Do Stocks Always Drop In December

As a mutual fund investor youre probably socking your hard-earned funds away in preparation for retirement or a big-ticket purchase. After markets trading is less efficient so traders are taking less favorable prices.

Fang Stock Diamondback Energy Stock Drops Is Fang A Buy Investment Loss Stocks To Watch Stock Broker

Fang Stock Diamondback Energy Stock Drops Is Fang A Buy Investment Loss Stocks To Watch Stock Broker

The stock market tends to go down in late December.

Do stocks always drop in december. Why Do Mutual Funds Always Drop in Value in Late December or Early January. How seasons holidays affect stocks. The January Effect suggests that large funds tend to rebalance their portfolios and investors sell underperforming stocks to take advantage of capital losses at the end of December.

On another five occasions the. The last hour of trading is the second most volatile hour of the trading day. Funds gain income from the securities the funds hold dividends for funds holding stock and interest income for funds holding bonds and money market instruments.

Still people believe that the first day of the work week is best. Analysts generally attribute this rally to an increase in buying which follows the drop in price. That research led to the conclusion that stocks tend to go up in value during the first week of the year.

Some people think. This can be because there are fewer traders active in the market for example over summer holidays or more traders in the market for example as companies and investors. Setting aside December 2018 where of course we do not know the ultimate outcome the SP 500 fell by at least 8 on 17 occasions.

The market closes at 4 pm. That translates to lower prices with todays economy but can just as easily translate to higher prices during a bull market. Barclays Capital market research team thinks the reason for the sell-off is because retail outflows have picked up unlike in the October sell-off.

The week after the arrival of the new year is one of those. Stock prices are influenced by a lot more than just the calendar but they do tend to do better at certain times of the year than others. Six times stocks immediately rose.

CNBCs Jim Cramer says he doesnt think the stock market will drop in December as it did last year. This may also be a tactic you can take advantage of. The stock market is subject to a seasonal effect in that at certain times of the year month or even week share prices can rise or fall.

The January Effect is a perceived seasonal increase in stock prices during the month of January. Investors tend to sell losing stocks at the end of December so they can claim tax. After that liquidity dries up in nearly all stocks and ETFs except for the very active ones.

Since 1950 the SP 500 index has never had its. The SP 500 closed in a bear market in December 2018 using intraday data. When the markets are open you have thousands of investors seeking to trade with each other after markets only a.

Also funds may realize capital gains when they liquidate holdings. There is no such thing as a sure bet in the market but December may come close since it has never been the worst month of the year for stocks. December has historically been the strongest trading month of the year but last year the SP 500.

The JanuaryDecember effects really do move the markets. Many day traders only trade the first hour and last hour of the trading day. Yes it happened last ie december 2018 that is why everyone is expecting a dip this year too.

While some do so monthly or quarterly most do so annually during the last half of December. Anecdotally traders say the stock market has had a tendency to drop on Mondays. Doesnt much surprise me to see January and December leading in the long term.

Its called the Monday Effect. The January effect takes place from the last trading day in December through the fifth trading day in January. Generally Stock market dips is not happening at the end of the year.

In fact it appears that the market shows unusual growth in record proportions. Look like it is not going to happen. Most mutual fund investors are fairly conservative folks with relatively long investment time frames.

This may affect your stockseven if you dont sell anything. Bear markets have lasted 145 months on average and have taken two years to recover on average. Mutual funds are getting cashed in and stocks.

Top 10 Canadian Dividend Stocks December 2020 Dividend Stocks Dividend Dividend Investing

Top 10 Canadian Dividend Stocks December 2020 Dividend Stocks Dividend Dividend Investing

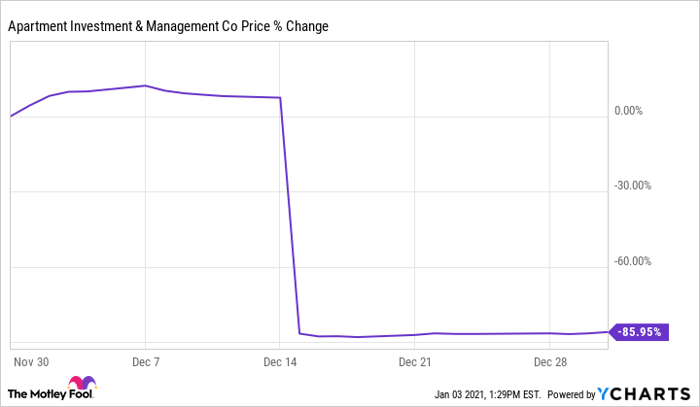

Why Apartment Investment And Management Stock Plummeted 86 In December Nasdaq

Why Apartment Investment And Management Stock Plummeted 86 In December Nasdaq

U S Mortgage Rates Fall To A Record Low 2 71 For 30 Year Loans Mortgage Rates Mortgage Loan

U S Mortgage Rates Fall To A Record Low 2 71 For 30 Year Loans Mortgage Rates Mortgage Loan

Jpmorgan S Complete Guide To Everything Going On In Global Markets Right Now Investment Services Investing Negative Relationships

Jpmorgan S Complete Guide To Everything Going On In Global Markets Right Now Investment Services Investing Negative Relationships

December Nyse Stock Summary Trends Weekly Wwwstocktrendscom Stockmarket Investing Decem Stock Market Stock Market Trends Stock Market Investing

December Nyse Stock Summary Trends Weekly Wwwstocktrendscom Stockmarket Investing Decem Stock Market Stock Market Trends Stock Market Investing

Should You Sell Stocks In December

Should You Sell Stocks In December

S6mbtondagtydearklwo Ktviugtng Raggxnia9xe7nnyuiu9ckp8rbuwl8wbtrevnvtbsand7yvrmxfefmsbjiccfpjeacu9j15gnk97 Smk Financial Institutions Economics Commercial Bank

S6mbtondagtydearklwo Ktviugtng Raggxnia9xe7nnyuiu9ckp8rbuwl8wbtrevnvtbsand7yvrmxfefmsbjiccfpjeacu9j15gnk97 Smk Financial Institutions Economics Commercial Bank

Here S How Long Stock Market Corrections Last And How Bad They Can Get

Here S How Long Stock Market Corrections Last And How Bad They Can Get

Both Metals Missed The Time Targets Which Were Set On The 13th Of December For Gold And On The 20th Of December For Sil Silver Chart The Last Drop Silver Gold

Both Metals Missed The Time Targets Which Were Set On The 13th Of December For Gold And On The 20th Of December For Sil Silver Chart The Last Drop Silver Gold

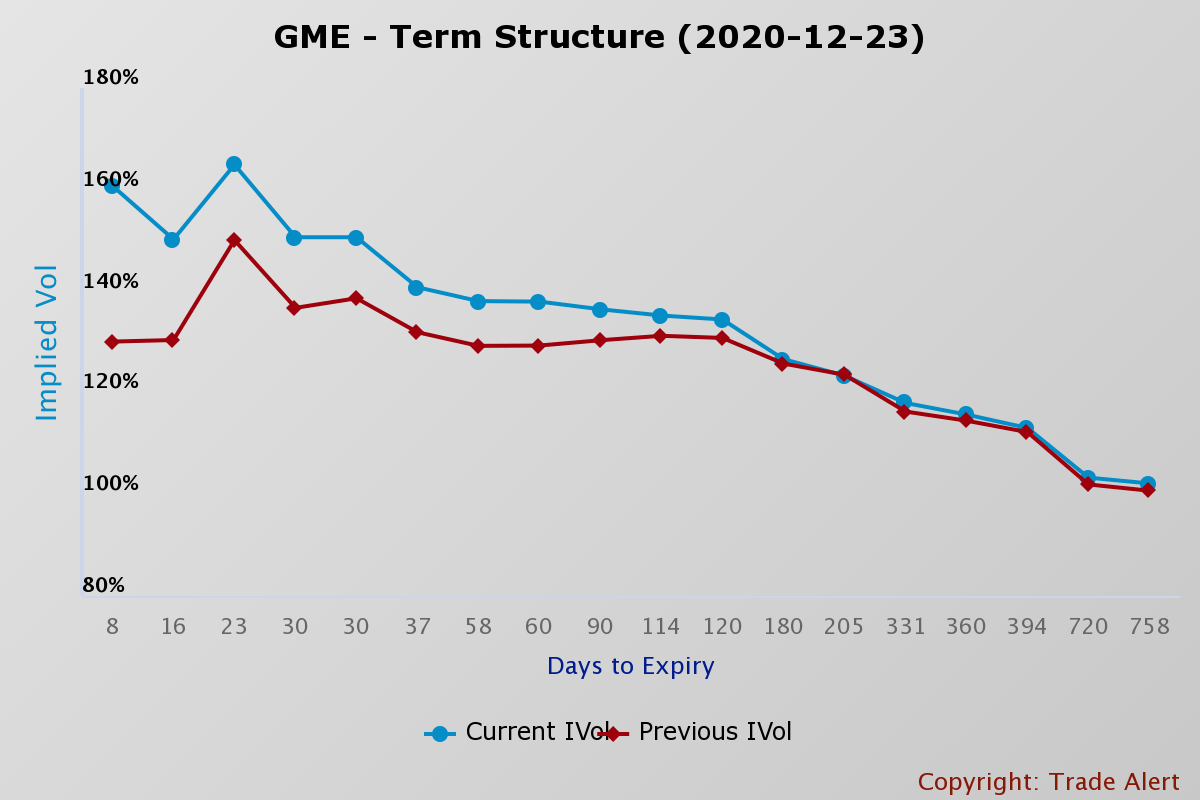

Gamestop S Soaring Stock May Crash And Burn Nyse Gme Seeking Alpha

Gamestop S Soaring Stock May Crash And Burn Nyse Gme Seeking Alpha

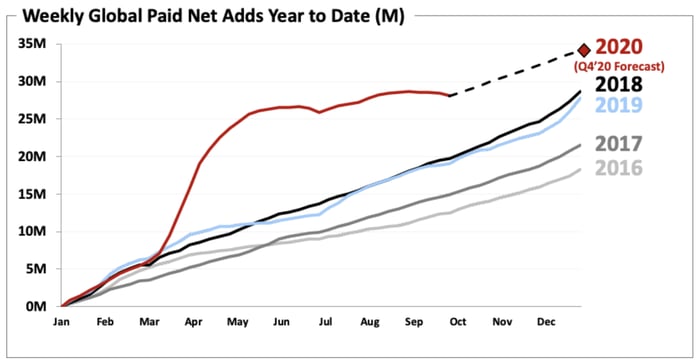

Investors Everywhere Are Basically Screwed At This Point Charts And Graphs Business Insider Pay Attention To Me

Investors Everywhere Are Basically Screwed At This Point Charts And Graphs Business Insider Pay Attention To Me

Now We Are On Whatsapp Join Our Whatsapp Group For Free Stock Equity And Commodity Trading Tips With Latest Market Update Trading Learn Forex Trading Forex

Now We Are On Whatsapp Join Our Whatsapp Group For Free Stock Equity And Commodity Trading Tips With Latest Market Update Trading Learn Forex Trading Forex

Will Tesla Do Another Stock Split In 2021 Nasdaq

Will Tesla Do Another Stock Split In 2021 Nasdaq

Best Time S Of Day Week And Month To Trade Stocks

What Does Seasonal Analysis Say About Stock Market Trends In December And 2020 Currency Com

What Does Seasonal Analysis Say About Stock Market Trends In December And 2020 Currency Com

3 Hot Stocks To Buy In December Nasdaq

3 Hot Stocks To Buy In December Nasdaq

Alpha Stock News Alphabetastock Com Stocks To Watch Stock News Risk Aversion

Alpha Stock News Alphabetastock Com Stocks To Watch Stock News Risk Aversion

Post a Comment for "Do Stocks Always Drop In December"