Stock Options Vs Rsu Calculator

Here the stock options are not call and put but the employee stock option. Less risk if stock price goes down But RSUs often have a certain type of vesting condition called triggers which can be performance or time-based.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg) Get The Most Out Of Employee Stock Options

Get The Most Out Of Employee Stock Options

If you measure 1 RSU against 1 stock option RSUs are pretty much always going to win.

Stock options vs rsu calculator. RSUs have benefits for both existing and newer employees. Calculate the value of a call or put option or multi-option strategies. No cost to exercise.

For a later stage company RSUs are usually better for both. Restricted stock and performance stock typically provide immediate value at the time of vesting and can be an important part of your overall financial picture. Head to Head Comparison Between Stock Option vs RSU Infographics Below are the top 7 differences between Stock option vs RSU.

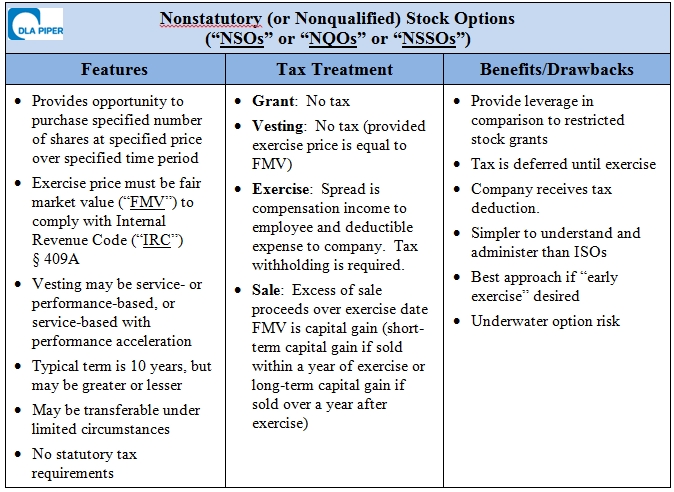

However stock options have a more complex taxation system. Stock option vs RSU of these employee benefits options can make a profit at a later stage depending upon the type of stock options. Stock grants often carry restrictions as well.

Your company grants you 2000 RSUs when the market price of its stock is 22. Non-qualified stock options typically vest over a period of time and have a strike price that you would pay in order to purchase the shares. Employee stock options and restricted stock units RSUs are both forms of stock-based compensation that companies can use to incentivize and reward employees.

The RSUs are taxed based on the ordinary income rates. Free stock-option profit calculation tool. Upon vesting you get access to the shares youve been awarded.

A restricted stock unit RSU is a form of compensation issued by an employer to an employee in the form of company shares. Feb 13 2020 207 PM EST. Restricted stock units RSU came in vogue in the 90s and early 2000s.

As the name implies RSUs have rules as to when they can be sold. Capital gains tax is also levied upon sale of the stock. See visualisations of a strategys return on investment by possible future stock prices.

RSUs represent an unsecured promise by the employer to grant a set number of shares of stock to the employee. They are a bit simpler than stock options in that there is no transaction or stock pricing involved. Unlike stock options all restricted stock is taxed as ordinary income on the fair market value on vesting date.

Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. Stock Options are usually better for both at an early stage company. The key difference between Stock Options and RSU is that in stock option the company gives an employee right to purchase the companys share at the pre-determined price and the date whereas RSU ie.

Stock Options vs RSUs The merits of Stock Options vs RSUs depends on whose perspective you have the employee or the employer company issuing the equity and the stage of the company. For a later stage company RSUs are usually better for both. Because an RSU is basically just a stock option with a 0 strike price and a stock option is always going to have a strike price higher than 0.

Restricted stock units are issued to an employee through a vesting plan. Instead the company simply commits to giving an employee stock in the company when a certain requirement is fulfilled. By the time the grant vests the stock price has fallen to 20.

RSUs resemble restricted stock options conceptually but differ in some key respects. Here is the information you need to know prior to jumping in. Restricted stock is easier to manage than options in that it requires fewer decisions.

Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. Unlike stock options RSUs always have some value to you even when the stock price drops below the price on the grant date. Most private RSUs have double-triggers.

The merits of Stock Options vs RSUs depends on whose perspective you have the employee or the employer company issuing the equity and the stage of the company. Though in early stage startups sometimes not that much higher. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 0 Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide.

The grant is then worth 40000 to you before taxes. Stock Options are usually better for both at an early stage company. In this sense between RSU vs stock options RSUs are more versatile than stock options.

If your share prices drop to the point where theyre below the option price. How your stock grant is delivered to you and whether or not it is vested are the key factors when determining tax treatment. Understanding what they are and your options for covering any associated taxes can help you make the most of the benefits they may provide.

There is a protection youll get with RSUs that doesnt come with stock options. Non-qualified stock options used to be the most common form of stock compensation but in recent years many companies have begun to transition to RSUs. The final major difference between RSU and stock options is the way they are taxed.

Including some major simplifications. Restricted stock units is the method of granting companys shares to its employees if the employee matches the mentioned performance goals or complete the specific tenure in the company as an employee.

Stock Options Vs Rsus Everything You Need To Know Eqvista

Stock Options Vs Rsus Everything You Need To Know Eqvista

Stock Options Vs Rsu Infographics Here Are The Top 7 Difference Between Stock Options Vs Rsu Stock Options Stock Options

Stock Options Vs Rsu Infographics Here Are The Top 7 Difference Between Stock Options Vs Rsu Stock Options Stock Options

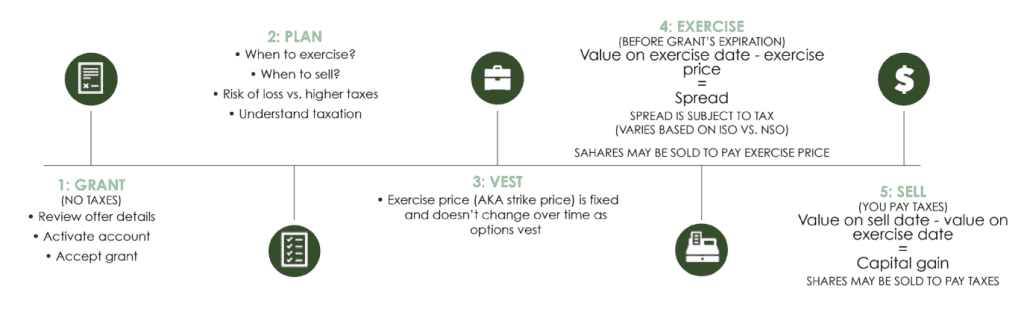

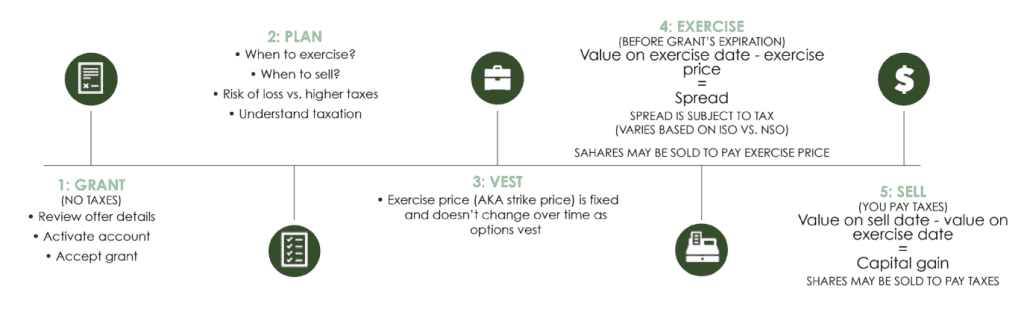

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

Stock Options 101 The Essentials Mystockoptions Com

Stock Options 101 The Essentials Mystockoptions Com

Which Is Better Stock Options Or Rsus All You Need To Know Stock Options Staging Companies Options

Which Is Better Stock Options Or Rsus All You Need To Know Stock Options Staging Companies Options

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Types Of Taxes Capital Gain

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Types Of Taxes Capital Gain

Guide To Choosing Between Procter Gamble Ltip Stock Options And Rsus Personal Choice Financial

Guide To Choosing Between Procter Gamble Ltip Stock Options And Rsus Personal Choice Financial

My Company Is Offering A Choice Between Stock Options Or Rsus Or A Mix What Is The Best Option Quora

Stock Options Vs Rsu Are They Both Same Know The Top Differences Youtube

Stock Options Vs Rsu Are They Both Same Know The Top Differences Youtube

The Mystockoptions Blog Pre Ipo Companies

When To Sell Stock Options Employee Stock Options Blog

When To Sell Stock Options Employee Stock Options Blog

Stock Options Vs Rsus What S The Difference Thestreet

Stock Options Vs Rsus What S The Difference Thestreet

We Apply Knowledge Gained From Our Last Post To Show What Taxes Would Be Incurred In Five Common Situations Fac Stock Options Option Strategies Venture Capital

We Apply Knowledge Gained From Our Last Post To Show What Taxes Would Be Incurred In Five Common Situations Fac Stock Options Option Strategies Venture Capital

Executive Compensation Plans How To Understand And Proceed With Restricted Stock And Stock Options Atlantic Wealth Partners

Executive Compensation Plans How To Understand And Proceed With Restricted Stock And Stock Options Atlantic Wealth Partners

Strategies For Stock Options And Restricted Stock Units Rsus To Maximize Tax Efficiency And Achieve Improved Tax Results Stock Options Tax How To Plan

Strategies For Stock Options And Restricted Stock Units Rsus To Maximize Tax Efficiency And Achieve Improved Tax Results Stock Options Tax How To Plan

Non Qualified Stock Options Vs Rsus Strategy Guide Level Up Financial Planning

Non Qualified Stock Options Vs Rsus Strategy Guide Level Up Financial Planning

Equity Compensation Alphabet Soup Iso Nso Rsa Rsu And More The Venture Alley

Equity Compensation Alphabet Soup Iso Nso Rsa Rsu And More The Venture Alley

Post a Comment for "Stock Options Vs Rsu Calculator"