Stock Market Crash Definition And Significance

The stock prices crashed on Black Tuesday Oct. In parallel with various economic factors a reason for stock market crashes is also due to panic and investing publics loss of confidence.

Venezuela Ibc Stock Market Index My Data Ends On 26 June At 987 565 00 It Is 1 239 591 00 Today If It Weren T Stock Market Index Stock Market Forex Brokers

Venezuela Ibc Stock Market Index My Data Ends On 26 June At 987 565 00 It Is 1 239 591 00 Today If It Weren T Stock Market Index Stock Market Forex Brokers

A stock market crash is when a market index drops severely in a day or a few days of trading.

Stock market crash definition and significance. Often stock market crashes end speculative economic bubbles. Crashes are driven by panic selling and underlying economic factors. 29 1929 the Dow Jones Industrial Average had dropped 248 marking one of the worst declines in US.

A crash is a sudden and significant decline in the value of a market. A crash is a sudden and significant decline in the value of a market. Stock Market Crash Definition In October 1929 the period of plunging stock market prices that helped initiate the Great Depression Stock Market Crash Significance This term is significant because it left the government shocked and without a plan of action against this.

People were not buying as much as the economy was producing bc of debt low wages. A crash is a sudden and significant decline in the value of a market. A crash is more sudden than a stock market correction which is when the market falls 10 from its 52-week high over days weeks or even months.

Stock market values in 1929 that contributed to the Great Depression of the 1930s. Stock market crashes occur after significant and rapid declines in the stock market over a short period of time -- even in one day in some cases. A crash is most often associated with an inflated stock market though any market can crash for example the international oil.

The stock market crash of 1929 considered the worst economic event in world history began on Thursday October 24 1929 with skittish investors trading a record 129 million shares. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. A stock market crash is often defined as a sharp dip in share prices of stocks listed on the stock exchanges.

A stock market crash is a social phenomenon where external economic events combine with crowd psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Stock market crash of 1929 also called the Great Crash a sharp decline in US. A crash is most often associated with an inflated stock market.

Market crashes can be made worse be fear in the market and herd. A crash is most often associated with an inflated stock market. 1 It destroyed confidence in Wall Street markets and led to the Great Depression.

The stock market could also crash over the next three months if history repeats itself. A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market resulting in a significant loss of paper wealth. A stock market crash is when a broad index or many related indices experience rapid double-digit declines.

Its one of the causes of the Great Depression. 1 Each of the bull markets in the last 40 years has had a correction and often several. The downward spiral is intensified as more and more investors seeing the bottom falling out of the market try to sell their holdings before these investments lose all their value.

There is no specific percentage decline that precisely defines a stock market crash. Any one-day market decline of 10 or more in a. A stock market crash is a steep and sudden collapse in the price of a stock or the broader stock market.

A stock market crash is an abrupt drop in stock prices which may trigger a prolonged bear market or signal economic trouble ahead. The stock market crash of 1929 was a collapse of stock prices that began on Oct. The indexes are the Dow Jones Industrial Average the SP 500 and the Nasdaq.

Once again its impossible to accurately predict when a correction or crash will occur. They often follow speculation and economic bubbles. It was followed by a general collapse of the American economy that persisted through 1821.

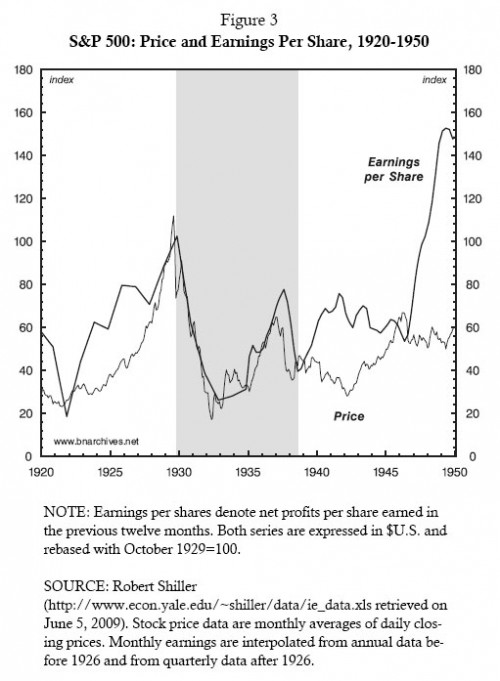

The two great US crashes of the 20th century in 1929 and 1987 had very different consequences. A crash is a sudden steep drop in stock prices. The Panic of 1819 was the first widespread and durable financial crisis in the United States and some historians have called it the first Great Depression.

The Fool And His Money Spdr S P 500 Trust Etf Nysearca Spy Seeking Alpha Economic Statistics The Fool Equity Market

The Fool And His Money Spdr S P 500 Trust Etf Nysearca Spy Seeking Alpha Economic Statistics The Fool Equity Market

Short Squeeze In Futures Hits Foreign Portfolio Investors Hard The Hindu Businessline Fii Stockmarket Nifty In 2020 Budget Meaning Futures Contract Investors

Short Squeeze In Futures Hits Foreign Portfolio Investors Hard The Hindu Businessline Fii Stockmarket Nifty In 2020 Budget Meaning Futures Contract Investors

Bear Market Analysis Essay Stock Market Bear Market

Bear Market Analysis Essay Stock Market Bear Market

Next Stock Market Crash Pic Of The Day Tradeopus Stock Options Trading Stock Options Stock Market

Next Stock Market Crash Pic Of The Day Tradeopus Stock Options Trading Stock Options Stock Market

How Does The Stock Market Affect The Economy Economics Help

How Does The Stock Market Affect The Economy Economics Help

Prospective Probabilities Following A Down Year Stock Market Marketing Probability

Prospective Probabilities Following A Down Year Stock Market Marketing Probability

The Truth About That 1929 Stock Market Crash Chart That Everyone Is Passing Around Stock Market Crash Us Stock Market Stock Market

The Truth About That 1929 Stock Market Crash Chart That Everyone Is Passing Around Stock Market Crash Us Stock Market Stock Market

Stock Market Crash Of 1929 Black Tuesday Cause Effects History

Stock Market Crash Of 1929 Black Tuesday Cause Effects History

Enron Stock Chart World Of Template Amp Format Inside Enron Stock Chart24320 Stock Charts Chart Investing

Enron Stock Chart World Of Template Amp Format Inside Enron Stock Chart24320 Stock Charts Chart Investing

Infographic The Worst Stock Market Crashes Of The 21st Century Stock Market Crash Dow Jones Dow Jones Industrial Average

Infographic The Worst Stock Market Crashes Of The 21st Century Stock Market Crash Dow Jones Dow Jones Industrial Average

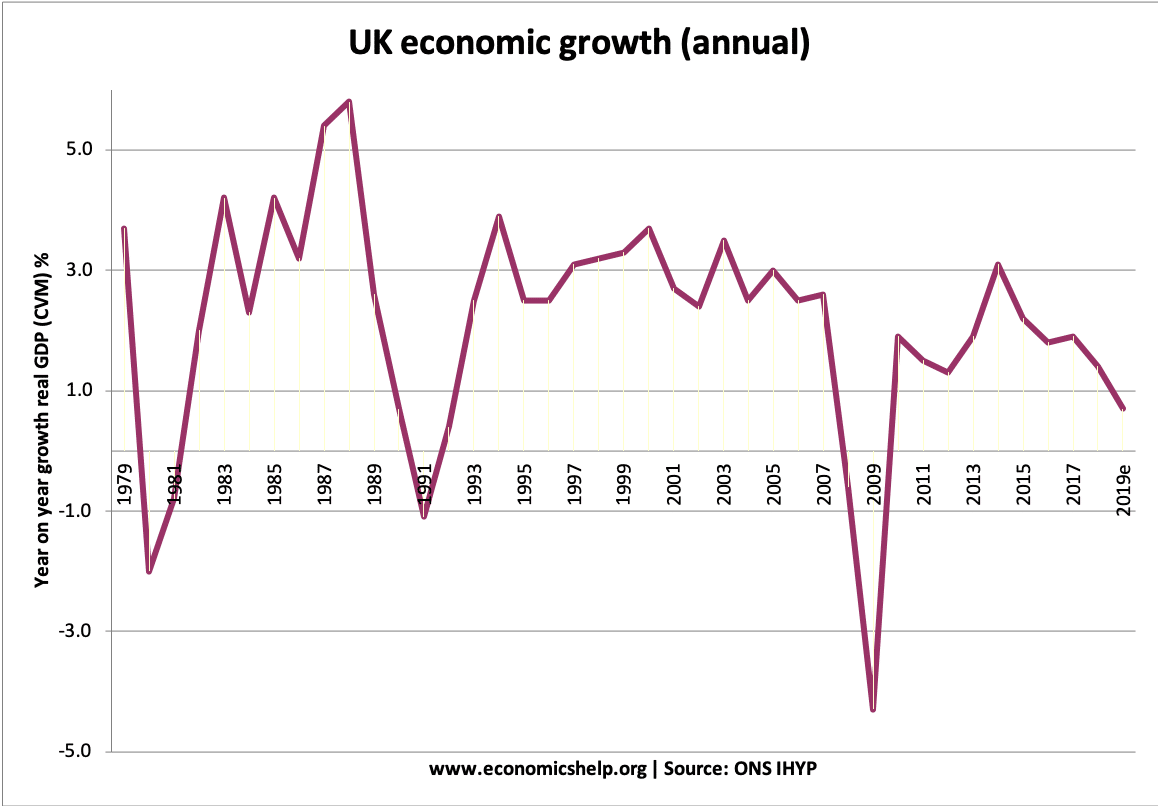

What Caused The Wall Street Crash Of 1929 Economics Help

What Caused The Wall Street Crash Of 1929 Economics Help

Stock Market Crash 2008 Stock Market Crash Gross Domestic Product Stock Market

Stock Market Crash 2008 Stock Market Crash Gross Domestic Product Stock Market

Stock Market Crash Overview How It Happens Examples

Stock Market Crash Overview How It Happens Examples

Stock Market Crash Of 1929 Licensed For Non Commercial Use Only The Stock Market Crash Of 1929 Stock Market Crash Stock Market Black Tuesday

Stock Market Crash Of 1929 Licensed For Non Commercial Use Only The Stock Market Crash Of 1929 Stock Market Crash Stock Market Black Tuesday

The Stock Market Crash Of 1929 And The Great Depression

The Stock Market Crash Of 1929 And The Great Depression

Stock Market Crash Of 2020 Stock Market Crash Stock Market Marketing Definition

Stock Market Crash Of 2020 Stock Market Crash Stock Market Marketing Definition

/BlackMonday-fdc4ac8ad641478eac2a09803e7ef366.png) Stock Market Crash Of 1987 Definition

Stock Market Crash Of 1987 Definition

:max_bytes(150000):strip_icc()/Capitulation12-d3efb4191a234673a04dc23340bb9f7e.png)

Post a Comment for "Stock Market Crash Definition And Significance"