How To Value Inventory At Year End

The inventory valuation is based on the costs incurred by the entity to acquire the inventory convert it into a condition that makes it ready for sale and have it transported into the. In the post Procedures for Year-End Inventory Count Small Business advises regarding stopping all orders If thats not an option try to get the count done during a slow period.

End Of Year Inventory Template Calculate Beginning And Ending Inventory Excel Worksheet In 2021 Spreadsheet Template Excel Templates Excel Spreadsheets Templates

End Of Year Inventory Template Calculate Beginning And Ending Inventory Excel Worksheet In 2021 Spreadsheet Template Excel Templates Excel Spreadsheets Templates

Determine the Gross Income.

How to value inventory at year end. Complete a physical inventory count and then post any adjustments. Refer to the Inventory Year-End Questions and Answers. Next figure out the inventory purchased during the year from the purchase.

Post all transactions for the year. In its most basic form you would determine your profits as follows. Retail subtract a set markup percentage from your selling price.

If you arent based in the US this report can still be quite useful to obtain your final revenue category breakdowns and your end of year inventory values so it is worth understanding how it is generated. Market value compare the cost of each item with the market value and choose the lower of the two. Your sales make your Total Revenue.

Physical counts A physical inventory count gives a snapshot of how much inventory your company has on hand at year end. It forms a key part of the cost of goods sold calculation and can also be used as collateral for loans. Multiply 1 - expected gross profit by sales during the period to arrive at the estimated cost of goods sold.

How you value inventory on your balance sheet determines your ending inventory which in turn determines the cost of goods sold and therefore profit. What you have not sold by the end of the year valued at your cost is. Inventory valuation is the cost associated with an entitys inventory at the end of a reporting period.

First determine the inventory of the company at the beginning of the year from the stock book and confirm with. How to Value Inventory. Beginning inventory inventory purchases - ending inventory Cost of goods sold.

If you have 8 yards on hand at the end of the year then your inventory value is 42. The formula for ending inventory can be simply calculated by using the following four steps. A physical count lets you know exactly how much inventory the business has at the time of the count.

Inventory valuation is done at the end of every financial year to calculate the cost of goods sold and the cost of the unsold inventory. Heres the formula for calculating the cost of goods sold. After selling 110 units your inventory would be 2100.

Last-In First-Out LIFO the LIFO method is the reverse of the FIFO method. The goal is to keep movement of inventory to a bare minimum to maximize accuracy. Due to shrinkage such as employee theft or loss you may not have the amount of inventory on hand you think you do.

Inventory Year-End Closing Tips. Inventory 100 x 10 50 x 15 75 x 20 3250. Use your physical inventory of what is on hand now plus any that were sold this year as the starting qty for 1117.

Inventory 3250 100 x 10 10 x 15 2100. Cost purchase price of the item plus any additional costs like shipping fees. It assumes that the newest items are sold first.

This valuation appears as a current asset on the entitys balance sheet. Close the fiscal periods for the Inventory series optional. Regardless of your type of inventory system a physical count of the inventory should be done at the years end.

OK if you used periodic inventory in 2016 Your income tax form in the cogs section will show an ending inventory balance for that year - that is the number you have to work with when valuing what is on hand to start 2017. This is crucial as the excess or shortage of inventory affects the production and profitability of a business. Your beginning inventory plus the items you buy each year minus your ending inventory form your Cost of Goods Sold COGS.

If you have your year-end inventory cost of materials to create unsold works lets say 6500 you then would be able to calculate your deductible direct costs sold by adding the previous 5000 to the additional 9000 and subtracting the inventory of 6500 left this year. Add together the cost of beginning inventory and the cost of purchases during the period to arrive at the cost of goods available for sale. Put the process of receiving and shipping product on hold.

The IRS loves record keeping so I find that the easiest way to calculate your inventory each year is to create a simple spreadsheet with your item in the first column the quantity in the second column the cost per item in the third column and then calculate the inventory value in the fourth column. To find the Schedule C Guidance Report navigate to your Reports page then click the Schedule C Guidance Report under the General section. Beginning inventory plus new inventory minus ending inventory would result in your annual cost of goods sold Remaining unsold goods is your inventory at the end of a year so your profits would equal total revenue minus COGS It is important to understand the calculation of profits because you will have to pay the taxes based on it.

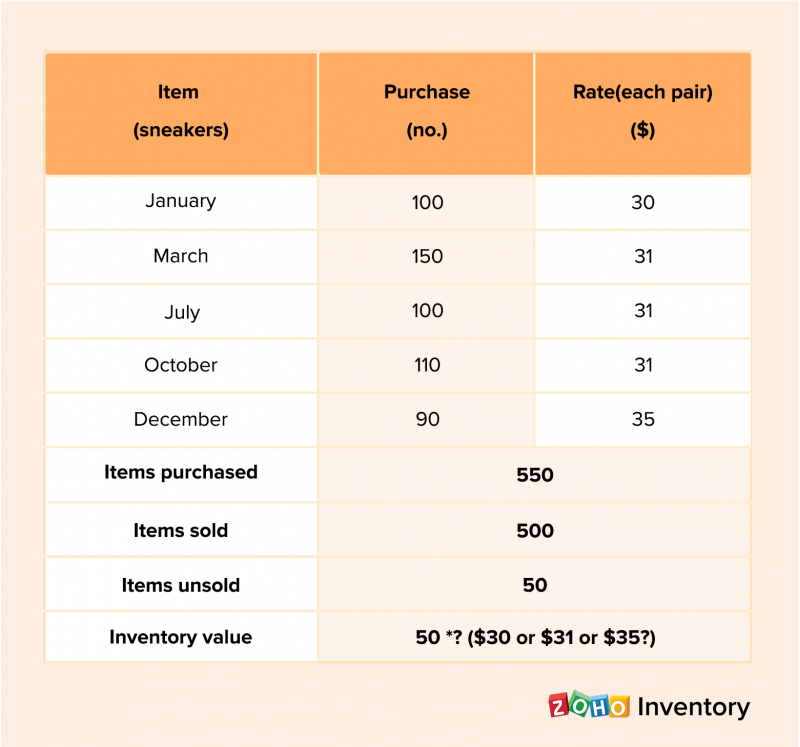

What Is Inventory Valuation Importance Methods And Examples Zoho Inventory

What Is Inventory Valuation Importance Methods And Examples Zoho Inventory

What Is The Weighted Average Cost Method Explained

What Is The Weighted Average Cost Method Explained

Daily Stock Maintain Template In Excel Sheet Spreadsheet Business Inventory Management Templates Inventory Management Business

Daily Stock Maintain Template In Excel Sheet Spreadsheet Business Inventory Management Templates Inventory Management Business

Inventory Sheet Template Inventory Management Templates Bookkeeping Templates Word Template

Inventory Sheet Template Inventory Management Templates Bookkeeping Templates Word Template

Methods Of Estimating Inventory Accountingcoach

Methods Of Estimating Inventory Accountingcoach

Excel Inventory Template Check More At Https Cleverhippo Org Excel Inventory Template

Excel Inventory Template Check More At Https Cleverhippo Org Excel Inventory Template

Learn Microsoft Excel Warehouse Inventory Template Free Download Excel 2013 Excel Spreadsheets Excel Budget Spreadsheet Excel Templates

Learn Microsoft Excel Warehouse Inventory Template Free Download Excel 2013 Excel Spreadsheets Excel Budget Spreadsheet Excel Templates

Business Benefits Measuring Valuing Financial Non Financial Business Benefits Financial Benefit

Business Benefits Measuring Valuing Financial Non Financial Business Benefits Financial Benefit

Ca Accounting Books End Of Year Adjustments For Inventory Accounting Books Accounting Financial Accounting

Ca Accounting Books End Of Year Adjustments For Inventory Accounting Books Accounting Financial Accounting

Free Home Inventory Spreadsheet Home Inventory Spreadsheet Template Household Insurance

Free Home Inventory Spreadsheet Home Inventory Spreadsheet Template Household Insurance

Inventory Manager Spreadsheet Numbers And Excel Nmcreation Studio Bookkeeping Business Excel Tutorials Excel

Inventory Manager Spreadsheet Numbers And Excel Nmcreation Studio Bookkeeping Business Excel Tutorials Excel

Accounting I Acc 100 Final Milestone Summer 2020 With Answer For 100 Score Income Statement Answers One Year Ago

Accounting I Acc 100 Final Milestone Summer 2020 With Answer For 100 Score Income Statement Answers One Year Ago

Inventory And Cost Of Goods Sold Explanation Accountingcoach

Inventory And Cost Of Goods Sold Explanation Accountingcoach

Handling Specialty High Value Inventory What You Should Know Supply Chain High Inventory

Handling Specialty High Value Inventory What You Should Know Supply Chain High Inventory

Lower Of Cost Or Market Rule Financial Statement Marketing Financial Accounting

Lower Of Cost Or Market Rule Financial Statement Marketing Financial Accounting

Fifo Inventory Valuation In Excel Using Data Tables How To Pakaccountants Com Excel Shortcuts Excel Data

Fifo Inventory Valuation In Excel Using Data Tables How To Pakaccountants Com Excel Shortcuts Excel Data

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

The Fifo Method Is A Way Of Determining Which Items Of Inventory Have Been Sold During A Period And Which Cost Of Goods Sold Cost Accounting Accounting Career

The Fifo Method Is A Way Of Determining Which Items Of Inventory Have Been Sold During A Period And Which Cost Of Goods Sold Cost Accounting Accounting Career

Post a Comment for "How To Value Inventory At Year End"