Stock Fair Value Lookup

Fair Value and Investments. Using The Graham Number for Stock Valuation.

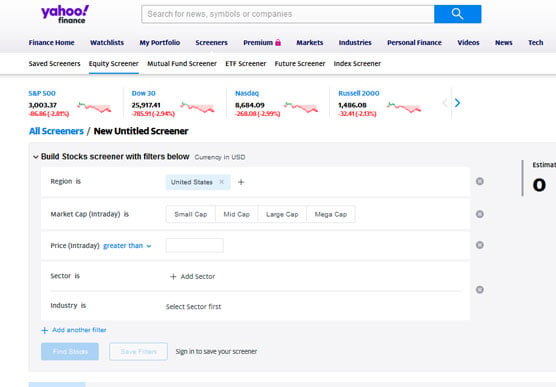

The Yahoo Finance Stock Screening Tool Dummies

The Yahoo Finance Stock Screening Tool Dummies

New York Markets Close in.

Stock fair value lookup. The answer is 3 x 2 or 6. Look up the historical stock quote prices on Marketwatch. Include earning per share cash flow per share earning per share growth revenue growth return on equity EBIT margin and book value per share.

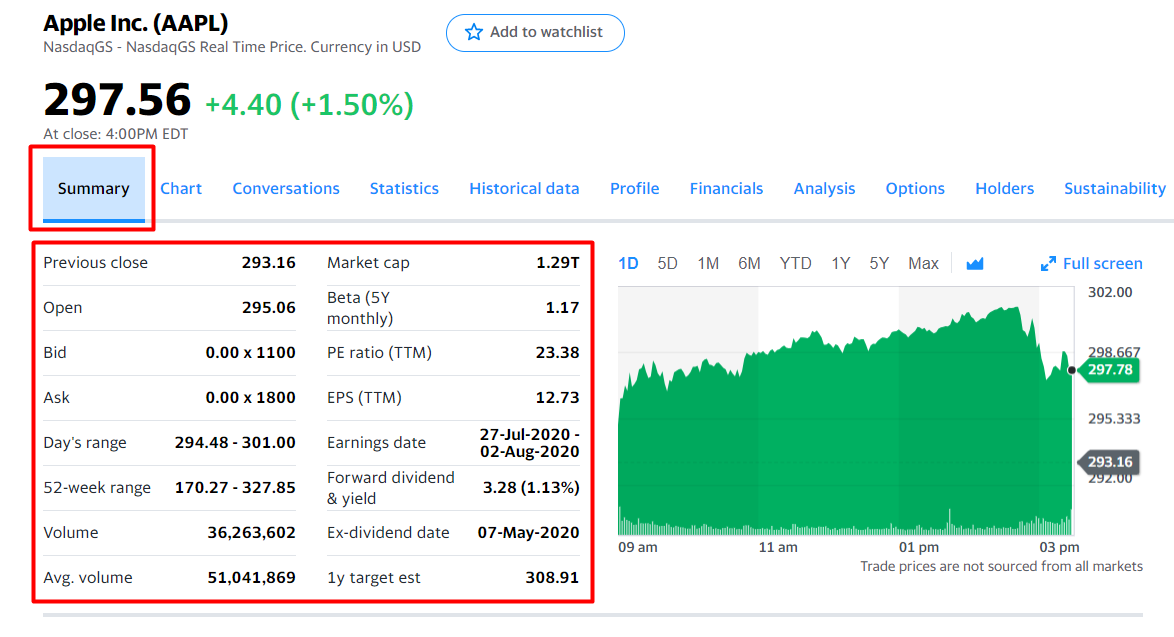

Appraisal - Auction Black Book - Blue Book Comparable Sales Donation Valuation Fair Market Value Insurance - Resale KBB - List Price MSRP - NADA. An equity analyst calculates what they think is the long-term intrinsic value of a stock helping you see beyond the present market price. Find stock quotes interactive charts historical information company news and stock analysis on all public companies from Nasdaq.

My fair value for Nike is 64I came to that price target by putting a 22x multiple on the current consensus 2020 EPS estimate of 289. The fair value of 100 shares would be 100 x 30 3000. Commonly referred to as pull behinds motorcycle trailers are lightweight and compact trailers that are designed to be towed by hitch-equipped motorcycles and smaller economy cars.

An investor needs to determine a stocks fair value or intrinsic value before they decide to buy it. In the investment world a common way to determine a securitys or assets fair value is to list it in a publicly-traded marketplace like a stock exchange. To more accurately determine the true fair value intrinsic value of the stock you can use the advanced calculator.

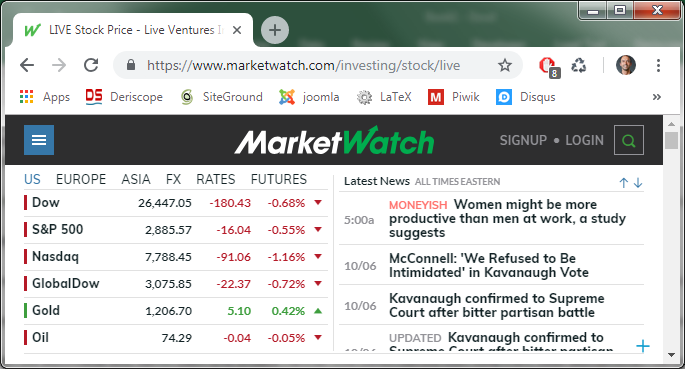

Boat Trailer Used Values and New Prices Trailers manufacturer pricing MSRP and book values. Lookup the fund or stock ticker symbol for any company on any exchange in any country at Marketwatch. The stocks valuation likely limits its downside in 2021 and any bullish momentum will be supplemented by the stocks 34 dividend.

Market Snapshot Winners and Losers. At its core the fair value of a common stock relates to what you are paying to buy a current dollars worth of the companys earnings. In such cases the fair market value is.

Keep a realistic growth rate for efficient calculations. Use respectable financial news and find the last closing price for the stock you want to buy. Value stocks may finally shine in 2021.

The fair market value for this stock is 6 not 10. New PE ratio x Earnings per share. The energy sector is the most undervalued heading into the new year.

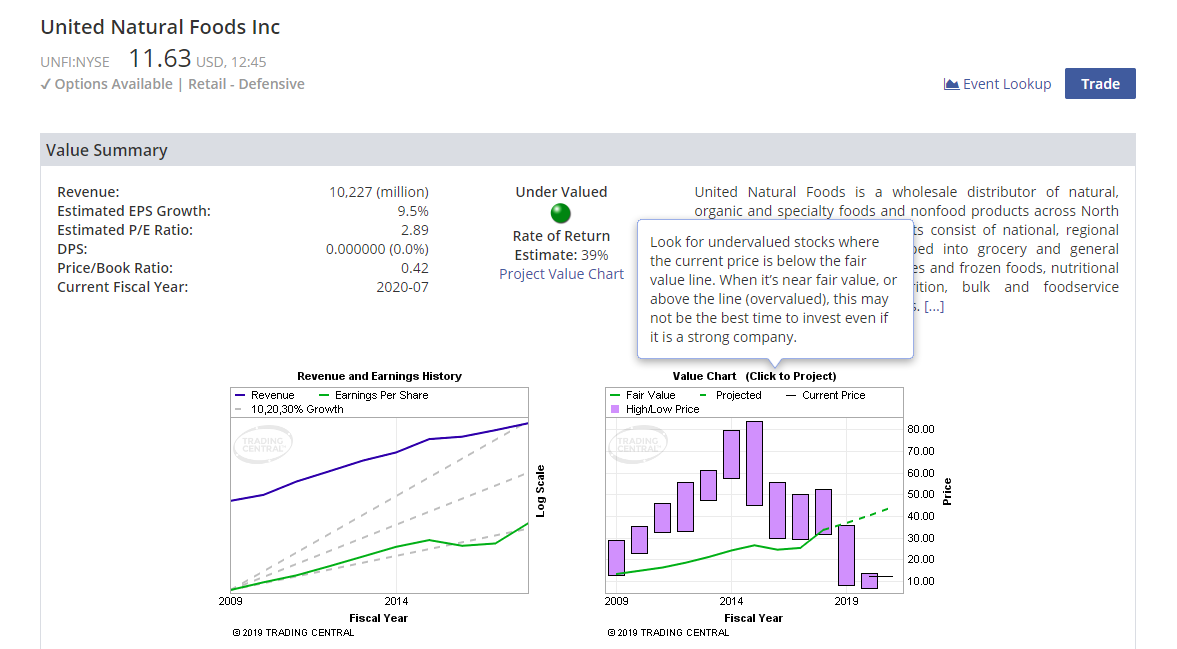

Also you can calculate the fair value using the discounted cash flows. Now you see instantly whether the desired stock is overvalued or undervalued. Once the appropriate valuation period has been determined select it by holding down the mouse button.

Research stock values by date. Grahams number was suggested by Benjamin Graham to estimate the fundamental value of a stock. The fair value of the stock is calculated based on earnings operating cash flows and dividend yields.

Fair market value for publicly traded stock Determining the fair market value is relatively straightforward for stock that is traded on a public exchange. The calculation consists of the following key values. Let us talk only about stocks to keep our discussion simple.

At its most basic level the Graham Number starts with the Book Value Per Share and the Earnings Per Share of a company then multiplies by magic numbers. With a few simple values you can estimate the rough intrinsic value of a stock. Motorcycle trailers are typically equipped with a single-axle to.

It is the expected rate at which the company will grow in the upcoming years. Insert the earning per share EPS and revenue growth into the approximate fair value calculator and get the approximate true fair value intrinsic value of the stock. The median stock in our coverage universe trades at a 10 discount to fair value says director David Meats in his quarterly.

Its not an easy task. Taking the square root of that intermediate value then suggests a reasonable valuation. The graph shows the ratio price to fair value for the median stock in the selected coverage universe over time.

From this perspective fair value depicts the current earnings yield that the investor is receiving on their capital. Right now Nike shares trade for 34x ttm EPS and. A ratio above 100 indicates that the stocks price is higher than Morningstars.

Say you want to buy 100 shares of some company and the last closing price of their stocks was 30. This is a simple discounted model calculator to help you find the fair value of a company.

Algorithmically Drawing Trend Lines On A Stock Chart Stock Charts Chart Lookup Table

Algorithmically Drawing Trend Lines On A Stock Chart Stock Charts Chart Lookup Table

Extratorrent S Main Domain Extratorrent Cc Shut Down By Registrar News 10 Things Alternative Googie

Extratorrent S Main Domain Extratorrent Cc Shut Down By Registrar News 10 Things Alternative Googie

Drako Launches The Whoscrowded App To Disrupt The Nightlife Industry Party Apps University Of Idaho Social Media Party

Drako Launches The Whoscrowded App To Disrupt The Nightlife Industry Party Apps University Of Idaho Social Media Party

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Google Hacks To Speed Up Stock Research Gurufocus Com

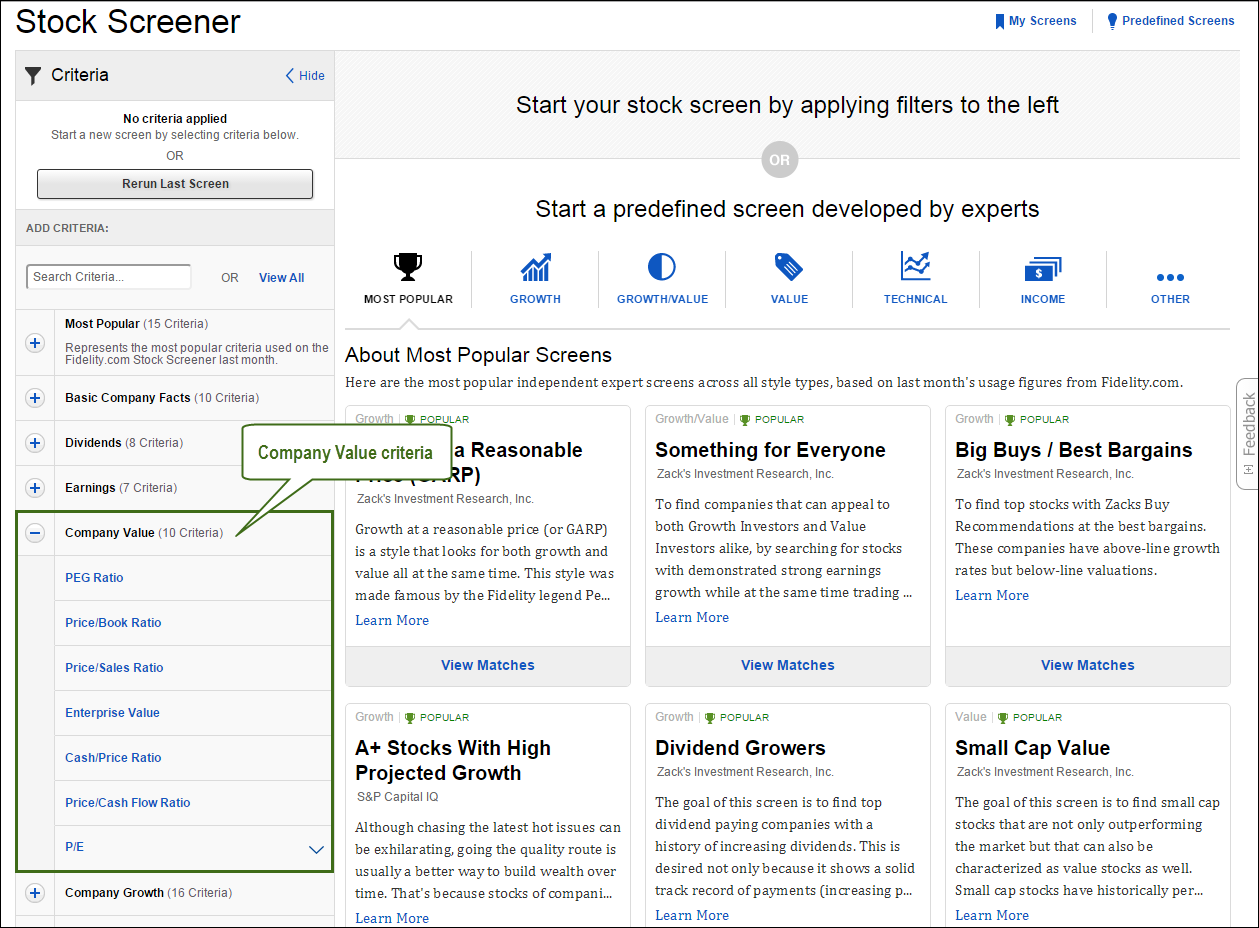

Company Valuation Ratios Fidelity

Company Valuation Ratios Fidelity

Create An Effective Resume And Get Haired Resume Tips Good Resume Examples Resume Examples

Create An Effective Resume And Get Haired Resume Tips Good Resume Examples Resume Examples

Check Any Stock In Value Analyzer

Check Any Stock In Value Analyzer

The 25 Most Used Filters For Stock Screens

The 25 Most Used Filters For Stock Screens

Find Undervalued Stocks Drawing Fast Fair Value Graphs

Find Undervalued Stocks Drawing Fast Fair Value Graphs

:max_bytes(150000):strip_icc()/ScreenShot2019-08-28at1.59.03PM-2e8cb1195471423392644ee65bf2ca31.png) Where Can I Find Historical Stock Index Quotes

Where Can I Find Historical Stock Index Quotes

How I Created My Own Stock Tracker Using Google Sheets By Harish V Making Of A Millionaire Medium

How I Created My Own Stock Tracker Using Google Sheets By Harish V Making Of A Millionaire Medium

How To Scrape Yahoo Finance And Extract Stock Market Data Using Python Lxml

How To Scrape Yahoo Finance And Extract Stock Market Data Using Python Lxml

Personal Inventory Log Template For Excel Jewelry Inventory Jewelry Making Business Spreadsheet Template

Personal Inventory Log Template For Excel Jewelry Inventory Jewelry Making Business Spreadsheet Template

Premarket Stock Trading Data Dow S P Nasdaq Futures

Premarket Stock Trading Data Dow S P Nasdaq Futures

Real Time Stock Prices In Excel Risk Management Guru

Real Time Stock Prices In Excel Risk Management Guru

Post a Comment for "Stock Fair Value Lookup"