How To Sell Stock After Hours

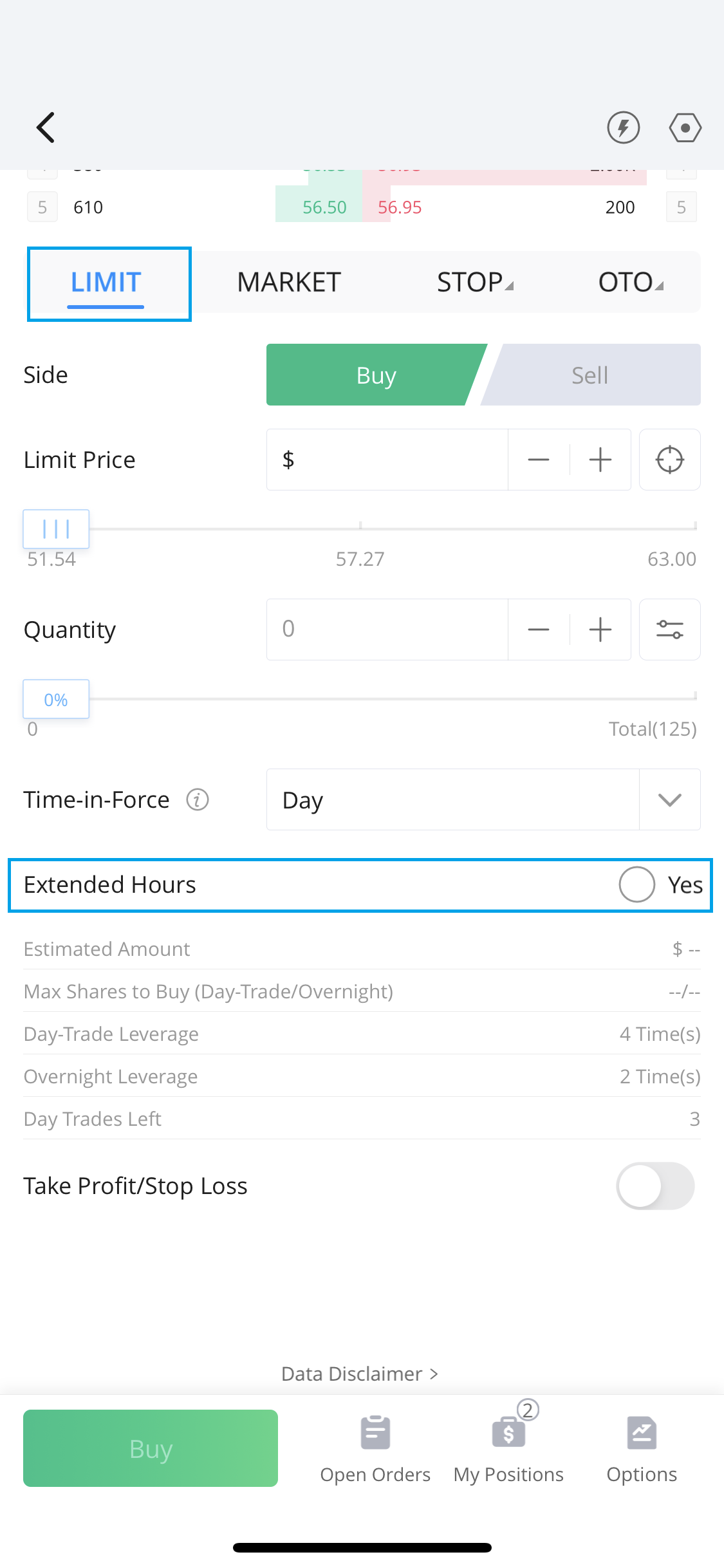

Also all orders must be limit orders. After selling short to express a bearish view on the market youll ideally buy the stock back after the.

Interactive Brokers After Hours Trading Pre Market Extended

Interactive Brokers After Hours Trading Pre Market Extended

However the ins and outs of how to trade after-hours can vary.

How to sell stock after hours. Normal stock market trading hours for the New York Stock Exchange and Nasdaq are from 930 am. Most exchanges usually operate post-market trading between 400 pm. Orders in the pre-market session can only be entered and executed between 700 am.

Third the apps watchlist will indicate pre-market and after-hours prices with the same labels. During the regular trading day investors can buy or sell stocks on the New York Stock Exchange and other exchanges. Pre-Market and After Hours Trading.

ET and closes at 4 pm. You check in your portfolio the next Monday and find that your limit order has executed. Those trading stocks after hours typically do so between 4 pm.

Open an account and select that you plan to actively trade during the sign up process. After hours trading is simply the buying and selling of shares following the close of the regular stock market session. To place an order for an overnight ETF outside of regular or extended hours the procedure is the same as for any other security at any other time.

Some brokerages may not allow you to buy or sell stock during this period or only permit it during narrower windows of time. In order to sell short your broker must be able to borrow the stock for you to sell. Trade Ideas Scanners Best Scan.

After hours and premarket trading takes place only through ECNs. Second youll see Pre-market or After Hours next to an extended-hours price depending on the time of day morning or evening. For example with a Fidelity brokerage account you can only place certain types of orders during extended-hours tradingincluding buy buy to cover sell or short-sale orders.

They may also have specific rules about what kinds of trading activities you can engage in outside of regular hours. Financial advisors will typically execute a sell order within 24 hours. However depending on your brokerage you may still be able to buy and sell stocks.

While stocks are typically traded within the context of markets like the New York Stock Exchange after-hours trading is facilitated by an electronic communication network ECN which is essentially a computerized matching system to pair up willing buyers and sellers. You made a small profit off the sale and youre happy with that but then you see that XYZs current price is 45. After-hours trading can be divided into two different parts of the day.

You can right click on a graph on thinkorswim and select buy or sell from the drop-down menu. How to Enter Extended-Hours Orders on Robinhood Robinhood only accepts limit orders during the pre-market and after-hours sessions. But there is no standard price quote on stocks trading after 4 pm.

The brokers after-hours period lasts from market close until 600 pm EST. The stock market opens at 930 am. This will produce a populated trading ticket in the bottom portion of the platform.

Keep in mind that not all securities trade during these times. Working With a Financial Advisor Assuming that you bought your stock through a financial advisor either in person or on the phone you can also sell your stock this way. Previous trading day and 925 am.

For example lets say you enter a 30 sell limit order on XYZ stock before taking a week off for vacation. Log into thinkorswim and select EXTO when placing an after-hours trade. Orders can be placed between 805 pm.

Note that in this case you must either speak directly to your broker or put your request in writing. They can also trade via digital markets called electronic communication networks or ECNs. These sessions combined produce an extra 2½ hours of trading.

During the extended-hours session the price displayed on a stocks Detail page is the stocks real-time price. Eastern Time and short sale orders are available only from 800 am to 928 am Eastern Time. Orders can be placed at any time and will only be executed from 930 am.

Trading Stocks After Hours. Orders made outside market hours and extended hours trading are queued and fulfilled either at or near the beginning of extended hours trading or at or near market open according to your instructions. The first is the post-market trading session.

During regular-hours trading you can place a market order to buy or sell a stock at the stocks current price. Trades in the after-hours session are completed through electronic. ET and will be eligible for execution between 700 am.

After-hours trading occurs after the market closes when an investor can buy and sell securities outside of regular trading hours.

Webull Extended Hours Trading Pre Market After Hours 2021

Webull Extended Hours Trading Pre Market After Hours 2021

Robinhood After Hours And Pre Market Trading 2021

Robinhood After Hours And Pre Market Trading 2021

/dotdash_Final_After_Hours_Trading_Oct_2020-01-e1708defac9e432eb6179f9c74d318a6.jpg) After Hours Trading Definition

After Hours Trading Definition

Forex Forex Forex Forextradingstrategies Forex Trading Forex Learn Forex Trading

Forex Forex Forex Forextradingstrategies Forex Trading Forex Learn Forex Trading

Merrill Edge Extended Hours Trading Pre Market After Hours

Merrill Edge Extended Hours Trading Pre Market After Hours

Vanguard Extended Hours Trading Pre Market After Hours 2021

Vanguard Extended Hours Trading Pre Market After Hours 2021

Etrade Extended Hours Trading Pre Market After Hours 2021

Etrade Extended Hours Trading Pre Market After Hours 2021

Td Ameritrade After Hours Pre Market Trading Extended Hours

Td Ameritrade After Hours Pre Market Trading Extended Hours

Extended Hours Trading Wikipedia

Extended Hours Trading Wikipedia

Charles Schwab Extended Hours Trading Pre Market After Hours

Charles Schwab Extended Hours Trading Pre Market After Hours

:max_bytes(150000):strip_icc()/professional-profession-chart-font-diagram-multimedia-1163690-pxhere.com1-f4d24f07af8c427699a8c18019ba0012.jpg) Can You Trade During After Hours

Can You Trade During After Hours

Tradestation Extended Hours Trading Pre Market After Hours

Tradestation Extended Hours Trading Pre Market After Hours

:max_bytes(150000):strip_icc()/germany--stock-exchange-trading-and-clock-in-the-foreground-535653283-ebb783a6d2534c66a979372943207bf8.jpg) How To Trade The After Market Movers

How To Trade The After Market Movers

:max_bytes(150000):strip_icc()/GettyImages-1146062956-e5b54f002b5f4231b1a7225f4a1c452a.jpg) Can You Trade During After Hours

Can You Trade During After Hours

:max_bytes(150000):strip_icc()/tradingafterhours-599630720d327a00114e9963.jpg) How To Trade The After Market Movers

How To Trade The After Market Movers

:max_bytes(150000):strip_icc()/PIXNIO-278671-4377x32831-1377f20b22674d16882feeff57e23817.jpg) How After Hours Trading Affects Stock Prices

How After Hours Trading Affects Stock Prices

/PlayingtheGap22-b74a16eb4de4467da30401c685653ef8.png)

Post a Comment for "How To Sell Stock After Hours"