Stock Warrants Vs Stock Rights

Stock warrants are a useful way for companies to boost revenues and for investors to get a shot at a quick profit. The holder of common stock has an actual stake in the profit or loss of the company.

/Wiener_Riesen_Rad_Ltd_1898-41accd5aa0f9438198764c26178b58cb.jpg) I Own Some Stock Warrants How Do I Exercise Them

I Own Some Stock Warrants How Do I Exercise Them

Plus you dont have voting rights as the holder of a stock warrant and you.

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Stock warrants vs stock rights. Warrants differ from rights in that they must be purchased from a broker for a commission and usually qualify as marginable securities. They tend to have a longer period before they expire usually a year or 2. Both rights and warrants conceptually resemble publicly.

You still have the right to freely decide to go forward with the purchase in the future. Investors the rights to purchase these stocks at a specified price and on a specific date. Entering the trade on September 4 2020 at roughly 106 USD for X number of warrants and at the time of this writing the Market Open is showing 450 USD about 2 weeks later.

Stock warrants are similar to stock rights but warrants typically have an exercise price above the current market price. Rights tend to expire after a few weeks. The easiest way to exercise a warrant is through your broker.

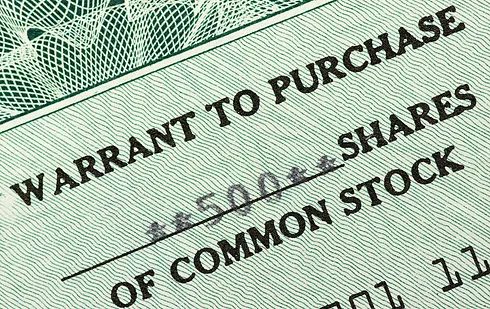

Stock warrants are legal instruments that give you the right to buy or sell a certain number of shares in a company in a particular time period for a particular price. They can produce large gains if the stock price goes up by even a small amount. Stock Options Unlike options warrants generally do not give the owner the right to buy 100 shares of the stock says Robert Johnson professor of finance at Heider College of.

A stock warrant represents the right to purchase a companys stock at a specific price and at a specific date. You get the shares of whatever they acquire and you also get some warrants which give rights to buy additional shares at a later date. Read full definition on an exchange.

In many ways a stock warrant is like a stock option which also gives the holder the right to buy shares at a fixed price during a defined period of time. Theyre similar to stock options but warrants are always issued by the company issuing the stock while others can write options. The usual strike price or the conversion price is 1150.

Its value is determined each time it trades in the open stock market. What is a Stock Warrant. Warrants are stock rights and literally defined as endowed with the right.

Quite a few considerations can be made for a myriad of other aspects but we are only interested in the subject of this articleCommon Stock Vs. A stock option is a secondary market instrument as trading takes place between investors whereas a warrant is a primary market instrument since it is issued by the company itself. A stock warrant is issued directly by a company to an investor.

Rights give stockholders entitlement to purchase new shares issued by the corporation at a predetermined price normally at a discount to the current market price in. For starters recall that a stock option is a contract between two parties and gives the stockholder the right to buy or sell stocks at a certain price and on a certain date. When you buy a warrant you are not locked in.

Longer-term stock warrants are typically good for up to 15 years while stock options are shorter-term and can expire in weeks or just two or three years. Warrants simply give the holder a right to purchase the common stock at a later time but warrants also have a finite lifetime and will expire. Stock Options Unlike options warrants generally do not give the owner the right to buy 100 shares of the stock says Robert Johnson professor of finance at Heider College of.

Rights and warrants typically trade Trade The process where one person or party buys an investment from another. Warrants are mostly offered to attract investors when a company issues new stock. In options trading the selling party writes the options while warrants have a single issuer responsible for the rights offered.

Stock rights and warrants protect current shareholders from dilution of ownership when the company issues new shares of stock. A stock warrant is a contract in which a company provides new shares for sale and offers the buying public ie. Generally warrants are issued by the company and there are different types but well just stick to traditional ones.

A stock warrant is issued by an employer that gives the holder the right to buy company shares at a certain price before the expiration.

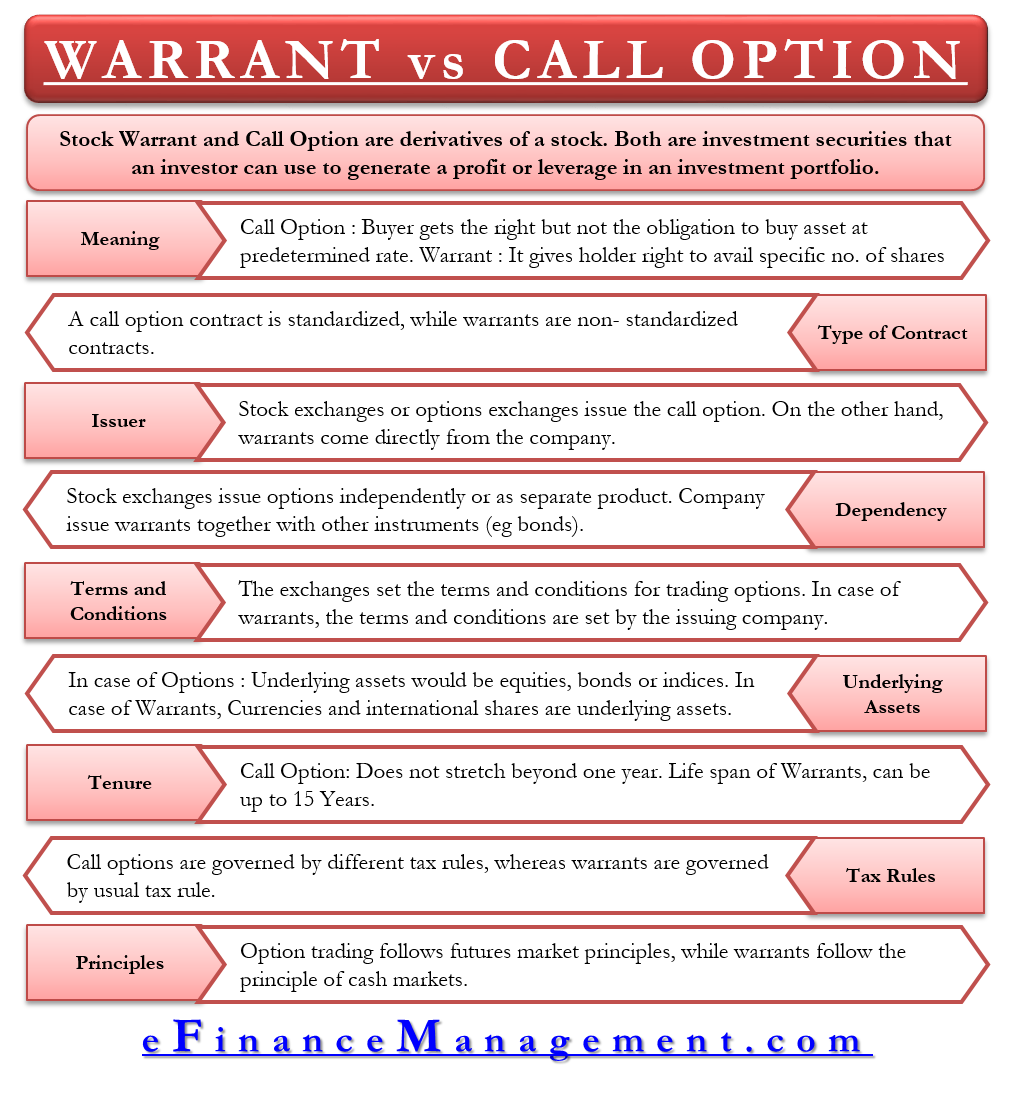

Warrant Vs Call Option All You Need To Know

Warrant Vs Call Option All You Need To Know

Stock Warrants Why Do Companies Issue Stock Warrants

Stock Warrants Why Do Companies Issue Stock Warrants

Stock Options Vs Rsus What S The Difference Thestreet

Stock Options Vs Rsus What S The Difference Thestreet

Peoples National Bank Of Norristown Stock Certificate Norristown Stock Certificates National

Peoples National Bank Of Norristown Stock Certificate Norristown Stock Certificates National

12 Extraordinary Due Diligence Checklist Template Checklist Financial Information How To Fix Credit

12 Extraordinary Due Diligence Checklist Template Checklist Financial Information How To Fix Credit

Dividend Per Share Dps Efinancemanagement Finance Investing Accounting And Finance Money Management

Dividend Per Share Dps Efinancemanagement Finance Investing Accounting And Finance Money Management

Free Printable Energy Of Legal Professional Common Authorized Varieties Attorney Forms Free General Power Of Attorney Form Legal Forms Power Of Attorney

Free Printable Energy Of Legal Professional Common Authorized Varieties Attorney Forms Free General Power Of Attorney Form Legal Forms Power Of Attorney

Trading Mechanics Of Securities In Secondary Market Secondary Market Marketing Trading

Trading Mechanics Of Securities In Secondary Market Secondary Market Marketing Trading

Spacs Shares Vs Warrants Vs Units Should You Buy Shares Or Warrants Here Are My Strategies Youtube

Spacs Shares Vs Warrants Vs Units Should You Buy Shares Or Warrants Here Are My Strategies Youtube

:max_bytes(150000):strip_icc()/stock-market-fluctuations-5955e0f63df78cdc29b6dce5.jpg) Investing In Stock Rights And Warrants

Investing In Stock Rights And Warrants

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg) Common Examples Of Marketable Securities

Common Examples Of Marketable Securities

Stockholders Equity And Its Components Bbalectures Equity Financial Markets Finance

Stockholders Equity And Its Components Bbalectures Equity Financial Markets Finance

Derivatives Markets As The Development And Creative Application Derivatives Market Marketing Business Articles

Derivatives Markets As The Development And Creative Application Derivatives Market Marketing Business Articles

Nifty Tips Price Resistance Share Advisory Firm Share Tips Silver Stock Futures Stock Futures Stock Market Stock Market Investing Intraday Trading

Nifty Tips Price Resistance Share Advisory Firm Share Tips Silver Stock Futures Stock Futures Stock Market Stock Market Investing Intraday Trading

Offering Employee Equity To Your Team Equity Options Steps More

Offering Employee Equity To Your Team Equity Options Steps More

What Are Non Qualified Stock Options Nsos Carta

What Are Non Qualified Stock Options Nsos Carta

Investing Essentials Stock Warrants The Motley Fool

Investing Essentials Stock Warrants The Motley Fool

United Air Lines Preferred Stock Warrant 1952s United Air Preferred Stock Major Airlines

United Air Lines Preferred Stock Warrant 1952s United Air Preferred Stock Major Airlines

Post a Comment for "Stock Warrants Vs Stock Rights"