What Are Stocks With Unrealized Gains

What are Unrealized Gains. Now if I was to sell the stock then these gains would be locked in because regardless of what happened to the stock I no longer hold.

Fall Stock Market Game Sessions Are Coming To A Close Read This Week S Smgtip About Portfolio Liquidation And Make Stock Market Stock Market Game Investing

Fall Stock Market Game Sessions Are Coming To A Close Read This Week S Smgtip About Portfolio Liquidation And Make Stock Market Stock Market Game Investing

As a result one strategy for managing highly appreciated investments is to set a capital gains budget the maximum amount of capital gains the investor is either willing to absorb and pay the taxes on andor the amount of capital gains that can be triggered and absorbed in the current capital gains tax bracket without increasing them.

What are stocks with unrealized gains. The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains. As with any stocks and bonds the prices fluctuate from minute to minute. The calculation can be done for any time.

Unrealized capital gains refer to the theoretical increase in value of assets that an investor holds onto. It is an increase in the value of an asset that has yet to be sold for cash such as a stock position. For example say you bought a stock for 200 and it grew to 300 giving you a 100 unrealized gain.

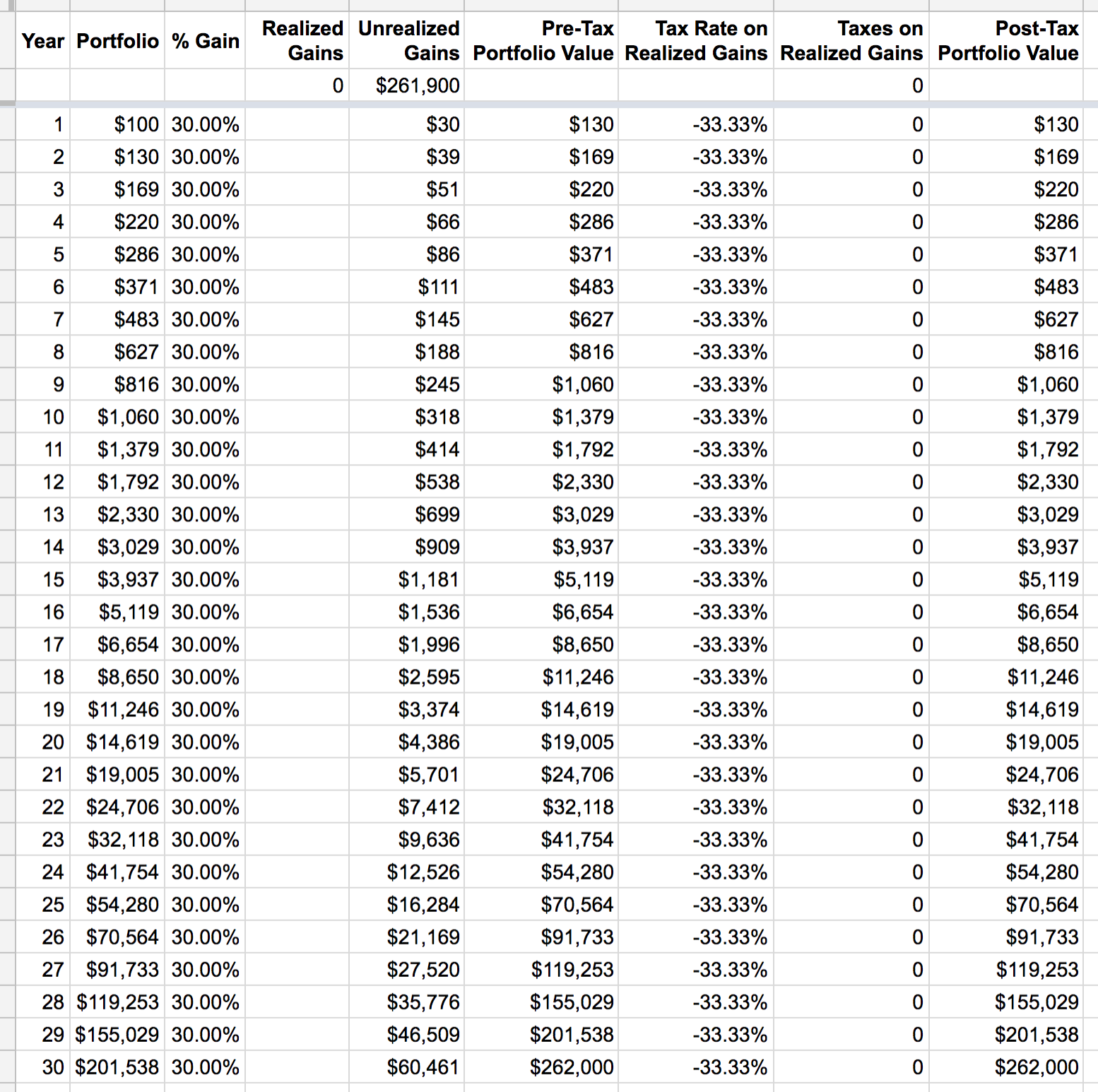

At this moment in time these gains are all unrealized because the stock could theoretically go back down to 11962 within the next minute therefore wiping out all the gains that I have earned so far. The table below shows. Shares of a given stock which now make up far too high a percentage of their overall net worth or An actively managed mutual fund with unreasonably high costs.

Currently taxpayers pay tax only on realized capital gains in. But if you die and your heirs sell it the next day for 300 they dont pay any taxes on the gains because their basis the value when they inherited it is 300. Unrealized gains refer to profits that have occurred on paper but the respective transactions have not yet been completed.

How to calculate Simply put an unrealized gain or loss is the difference between an investments value now and its value at a certain point in the past. An unrealized gain is also called a paper profit because it is recorded on paper but has not actually been realized. Those smaller gains still lead to big overall profits.

They are also known as paper gains and losses because they only exist on paper. An unrealized gain is a potential profit that exists on paper resulting from an investment. These investments are usually called trading securities.

Unrealized gains and losses can be useful to know because they let you know how your portfolio is performing. Readers often email me to ask what to do when you have asset that youd like to sell but which has a large unrealized capital gain. If you sold it you would realize the gain of 100 and pay taxes on it.

Realized gains are taxable so if you sell an investment at a profit youll need to report that income and pay capital gains taxes. An unrealized gain is an increase in the value of an asset or investment that an investor holds but has not yet sold for cash such as an open stock position. It is also called paper profit or paper loss.

Another example of unrealized gains is investments that are actively managed and meant to be sold within the next year. Therefore there is no cash receipt involved in unrealized gains. By investing unrealized capital gains within 180 days of a stock sale into an Opportunity Fund the investment vehicle for Opportunity Zones and holding it for at least 10 years you have no.

The two most common examples being. This tax on unrealized gains would be not only difficult to implement but also could devastate markets especially liquid markets where stocks bonds and commodities trade. Unrealized Gains or Losses refer to the increase or decrease respectively in the paper value of the different assets of the company which have not yet been sold by the company and once such assets are sold then the gains or losses arising on it will be realized by the company.

Its much easier to get three 20-25 gains out of different stocks than it is to get a 100 profit out of one stock. The gains are only realized when the investor sells the asset at a price higher than what. An unrealized gain by contrast is simply a gain on paper.

If a stock is up it is considered an unrealized gain.

Tip 42 Click The Table Headers Stock Market Game Stock Market Financial Literacy

Tip 42 Click The Table Headers Stock Market Game Stock Market Financial Literacy

Bunker Portfolio A New Strategy And Our Latest Dividend Aristocrat Seeking Alpha Dividend Value Investing Retirement Portfolio

Bunker Portfolio A New Strategy And Our Latest Dividend Aristocrat Seeking Alpha Dividend Value Investing Retirement Portfolio

Is This Nasdaq Rally For Real Here S How To Know Qqq Smh Stock Market Technical Analysis Stock Options Stock Options Trading

Is This Nasdaq Rally For Real Here S How To Know Qqq Smh Stock Market Technical Analysis Stock Options Stock Options Trading

How We Bought A Pullback In Lifelock Lock For A 15 Gain So Far Stock Trading Strategies Stock Charts Stock Market

How We Bought A Pullback In Lifelock Lock For A 15 Gain So Far Stock Trading Strategies Stock Charts Stock Market

Unrealized Gain And Loss Loss Gain Stock Ticker

Unrealized Gain And Loss Loss Gain Stock Ticker

Explaining Unrealized Gain And How It Affects Taxes For Investors

Explaining Unrealized Gain And How It Affects Taxes For Investors

How To Buy Top Breakout Stocks On A Pullback Yelp Stock Trading Strategies Stock Market Stock Charts

How To Buy Top Breakout Stocks On A Pullback Yelp Stock Trading Strategies Stock Market Stock Charts

Historical U S Stock Market Returns Over Almost 200 Years Stock Market Renewable Energy Wind Financial Wealth

Historical U S Stock Market Returns Over Almost 200 Years Stock Market Renewable Energy Wind Financial Wealth

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

How To Buy The Best Breakout Stocks On A Pullback Video Stock Trading Strategies Stock Trading Stock Market

How To Buy The Best Breakout Stocks On A Pullback Video Stock Trading Strategies Stock Trading Stock Market

Why Unrealized Gains Losses Isn T The Best Way To Look At Performance Merriman

Optionshouse Tax Center Online Broker E Trade Investing

Optionshouse Tax Center Online Broker E Trade Investing

How Relative Strength In The Nasdaq Can Increase Your Trading Profits Now Qqq Smh Swingtrading Stocks Stoc Nasdaq Stock Trading Strategies Stock Market

How Relative Strength In The Nasdaq Can Increase Your Trading Profits Now Qqq Smh Swingtrading Stocks Stoc Nasdaq Stock Trading Strategies Stock Market

Who Will Win The Present Tug Of War Between The Bulls And Bears Tug Of War Stock Trading Strategies Stock Market

Who Will Win The Present Tug Of War Between The Bulls And Bears Tug Of War Stock Trading Strategies Stock Market

What Happens When You Trade After Market Hours Read Smg Tip 5 To Learn More The Stock Market Game Is An Stock Market Game Stock Market Investment Portfolio

What Happens When You Trade After Market Hours Read Smg Tip 5 To Learn More The Stock Market Game Is An Stock Market Game Stock Market Investment Portfolio

Realized Vs Unrealized Gains And Losses Partners In Fire Investment Tips Dividend Investing Finance

Realized Vs Unrealized Gains And Losses Partners In Fire Investment Tips Dividend Investing Finance

How We Made An 11 Gain On A 6 Day Hold With Ung Etf Trading Strategy Etf Trading Trading Trading Strategies

How We Made An 11 Gain On A 6 Day Hold With Ung Etf Trading Strategy Etf Trading Trading Trading Strategies

Post a Comment for "What Are Stocks With Unrealized Gains"