Share Split Vs Share Consolidation

For example in a reverse 1-for-5 split 10 million outstanding shares at 050 cents each would now become 2 million shares outstanding at 250 per share. Share consolidation transactions also known as reverse share split arrangements involve the reduction of number of shares of an entity without affecting the total value of share capital.

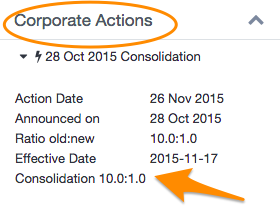

Consolidations Sharesight Help

Consolidations Sharesight Help

With reverse stock splits the corporation simply decreases the quantity of shares of its own stock available in order to.

Share split vs share consolidation. For example 600 shares worth 10 each that are consolidated 1-for-3 become 200 shares worth 30 each. When their share price has fallen a lot some companies will do a reverse split or share consolidation. This also applies when a consolidation reverse split takes place and the number of shares decreases and the price increases proportionally.

Share consolidation is an exercise whereby the shares of existing shareholders are combined. It does so by reducing the number of shares held by its existing shareholders. Share splits are often a straight 2 new shares for every old share 2 for 1 10 for 1 or 100 for 1 but can be 5 new shares for every 3 shares or even split the share class into two different share classes so as an example for every ordinary 1 share held each shareholder gets one ordinary 10p share and nine deferred 10p shares.

Share Consolidation refers to a reverse splitIn this corporate operation a number of shares of stock become merged together into only one single share. Most investors are familiar with a stock split in which a company issues additional shares to existing shareholders and the price per share is reduced proportionately. It merely alters the number of shares and the nominal value of each share.

These share consolidations can take place either in the forms of reverse stock splits or as stock share funded buyouts. If the stock split was 5-for-1 your previous 100 shares valued at 60 would become 500 shares each worth 12. Less well known are reverse stock splits also known as share consolidations.

For example a 1 for 2 share consolidation would entitle a shareholder with 10 existing ordinary shares with nominal value of 10 each with 5 new shares. Management of a business can benefit in several ways from a share consolidation. It is a corporate action to increase the total number of outstanding shares and decrease the nominal or par value of each share.

What is Stock Split in share market explained in tamil difference between stock split and share consolidation in tamil How Stock Split. Theoretically the price of the shares. Consolidations are likely to be viewed more negatively by investors than stock splits as strategy consolidations are often linked with companies whose stock price is low because they are facing challenges.

The implications of a share split or consolidation are. Before 100 Ord A. After the corporate action the shareholder will own more but theoretically lower priced shares due to the increase in total outstanding shares in the market.

Like a split this will not change the shareholders rights meaning that following the split the rights to dividends and voting rights will be unchanged. A reverse stock split is also known as a stock consolidation stock merge or share rollback and is the opposite exercise of a stock split where a share is divided split into multiple parts. Prefer to learn via listening and.

Even though the number of shares has been reduced nothing has changed in terms of the percentage of shareholdings. Bonus Share Split. What is Share Consolidation in stock market explained in tamil difference between Stock split and Share Consolidation how to companies.

They may issue 1 new shares for every 20 old shares for example. Share consolidation is a corporate action conducted by the company with the intention to reduce its number of shares trading on the stock exchange. In the US it is also known as Reverse Split.

In both cases the company is still. After the announcement on the Share Consolidation or Share Split the shares will be trading on a cum- entitlement basis which entitles an investor who holds the companys shares to receive additional new shares in a Share Split or to be offered a reduced number of shares in a Share Consolidation. Registered capital before and after remains the same eg.

What Is A Share Consolidation. For a share split the number of shares that you own are increased and for a reverse share split or consolidation the number of shares that you own are decreased however the total value of your shareholding remains constant. Date of announcement past 3 months Ex Date next 30 days Hints.

Is it a share split share consolidation or share reclassification. A 1-for-5 consolidation would mean the investor owns 200 shares priced at 25 implying the investor would still retain a holding equivalent to the 5000. Bonus Share Split Consolidation.

This is usually an attempt. This video about. Number of shares has increased.

In each of these cases the total market value is the same 6000. And nominal value has decreased EXAMPLE. 1 Click the Stock on table to view the Stocks entitlement page.

Share Split is the direct opposite of a Share Consolidation. A share consolidation is where a set number of existing shares in a share class are consolidated into one share. Resolution Use the details below as a guide to which event to use within the share register.

For example in a 10 to 1 consolidation 10000 shares that you own will become 1000 shares. This video about. A share consolidation is the opposite of a share split and indeed is sometimes referred to as a reverse share split.

What Is A Stock Split And Do They Help Investors Phil Town

What Is A Stock Split And Do They Help Investors Phil Town

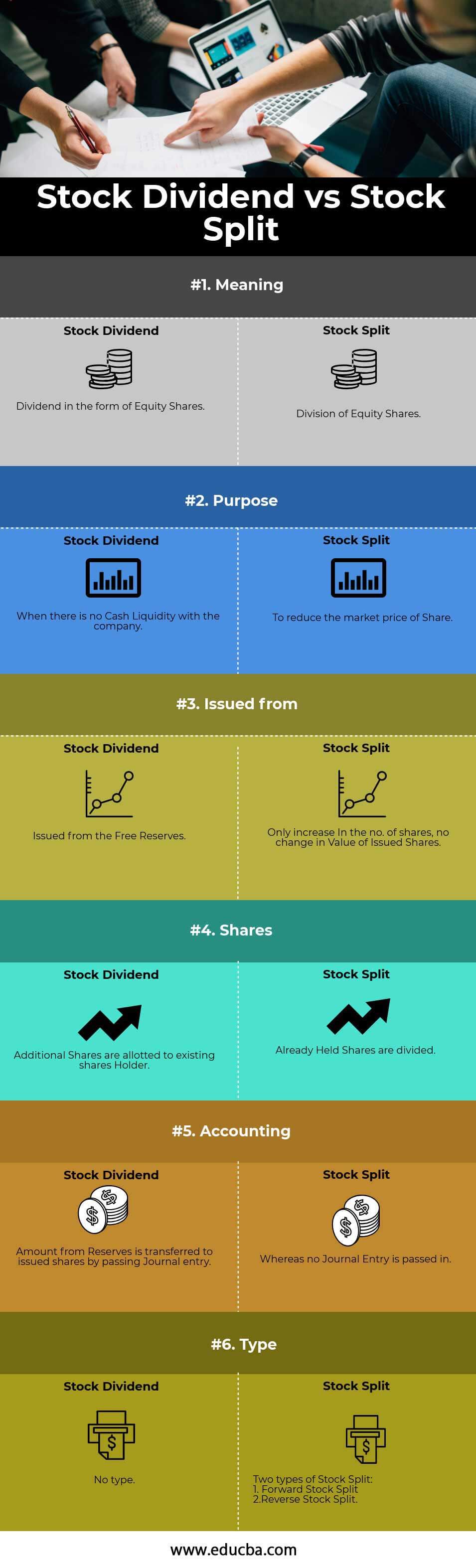

Stock Dividend Vs Stock Split Top 6 Best Differences With Infographics

Stock Dividend Vs Stock Split Top 6 Best Differences With Infographics

Consolidate Multiple Excel Workbooks Using Power Query Myexcelonline Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Consolidate Multiple Excel Workbooks Using Power Query Myexcelonline Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Dividend Yield Stock Capital Investment 19 Dividend Contenders With Real Big Dividend Growth Potential Dividend Debt Consolidation Programs Debt Advice

Dividend Yield Stock Capital Investment 19 Dividend Contenders With Real Big Dividend Growth Potential Dividend Debt Consolidation Programs Debt Advice

Bmw Helpdesk Consolidation Six Sigma Case Study Case Study Solutions Analysis

Bmw Helpdesk Consolidation Six Sigma Case Study Case Study Solutions Analysis

Share Split How A Company Can Subdivide Shares

Share Split How A Company Can Subdivide Shares

Further Consolidations Could Unfold Between S P 2327 And 2370 There Is A High Probability Of A Period Of Consolidation Activity Investing Supportive Trading

Further Consolidations Could Unfold Between S P 2327 And 2370 There Is A High Probability Of A Period Of Consolidation Activity Investing Supportive Trading

Dividend Yield Calculator Www Investingcalculator Org Dividend Yield Calculator Html Investing Investment C Dividend Financial Calculators Investing Money

Dividend Yield Calculator Www Investingcalculator Org Dividend Yield Calculator Html Investing Investment C Dividend Financial Calculators Investing Money

Stock Split Vs Bonus Issue Pros Cons Reverse Split

Stock Split Vs Bonus Issue Pros Cons Reverse Split

Term Finance Anmol Seth Finance Loans For Bad Credit Personal Finance Blogs

Term Finance Anmol Seth Finance Loans For Bad Credit Personal Finance Blogs

Suze Orman How To Split Bills Moneymusings Com Personal Finance Budget Suze Orman Combining Finances

Suze Orman How To Split Bills Moneymusings Com Personal Finance Budget Suze Orman Combining Finances

Difference Between Bonus Share And Stock Split Stocks Walls

Difference Between Bonus Share And Stock Split Stocks Walls

What S A Share Consolidation Quora

How I Increased My Credit Score By Over 100 Points In One Year Millennialcreditmom My Credit Score Credit Score Best Credit Repair Companies

How I Increased My Credit Score By Over 100 Points In One Year Millennialcreditmom My Credit Score Credit Score Best Credit Repair Companies

:max_bytes(150000):strip_icc()/dotdash_v2_Understanding_Stock_Splits_Aug_2020-012-b223f723115044d5897cdda57e1be4b7.jpg)

Post a Comment for "Share Split Vs Share Consolidation"