The Stock Market Bubble Of The Late 1990s And Early 2000s

In addition to the 2020 stock market Polcari discussed how widespread adoption of the internet revolutionized trading in the 1990s. The 1990s economic boom in the United States was an economic expansion that began after the end of the early 1990s recession in March 1991 and ended in March 2001 with the start of the early 2000s recession during the Dot-com bubble crash 20002002.

It was the longest recorded economic expansion in the history of the United States until July 2019.

The stock market bubble of the late 1990s and early 2000s. The aggregate bubble gauge is around the 77th percentile today for the US stock market overall. The dotcom bubble was a rapid rise in US. Saw an efficient allocation of resources toward the high-growth computerinternet sector.

Yamaichi was one of four major banks and brokerages that collapsed in 1997. Was a good example of the theory of efficient markets. Lessons From The Dot-Com Bubble.

Saw internet and computer technology companies over-invest. The UK Canada and Australia avoided the recession while Russia a nation that did not experience prosperity during the 1990s in fact began to recover from said situation. The greater fool theory plays a role in every investing bubble from the 17th centurys tulip mania to internet stocks in the late 1990s and real estate in the early 2000s.

The mother of all bubbles. Technology stock equity valuations fueled by investments in internet-based companies in the late 1990s. Does a battle over GameStop shares that has pitted defiant online investors against big Wall Street firms mean were in a stock market bubble.

The dotcom bubble started growing in the late 90s as access to the internet expanded and computing took on an increasingly important part in peoples daily lives. The value of equity markets grew exponentially. Was an example that not all bubbles burst.

The stock market bubble of the 1920s the dot-com bubble of the 1990s and the real estate bubble of the 2000s were asset bubbles followed by sharp economic downturns. Outspoken billionaire and Dallas Mavericks owner Mark Cuban says that the stock markets recent technology-driven run-up from coronavirus lows has many of the hallmarks of the bubble that rocked. In brief the aggregate bubble gauge is around the 77th percentile today for the US stock market overallIn the bubble of 2000 and the bubble of 1929 this aggregate gauge had a 100th percentile read.

Japans 1990s recession continued. Greenwood reminds us that even as dot-com stocks soared to outrageous valuations in the late 1990s and early 2000 other sectors of the market notably value stocks. Value stocks performed as the mirror opposite.

There was the Canadian cannabis bubble of 2018 the US. Compounding the market slide the Tokyo Stock Exchange in 1999 completed a decade-long switch to electronic trading closing the formerly bustling trading floor. This recession was predicted by economists because the boom of the 19.

Adding to this narrative the late 1990s and early 2000s equity bubble was concentrated in the technology and telecom sectors and then in a select handful of stocks like Coca-Cola KO which. Some commentators in the bubble camp see parallels between current conditions and the tech growth stock bubble of the late 1990s which burst in 2000. During the late 20th century the Internet created a euphoric attitude toward business and inspired many hopes for the future of online commerce.

For this reason many Internet companies known as dot-coms were launched and investors assumed that a company that operated online was going to. The party came to an end when the stocks bubble burst in the early 1990s. Understanding the Internet Bubble of the 1990s.

The early 2000s recession was a decline in economic activity which mainly occurred in developed countries. Housing bubble of the early 2000s the dot-com bubble of the 1990s the Japanese stock bubble of the late 1980s and thats just for. In the early 1970s and the dot-com bubble stocks in the late 1990s both of which I remember.

Between 1995 and its peak in March 2000 the Nasdaq Composite stock market index rose 400 only to fall 78 from its peak by October 2002 giving up all its gains during the bubble. The stock market bubble of the late 1990s and early 2000s. The recession affected the European Union during 2000 and 2001 and the United States from March to November 2001.

Is The Stock Market Experiencing Another Tech Bubble Moneylion

Is The Stock Market Experiencing Another Tech Bubble Moneylion

Image Result For Art Deco And The 80s Pattern Illustration Background Patterns Vector Background Pattern

Image Result For Art Deco And The 80s Pattern Illustration Background Patterns Vector Background Pattern

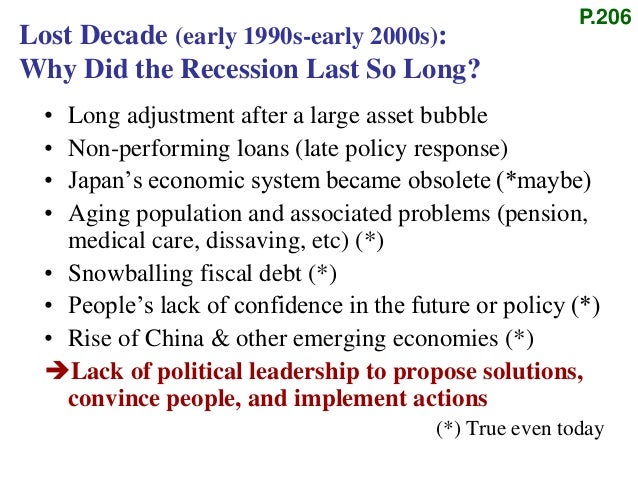

Lecture 12 The Bubble Burst And Recession

Lecture 12 The Bubble Burst And Recession

Kerry B Collison Asia News Pokemon Sexuality And The State Paradox Of Neoliberal Indonesia Asia News Pokemon Paradox

Kerry B Collison Asia News Pokemon Sexuality And The State Paradox Of Neoliberal Indonesia Asia News Pokemon Paradox

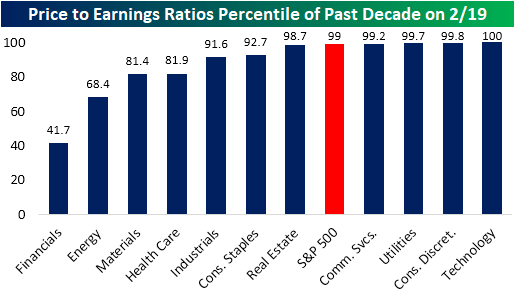

Valuations Stretching Seeking Alpha

Valuations Stretching Seeking Alpha

Photo Booth Props 90s Theme Party 90s Party Decorations Party Design Ideas

Photo Booth Props 90s Theme Party 90s Party Decorations Party Design Ideas

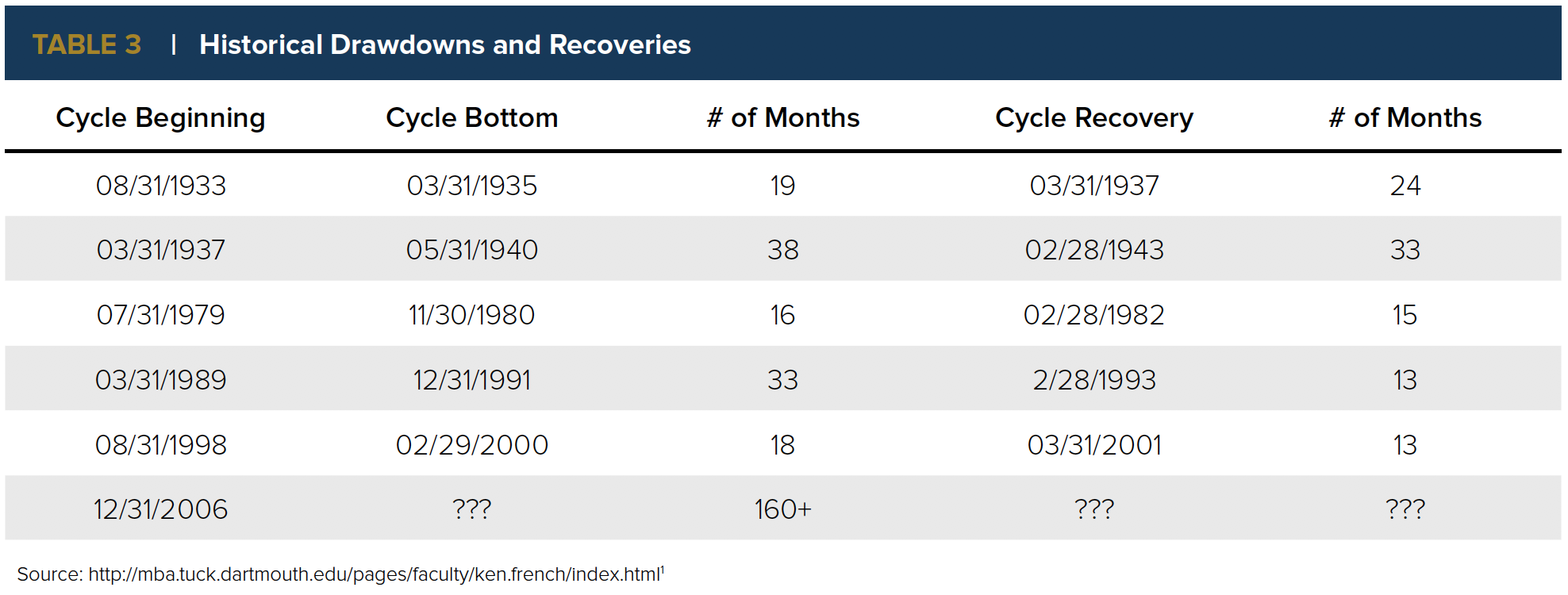

Growth Vs Value Historical Perspective Anchor Capital Advisors

Growth Vs Value Historical Perspective Anchor Capital Advisors

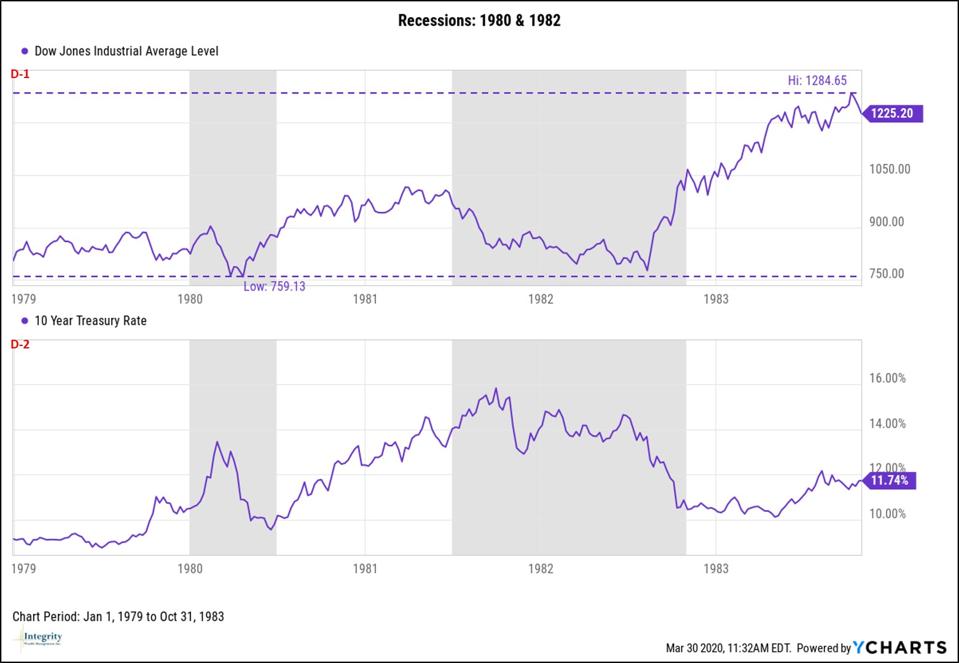

How Stocks Performed During The Past 6 Recessions

How Stocks Performed During The Past 6 Recessions

Kerry B Collison Asia News Pokemon Sexuality And The State Paradox Of Neoliberal Indonesia Asia News Pokemon Paradox

Kerry B Collison Asia News Pokemon Sexuality And The State Paradox Of Neoliberal Indonesia Asia News Pokemon Paradox

Bring A Loupe A Magnificent Vacheron Constantin And Many Tool Watches From Aquastar Iwc And Universal Geneve Hodinkee Vintage Watches Best Looking Watches Longines

Bring A Loupe A Magnificent Vacheron Constantin And Many Tool Watches From Aquastar Iwc And Universal Geneve Hodinkee Vintage Watches Best Looking Watches Longines

Analysis Three Decades Of Ipo Deals 1990 2019

Analysis Three Decades Of Ipo Deals 1990 2019

Pager Codes 1990s Childhood Pagers Funny Pictures

Pager Codes 1990s Childhood Pagers Funny Pictures

This Infogrpahic Is A Resume For Sarah Prevette Founder And Ceo Of Sprouter It Highlights Her Education And W Visual Resume Graphic Resume Infographic Resume

This Infogrpahic Is A Resume For Sarah Prevette Founder And Ceo Of Sprouter It Highlights Her Education And W Visual Resume Graphic Resume Infographic Resume

Loved Discontinued Food Skittles Retro Candy

Loved Discontinued Food Skittles Retro Candy

Clueless Clueless Childhood Cute Blankets

Clueless Clueless Childhood Cute Blankets

The Rough Timeline Of The Events Spanning Decades That Led To The Download Scientific Diagram

The Rough Timeline Of The Events Spanning Decades That Led To The Download Scientific Diagram

Macroeconomics All Quizzes Flashcards Quizlet

Macroeconomics All Quizzes Flashcards Quizlet

Is There Another Tech Bubble Bursting Financial Synergies Blog

Is There Another Tech Bubble Bursting Financial Synergies Blog

Post a Comment for "The Stock Market Bubble Of The Late 1990s And Early 2000s"