App Stock Trading

Calculator For Determining The Adjusted Cost Base Of Etfs Mutual Funds Reits In Canada There Are Free And Pr Financial Fitness Investing Money Mutuals Funds

Calculator For Determining The Adjusted Cost Base Of Etfs Mutual Funds Reits In Canada There Are Free And Pr Financial Fitness Investing Money Mutuals Funds

The Web Center For Stock Futures And Options Traders Option Trader Analysis Free Blog

The Web Center For Stock Futures And Options Traders Option Trader Analysis Free Blog

Derivatives Course Futures Options Trading Option Strategies Hedging Telugu Youtube Option Strategies Stock Market Learn Stock Market

Derivatives Course Futures Options Trading Option Strategies Hedging Telugu Youtube Option Strategies Stock Market Learn Stock Market

Taxes And Your Social Security Social Security Social Security Benefits Tax Quote

Taxes And Your Social Security Social Security Social Security Benefits Tax Quote

Stock Option Trading Stock Market Tips Ideas Of Stock Market Tips Stockmarkettips Stockmarket Dividend Stocks Dividend Investing Finance Investing

Stock Option Trading Stock Market Tips Ideas Of Stock Market Tips Stockmarkettips Stockmarket Dividend Stocks Dividend Investing Finance Investing

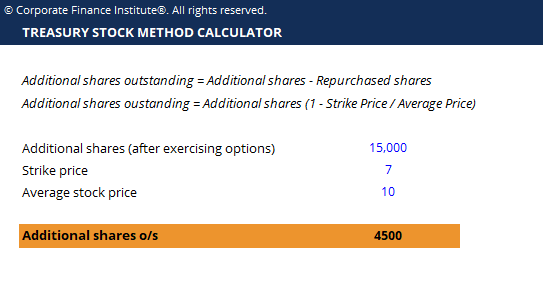

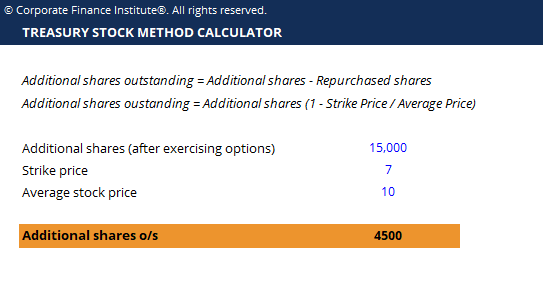

Treasury Stock Method Calculator Download Free Excel Template

Treasury Stock Method Calculator Download Free Excel Template

Georges Excel Car Loan Calculator V2 0 Car Loan Calculator Loan Calculator Car Loans

Georges Excel Car Loan Calculator V2 0 Car Loan Calculator Loan Calculator Car Loans

Options Profit Calculator Calculate Options Prices Greeks 2020

Options Profit Calculator Calculate Options Prices Greeks 2020

How To Calculate Stock Beta In Excel Replicating Yahoo Stock Beta Excel Finance Beta

How To Calculate Stock Beta In Excel Replicating Yahoo Stock Beta Excel Finance Beta

Forex Profit Calculator Forex 01 Forex Lifestyle Ea Best Forex Charts Forex Alliance Cargo Edmonton Canada Is The Learn Forex Trading Forex Chart

Forex Profit Calculator Forex 01 Forex Lifestyle Ea Best Forex Charts Forex Alliance Cargo Edmonton Canada Is The Learn Forex Trading Forex Chart

Stock Split History History Stock Options Finance

Stock Split History History Stock Options Finance

Options Trading With Iron Condors Trading Optionstrading Finance Iphone Option Trading Option Strategies Calculator App

Options Trading With Iron Condors Trading Optionstrading Finance Iphone Option Trading Option Strategies Calculator App

The Power Break Forex System Learn Forex Trading Learnforex Forexcourses Learn Forex Trading Forex Trading Forex Trading Basics

The Power Break Forex System Learn Forex Trading Learnforex Forexcourses Learn Forex Trading Forex Trading Forex Trading Basics

Forex Trading Can Be Hard But It Can Also Be A Very Rewarding Endeavor Here S How Many Traders Do Their Forex Tr Trade Finance Forex Trading Business Finance

Forex Trading Can Be Hard But It Can Also Be A Very Rewarding Endeavor Here S How Many Traders Do Their Forex Tr Trade Finance Forex Trading Business Finance

Reorder Point Formula Know When To Reorder

Reorder Point Formula Know When To Reorder

Weighted Average Cost Of Capital Wacc Business Valuation Calculator In Excel Business Valuation Cost Of Capital Weighted Average

Weighted Average Cost Of Capital Wacc Business Valuation Calculator In Excel Business Valuation Cost Of Capital Weighted Average

Post a Comment for "Stock Option Calculator Canada"