Stock Market Zero Sum Game Reddit

Zero-sum games are however less common in real life than non-zero-sum games. However it is difficult to make a clear distinction in real life because things are more difficult and cannot be.

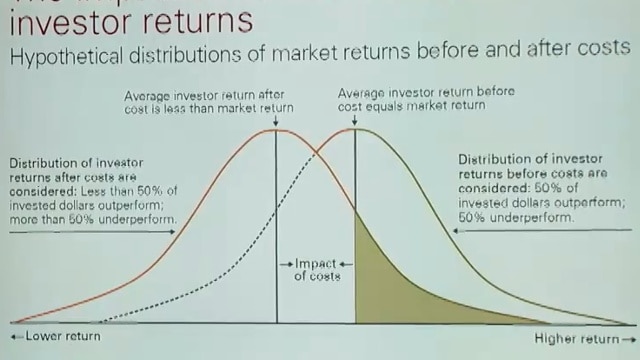

How Does A Zero Sum Game Impact Investors

How Does A Zero Sum Game Impact Investors

Zero-sum is a situation in game theory in which one persons gain is equivalent to anothers loss so the net change in wealth or benefit is zero.

Stock market zero sum game reddit. Widespread shortingwhen you borrow a share sell it and hope to buy it back at a lower priceensures that longs owners of the stock are set against shorts in a zero-sum game. The stock market as a whole is not a zero sum game. What this means is that trying to beat Wall Street at its own zero-sum game.

My point is that the market always has opportunities if youre patient. Investing Isnt a Zero-Sum Game We Can All Win. Importantly this is a positive sum system in the long-term because the pool expands as a result of market value changes.

Stock Market Theory A zero sum game is where the profit made by winners is equal to the loss made by losers hence making it an equal trade off of zero. Though there are always buyers and sellers everyone can win. And the thing about FO is that there are limited number of contracts and they have an expiry.

As in a stock ramps 1020 in the blink of an eye. One persons gain is another persons loss in futures and options. The initial way to view the stock market is as a zero-sum game.

In fact zero-sum games are the complete opposite to a win-win situation such as an agreement of a trade or to a lose-lose situation such as a war. Theres a mistaken tendency to think that a dollar that leaves the equity market translates into a dollar less in the stock market. Buying stocks are not a zero sum game.

With any stock trade one side wins because it buys a security that increases in price or because it sells one that declines. A zero-sum game At its best the stock market is a vehicle for creating generational wealth and one that can benefit all participants. When it comes to the stock market the majority assumes that the market is a zero-sum game.

Trading is a zero-sum game only when you measure gains and losses relative to the market average. Some trading is a zero sum game. The most common instrument of trading shares is Derivatives ie.

However this is not true. After all the money made by someone should come from a source and most believe that it costs from the other losing participant. But as Pagel stresses The stock market is a zero-sum game what one person wins the other loses And right now Wall Street is losing.

Robinhood is trying to stop the bleeding by freezing. Alt-Market Bearish News Boom Bust Blog Capitalist Exploits China Financial Markets Chris Martensons Blog Contrary Investor Credit Writedowns Danerics Elliott Waves DealBook Demonocracy Dr. Housing Bubble ETF Daily News ETF Digest Fibozachi Gains Pains Capital Global Economic Analysis Hedge Accordingly.

Many people believe that the stock market is an example of a zero sum game but they are wrong. The zero sum game is an idea from game theory. The economy is not a zero sum game so buying into the economy is not.

Thousands of so-called retail traders who came together on Reddit have been using apps like Robinhood to buy stock. Trading IS a zero sum game. Innovation technology education all drive productivity what grows the economy.

Widespread shortingwhen you borrow a share sell it and hope to buy it back at a lower priceensures that longs owners of the stock are set against shorts in a zero-sum game. In a zero sum game gains for one person s causes losses for another person s. In the zero-sum game there is always one winner and one loser.

The amount that one trader profit has to be equal to the amount the other loses. It finds most of its application in economics and political theory. A zero-sum game may have as.

That would mean the winners can profit only the amount that losers are ready to lose. This is very different from a zero sum game like a poker game which experiences an expansion in the size of the pool only when more people join the pool and not because the assets in the existing pool change value. The stock market is not a zero-sum game.

Investing in stock can be mutually beneficial.

Why You Should Care About The Zero Sum Game Video Financinglife Org

Why You Should Care About The Zero Sum Game Video Financinglife Org

Pin By Jeremy Burns On Quotes To Live By Stock Market Quotes Quotes To Live By Marketing Quotes

Pin By Jeremy Burns On Quotes To Live By Stock Market Quotes Quotes To Live By Marketing Quotes

Compxm 2019 Personal Support Emergency Loans Tips Zero Sum Game

Compxm 2019 Personal Support Emergency Loans Tips Zero Sum Game

Debunking The Option Trading Myth Of Zero Sum

Debunking The Option Trading Myth Of Zero Sum

Top 45 Quotes About Zero Sum Game Famous Quotes Sayings About Zero Sum Game

Top 45 Quotes About Zero Sum Game Famous Quotes Sayings About Zero Sum Game

Is The Stock Market Investing A Zero Sum Game Animated Youtube

Is The Stock Market Investing A Zero Sum Game Animated Youtube

Compxm 2019 Free Winning Guide And Tips Good Notes Guide Tips

Compxm 2019 Free Winning Guide And Tips Good Notes Guide Tips

E Mini Trading Should You Trade Candlesticks Heiken Ashi Or Better Renko Bars Forextrading Renkochartsandtrading Renkocharts Forex Forex Chart Trading

E Mini Trading Should You Trade Candlesticks Heiken Ashi Or Better Renko Bars Forextrading Renkochartsandtrading Renkocharts Forex Forex Chart Trading

Forexracer Professional Renko Trading System Trading Charts Forex Things To Sell

Forexracer Professional Renko Trading System Trading Charts Forex Things To Sell

Using The Flag Chart Pattern Effectively Chart Stock Charts Technical Analysis Tools

Using The Flag Chart Pattern Effectively Chart Stock Charts Technical Analysis Tools

Capitalism Is Not A Zero Sum Game

Capitalism Is Not A Zero Sum Game

Compxm 2019 Board Queries Quiz Support Good Notes Exam Results This Or That Questions

Compxm 2019 Board Queries Quiz Support Good Notes Exam Results This Or That Questions

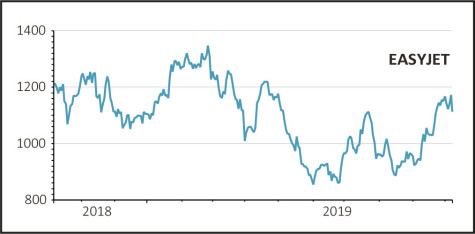

Why Shares In Easyjet Are Descending Despite Strikes At Rivals Boosting Profit Shares Magazine

Why Shares In Easyjet Are Descending Despite Strikes At Rivals Boosting Profit Shares Magazine

Price Action Methods To Define The Intraday Trading Charts Trend Trading Trading

Price Action Methods To Define The Intraday Trading Charts Trend Trading Trading

How To Win At The Stock Market By Being Lazy Orlando Sentinel

How To Win At The Stock Market By Being Lazy Orlando Sentinel

What Is A Zero Sum Game Youtube

What Is A Zero Sum Game Youtube

Download Forex Gump Indicator Free Best Scalping For Mt4 Forex Forex Trading Training Forex Brokers

Download Forex Gump Indicator Free Best Scalping For Mt4 Forex Forex Trading Training Forex Brokers

Cartoon 38 The Negative Sum Game In Investing Investing Negativity Sum

Cartoon 38 The Negative Sum Game In Investing Investing Negativity Sum

Post a Comment for "Stock Market Zero Sum Game Reddit"