Treasury Stock Method Warrants

Without suggesting that. This information is included in the calculation of diluted earnings per share expanding the number of shares and therefore reducing the amount of earnings per share.

How To Calculate Diluted Earnings Per Share Using The Treasury Stock Method Shortcut Approach Youtube

How To Calculate Diluted Earnings Per Share Using The Treasury Stock Method Shortcut Approach Youtube

The proceeds from exercise are then assumed to be used by the company to purchase common stock in the open market at the average market price during that period.

:max_bytes(150000):strip_icc()/stock-market-fluctuations-5955e0f63df78cdc29b6dce5.jpg)

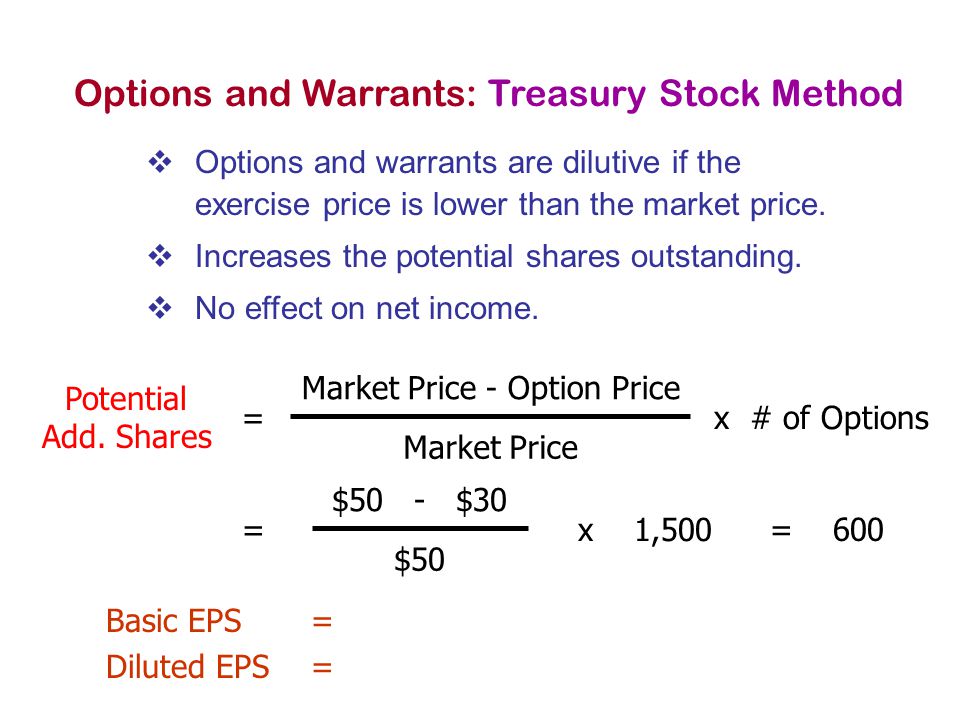

Treasury stock method warrants. In addition there are certain accounting benefits. The treasury stock method states that the basic share count used in calculating a companys earnings per share EPS must be increased as a result of outstanding in-the-money options and warrants. What is the Treasury Stock Method.

Treasury expects to conduct similar auctions in the future for other warrant positions it holds in financial institutions whose preferred stock Treasury has already sold or whose issuer has paid back its investment. It is assumed that call options were exercised-- at the beginning of the period 2. Warrants are the instruments that give the right to the holder to buy stock shares of issuing company at a.

The treasury stock method is a way for companies to calculate how many additional shares may be generated from outstanding in-the-money warrants and options. It is assumed that the proceeds were used -- to buy back its own common shares in the market. There is no adjustment to the net income in the numerator.

B the optionswarrants or equivalents are exercised at the beginning of the year. At the time of exercise-- option holders will pay exercise price per share-- to get common shares 3. Treasury stock method for written call options and warrants 1.

Each warrant position will be sold to a single winning bidder. The new additional shares are then used in calculating the companys diluted earnings per share. The treasury stock method is a technique by which the extent of dilution of the earnings per share can be calculated if options are exercised or securities converted to common stock.

When the ___ method of accounting for treasury stock transactions is used the acquisition of treasury stock is recorded as a debit to a treasury stock account and a credit to cash. Issuers can use the treasury stock method to calculate earnings per share and amortized warrant value can be used to increase interest expense. The number of shares of common stock that can be purchased is referred to as the number of incremental shares outstanding.

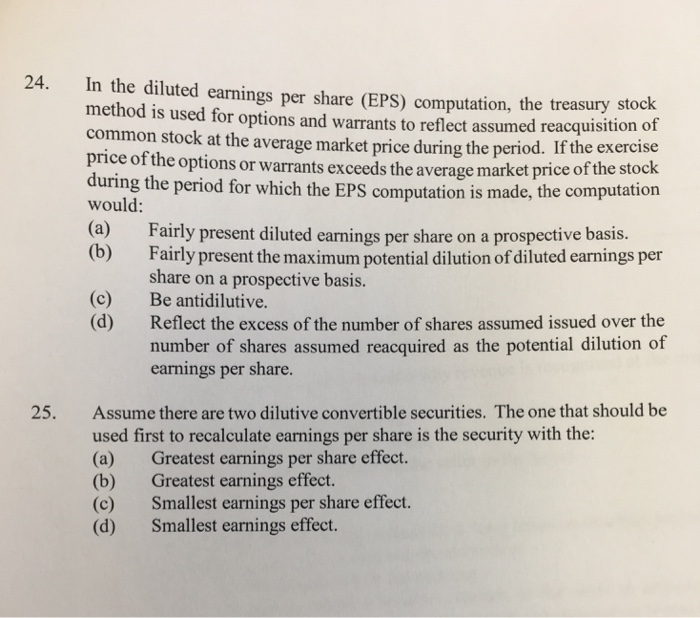

The treasury stock method applied to written call options and equivalents assumes that a the optionswarrants or equivalents are exercised at the end of the year. Treasury stock method for options and warrants The treasury stock method consists of three steps. If The Exercise Price Of The Options Or Warrants Exceeds The Average Market Price The Computation Would Fairly Present Diluted Earnings Per Share On.

The treasury stock method. The funds received from the exercise of the options or warrants are used to buy outstanding stock at the average market price over the year. Firstly it assumes that the options and warrants are exercised at the start of the reporting period and that a company uses the proceeds to purchase common shares at the average market price during the period.

The amount allocated to the stock warrants outstanding should be recorded in the ___. Treasury Stock Method assumes that the options and stock warrants are exercised at the beginning of the year or date of issue if later and the proceeds from the exercise of options and warrants are used to purchase common stock for the treasury. The treasury stock method is used to calculate the net increase in shares outstanding if in-the-money options and warrants were to be exercised.

This means they will have the 200000 basic shares plus the 10909 additional shares which will create a diluted EPS of 474. Stock warrants options have obvious potential for diluting the percentage ownership of existing shares. Under the Treasury Stock Method the options warrants and their equivalents are assumed to be exercised at the beginning of the period and common stock issued in return.

C the proceeds are used to purchase common shares for the treasury at the market price. In The Diluted Earnings Per Share Computation The Treasury Stock Method Is Used For Options And Warrants To Reflect Assumed Reacquisition Of Common Stock At The Average Market Price During The Period. O Proceeds from the exercise of the warrants or options are used to purchase common stock for treasury stock at the average market price for common stock during the year.

The treasury stock method employs the following sequence of assumptions and calculations. When you apply the treasury method the company will receive 1200000 if it exercises the options and warrants which can then be used to buy 10909 shares of stock at the current market value of 110. This is clearly implied within the TSM formula.

These increases extra shares are calculated by the diluted earnings per share a method used to calculate how much a company earns for one unit of stocks also known as EPS. Carta utilizes the Treasury Stock Method to calculate the dilutive effect of options warrants and non-vested stock. Treasury stock method is used to compute the amount of new company shares or net increase in shares that can be created from outstanding in-the-money warrants or options.

Implementing the treasury stock method The broad assumptions in the TSM are as follows. Options Warrants and Their Equivalents.

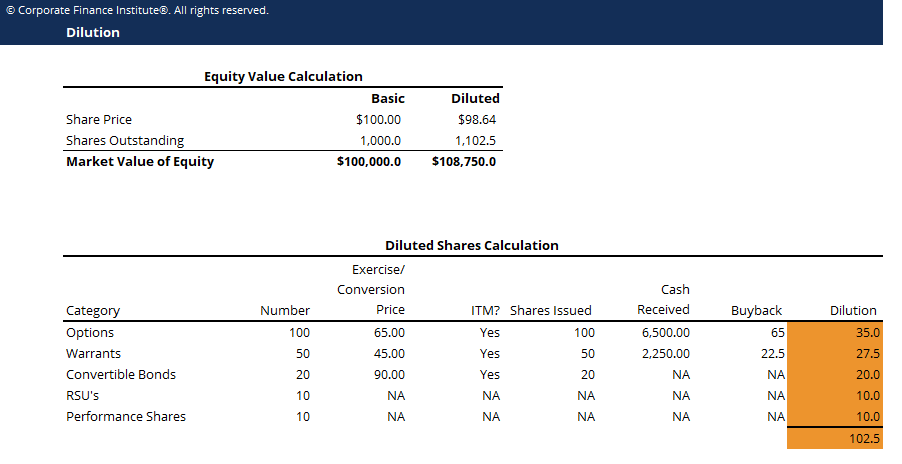

Dilutive Securities Example Of How Dilution Impacts Share Prices

Dilutive Securities Example Of How Dilution Impacts Share Prices

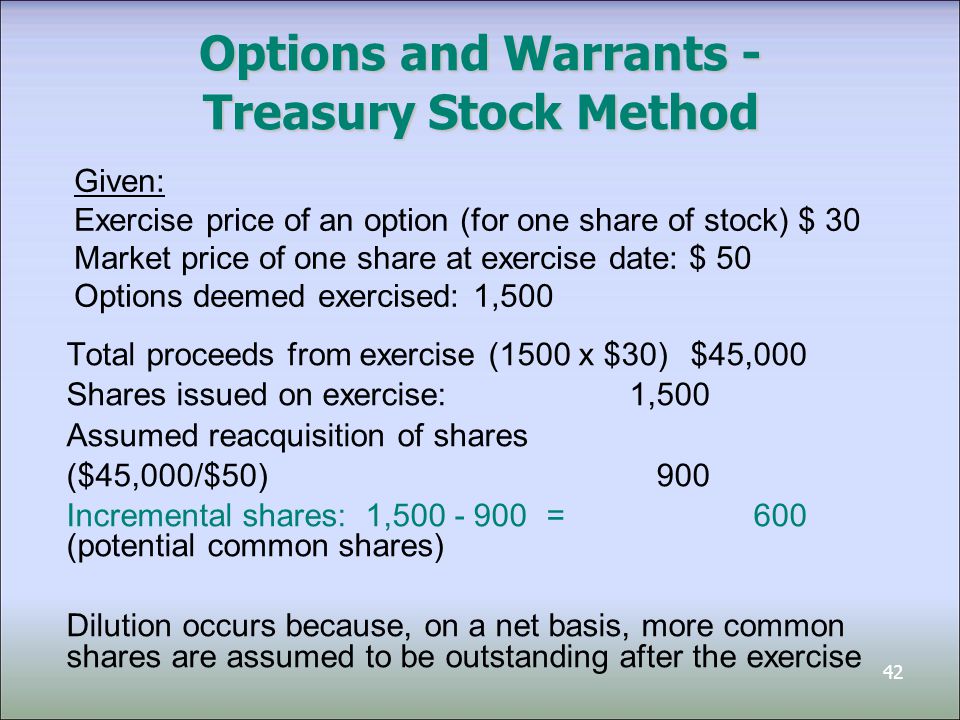

Intermediate Accounting Ppt Download

Intermediate Accounting Ppt Download

Treasury Stock Method Formula Examples Effect Of Stock Options On Eps Youtube

Treasury Stock Method Formula Examples Effect Of Stock Options On Eps Youtube

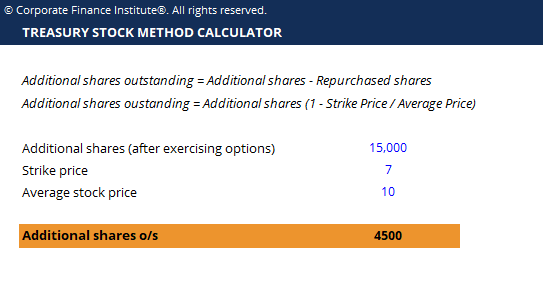

Treasury Stock Method Calculator Download Free Excel Template

Treasury Stock Method Calculator Download Free Excel Template

Chapter 17 Earnings Per Share Ppt Download

Chapter 17 Earnings Per Share Ppt Download

Treasury Stock Method Definition Formula And Explanation

Treasury Stock Method Definition Formula And Explanation

Warrants Definition Explanation Examples And Diluted Eps Play Accounting

Warrants Definition Explanation Examples And Diluted Eps Play Accounting

Chapter 16 1 Slideshow And Powerpoint Viewer Chapter 16 Dilutive Securities And Earnings Per Share Intermediate Accounting 13th Edition Kieso Weygandt And Warfield Chapter 16 2 Learning Le

Chapter 16 1 Slideshow And Powerpoint Viewer Chapter 16 Dilutive Securities And Earnings Per Share Intermediate Accounting 13th Edition Kieso Weygandt And Warfield Chapter 16 2 Learning Le

:max_bytes(150000):strip_icc()/stock-market-fluctuations-5955e0f63df78cdc29b6dce5.jpg) Treasury Stock Method Definition

Treasury Stock Method Definition

Additional Shares Outstanding Treasury Stock Method Trade Brains

Additional Shares Outstanding Treasury Stock Method Trade Brains

In Applying The Treasury Stock Method To Determine The Dilutive Effect Of Stock Course Hero

In Applying The Treasury Stock Method To Determine The Dilutive Effect Of Stock Course Hero

How To Use Treasury Stock Method To Calculate Diluted Shares

How To Use Treasury Stock Method To Calculate Diluted Shares

Intermediate Accounting Ppt Download

Intermediate Accounting Ppt Download

Solved 17 S Tock Warrants Outstanding Should Be Classifi Chegg Com

Solved 17 S Tock Warrants Outstanding Should Be Classifi Chegg Com

Complex Diluted Eps Treasury Stock Method Intermediate Accounting Cpa Exam Far Chp 16 P 7 Youtube

Complex Diluted Eps Treasury Stock Method Intermediate Accounting Cpa Exam Far Chp 16 P 7 Youtube

Factors That Influence Black Scholes Warrant Dilution

Chapter 16 Homework Day Ppt Video Online Download

Chapter 16 Homework Day Ppt Video Online Download

Intermediate Accounting Chapter Ppt Video Online Download

Intermediate Accounting Chapter Ppt Video Online Download

Post a Comment for "Treasury Stock Method Warrants"