Stock Daily Volatility Calculation

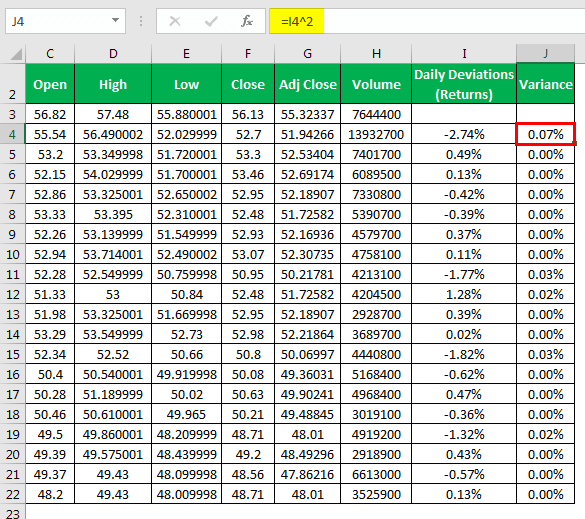

Variance in daily returns is the square of daily deviations. Therefore based on the daily price movements in August 2015 the SP 500s annualized.

Volatility Indices Chartschool

Volatility Indices Chartschool

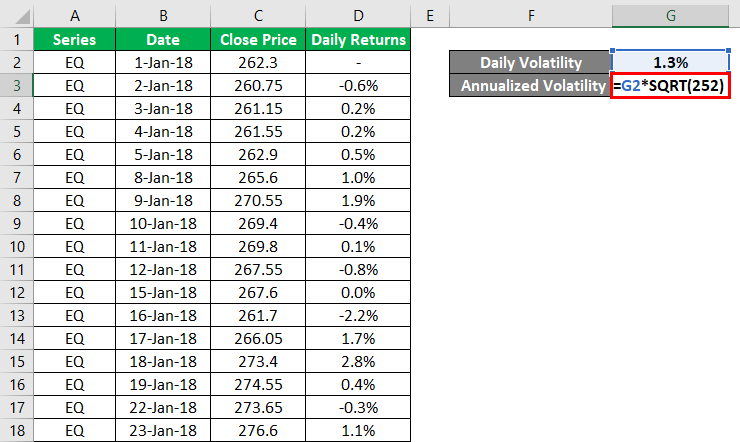

In our example 173 times the square root of 252 is 274.

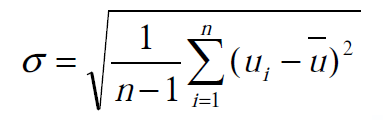

Stock daily volatility calculation. R i ln C i C i-1. To calculate the stock volatility from a set of historical stock price data you start by determining the daily logarithmic returns which is known as the continuously compounded return. The formula for square root in Excel is SQRT.

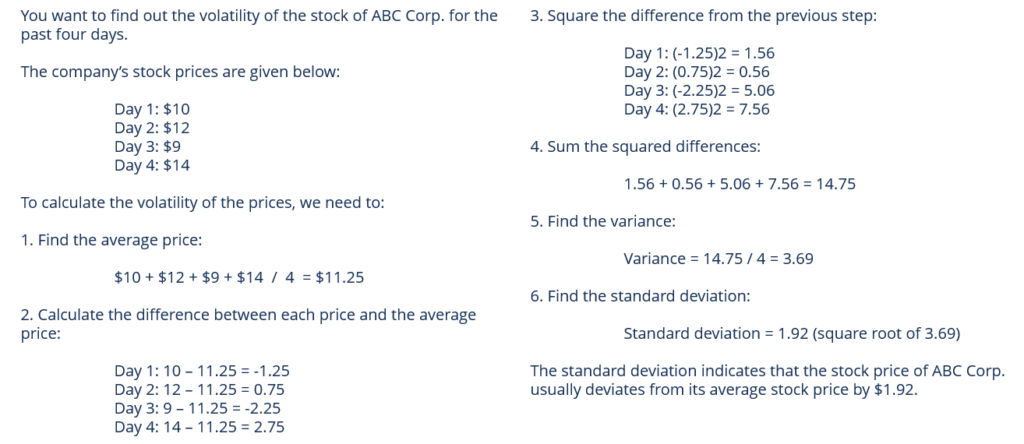

Convert the dollar amount a stock moves up or down each day into a percentage. In Excel you can use the function SQRT to calculate square root. Multiply this quotient by one hundred or 124 - 121 124 121 X 100 122 or 12.

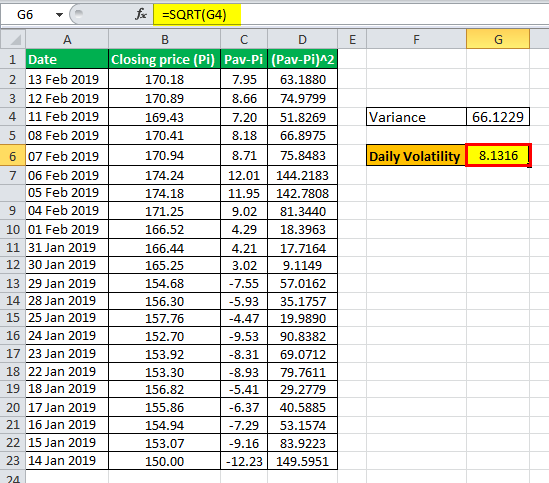

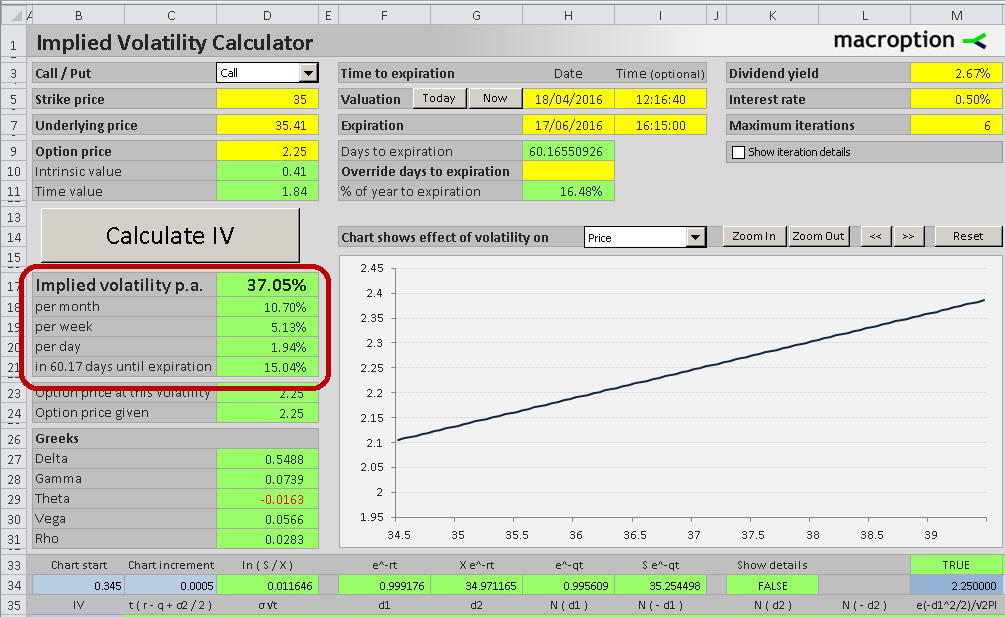

Then divide by the number of. In cell C23 enter STDV C3C22 to calculate the standard deviation for the past 20 days. Assuming 252 trading days per year which has been the average for US stock and option markets in the last years you can convert annual implied volatility to daily volatility by dividing it by the square root of 252 or approximately 1587.

Calculating Stock Volatility 1. Take all of your calculated returns and add them together. And the formula of realized volatility is the square root of realized variance.

For every return Rn a deviation Dn from the mean return m can be found. Knowing this you can easily convert annual volatility to daily volatility by dividing it by the square root of the number of trading days per year. To calculate the annualized historical volatility enter SQRT 252C23 in cell C24.

Traditional Measure of Volatility Most investors know that standard deviation is the typical statistic used to measure volatility. Find the mean return. To convert volatility from daily to annual you need to multiply it by the square root of the number of trading days per year.

The example above used daily closing prices and there are 252 trading days per year on average. The table below shows the volatility for McDonalds within a 10-day timeframe. Firstly gather daily stock price and then determine the mean of the stock price.

The calculation of realized variance for 20 days is the aggregate return for 20 days. Enter each amount into the appropriate cell in column C. The formula for the volatility of a particular stock can be derived by using the following steps.

Add the daily high to its daily low. 124 121 245. View and compare HistoricalVolatilityCalculatorBYPeterHoadley on Yahoo Finance.

This is computed as follows. Therefore in cell C14 enter the formula SQRT 252C13 to convert the standard deviation for this 10-day period to annualized historical volatility. For example if a stock that was trading at 50 drops by 2 in one day that is a 4 percent daily volatility 250 04.

Let us assume the daily stock. Calculate the average mean price for the number of periods or observations. In order to make the result compared to other stocks the value is then annualized.

Volatility is a measure of the company stocks inclination to either increase or decrease during the life of an option and is often calculated by looking at the volatility of public companies whos daily stock prices are available to be analyzed who are similar to your company. This is the volatility during this time. Volatility is measuring the tendency to change not the direction of the change.

Next compute the difference between each days stock price and the. Subtract the daily high from the daily low or 124 minus 121 or 3. Therefore the final step in our calculation is to convert 1-day volatility to annualized volatility which is much more common and much more useful.

Determine each periods deviation close less average price. Calculate the deviations from the mean. Calculation of Volatility of a security Formula For annualized volatility is given below Annualized Volatility Standard Deviation 252 assuming there are 252 trading days in a year.

Square each periods deviation. Standard deviation is simply defined as the square root of the. The calculation steps are as follows.

The example above used daily closing prices and there are 252 trading days per year on average. Therefore in cell C14 enter the formula SQRT 252C13 to convert the standard deviation for. Divide the difference 3 by the sum 245.

Chapter 13 Form 4 Compute Stock Volatility

Chapter 13 Form 4 Compute Stock Volatility

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Understanding Volatility In The Markets 5paisa 5pschool

Understanding Volatility In The Markets 5paisa 5pschool

How Do You Calculate Volatility In Excel

Computing Historical Volatility In Excel

Volatility Trading Converting Annual To Daily Volatility Raging Bull

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg) What Is The Best Measure Of Stock Price Volatility

What Is The Best Measure Of Stock Price Volatility

What Is Historical Volatility And Implied Volatility Financhill

What Is Historical Volatility And Implied Volatility Financhill

Implied Volatility Explained Best Guide W Examples Projectoption

Implied Volatility Explained Best Guide W Examples Projectoption

Volatility Formula Calculator Examples With Excel Template

Volatility Formula Calculator Examples With Excel Template

Historical Volatility Hv Overview How To Calculate

Historical Volatility Hv Overview How To Calculate

How To Calculate Historical Stock Volatility 12 Steps

How To Calculate Historical Stock Volatility 12 Steps

Standard Deviation Volatility Chartschool

Standard Deviation Volatility Chartschool

I Volatility Options Calculator

I Volatility Options Calculator

Volatility Calculation Historical Varsity By Zerodha

Realized Volatility Definition Formula How To Calculate Realized Volatility

Realized Volatility Definition Formula How To Calculate Realized Volatility

Converting Implied Volatility To Expected Daily Move Macroption

Converting Implied Volatility To Expected Daily Move Macroption

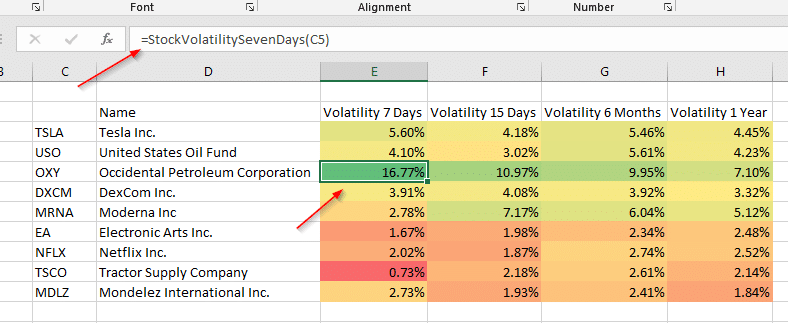

Stock Volatility Calculator Using Marketxls Functions

Stock Volatility Calculator Using Marketxls Functions

Post a Comment for "Stock Daily Volatility Calculation"