Ko Stock Buyback

The Coca-Cola Company NYSE. In depth view into Coca-Cola Co Buyback Yield explanation calculation historical data and more.

The Board of Directors of The Coca-Cola Company today authorized a new share repurchase program of 500 million additional shares of the Companys common stock.

Ko stock buyback. Thus this buy back program is almost 35 of the current outstanding shares. Start My Free Trial No credit card required. View Stock Buyback Annual for KO Access over 100 stock metrics like Beta EVEBITDA PE10 Free Cash Flow Yield KZ Index and Cash Conversion Cycle.

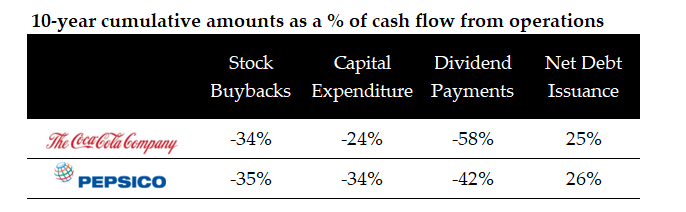

The first is that Pepsico is a much larger company than Coca-Cola. The companys current share repurchase program for 500 million shares was announced in October 2012. KO has spent freely on buybacks in recent years.

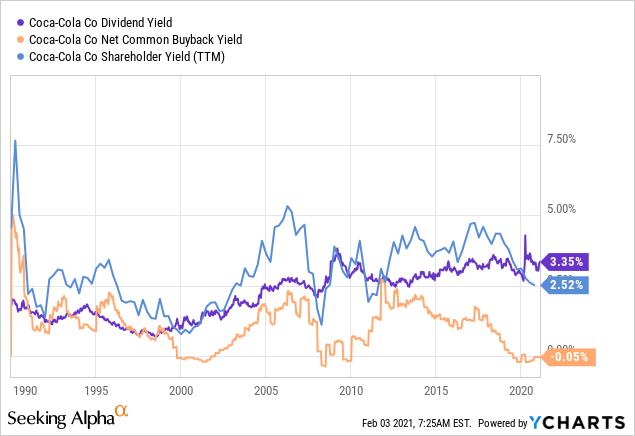

KO Buyback Yield as of today February 21 2021 is -025. The companys initial share repurchase program began in 1984. A share buyback occurs when a company purchases some of its shares in the open market and retires these outstanding shares.

The new program will take effect upon the conclusion of the Companys current program which began in 2006. Stock buybacks are big business. The new program would represent about 35 of the.

Common stock 0092 share of Columbia Pictures Entertainment Inc. PEP Stock Buybacks TTM data by YCharts Looking for more growth The good news is that Pepsi is targeting another year of market-thumping growth with organic sales rising in the mid-single digits. Coke said the new buyback program will go into effect when the current program for 500 million shares announced in October 2012 is completed.

Distribution of a dividend in-kind of Columbia Pictures Entertainment Inc. The second is that Pepsico grew its revenue in the 4th quarter and in 2020 which puts it in a much better position than Coke going into 2021. Pepsico reported 2246 billion in revenue-producing 88 quarterly growth and 48 annual growth.

Start your free 7-Day Trial. Coca-Colas stock buyback policies seem. The Coca-Cola Companys strong brand equity marketing research and innovation help it to garner a market share of more than 40 in the non-alcoholic beverage industry.

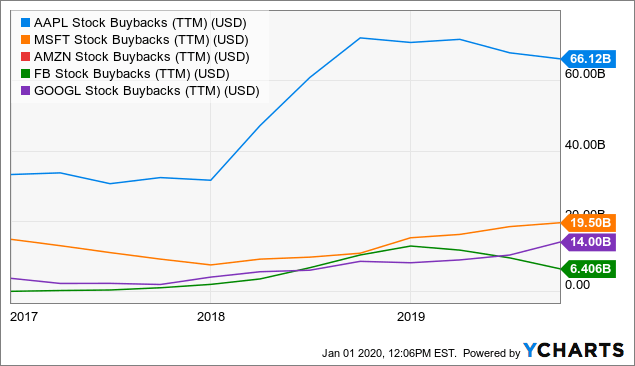

Coca-Cola has repurchased stock when it was affordable for the company but none of these repurchases occurred when Coca-Colas stock was undervalued. Coca-Colas dividend hike and new share buyback authorization follows one of the stocks worst trading sessions in years in reaction to a poor fourth-quarter earnings report. In the second quarter of 2019 alone SP 500 companies spent almost 165 billion on share repurchases and that was 26 less than the record high spent in Q4.

But it also issues an enormous amount of stock each year which reduces the buybacks effectiveness. Stock buybacks are when companies buy back their own stock removing it from the marketplace. This can be a great thing for shareholders because after the share.

The revenue strength was driven by a 5. At this moment The Coca Cola Company has a total amount of 4305M shares outstanding. The lowest was -330.

Stock buybacks increase the value of the remaining shares because there is now less common stock outstanding and company earnings are split among fewer shares. And the median was 100. During the past years Coca-Cola Cos highest 3-Year Average Share Buyback Ratio was 430.

The update also showed why the company has abruptly ended stock buyback spending for the time being as it aims to end a two-year slide in profitability. Stock issued at a cost basis of 74375 per share for each 1 share of KO owned 1989 Authorized repurchase for 20000000 shares of stock of The Coca-Cola Company 1990. NYSEKOs 3-Year Average Share Buyback Ratio is ranked higher than.

3 Main Stock Market Strategies Traders And Investors Can Use

3 Main Stock Market Strategies Traders And Investors Can Use

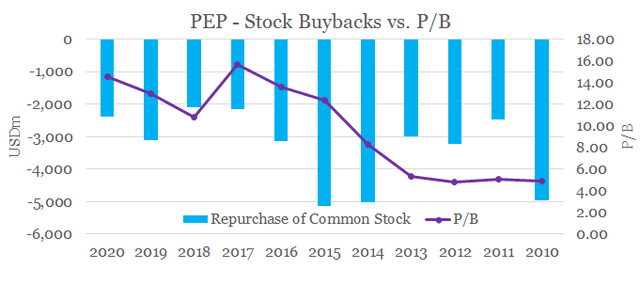

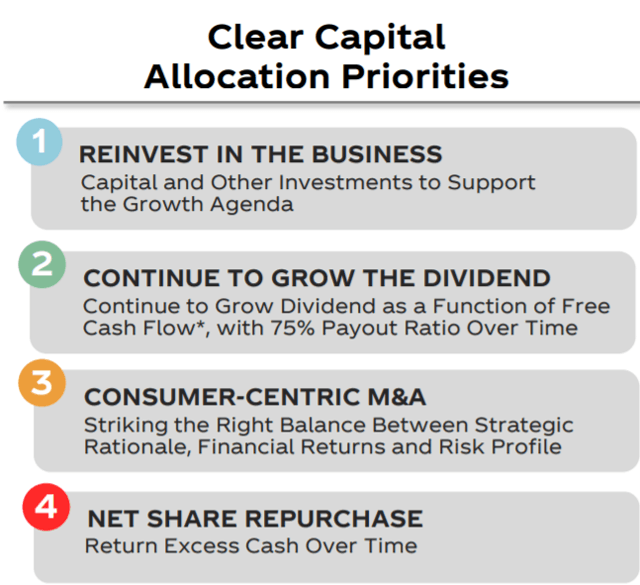

Pepsico S Capital Allocation Strategy Does Not Bode Well For Future Returns Nasdaq Pep Seeking Alpha

Pepsico S Capital Allocation Strategy Does Not Bode Well For Future Returns Nasdaq Pep Seeking Alpha

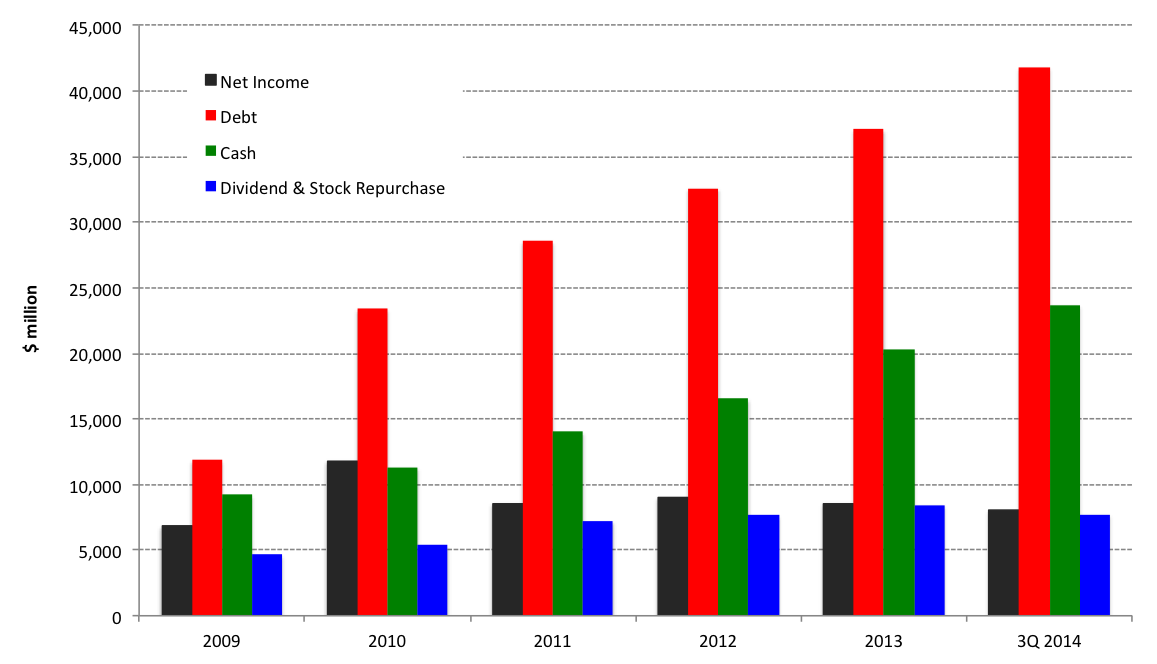

Coca Cola Outlook For 2015 Nyse Ko Seeking Alpha

Coca Cola Outlook For 2015 Nyse Ko Seeking Alpha

Nestle Announces Chf 20 Billion 20 07 Billion Share Buyback Program Moneyinvestexpert Com

Nestle Announces Chf 20 Billion 20 07 Billion Share Buyback Program Moneyinvestexpert Com

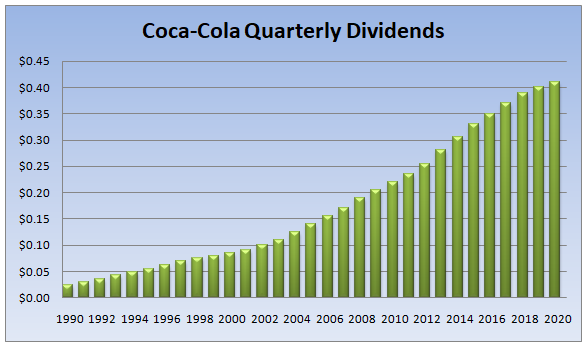

Coca Cola Stock A 58 Year Dividend Aristocrat Dividend Scholar

Coca Cola Stock A 58 Year Dividend Aristocrat Dividend Scholar

Upcoming Buybacks Of Shares 2021 Latest Buyback Announcement By Indian Companies Youtube

Upcoming Buybacks Of Shares 2021 Latest Buyback Announcement By Indian Companies Youtube

The Truth About Stock Buybacks Seeking Alpha

The Truth About Stock Buybacks Seeking Alpha

Dividend Yield Stock Capital Investment 15 Top Yielding Stocks From The Buyback Achievers Portfolio Dividend Financial Stocks Dividend Stocks

Dividend Yield Stock Capital Investment 15 Top Yielding Stocks From The Buyback Achievers Portfolio Dividend Financial Stocks Dividend Stocks

Coca Cola Raises Dividend Adds 150m To Share Buyback

Coca Cola Raises Dividend Adds 150m To Share Buyback

Coca Cola Highly Secure 3 5 Yield You Probably Shouldn T Buy Nyse Ko Seeking Alpha

Coca Cola Highly Secure 3 5 Yield You Probably Shouldn T Buy Nyse Ko Seeking Alpha

:max_bytes(150000):strip_icc()/BuySellandHoldRatingsofStockAnalysts3-6fc3f5431b974f20bb9585fc61fec4a7.png) Understanding Buy Sell And Hold Ratings Of Stock Analysts

Understanding Buy Sell And Hold Ratings Of Stock Analysts

Coca Cola Should We Follow Warren Buffett S Lead Gurufocus Com

Coca Cola Should We Follow Warren Buffett S Lead Gurufocus Com

Reasonably Valued High Quality High Yield Dividend Growth Stocks Seeking Alpha

Reasonably Valued High Quality High Yield Dividend Growth Stocks Seeking Alpha

Pepsico Seems To Be Losing Its Way Nasdaq Pep Seeking Alpha

Pepsico Seems To Be Losing Its Way Nasdaq Pep Seeking Alpha

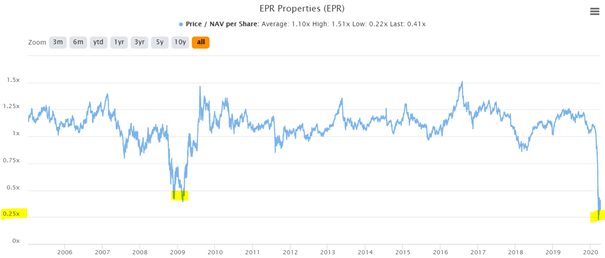

Important Message To All Reit Investors Seeking Alpha

Important Message To All Reit Investors Seeking Alpha

The Future Of Coca Cola S Dividend Nyse Ko Seeking Alpha

The Future Of Coca Cola S Dividend Nyse Ko Seeking Alpha

4 High Quality Stocks To Buy Hold Forever

4 High Quality Stocks To Buy Hold Forever

Amazon Why Corporate America S Future King Of Revenue Is A Must Have In The Decade Ahead Nasdaq Amzn Seeking Alpha

Amazon Why Corporate America S Future King Of Revenue Is A Must Have In The Decade Ahead Nasdaq Amzn Seeking Alpha

:max_bytes(150000):strip_icc()/buyback-f91333fa039d4d79ab430c65fc753e11.jpg)

Post a Comment for "Ko Stock Buyback"