Stock Option Leverage Calculator

Answer Using the margin calculator is specifically easy. See visualisations of a strategys return on investment by possible future stock prices.

A long call is a net debit position ie.

Stock option leverage calculator. In business terms leverage can be described as The ability to influence a systemenvironment to multiply the output without increasing the input. For your investment of 1 000 you could buy five options contracts increasing your financial leverage by allowing you to control 500 shares instead of just 10. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

The above options leverage calculation reveals that the 50 strike call options of XYZ company carries an options leverage of 115 times which means that it allows you to make 115 times the profit on the same amount of money which also means that it allows you to control 115 times the number of share equivalent with the same amount of money. What is Forex Leverage. The position profits when the stock price rises.

Leverage is sometimes referred to as Gearing. It also calculates your payoffs at the expiry and every day until the expiry. This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies.

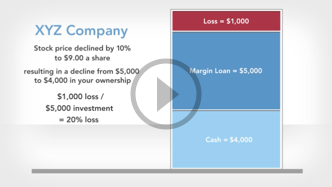

Use the below OptionPlus Leverage calculator to compare the margin requirements for trading options with OptionPlus and without OptionPlus. Margin Trading carries a high degree of risk and it magnifies a traderinvestor gains and losses. Say you decide to buy 1000 shares of XYZ at 4175 for a cost of 41750.

Options involve risk and are not suitable for all investors. Alternatively the option contracts may realistically be valued at 200 for lots of 100 shares 200 per option. Leverage is a common financial term which in simple terms is the ration of company debt to company investmentshares.

The position profits when the stock price rises. A margin requirement is the leverage offered by a broker and is usually updated at least once a month to account for market volatility or currency exchange rates. The Zerodha FO calculator is the first online tool in India that lets you calculate comprehensive margin requirements for option writingshorting or for multi-leg FO strategies while trading equity FO commodity and currency before taking a trade.

A 2 margin requirement is the equivalent of offering a 501 leverage which allows an investor to trade with 10000 in the market by setting aside only 200 as a security deposit. Long put bearish Calculator Purchasing a put option is a strongly bearish strategy and is an excellent way to profit in a downward market. Update your mobile number e-mail ID with your stock brokerdepository participant and receive OTP directly from depository on your email id andor mobile number to create pledge.

The trader pays money when entering the trade. It can be used as a leveraging tool as an alternative to margin trading. Select the scrip you are interested in the available margin and the present share price.

Disclaimer - Use of OptionPlus involves the use of financial leverage. The Impact of Leverage on Employee Stock Options. Options Leverage delta equivalent stock price - option price option price Options Leverage Interpretation The higher the Options Leverage multiple the higher the potential reward and the higher the risk of loss.

The trader pays money when entering the trade. Copies of this document may be obtained from your broker from any exchange on which options are traded or by contacting The Options Clearing Corporation 125 S. However instead of purchasing the stock at 4175 you can buy 10 call option contracts whose strike price is 30 in.

Free stock-option profit calculation tool. A long call is a net debit position ie. To illustrate leverage lets assume that you have 10000 employee stock options with an exercise price of 10 per share and a current market price of 20 per share.

The current value of your employee stock options is 100000. Value Number of Shares Current Price Exercise Price. You have to provide three inputs into the calculator and it will show you the leverage you will get and the number of shares that can be bought using the margin or leverage provided to you.

Calculate the value of a call or put option or multi-option strategies. Options leverage is a double edged sword which returns the same multiple on both option trading profits and losses. Alice Blues Commodity margin calculator helps you calculate the span exposure margin required for Commodity Futurs Options before trading.

Meet the 1 Options Trading Plugin for Excel. Stock brokers can accept securities as margin from clients only by way of pledge in the depository system wef. You can calculate the options leverage multiple of your stock options position with the Options Leverage Formula below.

Divided by the Price of Option 2 5 Therefore the leverage factor of these options contracts is 5 allowing you to make five times as much profit through buying options contracts as you would through buying the stock. This Option Profit Calculator Excel is a user contributed template will provide you with the ability to find out your profit or loss quickly given the stocks price moves a certain way. This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies.

Option Profit Calculator Excel Rank Scan And Analyze Stock Options

Option Profit Calculator Excel Rank Scan And Analyze Stock Options

Stock Option Trading Programs Stock Options Options Trading Strategies Stock Options Trading

Stock Option Trading Programs Stock Options Options Trading Strategies Stock Options Trading

Hdfc Securities Margin Calculator 2020 Hdfc Sec Exposure Leverage

Hdfc Securities Margin Calculator 2020 Hdfc Sec Exposure Leverage

Upstox Margin Calculator 2020 Calculate Upstox Exposure Leverage

Upstox Margin Calculator 2020 Calculate Upstox Exposure Leverage

The Definition Of Leverage And Margin Etoro Trading Academy

The Definition Of Leverage And Margin Etoro Trading Academy

How Can One Calculate The Margin In Angel Broking Quora

Swastika Investmart Margin Calculator 2020 Swastika Exposure

Swastika Investmart Margin Calculator 2020 Swastika Exposure

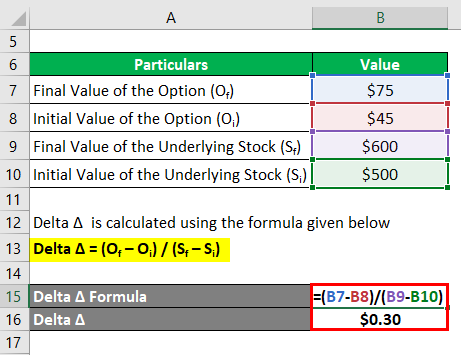

Delta Formula Calculator Examples With Excel Template

Delta Formula Calculator Examples With Excel Template

Margin Calculator Wisdom Capital

Margin Calculator Wisdom Capital

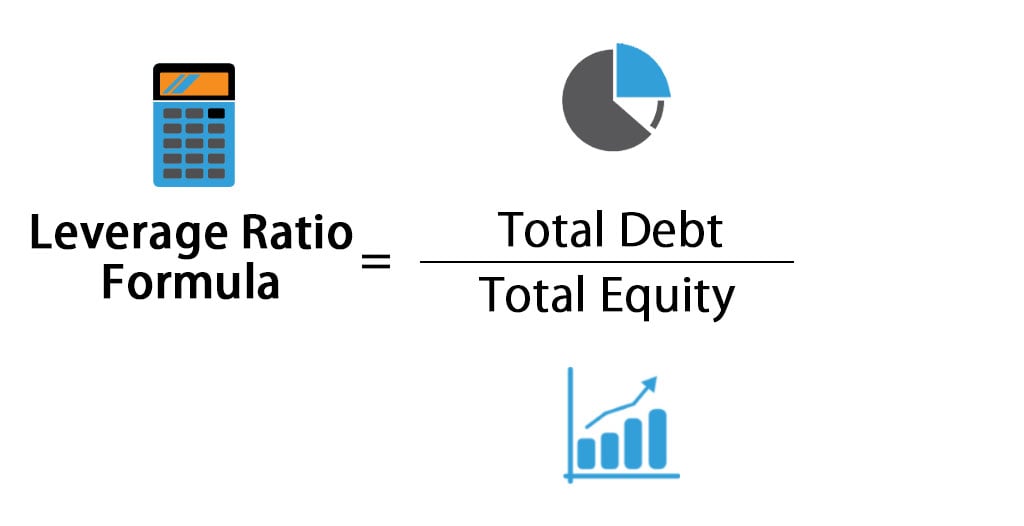

Leverage Ratio Formula Calculator Excel Template

Leverage Ratio Formula Calculator Excel Template

Zerodha Margin Calculator Cnc Mis Bo Co Leverage Calculator Zerodha Youtube

Zerodha Margin Calculator Cnc Mis Bo Co Leverage Calculator Zerodha Youtube

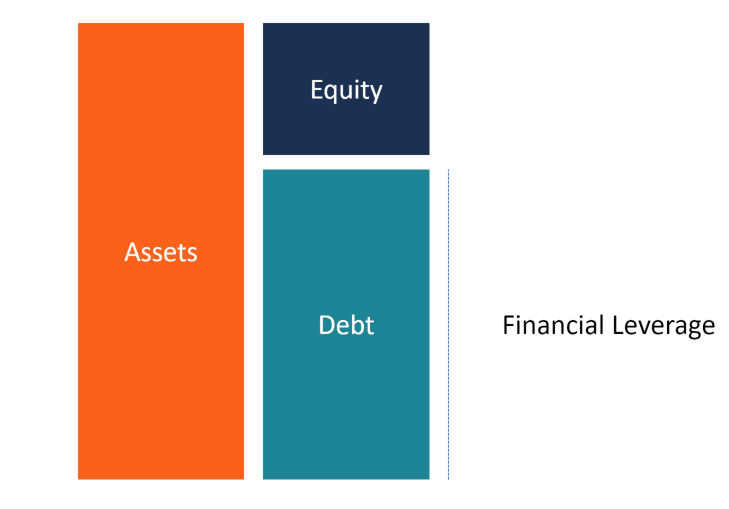

Financial Leverage Learn How Financial Leverage Works

Financial Leverage Learn How Financial Leverage Works

Zerodha F O Margin Calculator Z Connect By Zerodha Z Connect By Zerodha

Zerodha F O Margin Calculator Z Connect By Zerodha Z Connect By Zerodha

Edelweiss Margin Calculator 2020 Edelweiss Exposure Leverage

Edelweiss Margin Calculator 2020 Edelweiss Exposure Leverage

Ventura Securities Margin Calculator 2020 Ventura Securities Exposure

Ventura Securities Margin Calculator 2020 Ventura Securities Exposure

Kotak Securities Margin Calculator 2020 Kotak Securities Exposure Limit

Kotak Securities Margin Calculator 2020 Kotak Securities Exposure Limit

Margin Calculator Part 1 Varsity By Zerodha

Motilal Oswal Margin Calculator 2020 Motilal Oswal Exposure Leverage

Motilal Oswal Margin Calculator 2020 Motilal Oswal Exposure Leverage

Post a Comment for "Stock Option Leverage Calculator"