Stock Price Calculation From Balance Sheet

Substituting the values in the formula we get 33000500000100 66 Therefore Mark owns roughly 7 of XYZ. Calculation of Balance sheet ie Total asset of a company will sum of liability and equity.

How Do You Calculate A Company S Equity

This is a simple way of calculating how valuable a company is to traders at that moment.

Stock price calculation from balance sheet. For example if the firms total common stockholders equity is 41 million and the average number of common shares outstanding is 65000 then the stock prices book value for the firm would be 40. During this time Ive probably used 10 or so different portfolio trackers but nothing met my needs. Total Asset 1500 2000.

Ownership Percentage of Mark Number of common stocks owned by Mark Total number of Outstanding shares 100. How to Calculate Stock Price Per Common Share From the Balance Sheet Step 1. The Calculation You can calculate enterprise value by adding a corporations market capitalization preferred stock and outstanding debt together and then subtracting out the cash and cash equivalents found on the balance sheet.

Profit P SP NS - SC - BP NS BC Where. Multiply the percentage by your EFN. Calculate the firms stock price book value from the balance sheet.

The intrinsic value p of the stock is calculated as. Divide the firms total common stockholders equity by the average number of common shares outstanding. Keep in mind that equity is not just comprised of common stocks.

Note the difference between book value per share and market price per share. Calculations using the balance. I dont do complicated transactions but still nothing could really satisfy me.

Market cap is calculated by taking the current share price and multiplying it by the number of shares outstanding. Add the ending inventory to the COGS. A stock portfolio tracker using Google Drive with advanced functions than your average tracker.

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Are hybrid securities that have features of. The balance sheet can tell you whether a companys got enough money to keep funding growth or whether itll have to take on debt or issue bonds or additional stock to sustain itself.

2 005 - 003 100. Preferred stocks Cost of Preferred Stock The cost of preferred stock to a company is effectively the price it pays in return for the income it gets from issuing and selling the stock. Continuing the example multiply 100 percent or 1 by 10000 to get 10000.

For example 300 1200 1500. According to the Gordon Growth Model the shares are correctly valued at their intrinsic level. To calculate your new beginning inventory subtract the amount of purchased inventory from this amount.

Youll need the net income and preferred stock dividends if any from the income statement as well as the number of common shares outstanding which can be found in the stockholders equity. 1500 - 800 700. Subtract the preferred shareholders dividends from the companys net profit.

For example if the company has 14 million in net profit and pays 23 million in preferred shareholder dividends subtract 23 million from 14 million to get 117 million in earnings available to common shareholders. The Stock Calculator uses the following basic formula. For example a company with 50 million shares and a stock price of 100 per share.

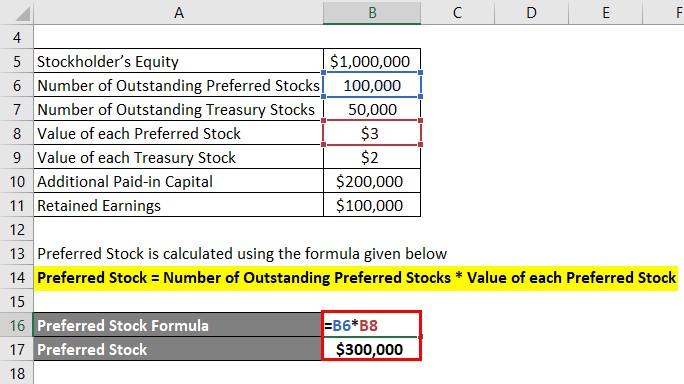

NS is the number of shares SP is the selling price per share BP is the buying price per share SC is the selling commission BC is the buying commission. However in some of the cases where there is no preferred stock additional paid-in capital and treasury stock then the formula for common stock becomes simply total equity minus retained earnings. Common Stock Total Equity Preferred Stock Additional Paid-in Capital Retained Earnings Treasury Stock.

To calculate it take the most recent share price of a company and multiply it by the total number of outstanding shares. A project that Ive always had was to improve on my stock portfolio tracking spreadsheets. Get it for yourself.

The total asset of a company is 3500. In the below-given figure we have shown the calculation of the balance sheet. Then add the result to the common stock amount from your current balance sheet to calculate the common stock on your pro-forma balance sheet.

As with the market price this value fluctuates with market forces. Divide the firms total common stockholders equity by the average number of common shares outstanding. Calculate the firms stock price book value from the balance sheet.

Your beginning inventory for the accounting period is 700. Locate shareholders equity on the balance sheet. For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices book value for the firm would be 63.

Shareholders equity represents the amount available.

Simple Balance Sheet Structure Breakdown By Each Component

Simple Balance Sheet Structure Breakdown By Each Component

Bottom Fishing Stocks Finance Investing Stock Picks Trade Finance

Bottom Fishing Stocks Finance Investing Stock Picks Trade Finance

Understanding Balance Sheet Statement Part 1 Varsity By Zerodha

Making Sense Of Your Balance Sheet Bookkeeping Business Small Business Accounting Accounting Basics

Making Sense Of Your Balance Sheet Bookkeeping Business Small Business Accounting Accounting Basics

Pin By Stock Target Entry Price On Stock Target Entry Price Stock Analysis Time Value Of Money Return On Equity

Pin By Stock Target Entry Price On Stock Target Entry Price Stock Analysis Time Value Of Money Return On Equity

How Are Book Value And Market Value Different

5 Types Of Financial Statements Balance Sheet Income Cash Flow 2 Financial Statement Accounting And Finance Financial

5 Types Of Financial Statements Balance Sheet Income Cash Flow 2 Financial Statement Accounting And Finance Financial

20 Balance Sheet Ratios Every Investor Must Know 20 Balance Sheet Ratios To Help You Determ In 2020 Financial Ratio Financial Statement Analysis Financial Analysis

20 Balance Sheet Ratios Every Investor Must Know 20 Balance Sheet Ratios To Help You Determ In 2020 Financial Ratio Financial Statement Analysis Financial Analysis

Poultry Farm Valuation Model Template Efinancialmodels Poultry Farm Spreadsheet Template Financial Modeling

Poultry Farm Valuation Model Template Efinancialmodels Poultry Farm Spreadsheet Template Financial Modeling

P S Ratio Financial Ratios Financial Ratio Fundamental Analysis Investment Analysis

P S Ratio Financial Ratios Financial Ratio Fundamental Analysis Investment Analysis

Personal Balance Sheet How To Create A Personal Balance Sheet Download This Personal Balance Sheet Template N Liability Balance Sheet Balance Sheet Template

Personal Balance Sheet How To Create A Personal Balance Sheet Download This Personal Balance Sheet Template N Liability Balance Sheet Balance Sheet Template

The Income Statement Statement In A Nutshell Fourweekmba Income Statement Cash Flow Statement Income

The Income Statement Statement In A Nutshell Fourweekmba Income Statement Cash Flow Statement Income

How To Calculate Retained Earnings On A Balance Sheet Business Finance Finance Financial Statement

How To Calculate Retained Earnings On A Balance Sheet Business Finance Finance Financial Statement

Financial Statement Format For Llp Seven Exciting Parts Of Attending Financial Statement For Balance Sheet Template Balance Sheet Financial Statement

Financial Statement Format For Llp Seven Exciting Parts Of Attending Financial Statement For Balance Sheet Template Balance Sheet Financial Statement

How To Calculate A Paid In Capital Balance Sheet Formula Or Equation The Motley Fool

How To Calculate A Paid In Capital Balance Sheet Formula Or Equation The Motley Fool

Common Stock Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

The Srf Stock Is A Market Outperformer But Its Balance Sheet Doesn T Justify The Rich Valuation Fixed Asset Balance Sheet Share Prices

The Srf Stock Is A Market Outperformer But Its Balance Sheet Doesn T Justify The Rich Valuation Fixed Asset Balance Sheet Share Prices

Financial Statements Financial Accounting Financial Statement Finance Investing

Financial Statements Financial Accounting Financial Statement Finance Investing

List Your Assets Vs Liabilities To Calculate Net Worth Solving Linear Equations Word Problem Worksheets Liability

List Your Assets Vs Liabilities To Calculate Net Worth Solving Linear Equations Word Problem Worksheets Liability

Post a Comment for "Stock Price Calculation From Balance Sheet"