Stock Sell Stop Limit Order Definition

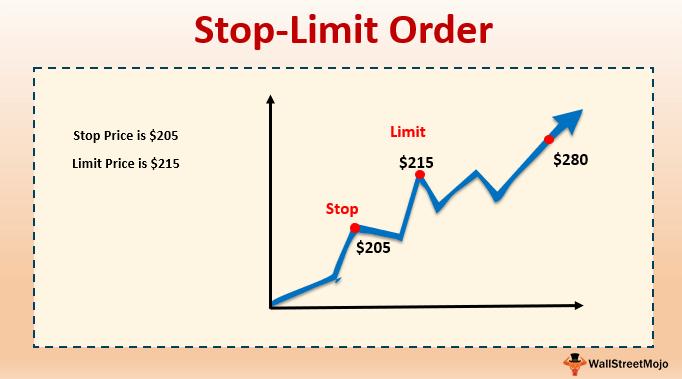

When it becomes active it will be executed at 19 or at a much better price. A stop-limit order true to the name is a combination of stop orders where shares are bought or sold only after they reach a certain price and limit orders where traders have a maximum price.

What Is A Conditional Order Fidelity

What Is A Conditional Order Fidelity

You could create a sell stop so that if price moves lower and into 13220 you would be entered into a short trade.

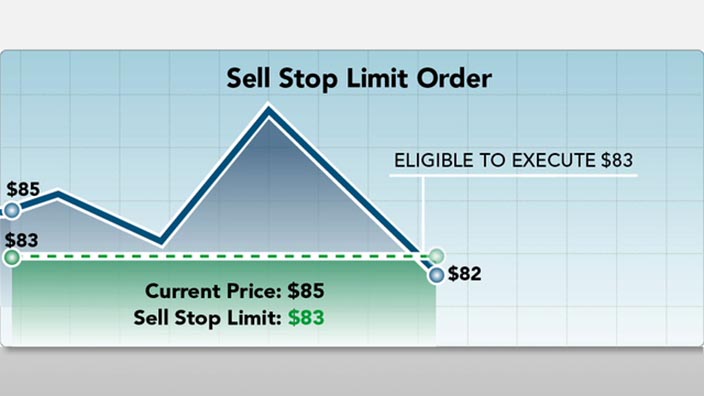

Stock sell stop limit order definition. A Sell Stop Limit Order will be executed at a specified price or above after a given stop price has been reached. Since you dont want to suffer slippage placing a sell stop limit order to sell the XYZ stock at 19 the order will only become active when the stocks price goes down past 19. If the stock reaches the stop price the order becomes a market order and is filled at the next available market price.

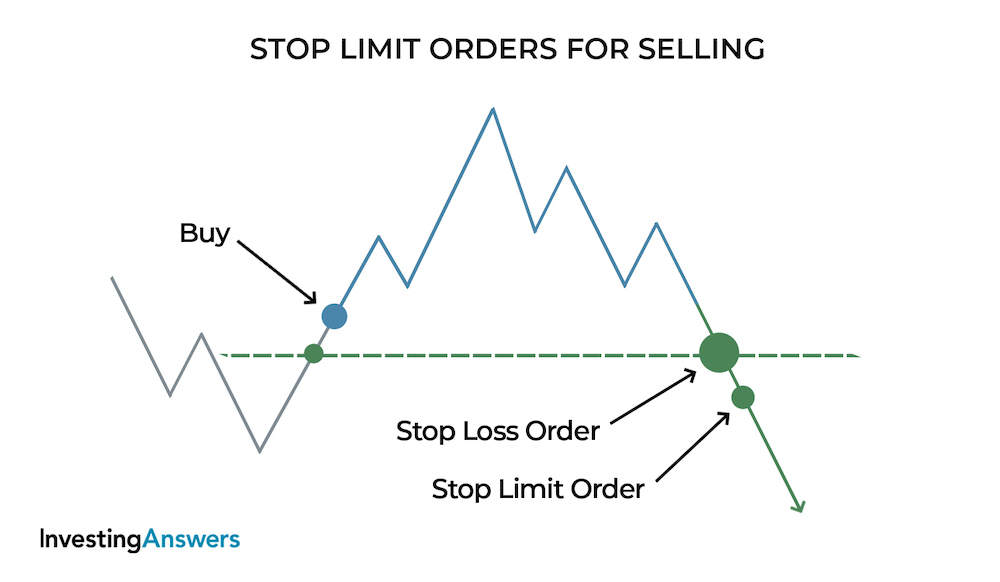

A stop limit order to sell becomes a limit order and a stop loss order to sell becomes a market order when the stock is bid National Best Bid quotation at or lower than the specified stop price. More Canceled Order Definition. Once the stop price is reached the stop-limit order becomes a limit order to buy.

A stop-limit is a combination order that instructs your broker to buy or sell a stock once its price hits a certain target known as the stop price but not to pay more for the stock or sell it for less than a specific amount known as the limit price. A stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price designed to limit an investors potential loss on a trading position. Note however that some market makers may apply the guidelines for listed security stop orders to OTC securities.

This order type can be used to activate a limit order to buy or sell a security once a specific stop price has been met. Stop-limit order A stop order that designates a price limit. A stop-limit order triggers a limit order once the stock trades at or through your specified price stop price.

A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. A limit order is an order to buy or sell a security at a specified price or better. Sell 100 Shares XYZ Limit 3345 In other words your stock wont be sold for any less than 3345 per share.

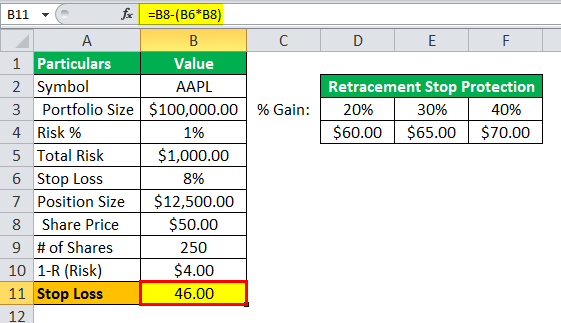

A stop limit order is a tool that is used to help traders limit their downside risk when. ABC XYZ is trading at 13250 and you want to sell when the price moves lower and reaches 13220. Unlike the stop order which becomes a market order once the stop is reached the stop-limit order becomes a limit order.

The stop-limit order will be executed at a specified price or better after a given stop price has been reached. A stop order is an order to buy or sell a stock at the market price once the stock has traded at or through a specified price the stop price. If the stock rises above that price before your order is filled you could benefit by receiving more than your limit price for the shares.

The limit price sets your sales floor or purchase ceiling. If you enter a limit sell order for 3345 it wont be filled for less than that price. A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk.

A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. If the stock fails to reach the stop price the order is not executed. This is the sell stop limit order.

Your goal is simple to limit your loss. Once the stop price is reached the order becomes a Sell Limit Order filled at the limit price specified or higher. Your stop price triggers the order.

Once the stop price is reached a stop-limit order becomes a limit order that will be executed at a specified price or better. A Sell Stop Limit Order is an order that combines the features of a Sell Stop Order with those of a limit order. A sell stop order is an order you will place to sell below the current market price.

A stop price and a limit price. A stop-limit order consists of two prices. An example of a sell stop order may be.

By using a stop limit order instead of a regular stop order a client will receive additional certainty with respect to the price received for the stock although there is the possibility that the order will not be executed at all.

Etf Order Types Back To The Basics Seeking Alpha

Etf Order Types Back To The Basics Seeking Alpha

/blur-1853262_19201-485cc15952974d8ab3af724fc5636238.jpg) The Difference Between A Limit Order And A Stop Order

The Difference Between A Limit Order And A Stop Order

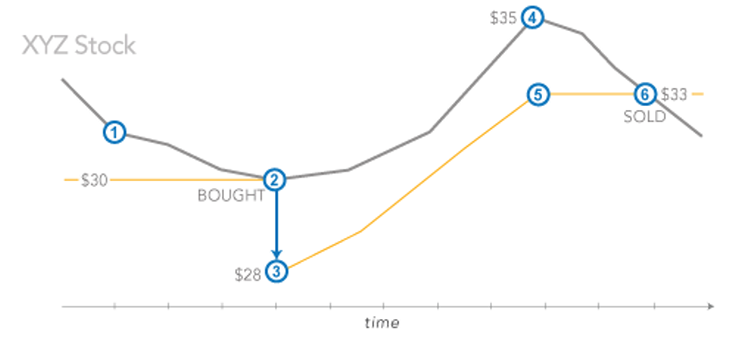

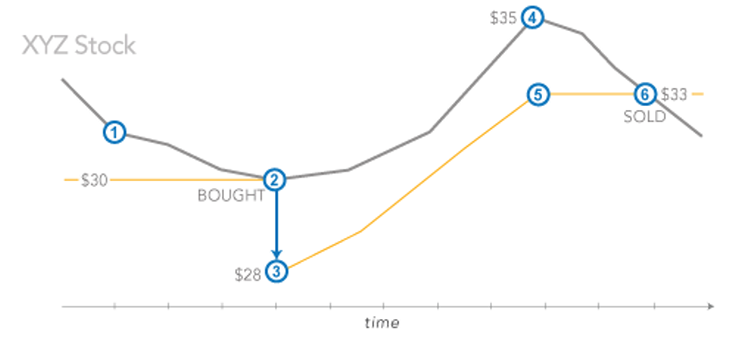

Stop Limit Order Examples Meaning Investinganswers

Stop Limit Order Examples Meaning Investinganswers

Trailing Stop Loss Example Meaning Investinganswers

Trailing Stop Loss Example Meaning Investinganswers

/dotdash_Final_How_the_Trailing_Stop_Stop_Loss_Combo_Can_Lead_to_Winning_Trades_Sep_2020-01-4c3b54bb0ca947608471ea2248542111.jpg) Trailing Stop Stop Loss Combo Leads To Winning Trades

Trailing Stop Stop Loss Combo Leads To Winning Trades

Stop Limit Order Definition Example How Does It Work

Stop Limit Order Definition Example How Does It Work

3 Basic Order Types Explained Ninjatrader Blog

3 Basic Order Types Explained Ninjatrader Blog

Limit Order Vs Stop Order Difference And Comparison Diffen

Limit Order Vs Stop Order Difference And Comparison Diffen

What Is A Stop Limit Order Fidelity

What Is A Stop Limit Order Fidelity

Stop Limit Order Example Step By Step Full Guide Free

Stop Limit Order Example Step By Step Full Guide Free

In Trailing Stop Limit Orders What Does The Limit Offset Mean Economics Stack Exchange

In Trailing Stop Limit Orders What Does The Limit Offset Mean Economics Stack Exchange

Td Ameritrade Limit Order Buy Sell On Stocks How To Enter 2021

Td Ameritrade Limit Order Buy Sell On Stocks How To Enter 2021

Types Of Forex Orders Babypips Com

Types Of Forex Orders Babypips Com

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Trading Up Close Stop And Stop Limit Orders Youtube

Trading Up Close Stop And Stop Limit Orders Youtube

Stop Vs Limit Orders What Are The Types Of Orders In Trading Ig En

Stop Vs Limit Orders What Are The Types Of Orders In Trading Ig En

Stop Loss Order Definition Examples Calculate Stop Order To Buy Sell

Stop Loss Order Definition Examples Calculate Stop Order To Buy Sell

Trade Orders Definition Types Financial Securities Class Study Com

Trade Orders Definition Types Financial Securities Class Study Com

Post a Comment for "Stock Sell Stop Limit Order Definition"