Stock Market Terms Call

Therefore to calculate how much it will cost you to buy a contract take the price of the option and multiply it by 100. After a large sell-off or drop in the market a slang term for picking oversold stocks.

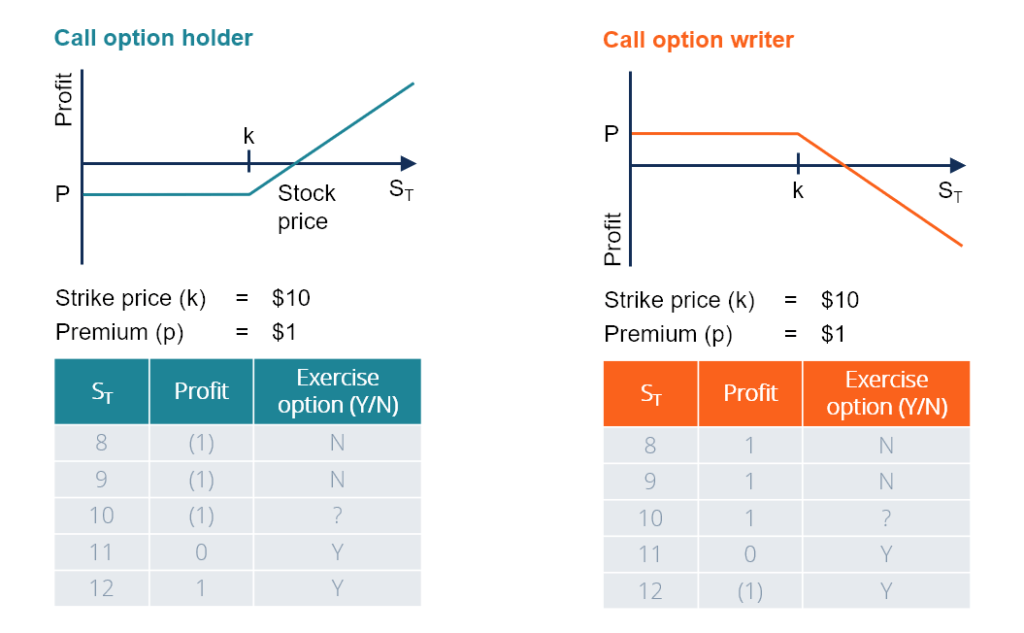

The seller of a Call.

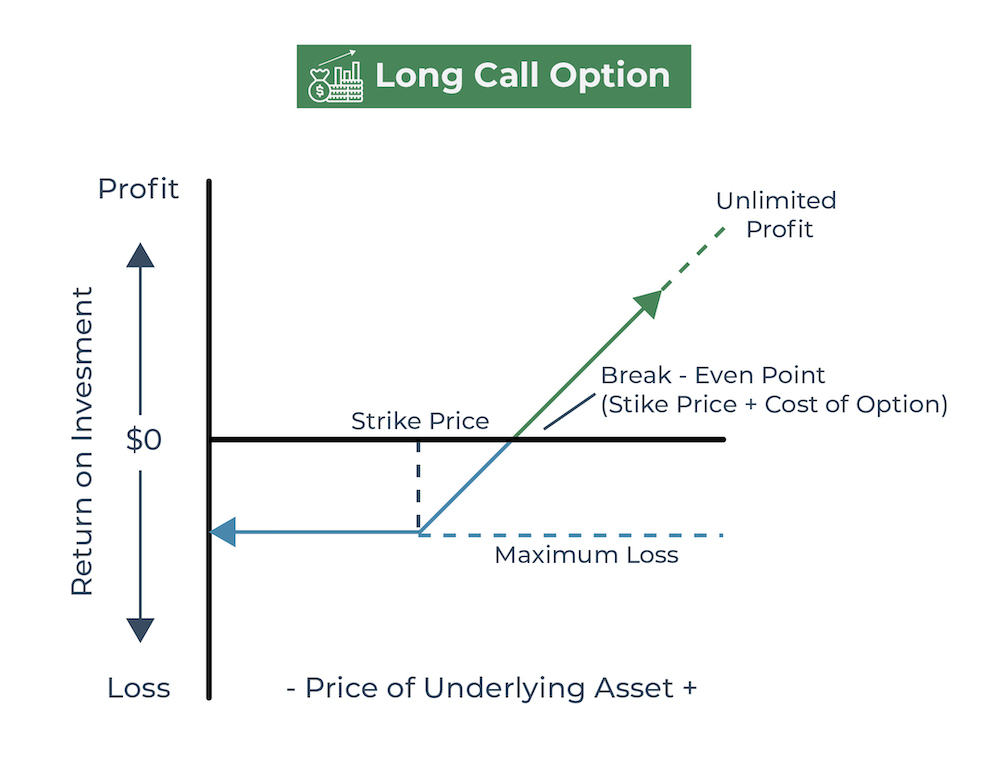

Stock market terms call. The right to buy an agreed amount of a commodity or security for an agreed price by an agreed date. This option gives you the right to buy IBM stock for 95 on or before the 3rd Friday of December. When you buy a call you pay the option premium in exchange for the right to buy shares at a fixed price strike price on or before a certain date expiration date.

Call Option An option which gives the holder the right but not the obligation to buy a fixed amount of a certain stock at a specified price within a specified time. The term call comes from the fact that the owner has the right to call the stock away from the seller. A foolish method of investing when you buy a stock and completely forget about it indefinitely.

Short-term finance repayable on demand. Import substitution development strategy. A bond where the issuer has the option to redeem it early.

Importexport letters of credit. The buyer pays a fee called a premium for this right. A call auction is also known as a call market.

Beta is a measure of the sensitivity of the stock relative to the stock market. Call options are financial contracts that give the option buyer the right but not the obligation to buy a stock bond commodity or other asset or instrument at a specified price within a. Investors most often buy calls.

The intention of this post is to help you familiarize yourself with important terms relating to the stock markets that you would frequently come across in your journey as a stock market investor. Call options give you the right to buy a stock at a specified price. The call auction is a type of trading method on a securities exchange in which prices are determined by trading during a specified time and period.

Orders in a call market at taken at one time and buy or sell price s are then determined. Call Market - A call market is a market where trades are not continuous but rather take place only at specified times. Calls are purchased by investors who expect a price increase.

To believe the market will go up. You dont have to know as much as the manager of a world-famous hedge fund but it helps beginning and intermediate investors to at least know some key definitions and ideas. 4 Call options can be in at or out of the money.

A Call option is a contract that gives the buyer the right to buy 100 shares of an underlying equity at a predetermined price the strike price for a preset period of time. Bid and ask orders are aggregated and transacted at specified. The seller or writer is obliged to sell the commodity or financial instrument to the buyer if the buyer so decides.

This post is a collection of important stock market terms and their meanings. Complete stock market coverage with breaking news analysis stock quotes before after hours market data research and earnings. One stock call option contract actually represents 100 shares of the underlying stock.

If for example the strike price is 60 and the open market price for the stock is 65 at the time the options contract is exercised the options seller will incur a loss of 5 per share of stock. The day the stock market crashed on October 29 1929. Conference Calls - A conference call is an.

What Every Investor Needs to Know. A further payment for partly-paid shares. Canadian Depository for Securities Limited CDS.

A call market or call auction is a type of market mechanism in which each transaction takes place at predetermined time intervals. In the example above lets say you bought an IBM December 95 Call option instead. Stock call prices are typically quoted per share.

To that end weve compiled a master list of stock market terms. You buy a Call option when you think the price of the underlying stock is going to go up.

Strike Price Definition Example

Strike Price Definition Example

Call Option Understand How Buying Selling Call Options Works

Call Option Understand How Buying Selling Call Options Works

Margin Call Overview Formula How To Cover Margin Calls

Margin Call Overview Formula How To Cover Margin Calls

:max_bytes(150000):strip_icc()/dotdash_Final_The_Top_Technical_Indicators_for_Options_Trading_Oct_2020-01-5460e86ccf304d97a32bfd2ca4e7fcaa.jpg) The Top Technical Indicators For Options Trading

The Top Technical Indicators For Options Trading

:max_bytes(150000):strip_icc()/close-up-of-stock-market-data-on-digital-display-1058454392-9e48e65462e14a04a74008cbe0ec9aa9.jpg) Understand The Option Risk With Covered Calls

Understand The Option Risk With Covered Calls

What Does Call Ce And Put Pe Mean In Share Market Quora

:max_bytes(150000):strip_icc()/stock-market-fluctuations-5955e0f63df78cdc29b6dce5.jpg) Investing In Stock Rights And Warrants

Investing In Stock Rights And Warrants

:max_bytes(150000):strip_icc()/dotdash_Final_Forecasting_Market_Direction_With_Put-Call_Ratios_Nov_2020-03-3ae927804fd145b98b411617993187c9.jpg) Forecasting Market Direction With Put Call Ratios

Forecasting Market Direction With Put Call Ratios

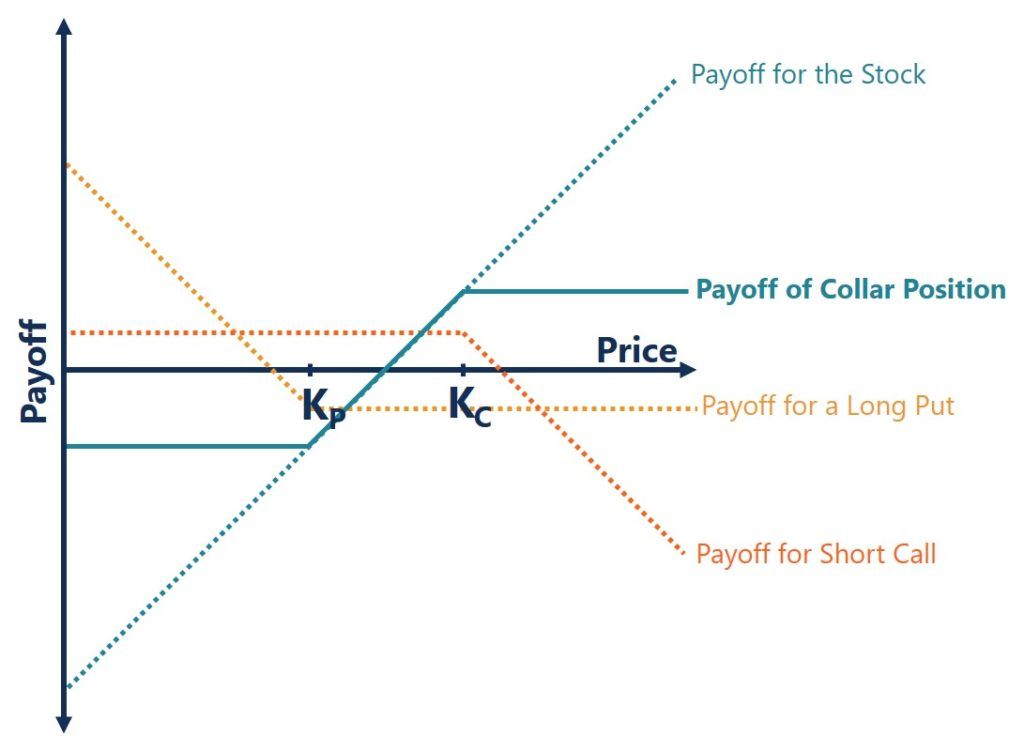

What Is A Collar Option Strategy Corporate Finance Institute

What Is A Collar Option Strategy Corporate Finance Institute

Call Options What They Are And How They Work Nerdwallet

Call Options What They Are And How They Work Nerdwallet

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-f215806b843b4874ae6e1a0481724d7d.jpg) Employee Stock Option Eso Definition

Employee Stock Option Eso Definition

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png) Beginner S Guide To Call Buying

Beginner S Guide To Call Buying

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg) Essential Options Trading Guide

Essential Options Trading Guide

/understandingstraddles2-c0215924b5ba43189e1a136abc5484bf.png)

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

/dotdash_Final_Bear_Call_Spread_Apr_2020-01-876ed1191c524f8dbbea367e3d1bb3b9.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

:max_bytes(150000):strip_icc()/Capitulation12-d3efb4191a234673a04dc23340bb9f7e.png)

/bigstock-Stock-Market-Chart-Big-Data--259733245_2440-ab2b367709b1466a9a064ba3ac693e53.jpg)

:max_bytes(150000):strip_icc()/PutDefinition2-8a7d715894554ca990ef6946cc6a0306.png)

Post a Comment for "Stock Market Terms Call"