Stock Market Orders Define

Order to buy or sell a stated amount of a security at the most advantageous price obtainable after the order is represented in the trading crowd. This tends to stay in place for a day and then prompts the buying or selling of the shares provided they are still actively traded.

Generally it will execute at or close to the current bid sell or ask buy price.

:max_bytes(150000):strip_icc()/GettyImages-1131828360-addbba36b65e4e5d9097e56fca635084.jpg)

Stock market orders define. It remains in effect only for the day and usually results in the prompt purchase or sale of all the shares of stock or options contracts in question as long as the security is actively traded and market conditions permit. A buy limit order can only be. A market order is the simplest of the order types.

Market orders are well-suited for securities that are traded in very high volumes such as. A market order is an order to buy or sell a stock at the markets current best available price. A market order is a buy or sell order to be executed immediately at the current market prices.

Market Order Definition The Basics of Market Orders. On most markets orders are accepted from both individual and institutional investors. Types of Orders A market order is an order to buy or sell a security immediately.

In an active market market orders will execute immediately but not necessarily at the exact price that the trader intended. A limit order is an order to buy or sell a stock for a specific price. A market order instructs Fidelity to buy or sell securities for your account at the next available price.

A stop order also referred to as a stop-loss. A market order is considered the most basic of all orders. The opposite of a limit order is a market order.

A market order to buy or sell goes to the top of all pending orders and gets executed almost immediately regardless of price. Market orders are optimal when the primary goal is to execute the trade immediately. A limit order is an order to buy or sell a security at a specific price or better.

Additional Stock Order Types. When a layperson imagines a typical stock market transaction they think of market orders. When to Use a Market Order.

Order Definition Understanding Orders. 1 For example if you wanted to purchase shares of a 100 stock at 100 or less you can set a limit order that wont be. This type of order guarantees that the order will be.

A stop-loss order is also referred to as a stopped market on-stop buy or on-stop sell this is one of the most useful orders. A market order typically ensures an execution but it does not guarantee a specified price. If you are buying or selling shares on a certain platform when you make a market order you are essentially just requesting the transaction to go through at the next available price.

Market and limit orders While market and limit orders are both used to buy and sell securities the difference between them is how the trades are executed. All or None AON Immediate or Cancel IOC Fill or Kill FOK. Market Order A market order is when an investor requests an immediate execution of the purchase or sale of a security.

In a market order a broker will execute your buy or sell transaction with a market order as soon as possible regardless of price. The market order on the other hand says I want that stock and Im willing to pay whatever the price is in order to get that stock so if youve ever been to a fancy restaurant or at least a specialty restaurant where sometimes things are not as abundant for example fish sometimes you will notice on the menu that it says market price so youll pay for lets say grouper sandwich the market price for what it currently is. Market orders are used when certainty of execution is a priority over the price of execution.

It is meant to be executed as. Pending orders for a stock during the trading day get arranged by price. Example of Using an Order For a Stock.

For example a trader might place a market order to buy a stock when the best price is 129 but the order is for a popular stock that sees millions of shares exchange hands every day. 3 If youre new to trading and have been using the default setting on brokerage apps youve most likely been placing market orders. As long as there are willing sellers and buyers market orders are filled.

While this type of order guarantees the execution of the order it doesnt guarantee the execution price. Any time a. Investors utilize a broker to buy or sell an asset using an order type of their choosing.

When you place an order for a stock on an exchange through a broker or an electronic trading platform one of the important specifications is the time-in-force specification which tells the. Used in the context of general equities. These orders are the most basic buy and sell trades where a broker receives a security trade order and.

/activetrading5-5bfc2b9a46e0fb00265bed7e.jpg) The Basics Of Trading A Stock Know Your Orders

The Basics Of Trading A Stock Know Your Orders

Stock Option Trading Programs With Images Intraday Trading Stock Market Forex Trading Basics

Stock Option Trading Programs With Images Intraday Trading Stock Market Forex Trading Basics

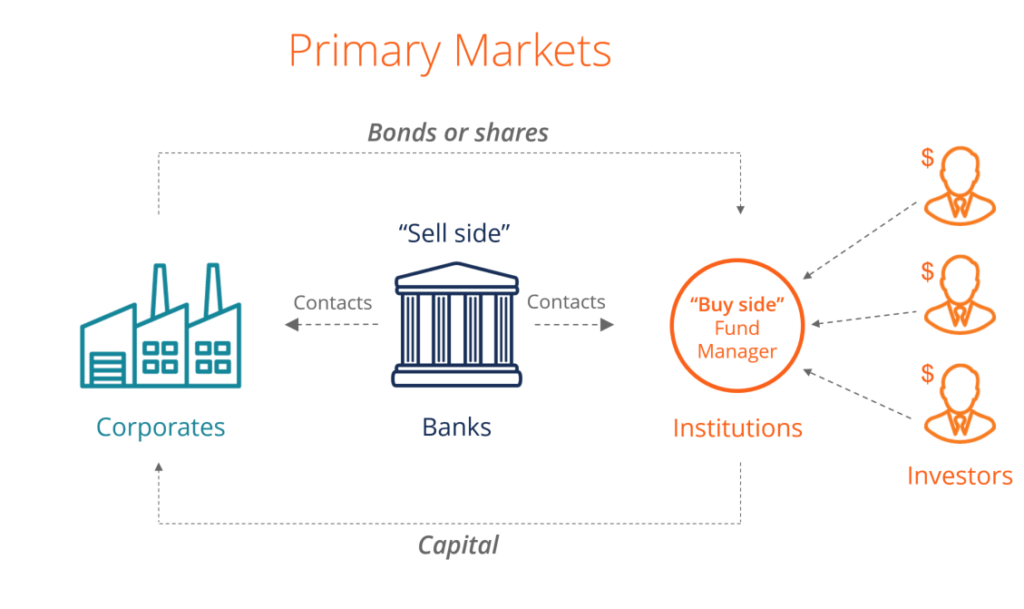

Primary Market How New Securities Are Issued To The Public

Primary Market How New Securities Are Issued To The Public

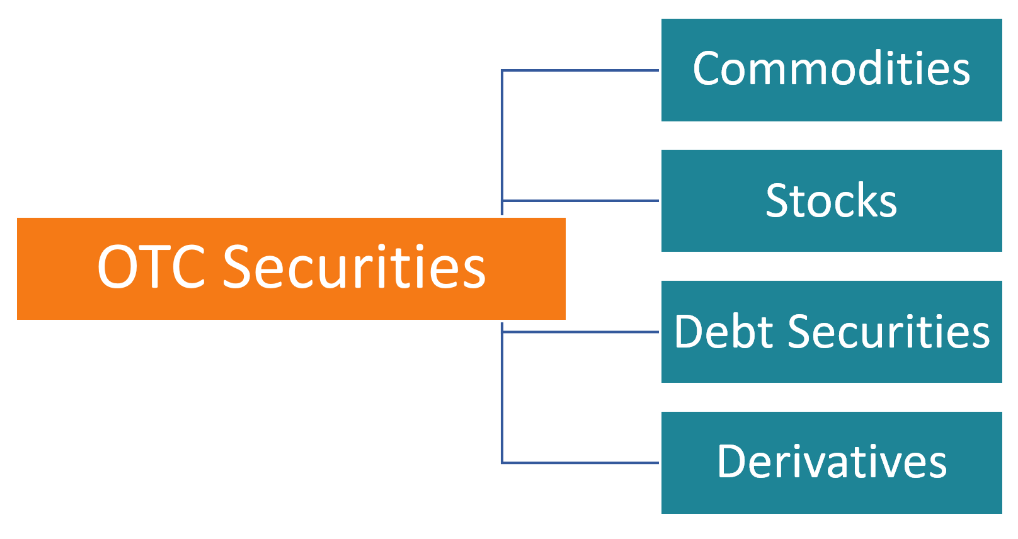

Over The Counter Otc Understand How Otc Trading Works

Over The Counter Otc Understand How Otc Trading Works

25 Stock Market Definitions The Dough Roller

25 Stock Market Definitions The Dough Roller

:max_bytes(150000):strip_icc()/GettyImages-1131828360-addbba36b65e4e5d9097e56fca635084.jpg) Market On Open Order Moo Definition

Market On Open Order Moo Definition

:max_bytes(150000):strip_icc()/dotdash_final_Quote-Driven_vs_Order_Driven_Markets_Whats_the_Difference_Jan_2021-01-c854ebbf2ebd46fdb4a25bda2cd931dc.jpg) Quote Driven Vs Order Driven Markets The Difference

Quote Driven Vs Order Driven Markets The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Swing_Trading_Definition_and_Tactics_Sep_2020-01-3076f5051df14af8a12fdeba61c23144.jpg) Swing Trading Definition And Tactics

Swing Trading Definition And Tactics

Stock Order Types Limit Orders Market Orders And Stop Orders Youtube

Stock Order Types Limit Orders Market Orders And Stop Orders Youtube

Nerdtrader123 I Will Perform Stock Trading Plans With Technicals And Brief Fundamentals Optimal Win For 10 On Fiverr Com Stock Trading Stock Analysis How To Plan

Nerdtrader123 I Will Perform Stock Trading Plans With Technicals And Brief Fundamentals Optimal Win For 10 On Fiverr Com Stock Trading Stock Analysis How To Plan

Trade Order Definition Types And Practical Examples

Trade Order Definition Types And Practical Examples

Stock Market Basics Candlestick Patterns Toughnickel Stock Market Basics Stock Market Candlesticks

Stock Market Basics Candlestick Patterns Toughnickel Stock Market Basics Stock Market Candlesticks

:max_bytes(150000):strip_icc()/dotdash_Final_Extended_Trading_Nov_2020-01-58b7800025324f1c913b7ee962de5bfe.jpg) Extended Trading Definition And Hours

Extended Trading Definition And Hours

Setting Up Stop Loss Orders Setting Up Stop Loss Orders Stop Loss Order Levels Should Be In Fact C Stock Market Trading Charts Technical Analysis Indicators

Setting Up Stop Loss Orders Setting Up Stop Loss Orders Stop Loss Order Levels Should Be In Fact C Stock Market Trading Charts Technical Analysis Indicators

The Stop Loss Order Make Sure You Use It

The Stop Loss Order Make Sure You Use It

Stock Market Investing For Beginners Investing In Shares Stock Market Investing Investing Books

Stock Market Investing For Beginners Investing In Shares Stock Market Investing Investing Books

How To Select A Stock To Invest In Indian Stock Market For Consistent Returns Stocks For Beginners Investing Stock Market

How To Select A Stock To Invest In Indian Stock Market For Consistent Returns Stocks For Beginners Investing Stock Market

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/RobinhoodLevel2-9fc2600afd384175b8b6a9af7e37df62.png)

Post a Comment for "Stock Market Orders Define"