Stock Options Explained Employee

An employee stock option is a contract between an employee and her employer to purchase shares of the companys stock typically common stock at an agreed upon price within a specified time period. Stock options arent actual shares theyre the opportunity to exercise purchase a certain amount of company shares at an agreed-upon price called your grant strike or exercise price.

A No B S Guide To Startup Stock Option Grants By Matt Cooper The Startup Medium

The employee will continue to hold the options even if no longer employed unless the stock option plan states otherwise Sometimes private companies dont go public Elkins notes.

Stock options explained employee. For starters its important to note that there are two types of stock options. A stock option is simply a contract that allows you to purchase or sell shares of stock usually in blocks of 100 shares for a certain period of time for a certain price. Vesting schedule which is the time table under which the employees gain full control over the options.

You assign the right to a person- the holder to buy a certain underlying asset in this case the shares in your company at a price that you decide today. NQs Non-Qualified Stock Options ISOs Incentive Stock Options. Also known as incentive or qualified stock options statutory stock options are typically.

They do not receive special tax treatment from the federal. Incentive stock options must be granted under a written plan document. Employee stock options ESO is a label that refers to compensation contracts between an employer and an employee that carries some characteristics of financial options.

Non-qualified stock options NQSOs are the most common. A stock option functions in the following way. Types of Stock Compensation Non-statutory Stock Options.

You usually have to earn your options over timea process called vesting. In financial markets stock options give the trader the right but not the obligation to buy or sell an underlying stock. This can vary by.

So its often to your advantage to use ISOs to attract and retain key employees. Essentially a stock option allows an investor to bet on the rise or fall. Otherwise the employee continues to own the stock or an ownership interest in the company until it goes public or is sold or acquired.

Employee stock options are commonly viewed as an internal agreement providing the possibility to participate in the share capital of a company granted by the company to an employee as part of the employees remuneration package. Generally ISOs receive more favorable tax treatment than nonqualified stock options do. Stock Option Plans permit employees to share in the companys success without requiring a startup business to spend precious cash.

Here are some key ideas specific to employee stock options. The strike price which is the price at. We now arrive at.

In fact Stock Option Plans can actually contribute capital to a. Corporate benefits for some or all employees may include equity compensation plans. This is the simpler of the two forms of employee stock compensation that come in the form.

Simple explanations so you have the tools to begin to manage your stock options. Grant date which is the date on which employees are granted the options. Restricted Stock and.

Stock options or awards can be quite complex. Instead youre getting the right to exercise buy a set number of shares at a fixed price later on. There are two key parties in the ESO the grantee employee and grantor employer.

Stock vesting explained With stock options like ISOs or NSOs you arent getting actual shares of stockyet. The hope is you get to sell your purchased shares for more than you paid for them. On paper this is a legal document signed and approved by the Board of Directors and it represents a new issue of company shares.

Employee Stock Option ESO Understanding ESOs. You can buy stock option contracts through most online brokers. It all starts with a stock option pool.

There are two types of stock options companies issue to their employees. This is a pool of shares that the company issues and that it reserves for employees. The goal of Employee Stock Options Explained is to provide employees with a complete primer to their stock options.

If after that time the owner has not exercised the option it expires and is worthless. The bet for the holder of the option is that the price of the asset tomorrow is going to be higher than the price of the option. Incentive stock options ISOs which are given to executives do receive special tax treatment.

Incentive stock options ISOs are given only to key employees and top management of the company.

Employee Stock Option Eso Overview Forms Tax Implications

Employee Stock Option Eso Overview Forms Tax Implications

How Employee Equity Works A Simple Introduction Gusto

How Employee Equity Works A Simple Introduction Gusto

Do You Understand How Your Esops Work

Do You Understand How Your Esops Work

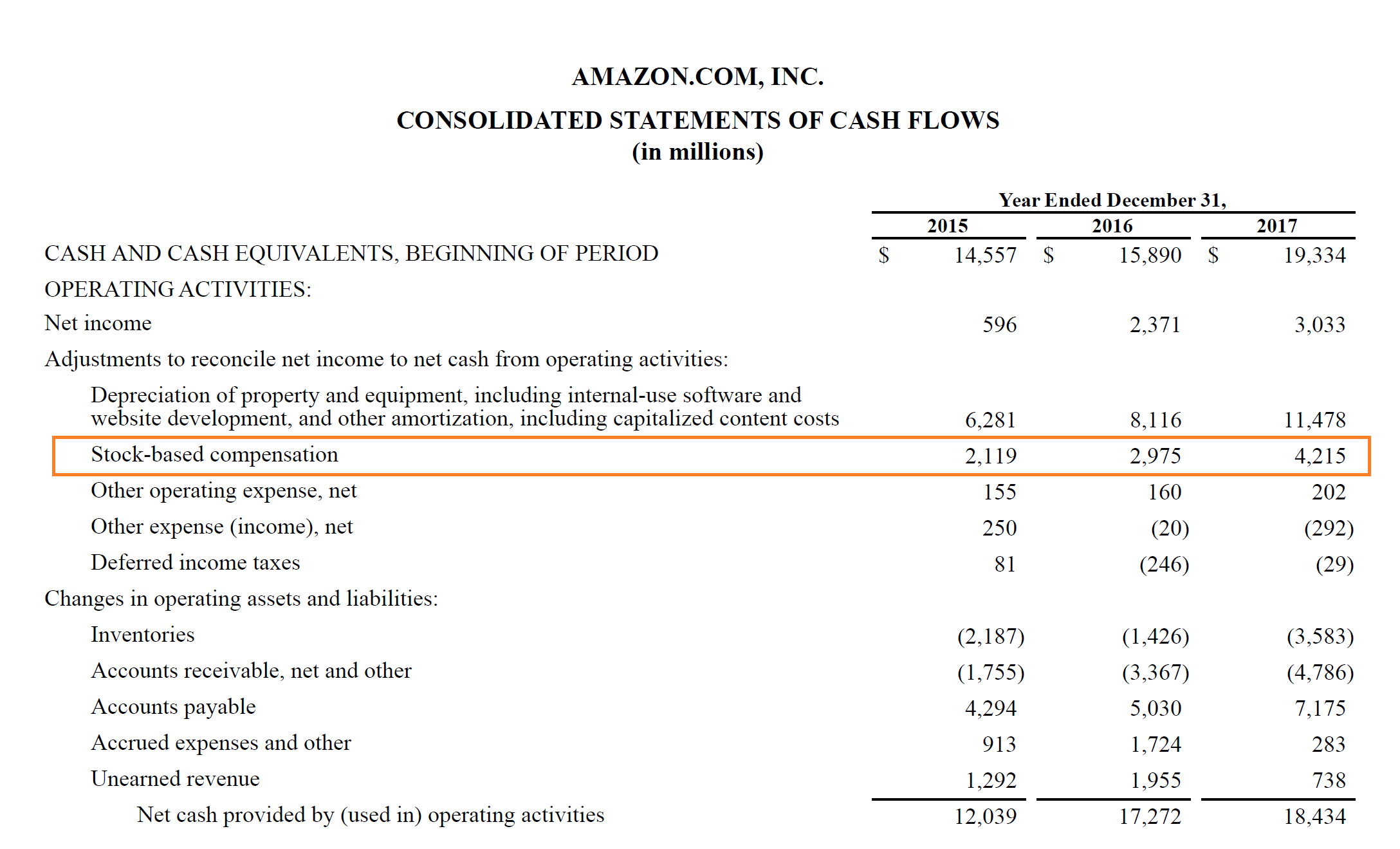

Stock Based Compensation Overview And What You Need To Know

Stock Based Compensation Overview And What You Need To Know

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg) Get The Most Out Of Employee Stock Options

Get The Most Out Of Employee Stock Options

Equity 101 Part 2 Stock Option Strike Prices Carta

Equity 101 Part 2 Stock Option Strike Prices Carta

Different Types Of Employee Compensation Eqvista

Different Types Of Employee Compensation Eqvista

Employee Stock Options Explained Youtube

Employee Stock Options Explained Youtube

Read This Before Exercising Your Stock Option Plan The Hindu

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-04-9b5dfea250a14cd9902b1d3406e185b2.jpg) Employee Stock Option Eso Definition

Employee Stock Option Eso Definition

Equity 101 Stock Options Explained For Startup Employees Carta

Equity 101 Stock Options Explained For Startup Employees Carta

Employee Stock Options Plan Esops Understanding The Background Nov 2020 Youtube

Employee Stock Options Plan Esops Understanding The Background Nov 2020 Youtube

How To Understand Employee Stock Options And Maximize Financial Gain Modernadvisor Blog

Employee Stock Options What You Need To Know

Employee Stock Options What You Need To Know

7 Questions To Ask Before Issuing Stock Options To Your Employees Buchwald Associates

7 Questions To Ask Before Issuing Stock Options To Your Employees Buchwald Associates

Exercising Stock Options Everything You Should Know Carta

Tax Alert Beware Of Double Taxation On Employee Stock Options Legacy Financial Group

Tax Alert Beware Of Double Taxation On Employee Stock Options Legacy Financial Group

Post a Comment for "Stock Options Explained Employee"