Stock Split In The Form Of A Dividend

RE no effect. A stocks payout ratio is the amount of money it pays per share in dividends divided by its earnings per share.

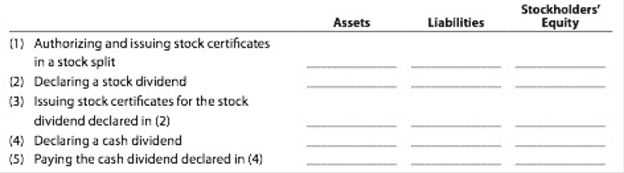

Effect Of Cash Dividend And Stock Split Indicate Whether The Following Actions Would Increase Decrease Or 0 Not Affect Indigo Inc S Total Assets Liabilities And Stockholders Equity Bartleby

Effect Of Cash Dividend And Stock Split Indicate Whether The Following Actions Would Increase Decrease Or 0 Not Affect Indigo Inc S Total Assets Liabilities And Stockholders Equity Bartleby

A stock split effected in the form of a dividend is a distribution of corporate stock to present stockholders in proportion to each stockholders current holdings and can be expected to cause a material decrease in the market value per share of the stock.

Stock split in the form of a dividend. PIC no effect. When the total number of shares issued is less than twenty-five percent of the entire value of shares that were outstanding before dividend it is called a small dividend payout. Stock dividends are not taxed until the shares granted are sold by their.

A stock dividend is a dividend paid to shareholders in the form of additional shares in the company rather than as cash. Aviat Networks AVNW says its board has approveda two-for-one stock split in the form of a stock dividendThat is each stockholder of record Apr. Common stock is increased for the par value of the shares issued the PIC-excess of par is debited for the same amount.

RTTNews - While reporting its financial results for the fourth quarter on Wednesday Amphenol Corp. SHW Sherwin-Williams today announced that its Board of Directors has approved and declared a three-for-one stock split in the form of a stock dividend to make the stock more accessible to employees and a broader base of investors. For example if you own 50 shares in a company that completes a 2-for-1 split youll be issued 50.

43 specifies that a distribution in excess of 20 to 25 of the number of shares previously outstanding would cause a material decrease in the market value. A stock split is exactly what it sounds like. Account Research Bulletin No.

APH said its board of directors has approved a 2-for-1 stock split to be paid in the form of. Each stockholder of record on August 21 2020 will receive a dividend of four additional shares of common stock for each then-held share to be distributed after close of trading on August 28. In the Stock dividend additional shares are given to shareholders whereas in stock split already issued shares are split in an agreed ratio.

When a stock is split the dividend per share paid to shareholders is also split but the total amount paid remains the same. A dividend or cash payment made periodically by a company is impacted by a stock split depending on the dividends date of record or the date on which one must be a shareholder to receive a. Stock dividends are very similar to stock splits.

Assume a stock pays a quarterly dividend of 1 per share and an investor owns 100 shares. Retained earnings and Paid-in capital. 3 2021 PRNewswire -- The Sherwin-Williams Company NYSE.

Dividend checks D. Its an action by a companys board of directors to increase the number of shares of stock in the company by splitting its existing shares. For example a shareholder who owns 100 shares of stock will own 125 shares after a 25 stock dividend essentially the same result as a 5 for 4 stock split.

In other words this tells you what percentage of earnings a stock. No additional shares are allotted. Dividend-paying stocks return 191 of the amount you invest in the form of.

What is the effect of the declaration and subsequent issuance of a stock split effected in the form of a stock dividend on each of the following. When a company is doing well a portion of its profits may be split among stockholders in the form of _____. A stock split by definition replaces share with a greater number of shares.

For example a stock might split 2-for-1 replacing each share with two new shares or 3-for-2 replacing every pair of. The total dividend to that investor is 100. A stock dividend means dividend which is paid in the form of additional shares whereas stock split is a division of issues shares in the ratio as decided by Company.

Depending on the percentage of shares issued to the total value of shares outstanding before dividend this can be small or large. A stock dividend functions essentially like an automatic dividend reinvestment program more on that below. When a company splits its stock the number of outstanding shares owned by investors increases.

What Is A Stock Split Definition Types Example Objectives Advantages Disadvantages The Investors Book

What Is A Stock Split Definition Types Example Objectives Advantages Disadvantages The Investors Book

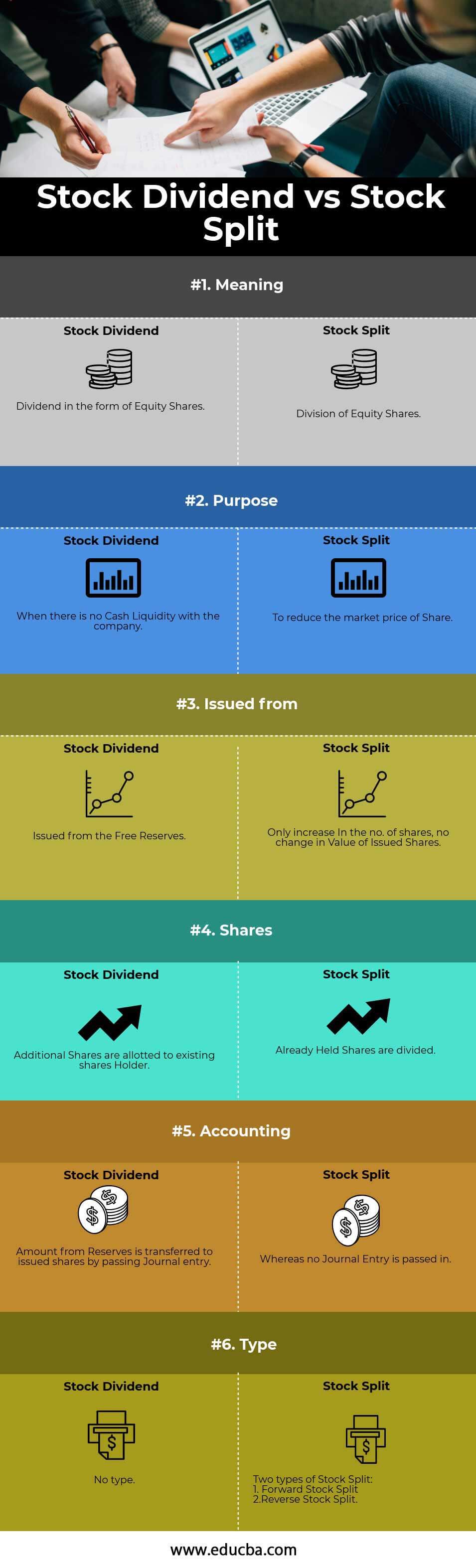

Stock Dividend Vs Stock Split Top 6 Best Differences With Infographics

Stock Dividend Vs Stock Split Top 6 Best Differences With Infographics

A Stock Split Increases The Number Of Existing Shares By Splitting Or Dividing The Shares Into More Shares But Is Smart Money Investing In Shares Money Habits

A Stock Split Increases The Number Of Existing Shares By Splitting Or Dividing The Shares Into More Shares But Is Smart Money Investing In Shares Money Habits

Corporate Actions How Dividends Stock Splits Etc Are Accounted For In Cfd Trading Contracts For Difference Com

Corporate Actions How Dividends Stock Splits Etc Are Accounted For In Cfd Trading Contracts For Difference Com

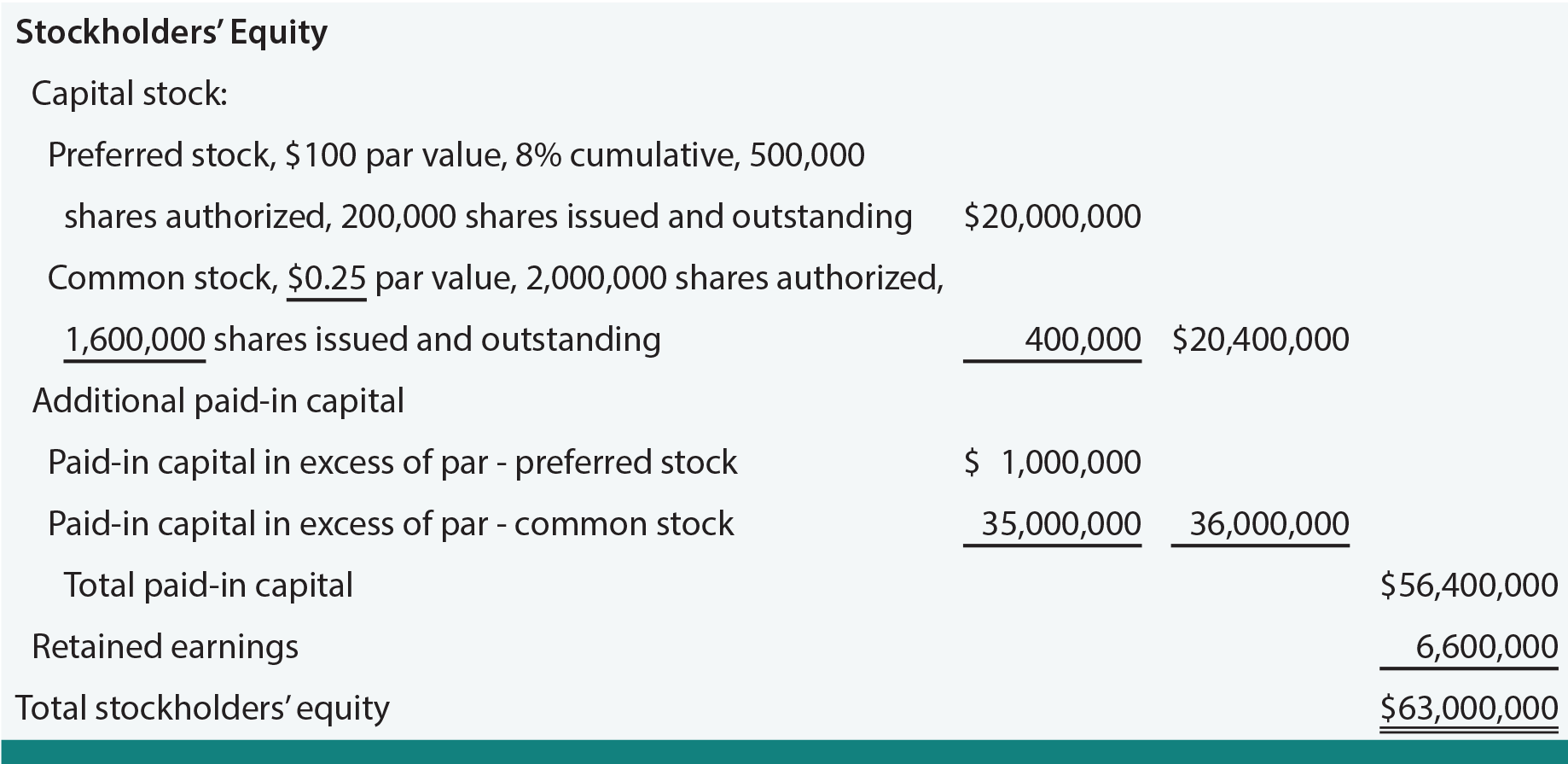

Dividend Preferences Ch 15 P 9 Intermediate Accounting Cpa Exam Cpa Exam Accounting Accounting Student

Dividend Preferences Ch 15 P 9 Intermediate Accounting Cpa Exam Cpa Exam Accounting Accounting Student

Stock Dividend Ch 15 P 7 Intermediate Accounting Cpa Exam Cpa Exam Accounting Dividend

Stock Dividend Ch 15 P 7 Intermediate Accounting Cpa Exam Cpa Exam Accounting Dividend

Stock Splits And Stock Dividends Accountingcoach

Stock Splits And Stock Dividends Accountingcoach

Stock Split Definition Explanation And Examples Play Accounting

Stock Split Definition Explanation And Examples Play Accounting

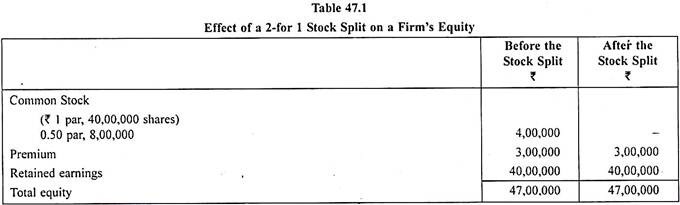

Stock Split Efinancemanagement Financial Life Hacks Accounting And Finance Money Management Advice

Stock Split Efinancemanagement Financial Life Hacks Accounting And Finance Money Management Advice

Demat Account Dematerialized Account Provides The Shareholders Investors To Hold The Shares In An Electronic Form O Accounting Smart Money Online Accounting

Demat Account Dematerialized Account Provides The Shareholders Investors To Hold The Shares In An Electronic Form O Accounting Smart Money Online Accounting

Stockholders Apos Equity Best Study Notes In 2020 Study Notes Equity Learning Objectives

Stockholders Apos Equity Best Study Notes In 2020 Study Notes Equity Learning Objectives

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png) What S The Difference Between The Record Date And Ex Dividend Date

What S The Difference Between The Record Date And Ex Dividend Date

Facebook Marketing The Definitive Guide In 2020 Clickfunnels In 2020 Sales And Marketing Email Marketing Lists Facebook Marketing

Facebook Marketing The Definitive Guide In 2020 Clickfunnels In 2020 Sales And Marketing Email Marketing Lists Facebook Marketing

1 Overview Of Corporation General 2 Cash And Property Dividends 3 Stock Dividends And Stock Splits 4 Treasury Stock Transactions 5 Stock Rights Ppt Download

1 Overview Of Corporation General 2 Cash And Property Dividends 3 Stock Dividends And Stock Splits 4 Treasury Stock Transactions 5 Stock Rights Ppt Download

Stock Splits And Stock Dividends Principlesofaccounting Com

Stock Splits And Stock Dividends Principlesofaccounting Com

7 Points Comparison Bonus Share Vs Stock Split Yadnya Investment Academy

7 Points Comparison Bonus Share Vs Stock Split Yadnya Investment Academy

Solved On October 31 The Stockholders Equity Section Of Chegg Com

Solved On October 31 The Stockholders Equity Section Of Chegg Com

Benefits And Disadvantages Of Equity Shares Investment Investing Accounting And Finance Financial Management

Benefits And Disadvantages Of Equity Shares Investment Investing Accounting And Finance Financial Management

Post a Comment for "Stock Split In The Form Of A Dividend"