What Etfs Do Well In Recession

During a recession its best to bet on the consumer. Those ETFs pick up some of the social media and tech types of stocks which wouldnt tend to do very well in a recession Mr.

Best Fixed Income Etfs To Have In A Recession

Best Fixed Income Etfs To Have In A Recession

From 1980 to 2009 which is the most recent 30-year period as of this.

What etfs do well in recession. Mining companies are stocks that do well in a recession. The History of Recessions. Which are battered in a recession.

The answer depends on several variables. There are ways for us to get in front of a recession. ETFs 401k InvestingTrading.

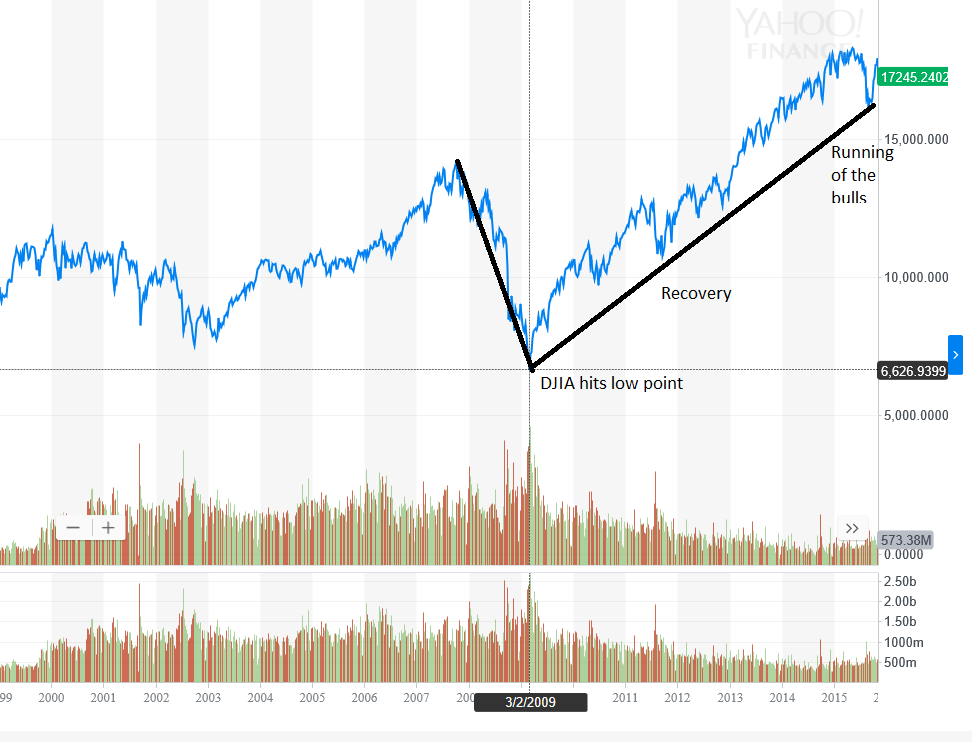

They may also benefit from. The National Bureau of Economic Research has tracked US. Equity markets tend to do very well during economic recoveries.

And are in industries that historically do well during tough. However with nearly all SP 500 sectors down over the past year it can be difficult for investors to. ETFs that specialize in consumer staples and non-cyclicals.

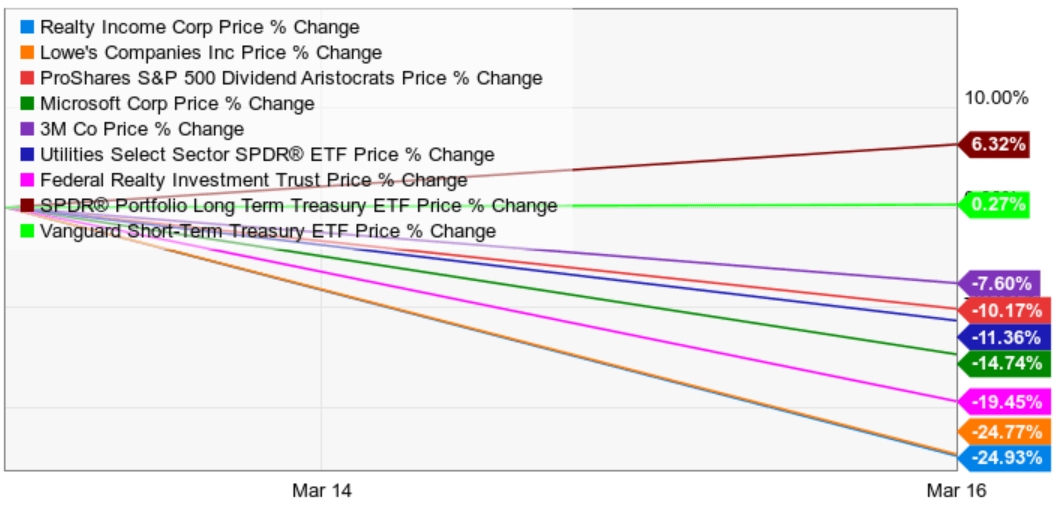

ETFs are one tool that can help you weather a recession. Healthcare food consumer staples and basic transportation are examples of relatively inelastic industries that can perform well in recessions. We compare the behavior of nearly 75 DGI stocks some dividend ETFs a dozen CEFsfunds and Treasuries with the SP-500 to find securities that may be recession and crash resistant albeit on a.

GLD is a staple ETF that I check the trend to see where this sector might be headed or check gold futures. Invesco QQQ Trust QQQ QQQ could be a good recession-proof mutual fund pick if youre looking for exposure to the biggest tech companies. The Consumer Staples SPDR has long been among the best ETFs to buy from a sector standpoint in market downturns.

Cyclical stocks tend to do well during boom times when. Another potential place for investors to find safety during a recession is Utility stocks. What signals do you look at specifically to assess the risk of a recessionone that would cause you to reallocate assets.

Leverage may also hurt during a recession but it works well during good times allowing firms. Not every bear market recession or financial crisis is the same. Also different kinds of fixed income investments especially bonds vary.

Consumer staples stocks are relatively recession-resistant making them safe places to invest during market downturns. ETFs 401k InvestingTrading. Over the past month the XLP ETF is down just 194 making it the best-performing SPDR sector ETF of all.

By learning more about the types of bonds bond mutual funds and bond exchange-traded funds ETFs investors may be able to benefit when stock prices are falling. Technology sector funds can become dark horses during a. Investors looking to weather a recession can use exchange-traded funds ETFs as one way to reduce risk through diversification.

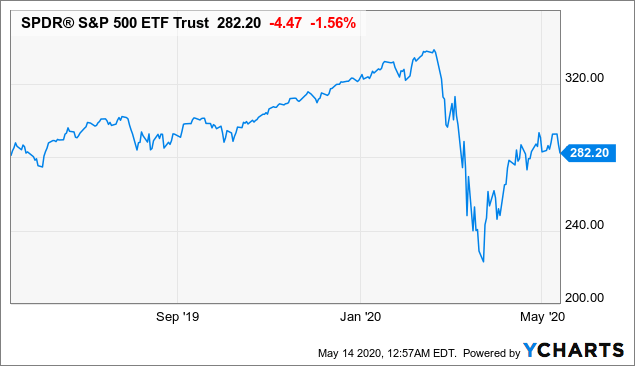

It proved its mettle during the bear market of 2007-09 when it delivered a total. Precious metals like gold silver and platinum are always going to be seen as a safe haven in a time of recession. Recessions dating back to the 1850s.

Over the past month the XLP ETF is down just 194 making it the best-performing SPDR sector ETF of allAs an added bonus the XLP ETF pays a 31 dividend so investors can get paid while they. The ProShares Short SP500 ETF SH 2935 is perhaps the ultimate crash-proof ETF in the sense that its quite literally designed to profit from a market crash. However buy-and-hold investors.

By concentrating on these during a market downturn you can avoid most of the loss experienced by long-term bond funds. The Consumer Staples Select Sector SPDR ETF XLP and Consumer Discretionary Select Sector SPDR ETF XLY held up better during the past two. Short-term bonds mature in three years or less.

How ETFs Can Help in a Recession.

8 Great Recession Proof Stocks That Are Perfect For Times Like These Seeking Alpha

8 Great Recession Proof Stocks That Are Perfect For Times Like These Seeking Alpha

Vglt A Defensive Bond Etf That Should Outperform In An Economic Recession Nasdaq Vglt Seeking Alpha

Vglt A Defensive Bond Etf That Should Outperform In An Economic Recession Nasdaq Vglt Seeking Alpha

An Exchange Traded Fund Etf Is A Security That Tracks The Movements Of An Index Commodity Or Currency An Etf Is A Index Stock Exchange Investing In Stocks

An Exchange Traded Fund Etf Is A Security That Tracks The Movements Of An Index Commodity Or Currency An Etf Is A Index Stock Exchange Investing In Stocks

Credit Risk Risky Business Corporate Bonds Earnings Calendar

Credit Risk Risky Business Corporate Bonds Earnings Calendar

Recession Is A Phase Of A Business Cycle Which Goes Through 4 Phases A Peak A Downturn A Upturn And A Boom Recession Is Thus Associated With The Downturn O

Recession Is A Phase Of A Business Cycle Which Goes Through 4 Phases A Peak A Downturn A Upturn And A Boom Recession Is Thus Associated With The Downturn O

Etf Vs Mutual Fund Which Is Best For Your Portfolio Business Talks In 2020 Mutuals Funds Personal Financial Planning Fund

Etf Vs Mutual Fund Which Is Best For Your Portfolio Business Talks In 2020 Mutuals Funds Personal Financial Planning Fund

Where To Look For Recession Proof Etfs In 2020 The Motley Fool

Where To Look For Recession Proof Etfs In 2020 The Motley Fool

Retirement 10 Recession Proof Dgi Stocks Almost Seeking Alpha

Retirement 10 Recession Proof Dgi Stocks Almost Seeking Alpha

:max_bytes(150000):strip_icc()/GettyImages-965003236-e653e1e10a824d3297c47aada4cc5e2b.jpg) 6 Etfs That Could Be Recession Proof

6 Etfs That Could Be Recession Proof

6 Etfs That Could Be Recession Proof

6 Etfs That Could Be Recession Proof

Pin On Numerology November 2020

Pin On Numerology November 2020

The Ark Innovation Etf Gives Investors Exposure To Stocks With Groundbreaking Products Services The Strong Growth Of These Stoc Investing Innovation Investors

The Ark Innovation Etf Gives Investors Exposure To Stocks With Groundbreaking Products Services The Strong Growth Of These Stoc Investing Innovation Investors

This Index Etf Is Beating The S P 500 By Excluding Losers Marketwatch Ishares Fact Sheet Index

This Index Etf Is Beating The S P 500 By Excluding Losers Marketwatch Ishares Fact Sheet Index

Pin On Kids Financial Education

Pin On Kids Financial Education

Pin On Trading Stocks Options Investing Etfs Futures

Pin On Trading Stocks Options Investing Etfs Futures

Vanguard Continued To Dominate The Etf Flows Rankings In September Morningstar Vanguard Dominant Flow

Vanguard Continued To Dominate The Etf Flows Rankings In September Morningstar Vanguard Dominant Flow

The Great Owl Portfolio Janus Henderson Balanced Fund Mutf Jabax Seeking Alpha Portfolio Greatful Investing

The Great Owl Portfolio Janus Henderson Balanced Fund Mutf Jabax Seeking Alpha Portfolio Greatful Investing

Leveraged Etfs In A Recession Bogleheads Org

Leveraged Etfs In A Recession Bogleheads Org

Post a Comment for "What Etfs Do Well In Recession"