What Is The Current Volatility Index

The current VIX index level as of March 01 2021 is 2335. When the VIX rises the market is experiencing volatility and.

Low Volatility Index Suggests Huge Bitcoin Price Move Incoming History In Favor Of The Bulls Bitcoin Price Volatility Index Bitcoin

Low Volatility Index Suggests Huge Bitcoin Price Move Incoming History In Favor Of The Bulls Bitcoin Price Volatility Index Bitcoin

Put simply it is a mathematical measure of how much the market thinks the SP 500 Index option or SPX will fluctuate over the next 12 months based upon an analysis of the difference between.

What is the current volatility index. The Cboe Volatility Index VIX is a real-time index that represents the markets expectations for the relative strength of near-term price changes of the SP 500 index SPX. If history is about to repeat it might be an idea to have a good cash position over the next. View real-time VIX index data and compare to other exchanges and stocks.

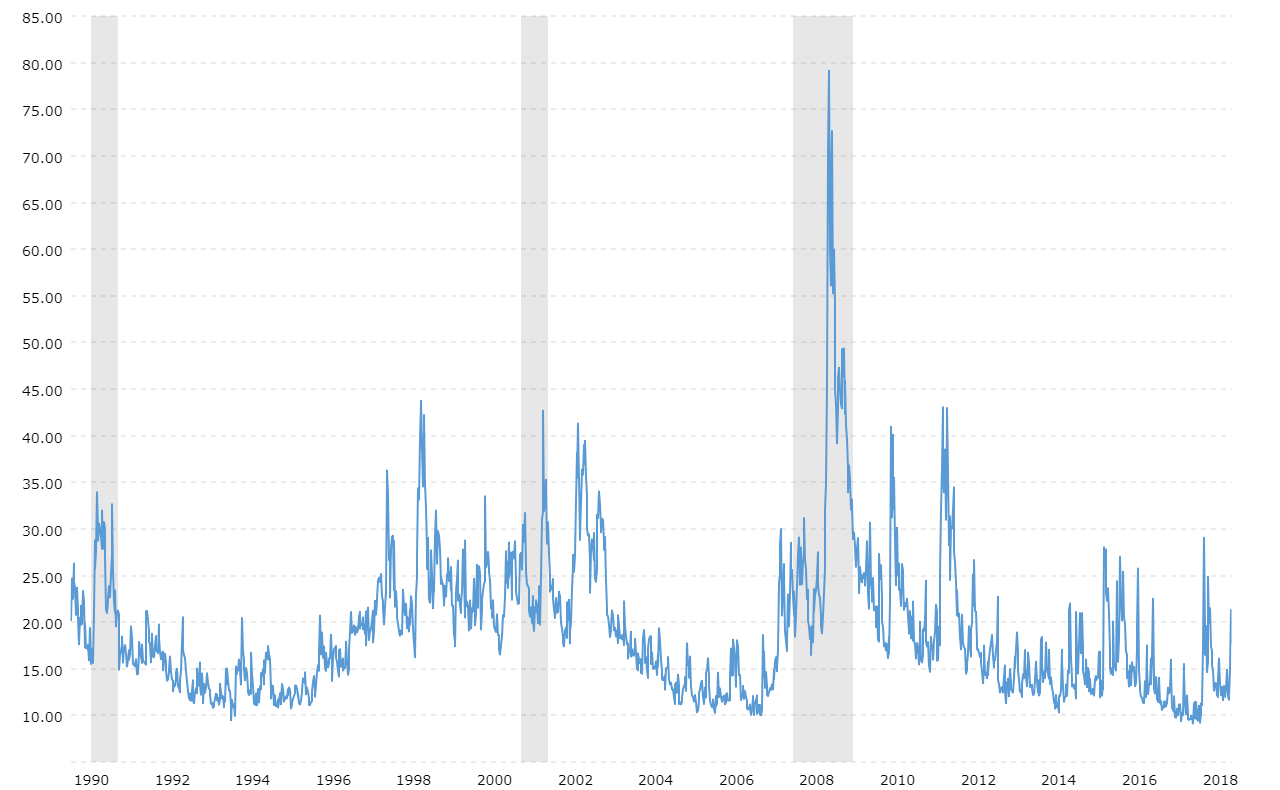

Interactive historical chart showing the daily level of the CBOE VIX Volatility Index back to 1990. The VIX Index estimates expected volatility by aggregating the weighted prices of SP 500 Index SPX puts and calls over a wide range of strike prices. The Cboe Volatility Index - more commonly referred to as the VIX Index - is an up-to-the-minute market estimate of expected volatility that is calculated by using real-time prices of options on the SP 500 Index listed on Cboe Exchange Inc.

The VIX often referred to as the fear index is calculated in real. Get all information on the VIX Index including historical chart news and constituents. CBOE Volatility Index advanced index charts by MarketWatch.

The VIX index measures the expectation of stock market volatility over the next 30 days implied by SP 500 index options. The last time this occurred the markets crashed hard back in February 2020. VIX A complete CBOE Volatility Index index overview by MarketWatch.

Get CBOE Volatility Index VIXExchange real-time stock quotes news price and financial information from CNBC. Forex Volatility Charts Live - Today This Week This Month USD EUR JPY GBP CHF CAD AUD NZD. The Cboe Volatility Index VIX posted decent gains to start the weekjumping from 22 to above 26 at one point Tuesday morningand theres been no sign of any long-term move below the.

Is history about to repeat itself. SP 500 Volatility Index VIX January 12th 2021 through July 2021 Low. VIX Volatility Index - Historical Chart.

If you want to browse ETFs with more flexible selection criteria visit our screenerTo see more information of the Volatility ETFs click on one of the tabs above. Because it is derived. The VIX Index is a financial benchmark designed to be an up-to-the-minute market estimate of the expected volatility of the SP 500 Index and is calculated by using the midpoint of real-time S.

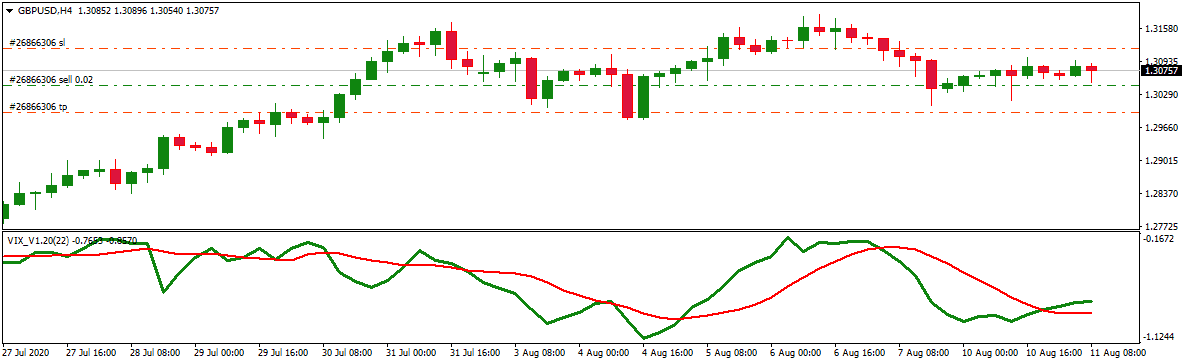

Specifically the prices used to calculate VIX Index values are midpoints of real-time SPX option bidask price quotations. On the above 1-day chart price action on the Volatility index finds support on previous resistance. Forex volatility charts tell you which currency is most volatile relative to each other.

To summarize VIX is a volatility index derived from SP 500 options for the 30 days following the measurement date 4 with the price of each option representing the markets expectation of 30-day forward-looking volatility. 25-55 Very rough and general draft of an idea with 2 possible routes for stock markets in the next couple months. View stock market news stock market data and trading information.

The current VIX index value quotes the expected annualized change in the SP 500 index over the following 30 days as computed from options-based theory and current options-market data. The VIX index is based on options prices of the SP 500 and captures investor sentiment of 30-day expected stock market volatility. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days.

Market Volatility Marketing Financial Financial Trouble

Market Volatility Marketing Financial Financial Trouble

Vix Volatility Index Historical Chart Macrotrends

Vix Volatility Index Historical Chart Macrotrends

Learn How To Trade Binary Com S Volatility Index 75 This Guide Is An Introduction To Volatility Indices Trading V Volatility Index Learn Forex Trading Index

Learn How To Trade Binary Com S Volatility Index 75 This Guide Is An Introduction To Volatility Indices Trading V Volatility Index Learn Forex Trading Index

Barrons Hedging Against A Drop In The S Implied Volatility Volatility Index S P 500 Index

Barrons Hedging Against A Drop In The S Implied Volatility Volatility Index S P 500 Index

Steep Vix Curve Steep Wall Of Worry Volatility Index Equity Market Pragmatics

Steep Vix Curve Steep Wall Of Worry Volatility Index Equity Market Pragmatics

Forex Volatility Hypertrend Indicator Forexobroker Forex Volatility Index Investing

Forex Volatility Hypertrend Indicator Forexobroker Forex Volatility Index Investing

What Is Volatility 75 Index Download Vix Mq4 Indicator Forex Education

What Is Volatility 75 Index Download Vix Mq4 Indicator Forex Education

What Is The Vix Volatility Index And How Do You Trade It

What Is The Vix Volatility Index And How Do You Trade It

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg) The Volatility Index Reading Market Sentiment

The Volatility Index Reading Market Sentiment

Small Cap U S Stocks Go Large In Volatility Comparison Small Caps Nasdaq 100 Nasdaq

Small Cap U S Stocks Go Large In Volatility Comparison Small Caps Nasdaq 100 Nasdaq

Volatility Analysis 2020 03 15 Analysis Trade Finance Volatility Index

Volatility Analysis 2020 03 15 Analysis Trade Finance Volatility Index

Vix Volatility Index How To Use The Fear Index To Confirm Stock Market Bottoms Investor S Business Daily

Vix Volatility Index How To Use The Fear Index To Confirm Stock Market Bottoms Investor S Business Daily

A 9 000 Retest Likely For Bitcoin As Btig Relays Negative S P 500 Outlook Newsbtc Bitcoin Negativity Volatility Index

A 9 000 Retest Likely For Bitcoin As Btig Relays Negative S P 500 Outlook Newsbtc Bitcoin Negativity Volatility Index

Stock Volatility And Beta Coefficient Bist 30 Index Numerical Expression Index Stock Market Index

Stock Volatility And Beta Coefficient Bist 30 Index Numerical Expression Index Stock Market Index

:max_bytes(150000):strip_icc()/dotdash_Final_CBOE_Volatility_Index_VIX_Definition_Aug_2020-02-c820dbe721f84e37be0347edb900ba5b.jpg) Cboe Volatility Index Vix Definition

Cboe Volatility Index Vix Definition

Should You Be Trading Volatility Index In Current Situation Volatility Index Trading Vix

Should You Be Trading Volatility Index In Current Situation Volatility Index Trading Vix

Nasdaq 100 Volatility Index Volq Deconstruct Skew To See Inflection Points Nasdaq

Nasdaq 100 Volatility Index Volq Deconstruct Skew To See Inflection Points Nasdaq

Double Harmonic Volatility Indicator Time Box Indicator Free Timeboxing Free Tools Investing

Double Harmonic Volatility Indicator Time Box Indicator Free Timeboxing Free Tools Investing

Post a Comment for "What Is The Current Volatility Index"