Average Recovery Time For Stock Market Crash

Recovery Will Crash The Stock Market. Could let it crest a little over the target for some time.

Warnings Of A 2021 Market Crash Online Side Hustle Value Investing Are You Bored

Warnings Of A 2021 Market Crash Online Side Hustle Value Investing Are You Bored

The bounce-back from the 2008 crash took five and a half years but an additional half year to regain your purchasing power.

Average recovery time for stock market crash. The average time for stocks to recover was 12 years. A correction is defined as a 10 decline in one of the major US. Its taken two years on average to come back from bear markets since 1946.

Among the primary causes of the chaos were program trading and illiquidity both of which fueled the vicious decline for the. All-Stock Portfolio Stock prices suffer during financial crises but they typically recover over time. In 2000 it took about five years.

There are 252 trading days in a year so. According to a research note from Bank of America Securities it has taken 1100 trading days on average to regain the territory lost during a bear market. For investors who sold at the bottom of these markets these down times had a detrimental effect.

During this period the average expansion was approximately 58 months and the average contraction was approximately 11 months. The Depth of Corrections And here we are. Infamous stock market crash that represented the greatest one-day percentage decline in US.

Stock market history culminating in a bear market after a more than 20 plunge in the SP 500 and Dow Jones Industrial Average. But after the 1987 crash it took about 23 months to get back. Now mean reversion.

Down 86 over 34 months. When it comes to non-recession corrections it takes less than a year to recover or an average of about ten months to be more precise. Following that crash it took about 6 years for prices to recover to their previous all-time highs.

31 1945 to Oct. In 7 of 11 historical drops it only took one year for the SP 500 to recover to its previous all-time high. And of course those who stayed in long enough to experience a subsequent recovery were better off.

Market Recovery After Financial Crises. In 1990 it took about eight months. CFRA SP 500 index price declines from Dec.

Note specifically that the market can recover. In the short term Continue reading. In general the stock market is incredibly resilient in its recoveries from drops.

After the 1929 crash it took investors 16 years to restore their investments if they invested at the market high. While this certainly means some took longer others took much less time. Stock indexes typically the SP 500 or Dow Jones Industrial Average from a recent 52-week high close.

Remaining focused on the long-term is important when in the middle of a bear market. Bear markets since the mid-1920s it took an average of 31 years for the broad market to recover from where it stood before the. If we exclude this data point we get an average of 38 years to fully recover.

But keep in mind the average was highly influenced by the six years it took to recover from the bear market in the 1970s. According to the Wall Street Journal taking into account all US. The mean time to recovery for bear markets is 702 days which is nearly twice as long as it took to reach a trough.

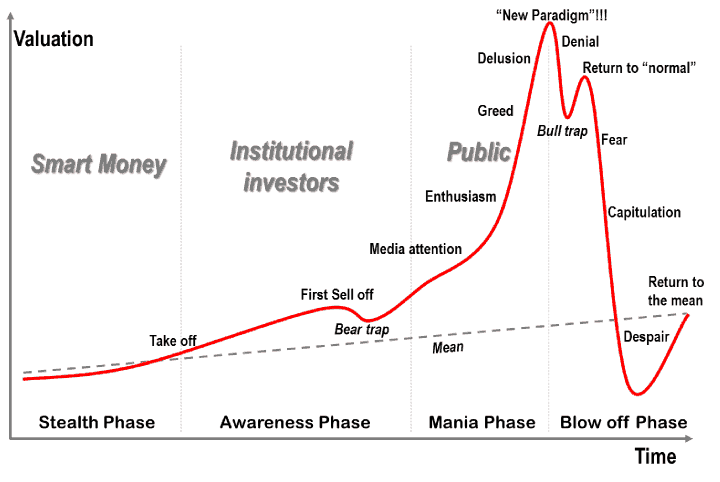

If there were one chart that could explain the stock market right now it would be this. And for routine bear markets with declines of 20 to 40 the comeback has only taken 14 months says CFRA. Stock Market Crash and Recovery.

On average and with some exceptions its paid off to stay the course after a really brutal year. Most recently it took 49 months to recover from the 57 meltdown in 2007-2009 and 56 months following he 2000-2002 bust. 2008 was one of the very worst years the stock market ever had.

This image illustrates the cumulative returns of an all-stock portfolio after six historical US. Starting with the tech wreck in 2000 inflation totaled 357 prolonging the real recovery in purchasing power an additional seven years and nine months.

Data Reveals The Stock Market Crash Is Far From Over Traders Magazine

Data Reveals The Stock Market Crash Is Far From Over Traders Magazine

New Highs From The Infamous V What S Next Sassy Options Marketing What Next V Shape

New Highs From The Infamous V What S Next Sassy Options Marketing What Next V Shape

The Stock Market Crash Of 1929 What You Need To Know

Mkt Returns Are Rarely Average Global Stock Market Equity Market Richard Feynman

Mkt Returns Are Rarely Average Global Stock Market Equity Market Richard Feynman

This Is A Graph Of The Dow Jones Industrial Average During The 1920 S Each Point On The Dow Repres Dow Jones Industrial Average Stock Market Crash Stock Index

This Is A Graph Of The Dow Jones Industrial Average During The 1920 S Each Point On The Dow Repres Dow Jones Industrial Average Stock Market Crash Stock Index

Secular Bull Market Analogs Investment Analysis Stock Market Marketing

Secular Bull Market Analogs Investment Analysis Stock Market Marketing

Internet Bubble Bursting And Time To Breakeven Event Marketing Stock Market Crash Stock Market History

Internet Bubble Bursting And Time To Breakeven Event Marketing Stock Market Crash Stock Market History

Diversification And The Average Investor Marketing Asset Management Charts And Graphs

Diversification And The Average Investor Marketing Asset Management Charts And Graphs

What Happened Each Time Rates Spiked The Big Picture Stock Market Investing In Stocks Stocks For Beginners

What Happened Each Time Rates Spiked The Big Picture Stock Market Investing In Stocks Stocks For Beginners

This Chart Shows What Happens When You Hold Stocks For Decades Stock Market Stock Market Crash Marketing

This Chart Shows What Happens When You Hold Stocks For Decades Stock Market Stock Market Crash Marketing

Don T Be Fooled By The Stock Market S Rally Smart Money Is Staying On The Sidelines

Don T Be Fooled By The Stock Market S Rally Smart Money Is Staying On The Sidelines

Prospective Probabilities Following A Down Year Stock Market Marketing Probability

Prospective Probabilities Following A Down Year Stock Market Marketing Probability

The Most Bullish Chart In The World Has A Big Stock Market Crash In The Middle Of It Stock Market Stock Market Crash Marketing

The Most Bullish Chart In The World Has A Big Stock Market Crash In The Middle Of It Stock Market Stock Market Crash Marketing

Here S How Long Stock Market Corrections Last And How Bad They Can Get

Here S How Long Stock Market Corrections Last And How Bad They Can Get

Ndr The Deeper The Decline The Longer The Recovery Enterprise Value Stock Market Marketing

Ndr The Deeper The Decline The Longer The Recovery Enterprise Value Stock Market Marketing

What Slower Growth Means For Investors Fidelity Developed Economy Stock Research Growth

What Slower Growth Means For Investors Fidelity Developed Economy Stock Research Growth

Here S How Long It Really Takes To Recover From Stock Market Crashes Goldsilver Com

Here S How Long It Really Takes To Recover From Stock Market Crashes Goldsilver Com

Post a Comment for "Average Recovery Time For Stock Market Crash"